FORT WORTH, TX / ACCESSWIRE / October 31, 2022 / Askeladden Capital Management LLC

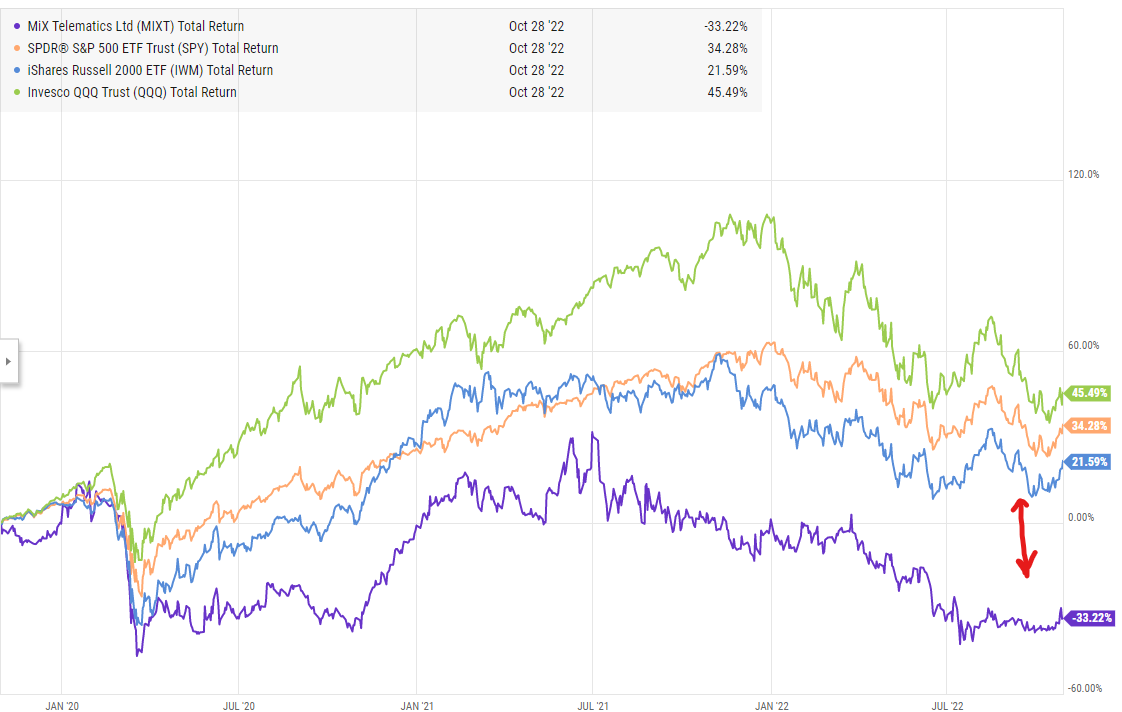

- Over the past three years, MiX Telematics (NYSE:MIXT) has seen organic revenue contraction (in USD terms) and a decline in EBITDA margins from 30%+ to ~17% in the most recent two quarters. At least partially due to these factors, shareholders have lost 33% (including dividend payments) over the past three years, compared to gains of 20 - 45% for market indices such as the S&P 500, Nasdaq, and Russell 2000.

- Management has consistently missed its internal targets of 15%+ organic revenue growth and is far off from achieving 30%+ Adj. EBITDA margins. Management attributes performance challenges to macroeconomic headwinds, yet peers such as Karooooo Ltd / Cartrack (KARO), and privately-held Lytx, have achieved and surpassed MiX's targets on both growth and profitability while facing the same headwinds.

- Our research suggests that the problems at MiX are fixable - based on reported results and multiple interviews with former employees who have direct experience with both MiX and competitors, we believe MiX has solid technology/products but poor sales execution.

- On behalf of clients, Askeladden Capital owns ~562,000 ADRs, representing ~2.5% ownership in the company. In light of the company's underperformance, we are taking an activist stance to fulfill our fiduciary duty to our clients. In this open letter to shareholders, management, and the Board, we highlight what we believe has gone wrong, and call for dramatic and immediate changes to restore shareholder value.

- We believe the Board should concurrently run a strategic alternatives process, as we believe that the company could be sold for $15+ compared to the current share price close to~$8. Should management be unwilling or unable to substantially improve the trajectory of the business over the next few quarters, we believe the Board should sell the business.

Note: a formatted version of this press release that is easier to read is available on our website here.

Introduction

Askeladden Capital is an investment advisor with $65 million of assets under management; our clients range from individual investors to family offices to billion-dollar endowments. We are long-term investors in primarily small-and micro-cap securities. We have followed MiX Telematics since 2017, investing in the company twice, most recently from Fall 2019 to present.

As of the current date, we own over 562,000 ADRs on behalf of clients, representing a roughly 2.5% ownership stake in the company. (We may increase or decrease this stake at any time without further notification, except as required by relevant regulatory authorities.)

Over the past three years, management has presided over significant shareholder value destruction, with reported results significantly lagging many peers and the stock price significantly lagging major indices. In fact, the chart below demonstrates that since the onset of the COVID pandemic, there has not been a single time when MIXT shares had a higher return than the Nasdaq, S&P 500, or Russell 2000.

Including dividends paid, MIXT shareholders have lost a third of the value of their investment, compared to 20 - 45% gains over the same period for broad market indices.

Source: YCharts

After multiple conversations with management that we view as unproductive, we are initiating our first-ever activist campaign.

Activism is normally not part of our strategy, but we believe it is our fiduciary duty to our clients to attempt to remedy the shareholder value destruction that has occurred at MiX. We are not "hit-and-run" greenmailers swooping in opportunistically when the share price is down; we are simply frustrated shareholders who have seen the value of our investment erode.

As shareholders are undoubtedly aware, MiX Telematics provides telematics solutions ranging from relatively inexpensive asset tracking all the way up to AI-enabled video telematics solutions. For their most valuable "premium fleet" business, these services are provided under multi-year SaaS contracts with high gross margins.

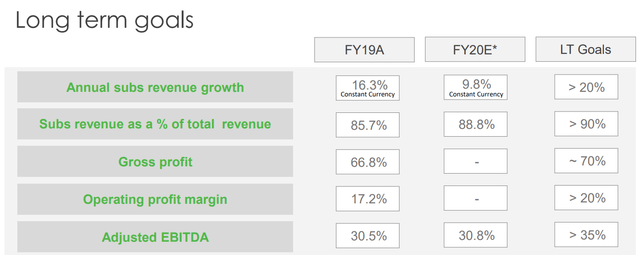

Telematics is generally considered to be an attractive and growing industry with both unpenetrated whitespace and the opportunity to move existing customers to higher-value solutions. As such, in FY2020 (mostly CY2019), the company guided to long-term constant-currency subscription revenue growth of 15-20%+ and Adj. EBITDA margins of 35%+.

Since 2017, MIXT has consistently targeted 15%+ subscription revenue growth with operating leverage and high margins. For example, in its December 2019 investor presentation, MIXT put forth long-term goals of 20%+ subscription revenue growth and 35%+ Adjusted EBITDA margins, having already posted strong results in FY19 and below-target, but still good, guidance for FY20.

Source: company presentation

At that time, prior to COVID, the company's guidance for the fiscal year was ~$130 million in subscription revenue and ~$45 million in Adj. EBITDA (a 30%+ margin).

Source: company presentation

Coming up on three years later, ARR is ~$128 million (roughly flat to the pre-COVID FY2020 guidance), and that is pro forma for a recent acquisition from Trimble (TRMB) - without this acquisition, pro forma ARR would be closer to $120 million.

Far from the long-term target of 15-20%+ annual growth, MiX will have seen meaningfully negative organic growth over the past three years on a USD basis. Currency/FX movements account for part but not all of this performance gap.

Even worse, EBITDA margins in H1 FY23 were roughly 17%, or roughly $12 million, compared to $21.5 million in H1 FY20, or roughly 30.8%.

This is despite the fact that both years had relatively similar subscription revenue in the neighborhood of $61 million - so on a similar revenue base, costs have increased by nearly $9 million, or 15% of subscription revenue.

Worse yet, MIXT spends capex dollars to buy hardware that customers utilize as part of their subscription. In fact, it has to spend these dollars up front in hopes of getting paid back later, and during COVID, had to book some accelerated depreciation charges. As a result, D&A is a very real and material cost - the exact amount depends on the year, but ~10%+ of revenues is a good starting point. As such, operating margins over the first half of FY23 are single digits.

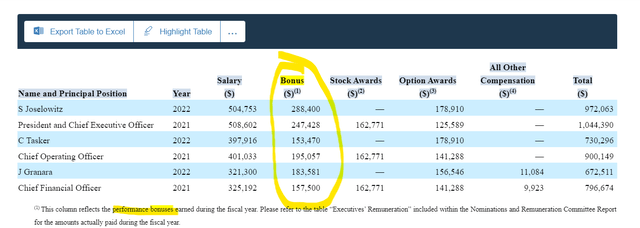

Despite not even coming close to achieving these publicly-stated goals, and the shareholder value destruction that has occurred, management has continued to earn "performance bonuses" over the last several years. Over the past two fiscal years, the three executive officers named below have cumulatively received over $1.2 million of cash performance bonuses in addition to their base salary and stock/option awards.

Actions speak louder than words, and while management continually references "cost discipline," it is nowhere to be seen in operating results. Management is targeting reaching a "mid-20s" level over the next several quarters, but this still leaves them far off where they were prior to COVID.

As a result of this substantial degradation in earnings, it is no wonder that the share price is down so dramatically relative to the market.

The good news is that our research suggests that MiX has good products and R&D capability - however, we believe sales execution capability and cost discipline is lacking. Summarily, we think that MiX is not very good at the sales process and does not have an efficiently-run organization; if this is the case, then the company's decision to throw more money at the problem by hiring more people is not really the right solution.

We believe the problems facing MiX are fixable. This letter is a call to action for shareholders, the management team, and the Board. Shareholders deserve better and should carefully review MiX's performance relative to its own internal targets, as well as peer results.

The company should either take concrete and immediate steps to remedy the situation. Concurrently, we believe the Board should consider replacing or supplementing existing management with a team with proven sales and operational excellence capabilities. In terms of the former, perhaps a new head of sales could be hired away from a competitor such as Lytx or Samsara, which have achieved what MiX can only dream of at this point. In terms of the latter, we believe MiX should bring in a talented executive to implement a "Danaher Business System" approach to optimize the efficiency of operations.

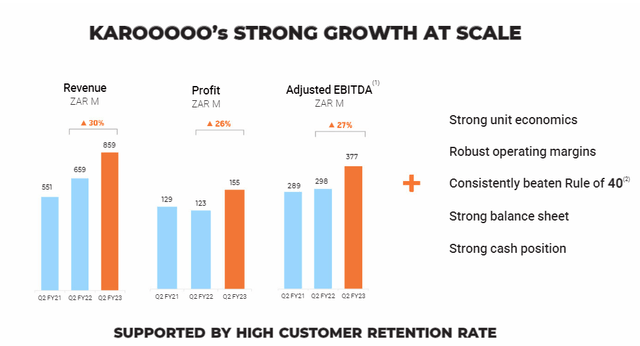

On public calls and in our private discussions, management has attributed the poor margins to growth investments as well as macroeconomic headwinds such as inflation, supply chain constraints, and so on. However, in the face of such headwinds, peers in both asset tracking and AI-enabled video telematics such as Lytx and Karooooo/Cartrack (KARO) continue to deliver both exceptional margins and stellar growth.

Based on public disclosures, both companies are growing well in excess of MiX's targeted 15 - 20% growth rate and achieving 40%+ EBITDA margins (this is verifiable for KARO, and we believe it is likely for Lytx). There are other fast-growing comps as well, such as Samsara (IOT), which is currently reporting a 50%+ growth rate - but we chose to focus on KARO and Lytx because Samsara is reporting losses to fund rapid growth, whereas KARO and Lytx seem to have more of a MiX-like approach of balancing profitability and growth.

On multiple occasions, we have queried management as to why they are so severely lagging competitors. Management's response has either been what seems like dismissiveness ("our business is different") or what we perceive as lack of interest or knowledge. For example, CEO Stefan Joselowitz ("Joss") has told us on two separate occasions that because Lytx is a private business, he doesn't have much visibility into its performance, and the conversation ends there.

We view this as an unacceptable response for two reasons. First, many "expert networks" exist that allow investors and companies to gain competitive intelligence on other companies in an industry. When there are competitors which are clearly outperforming you, we believe it is incumbent upon management to figure out how and why competitors are achieving those results, and how MiX can look to replicate them.

Second, not only are these companies' reported results better, but our review of such competitive intelligence demonstrates clear and tangible reasons why. Multiple interviews with former employees mentioned that Cartrack has a much more efficient operating structure and a better-managed, more aggressive sales structure than MiX. We will review these issues more fully later, but we believe that a primary problem is that MiX has poor sales execution.

We believe that we can connect the dots between a number of "cookie crumbs" ranging from these experts' commentary, to MiX's publicly-disclosed results relative to competitors, to comments made on public calls by MiX management over the years, to the complete failure of a product they were very excited about.

One important contextual factor is that telematics solutions provide a quantifiable ROI for customers, which should make sales very easy (and are likely why several of the company's competitors, which we will highlight, are growing very rapidly with very attractive margin structures).

In an investor deck published in July, MiX claimed to generate over $440 million in annual efficiency savings for clients - worth more than 3x what customers pay MIXT on an annual basis. This includes savings in fuel, labor, and insurance costs, as well as better asset utilization and security.

We believe this figure does not include all the intangible benefits, such as safety - including human lives saved by averted road collisions. Nor does it include the indirect benefits of having more real-time visibility into key business assets. Such quantifiable ROI is a massive sales asset that many of our other portfolio companies would love to have - yet MiX appears unable to capitalize on the opportunity.

While the company works to fix these issues, the Board should also consider running a full strategic alternatives process, which we believe could result in a sale at a price of $15+ (almost double the current stock price) based on precedent and current comparable valuations. Management communicated to us that such a process has not been run since roughly 2015, and given the current valuation and destruction of shareholder value over the last three years, we believe that shareholders at least deserve to know what the best offer out there is.

Even in today's challenging environment, PE firms have shown an interest in acquiring SaaS assets, which are highly leverageable (whether now or in the future) due to their steady recurring revenue streams. MiX represents a very attractive LBO candidate for a financial buyer.

Furthermore, the telematics industry is highly fragmented and there are obvious benefits to consolidation, with synergies easily evident on the R&D side (don't need two teams developing the same feature) and the sales and marketing side (one less competitor in any given deal.)

Management's response to our queries has largely been "results will improve over the next several years." We simply don't believe that's good enough - why should shareholders trust the same strategy and team that has severely underperformed over the last several years?

Karooooo (Cartrack) and Lytx - Models To Emulate

Let's take a deeper dive into results at Karooooo and Lytx.

We believe that these two companies represent good comps because they "bookend" MiX's offerings. Cartrack is more focused on the African continent, with a larger presence in the lower-end asset tracking portion of the market. Meanwhile, Lytx plays more in Western markets, with a high-end, AI-driven video telematics solution.

Taken together, these companies are both undoubtedly facing many of the same macroeconomic headwinds that MiX references, such as inflation and supply chain constraints. Yet these companies seem to be succeeding at achieving well above MiX's targeted results, in spite of all of these headwinds.

Lytx also provides video telematics solutions and is achieving blistering growth. Although the company is private, various sources, including the company, provide some publicly-available information. For example, in May 2022, the company stated that it had grown new subscriptions by 65% y/y. This comes on top of strong performance in 2021, per the company:

- In 2021, the company [Lytx] delivered its 21st consecutive year of record revenue. Lytx experienced rapid growth across all business units in 2021, with a 250% year-over-year increase in new indirect subscriptions, a 120% increase in new enterprise subscriptions, and a 105% increase in new small-market subscriptions.

The company noted that it still delivered "strong profitability," and a previous article in 2019, citing four sources close to the situation, suggested Lytx had Adjusted EBITDA margins in excess of 50%. Therefore, it does not appear that Lytx is a case of a tech company growing uneconomically with "free" venture capital money - rather, it seems to have very strong unit economics and deliver outstanding growth with strong margins.

Nor is Lytx the only success story - we can look at another publicly-traded peer with audited financials.

At the lower end, peer Cartrack/Karooooo, traded as (KARO) is more comparable to MIXT's asset-tracking business, with an African focus. Results there have also been strong, with excellent revenue growth and EBITDA margins that are well above MiX's previous high water mark.

Importantly, KARO is a similar sized business to MIXT - they reported ARR of ~3 billion ZAR in their most recent quarter, which equates to ~$165 million USD. So their ARR base is not substantially larger than MIXT's, demonstrating that you don't need massive scale to achieve these sorts of results - we believe it is economically implausible to argue that the sole reason for margin delta is a small difference in revenue.

Source: KARO deck

To preempt a likely rebuttal, in a conversation with us on 10/31/2022, management stated that there isn't much competitive overlap between Cartrack and MiX. We simply don't believe this is the case based on a number of interviews with former employees that we will reference shortly, along with the fact that many former employees have worked at both companies, suggesting their skills and expertise are transferable. Indeed, a former Cartrack executive stated - verbatim:

- "If you're looking for a like-for-like competitor of Cartrack in the telematics space, I think a good place to start is like MiX Telematics."

MIXT management often points to macro headwinds, such as the unavailability of vehicles due to supply chain issues, the downturns in oil and gas, currency headwinds, and so on, as reasons that they are not achieving their goals.

We do not dispute that these factors are very real. However, as we demonstrated above, peers like Lytx and Cartrack continue to succeed in spite of these factors, showing that better results are achievable in this environment with strong execution.

To put a finer point on it, when MiX blames its spiraling cost structure and anemic USD-denominated revenue growth on factors like inflation, FX, or delays in implementation of contracts - yet its competitors are facing these very same issues and nonetheless still delivering strong results for shareholders. So while the macroeconomic environment is a real factor, it's not one that should overwhelm the inherently attractive characteristics of the telematics industry, particularly since the world has "returned to normal" post-COVID.

One of the most frustrating things to us as shareholders is that when we have asked management about their performance relative to these companies, they don't have a good explanation as to why competitors are succeeding when MiX is not.

Expert Interviews Suggest Poor Management And Execution Is The Problem - Not The Industry, Not The Technology

As part of our research process on public companies, we often speak to current or former industry participants or review available transcripts of such calls.

In the case of MIXT, such calls were generally highly complimentary of the company's technology and R&D - suggesting the reason they are struggling is not that their technology is outdated or inferior.

We will cite some examples from Tegus transcripts - professional investors with a subscription are encouraged to read the full versions for themselves.

To start with, one former employee on the tech side noted that MIXT has a "very well-organized development business" with a "constant stream of investment into new technology." For example, this individual noted that MIXT's video solutions "progressed significantly" during his employment.

While this is just one person's opinion, we didn't see many indications in the transcripts that MIXT's technology is a problem - as with any company, we're sure there's room for improvement, but there is no indication that they are extremely far behind. This is a good thing, because it means that MiX should be capable of competing effectively in the marketplace.

Unfortunately, the converse seems to be true when it comes to the sales and marketing side. For example, someone on the sales and operations side mentioned that prioritization was off:

- the priority will always lie with whoever shouts loudest. It's not a priority as to justification based on the number of sales that could be lost or the number of sales that could be gained. I think there's a different methodology that needs to be followed in terms of the prioritization of these...

We can see this "prioritization" issue reflected in public results. For example, MIXT struggled during COVID because of its over-exposure to oil and gas (which comprised ~20 - 25% of revenues).

Oil and gas is an industry where two things are obvious - first, it is extremely cyclical, and second, there are potential long-term secular headwinds from electric vehicles and the broader move towards renewable energy.

At the William Blair growth conference in 2017 (transcript from Sentieo), Joss observed that they "focused on low hanging fruit":

- We focused on low hanging fruit, which at the time was the energy sector for us. And it worked extremely well where we're probably, certainly on the exploration side of the energy sector, the largest player in our space there and will continue to build on that. But we do recognize that we don't want to remain overexposed in this geography to one vertical. So we are certainly exploring other verticals as we speak. And although the United States is quite a specialized market, we would like to see ourselves being successful in at least three different verticals here

Several years later, they hadn't sufficiently diversified away from that vertical. Failure is exemplified by the lack of traction achieved by their MiX Now product. This was supposed to be a "rocket engine" (direct quote from management) that accelerated and diversified growth in the US. Here is an exchange from the Q3 2019 CC in January 2019:

- Brian Christopher Peterson, Raymond James & Associates, Inc., Research Division - Senior Research Associate [2]

So just wanted to start out on MiX Now. It sounds like you're really hitting the ground running there. How should we think about the expectations for that product offering over the next few years? And I think you mentioned 12 million service fleet vehicles in the U.S. Any sense for what the penetration of those service fleet vehicles looks like maybe versus some of your other end markets that you just historically served?

- Stefan Brian Joselowitz, MiX Telematics Limited - President, CEO & Executive Director [3]

Thanks, Brian. The -- yes, it's certainly going according to expectations, and I think as I outlined at the Investor Day, for this fiscal year, we've certainly banked on a -- pretty much baked in all of the costs, but not much. In fact, no revenue or no real top or bottom line upside from this particular product. And you'll remember, these are small fleets. So we have signed deals, and we are happy with that. And -- but collectively, these are not large deals. You need to do lots of them to be malleable.

- So we certainly, in our minds, see this product being a contributor in the next fiscal year, in our fiscal 2020, and we see it being potentially one of our rocket engines in 2021.

- So that's how we think about the product. In terms of the other part of your question, penetration rates, there's a -- in terms of the small service fleet kind of vehicles in the U.S., there's an estimate of about 12 million vehicles. The estimate goes on further that about 2 million of them have been penetrated. So there's still a very healthy balance of opportunity. And we certainly believe it's, as I said, around about of $4 billion to $5 billion annual market ARPU opportunity. So we're very excited about it

In December 2020, they admitted it hadn't really grown as they expected it to...

- John R. Granara, MiX Telematics Limited - CFO, Executive VP & Director [34]

- Yes. Yes. So I think with mix now, that's one of the areas that we've been, say, if you would -- we would candidly say that it has not grown as quickly as we would have liked when we first came out with it

So how has this "rocket engine" played out? Using Sentieo's keyword search function, we discovered that the term "MiX Now" has not been used in an earnings release or conference call transcript a single time since May 2021. We think that speaks for itself.

We asked management directly why MiX Now had failed to gain traction in the US, and their response was that customer acquisition costs were too high.

We think that this is an example of the poor sales execution and prioritization in the organization. The product was fine, but the sales team was unable to sell it cost-effectively. If there was no product-market fit, then why did the company spend money and time developing it in the first place? They should have been able to determine that they could not achieve the necessary ARPUs.

Continuing the theme of low-hanging fruit, one former employee mentioned that MIXT "is not as aggressive when it comes to sales as Cartrack."

This individual, a former sales director who worked for all three companies (MiX, Lytx, and Cartrack), noted about MiX's presence in the UK:

- "They have won a lot of business here, there's no doubt about it, but not as much as they should have won for how long they've been here."

Comparing Cartrack and MiX directly, the same individual noted:

- They are so much more adaptable to finding solutions for customers and integrating it into their dashboards, their programs. They have a really advanced technical department. They have their own manufacturing site, their manufacturing department on-site. They have a really aggressive sales team on-site. The sales director is the group sales director right now, he was my direct manager. So really good at what he did.

In another interview, he went further:

- I think the operational philosophy behind how Zak Calisto runs his business is a lot different to MiX Telematics. There is more focus on getting business in as quickly as possible... I think Cartrack has the ability to expand a lot more, a lot more efficiently and has that backing and support from an engineering perspective than MiX Telematics. I don't think MiX Telematics is as aggressive as Cartrack when they look at expansion.

Perhaps this lack of aggressiveness explains why they went after the low-hanging fruit (energy exposure that has proved to be an anchor stuck in the mud) rather than the higher-quality fruit (more diversified business in secular growth areas) that would have been better for MiX over the longer-term.

A former Head of Engineering noted - impromptu - a similar theme about the inconsistency of sales execution at MiX.

- "I think what is a big contributor in the success of these businesses is the salespeople as well, the way that they sell and how professional they are able to sell solutions. That is a big factor in this business as well. It's technology is one thing. But if you can't properly sell it, then it will affect the performance of the business.

- It is one thing to have good technology, but it's also a challenge to go and sell. And I do think that in certain areas in South Africa, for example, MiX Telematics has a really strong sales team, whereas in other areas, that sales team, would be significant in terms of bringing up performance for MiX Telematics. […]

- the sales strategies and how customers is approached and how do they find customers that's ready to buy the solution, I think, is a key differentiator with some of these companies. And that's one of the good reasons why some companies grow faster than others."

Certainly some employees did have positive things to say as well - clearly not all is bad, as MiX is still growing. This is not a company in distress. However, we think the above makes it clear that things could be so much better with proper management. Shareholders should not settle for mediocrity.

Perhaps hiring a new head of sales from a company such as Lytx, Samsara, or Cartrack would be a better investment than simply spending more money to hire more sales resources in a system that is underperforming. We believe that MiX should substantially reduce non-essential expenditures (such as travel). Some savings should be dropped to the bottom line, while others should be used to invest in improving the quality (rather than the quantity) of the sales organization.

End-Markets Are Back - MiX's Results Are Not

We also disagree with management about the supportiveness of the environment they have been in over the past several years. While they point to revenue headwinds such as the unavailability of vehicles, we believe that they actually should have seen some tailwinds, too.

COVID should have represented a temporary blip rather than a permanent reset lower. Many of the company's verticals (such as rental cars and oilfield vehicles) were deeply impacted by the crisis. MIXT certainly cannot be blamed for this initial decline, as many of its customers' businesses were essentially legislated out of existence, or saw near-zero demand due to fear of illness.

But MIXT should have seen a strong bounce back - this earnings season, airline CEOs, rental car providers, and other travel-related companies have talked about surging travel demand.

In a December 2020 Raymond James conference, Joss made comments about expecting "great growth" once the rental car and bus-and-coach sector bounced back:

- So whilst a lot of the contraction we've experienced over the last 2 quarters have been from this car rental space, as you can appreciate, there's no tourism at the moment, and there's no business travel. So they've really cut back their fleets significantly. […]

- But we haven't lost a single customer in this space. Any that have come up for renewal have renewed, and they will return to growth. It's just a question of when, I mean, there's now vaccines that are starting to be rolled out, the COVID era will end, tourism will resume, business travel will resume.

- And we expect that, ultimately, we're going to get -- see great growth for at least a period of time until they -- until things return to normal out of those kind of sectors.

Similarly, large energy service companies like Schlumberger and Halliburton keep raising their guidance, talking about the existing strength of their business and the outlook for a very strong 2023. On the most recent public conference call, Schlumberger CEO Oliver Le Peuch discussed the "largest-ever" natural gas investment cycle in the Middle East as a driver of continued strength over the next several years.

SLB and HAL are MIXT clients per the annual report, and yet the rebound in their business is somehow not benefiting MIXT's current results or near-term outlook.

In previous energy cycles, MIXT has seen these vehicles come back online, leading to accelerated growth coming out of the downturn. For example, here is an exchange between an analyst and Joss at the company's 2018 Investor Day:

- Q: There's quite a few vehicles that actually aren't turned on, like in the energy space where they -- because of what's going on with the pricing. Do you think there is 15,000, 20,000 vehicles that are not turned on every year that can also provide growth if the price of oil and other things come back?

- [...]

- A: Second part of your question was the energy sector. I think, another reason is that the energy customers that -- I used that term previously a couple of years back that we were pregnant with growth, we had a lot of customers that have turned up vehicles, and when they started expanding their fleets again, we would see -- we would get some tailwind growth. And we'll definitely experience this.

Source: transcript available in Sentieo

Given all of the above, we believe that MiX should be currently experiencing a significant growth tailwind as customers in sectors like energy and travel are increasing the size of their fleets relative to what they were operating a year or two ago. Despite such a tailwind, MiX is unable to achieve its targeted growth rates - yet another data point suggesting the organization's sales team is underperforming.

The company's business is not collapsing by any means, but more is possible, and management needs to take action.

Sale of the Company - Another Alternative to Unlock Value

Our first preference is management fixing the issues described so that we, and others, can continue to be long-term shareholders in an ongoing value creation story. The potential for an attractive combination of ongoing free cash flow and a double-digit growth rate is why we invested in MiX for the first place.

However, we believe the Board should also run a full strategic alternatives process, such that they can sell the company should management prove unwilling or unable to improve performance towards peer levels over the next several quarters.

There are many precedent transactions or valuations suggesting MIXT is worth a lot more than it trades for to a prospective acquirer - we believe 2-3x ARR is a reasonable multiple, which we believe implies a stock price of $15+ when including the cash on the balance sheet and the excess inventory held due to now-resolving supply chain issues that should convert to cash over the next few years.

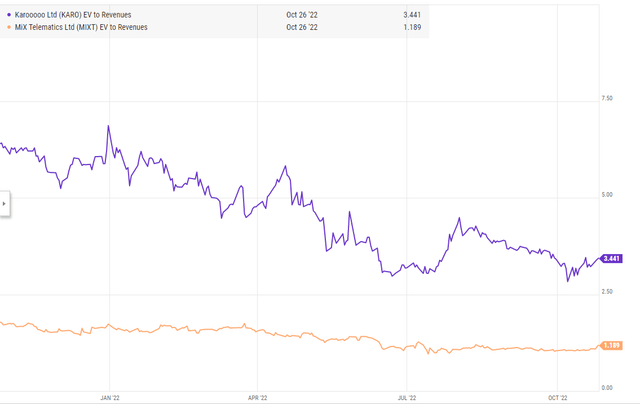

Lytx obviously has a much higher growth rate, but was valued at over $2.5 billion (based on $300 million plus of revenues and $100 million plus of EBITDA) in an early 2020 transaction with Permira. Multiples for tech companies have broadly declined since then, but even today, publicly traded Karooooo (KARO) sports an EV/revenues multiple 3x higher than MIXT's.

Similarly, in 2019, Pointer Telocation (PNTR) - which we viewed as a lower-quality business with higher churn and slower growth - was acquired for nearly 2x trailing revenues and ~10x Adj. EBITDA despite a lower growth rate than MIXT (merely 5% in the last fiscal year before it was acquired).

There are many other comps we could point to, but we believe even in today's rough macroenvironment, one of the areas of PE demand continues to be for recurring-revenue software businesses, due to their attractive characteristics.

Ultimately, we believe the Board could sell the business to an acquirer for a substantial premium - so with the stock recently bouncing around in the $7s and $8s over the last several quarters, management needs to justify why this remains a public company. If they can't or won't organically improve performance, then they have an easy solution - sell, and give shareholders their capital back to reinvest as they see fit.

At something like 1.2x ARR if you add back cash and the excess inventory that will turn into cash, MIXT is grossly undervalued.

Conclusions

It is factual and obvious to state that MIXT has underperformed its own internal targets over the past three years, and continues to do so this quarter (and this year). We think we've made a clear case as to some of the underlying drivers of that underperformance, based on our research. Current results and near-term plans are simply not good enough. Therefore, we call on management in the strongest possible terms to fix these problems today - not next year or sometime in the future.

We do not wish to be a distraction, and we are not typically activists - but we have a fiduciary duty to our clients. We believe that simply walking away from MIXT at current share prices, rather than trying to get it fixed and return the share price to an acceptable level, would violate that fiduciary duty.

MIXT has extraordinary potential in the right hands. We think it would be better for everyone if management and the Board agreed to unlock that potential by listening to constructive feedback from the people they are supposed to serve (shareholders, such as ourselves). If management and the Board will not work constructively with us to restore shareholder value, we will have no choice but to take more aggressive steps to fulfill our fiduciary duty to our clients.

The current state of affairs is unfair not only to shareholders, but also to other stakeholders such as employees. A MIXT delivering stronger results, like Lytx or Cartrack, would have more funds available to invest in its employees and the communities it serves.

Any shareholders who have thoughts, whether they agree with my analysis or not, are encouraged to reach out to me.

Contact information:

Samir Patel

Portfolio Manager, Askeladden Capital

[email protected]

Disclaimer: everything herein is solely our opinion and should not be construed as investment advice. We may change our position at any time without notification other than as is required by relevant regulatory authorities.

SOURCE: Askeladden Capital Management LLC