MIAMI, FL / ACCESSWIRE / April 17, 2023 / Equity securities in the energy sector outperformed the broad market in 2022. The Energy Select Sector Index and the MicroSectors Energy Index were up around 58% and 63%, respectively, while the S&P 500 Index dropped nearly 20%. A few notable performers were ConocoPhillips, which returned roughly 71%, and Occidental Petroleum Corporation which returned 119%.

The Solactive MicroSectors Energy Index, which measures the performance of 12 highly liquid companies active in the US energy sector, is a potential investment option for those who believe in the sector's future growth. The index is composed of top energy sector companies, including Chevron Corporation, Exxon Mobil Corp., Occidental Petroleum Corp., ConocoPhillips and Devon Energy Corp.

MicroSectors™ Energy levered exchange-traded notes, which include the MicroSectors Energy 3X Leveraged ETN (NYSE Arca: WTIU) and the MicroSectors Energy -3X Inverse Leveraged ETN (NYSE Arca: WTID), offer investors exposure to the performance of the Solactive MicroSectors Energy Index. WTIU offers investors three times the daily performance of the Solactive MicroSectors Energy Index, while WTID offers investors the inverse performance of the index, in each case, before fees.

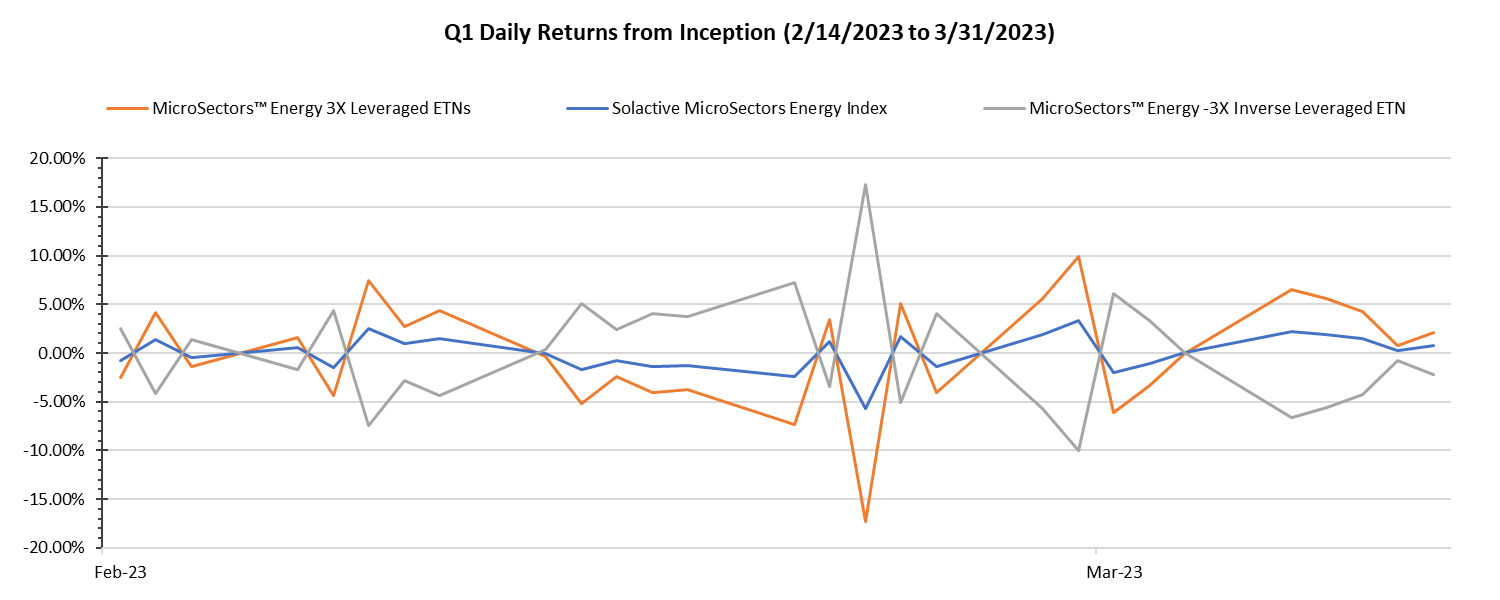

The following graph illustrates, for the indicated period, the daily changes in the closing level of the index, and the daily changes in the closing indicative note value of each ETN. Past performance is no indication of future results as to the index, or any ETN.

Source: MicroSectors.

Investing in REX Shares' MicroSectors™ Energy exchange-traded notes, is subject to significant risks. Like all investments, the energy sector is subject to market conditions and geopolitical risks that could impact the returns of these companies, as discussed in the pricing supplements for the ETNs. Additionally, the use of leverage in WTIU and WTID means that investors could lose their entire initial investment. Investors should carefully consider their investment goals and risk tolerance before investing in these exchange-traded notes.

Click here to learn more about MicroSectors™ Energy ETNs.

Featured Photo by Galen Crout on Unsplash

The exchange traded notes are subject to the credit risk of Bank of Montreal, the issuer of the ETNs. The ETNs are also subject to the issuer's credit ratings, and the issuer's credit spreads may adversely affect the market value of the notes.

Please note that leveraged ETNs seek a return on the underlying index for a single day. Those investments are not "buy and hold" investments, and should not be expected to provide the respective return of the underlying index's cumulative return for periods greater than a day. The investments are intended to be daily trading tools for sophisticated investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment objectives only on a daily basis. Leveraged investments include risk and are not suitable for all investors. Please read the disclosure documents, including the relevant pricing supplements, for more complete information, prior to making an investment decision.

Bank of Montreal, the issuer of the ETNs, and which participated in the preparation of this article, has filed a registration statement (including pricing supplements, a product prospectus supplement, a prospectus supplement and a prospectus) with the Securities and Exchange Commission (the "SEC") about the ETNs that are being offered by this article. Please read those documents and the other documents relating to these offerings that Bank of Montreal has filed with the SEC for more complete information about Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent or any dealer participating in these offerings will arrange to send the applicable documents if so requested by calling toll-free at 1-877-369-5412.

Contact:

Caitlyn Foster

[email protected]

SOURCE: REXShares