Bradda Head Reports High-Grade Channel Sampling at San Domingo and Basin Project Update

BRITISH VIRGIN ISLANDS / ACCESSWIRE / April 8, 2024 / Bradda Head Lithium Ltd (AIM:BHL)(TSX-V:BHLI,), the North America-focused lithium development group, is pleased to announce the results from surface channel samples at the San Domingo ("SD") Project in central Arizona. The results included 5.00m of 2.33%, 4.10m of 2.81%, and 4.00m of 1.26% Li2O at the White Ridge Target and 5.30m of 1.25% Li2O at Morning Star. These and other surface samples collected were designed to augment the Phase II, 2023 drilling program as well as determine that this technique can and will be applied to future surface exploration programs planned in Q3 of this year.

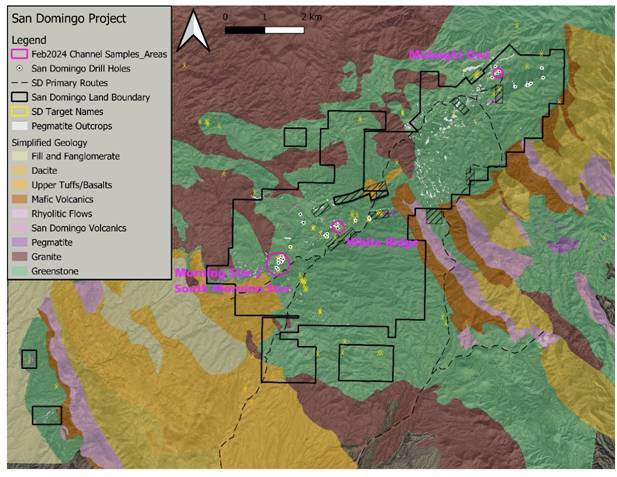

Sample locations include: Morning Star, South Morning Star, White Ridge, and Midnight Owl.

Channel Sample Highlights:

5.00m @ 2.33% Li20 at White Ridge

4.10m @ 2.81% Li2O at White Ridge

4.00m @ 1.26% Li2O at White Ridge

5.30m @ 1.25% Li2O at Morning Star

4.00m @ 0.43 % Li2O at South Morning Star

2.90m @ 2.31% Li2O at Midnight Owl

Highlights

A total of 77 samples were collected from strategic targets across the San Domingo project, with locations designed to supplement drill holes that contain lithium (spodumene) mineralization, particularly those that could result in mineable resources;

Some locations were chosen as a result of newly exposed spodumene bearing pegmatites at new drill sites;

White Ridge channel samples correspond to drill hole SD-DH23-072, confirming continuity of spodumene rich pegmatite, indicates mineralization is open to the north and at depth;

Channel samples at Morning Star drill site SD-DH23-090 cut, 5.30m at 1.25% Li2O, clearly connect and add confidence in continuity, building on resource potential;

The channel samples at Midnight Owl likely connect to drill hole SD-DH23-049 which had an intercept of 6.35m @ 0.83% Li2O and 3.05m of 1.03% (see 11 Nov 2023 Press Release for details), a distance of 55m from surface.

The Company is capitalizing on surface lithium mineralization exposures through channel sample techniques and by connecting to drill holes; this continues to demonstrate open cut potential and in part, will drive the next exploration program.

Ian Stalker, Executive Chair, commented:

"We are highly encouraged by the surface channel samples taken at our San Domingo Project, which was designed to test multiple sample locations and provide further data that can be integrated into our planned work programme whilst targeting resource development. We believe that these high-grade samples bode extremely well for the potential of the asset in its entirety, and reaffirms favourable results from both previous sampling undertaken by Bradda, as well as the historic sampling.

Looking forward, the success of this cost-effective and efficient technique is also a notable positive, particularly as we look to further our surface exploration in Q3 of this year. This demonstrates our innovative thinking in regard to how to best maximise our resources, and so far, we are having great success."

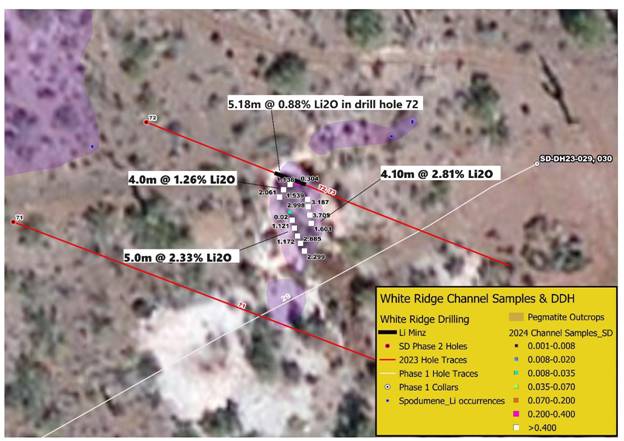

Channel samples collected at White Ridge mine cut returned excellent results, including 5.00m at 2.33% and 4.10m at 2.81% Li2O. Each of the three sample groups at White Ridge are separated by roughly 2.0m, where sample material was unavailable. The results strengthen Bradda's confidence that the values represent viable thicknesses in these steeply dipping pegmatites. The sample locations are correlative to drill hole SD-DH23-072 intercept which carries 5.18m @ 0.88% Li2O (see January 16, 2024 RNS for drill hole intercepts), see Figure 1 below. The shallow mineralization in the mine cut and at depth in the drill hole is open to the north.

Figure 1. White Ridge channel sample locations and values in percent, drill hole intercept and surface projection.

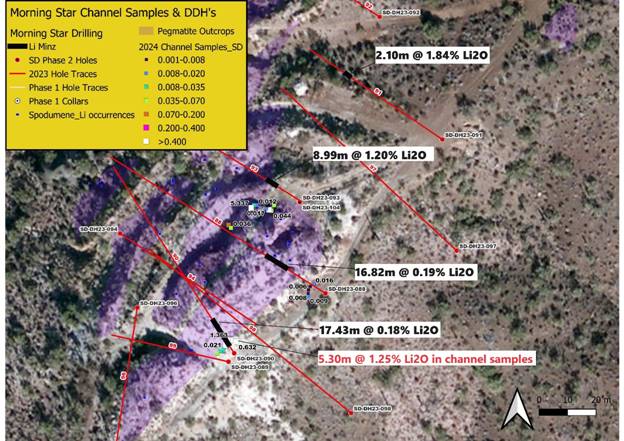

The sampling on the surface at Morning Star and near the center of this target, contains 5.30m a 1.25% Li2O, which is proximal to drill hole SD-DH23-090 where 2.80m of 0.655% Li2O was encountered within a broader zone of 17.43m at 0.18% Li2O (see Figure 2 below). Towards the north end of Morning Star and proximal to drill hole SD-DH23-093 is an isolated 0.80m sample running 5.337% Li2O. Hole SD-DH23-093 contains 8.99m at 1.20% Li2O, which could link to the 5.337% surface sample, providing opportunity for expansion in this part of Morning Star.

Mine cut channels collected at South Morning Star, resulted in 4.00m of 0.43% Li2O. This interval is very proximal and above drill hole SD-DH23-099 which contains 6.69m at 0.576% Li2O followed by 5.55mm at 1.034% Li2O.

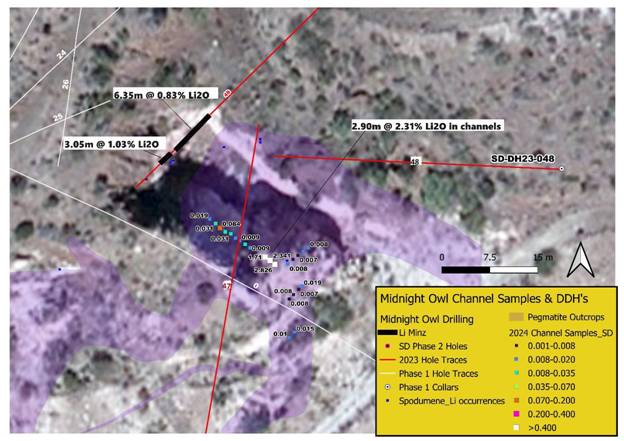

The mine cut at Midnight Owl was sampled, resulting in a 2.90m interval running 2.31% Li2O. This interval is the up-dip correlation to intervals seen in our drill holes, such as hole SD-DH23-049 which has 6.35m at 0.83% Li2O followed by 3.05m at 1.03% Li2O (see Figure 3). These drill hole intercepts are interpreted to connect with the surface channel samples, a vertical distance of 55m. Several areas within the historic mine were inaccessible due to steep walls or obvious spodumene which was out of reach. Outcrops above and outside the mine were also sampled to provide information on natural exposures.

Figure 2. Morning Star channel samples and relevant drill hole intercepts.

Elevated to well mineralized lithium-rich channel samples also contained very anomalous amounts of tin, tantalum, caesium, niobium, and rubidium, again typifying the LCT nature of this pegmatite district.

Bradda Head considers this channel sample program a success and will continue to implement this technique over the property on pegmatites that are reasonably accessible, visibly lithium-bearing, offering the opportunity to collect clean samples over continuous lengths and subsequently adding value to future drill targeting.

The sampling procedures were designed for integration into 3-D models that could lead to development of shallow resources. Sample cuts were made with a diamond saw along contiguous exposures, adding certified standards for every 10th sample, similar to our drill holes. Cuts were dominantly horizontal and along pegmatite exposures with a diamond handheld core saw. Two parallel cuts were made at 4-5cm apart and the material between the cuts was sampled to depths of 2-3cm.

Figure 3 above. Midnight Owl channel samples and nearby drill holes.

Figure 4 above. Location map of channel samples, property, drilling, land

Basin Drilling Update

The drilling at Basin is progressing well, with the Company completing its second drill hole, encountering >80 meters of Upper Clay in both holes and finding encouraging thicknesses of between 25 to 35m of the Lower Clay unit. The first two holes have been logged, sampled, and shipped to the laboratory for analysis.

QAQC

Channel samples cut in the field under the supervision of Joey Wilkins. Samples cuts were labelled and photographed, bags were tied-off, labelled, then transported to the core shed under lock and key. Samples were shipped by the Company directly to SGS Laboratories in Burnaby, B.C., Canada where SGS prepped then analysed all samples using sodium peroxide fusion combined ICP-AES and ICP-MS, method GE_ICM90A50. Certified standards were inserted into the sample stream and reviewed by the Qualified Person. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 38 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

For further information please visit the Company's website: www.braddaheadltd.com.

ENDS

Contact:

| Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

| Ian Stalker, Executive Chairman Denham Eke, Finance Director | |

| Beaumont Cornish (Nomad) | +44 (0) 2076 283 396 |

| James Biddle / Roland Cornish | |

| Panmure Gordon (Joint Broker) | +44 (0) 2078 862 500 |

| Hugh Rich | |

| Shard Capital (Joint Broker) | +44 (0) 2071 869 927 |

| Damon Heath / Isabella Pierre | |

| Red Cloud (North American Broker) | +1 416 803 3562 |

| Joe Fars | |

| Tavistock (Financial PR) | + 44 20 7920 3150 |

| Nick Elwes / Adam Baynes | [email protected] |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 17 Mt at an average grade of 940 ppm Li and 3.4% K for a total of 85 kt LCE and an Inferred Mineral Resource of 210 Mt at an average grade of 900 ppm Li and 2.8% K (potassium) for a total of 1.09 Mt LCE. In the rest of the Basin Project SRK has determined an Exploration Target of 250 to 830 Mt of material grading between 750 to 900 ppm Li, which is equivalent to a range of between 1 to 4 Mt contained LCE. The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a 100% equity basis and are in close proximity to the required infrastructure. Bradda Head is quoted on the AIM of the London Stock Exchange with the ticker of BHL and on the TSX Venture Exchange with a ticker of BHLI.

Technical Glossary

| Kt | Thousand tonnes |

| Ppm | Parts per million |

| Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

| Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

| Sn | Tin |

| Ta2O5 | Tantalum pentoxide |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals, or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited