VANCOUVER, BC / ACCESSWIRE / March 22, 2024 / Europacific Metals Inc. (TSXV:EUP)(OTCQB:AUCCF U.S.) (the "Company" or "Europacific") is pleased to announce a corporate update letter to shareholders in address from the Company's Chief Executive Officer, Karim Rayani.

Dear Shareholders,

As we embark on the ensuing year ahead, I'm pleased to share with you a corporate update letter outlining the Company's objectives and strategies for 2024 and beyond.

We are in the midst of what is quickly shaping up to be a very favorable macroeconomic environment for Gold, Copper and precious metals. Yet a perplexing disparity persists for companies despite the favorable backdrop as metal prices head higher market capitalizations continue to struggle creating unprecedented opportunities in the resources sector. Additionally low interest rates can weaken the purchasing power of fiat currencies, making precious metals relatively more attractive as a store of value setting stage for a return to commodities and market capitalizations within the junior mining sector.

One of the commodities that I feel presents tremendous opportunity in the sector is Copper, the recent surge in copper prices combined with anticipated supply shortfalls over the next few years Copper is a value proposition that one should not ignore.

- Supply-Demand Imbalance: With increasing demand for copper driven by infrastructure projects, renewable energy initiatives, and electric vehicle adoption, the market is facing a potential supply-demand imbalance. The result upward pressure on prices, benefiting copper producers.

- Investment Potential: The expected shortfall in copper supply creates an attractive investment opportunity for those looking to capitalize on potential price appreciation. Investors can consider exposure to copper through various avenues such as stocks of mining companies, exchange-traded funds (ETFs), or directly trading copper futures contracts.

- Strategic Importance: Copper is a critical metal with diverse industrial applications, ranging from construction and electronics to transportation and telecommunications. Its strategic importance in various sectors ensures sustained demand, further supporting its price outlook.

- Long-term Trends: Structural shifts such as the transition to renewable energy, electrification of transportation, and urbanization in emerging markets are expected to drive long-term demand for copper. Investing in copper now could position investors to benefit from these ongoing trends.

- Geopolitical Factors: Geopolitical tensions, trade disputes, and supply chain disruptions can impact copper production and distribution. As such, can provide a hedge against geopolitical risks and uncertainties.

Overall, the combination of surging copper prices and anticipated supply shortfalls presents an opportunity for investors bullish on the copper sector. However, it's essential to conduct thorough research and consider risk factors before making investment decisions.

I was newly appointed Chief Executive Officer, director of EuroPacific on October 17, 2023, and since have made several changes to streamline operations optimizing resources and enhancing productivity across all aspects of operations. We prioritize and recognize the importance of sustainable and social initiatives to the well-being of our communities as we develop our asset portfolio.

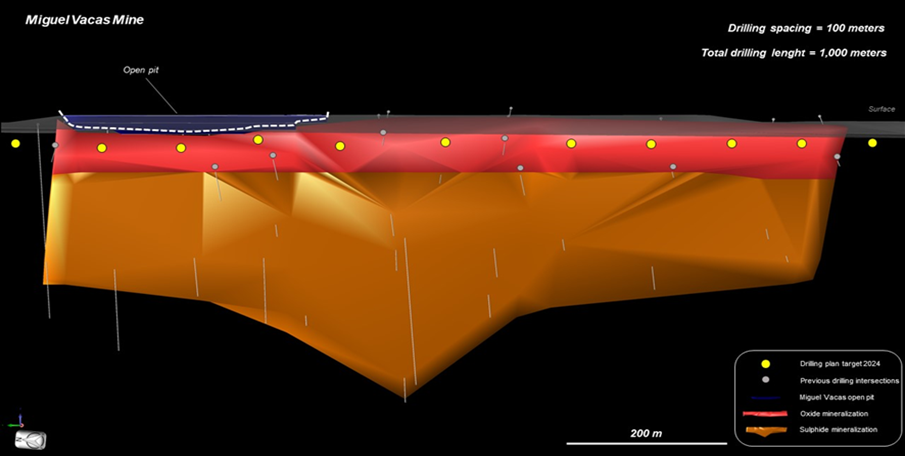

Looking ahead, our primary objective for the ensuing year is the Immediate planning of advancing the Miguel Vacas Copper prospect. An 11-hole program totaling 1,000-meters is currently being planned to test the surface mineralization along strike, we will be reporting back in the coming weeks on the estimated start date once drill contractors have been confirmed.

A 2-year exploration plan has been approved internally for the advancement of the project where we feel a resource can be developed.

- The area lies approximately 180km east by road from Lisbon and 70km from Évora, the Alentejo region capital. It is close (< 10km) to the small towns of Estremoz, Borba, Vila Viçosa and Alandroal.

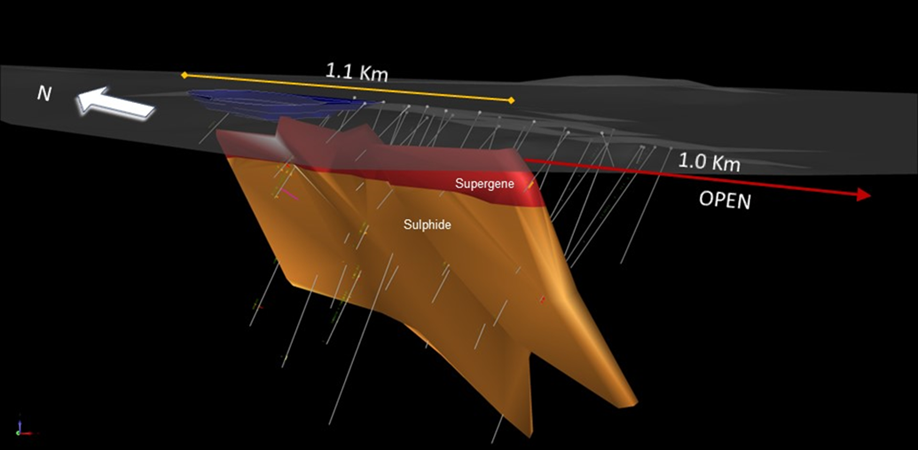

- Confirm the high- grade zones from old reports and expand the "mining widths" to a more substantial target size over the main drilled area covering a strike length of 1.1 km of the mineralized shear zone.

- Infill drilling with a 100m X 100m grid to produce an initial reliable mineral resource estimation (Inferred category) of the supergene heap leachable copper blanket (0 - 80m depth).

- Further soil testing and advancement studies, for expansion along less advanced prospects including geochemistry (soils and rocks) along with geophysics (Airborne EM and Ground IP).

- Borba 2 projects, further exploration plans underway with well-documented potential to host precious and base metals mineralization for Copper and Gold.

The Miguel Vacas mine was an open pit copper mine last operated in 1986 by heap leaching methods. Records show that between the 1920's and 1990, 346 068 tonnes of oxide copper mineralization were mined but due to poor recovery only 895 tonnes of copper metal were produced. Copper grades ranged from 0.6 to 0.7% in the early years of the operation but later reached up to 1.4%. This mine was closed in 1986 due to financial trouble after having produced 464,100 t of ore with an average grade of 2.1% Cu. Prior exploration was carried out by Rio Tinto for epithermal gold deposits during the early 1980's. The project changed hands a number of times before we were able to acquire ownership.

Recent exploration results have indicated a potential strike extension of 2 km. Cu-bearing shear zones.

- Assays from a channel sampling program carried out in 2006 by Rio Narcea Gold Mines (RNGM) in the old Miguel Vacas north pit walls, has indicated a width of 13.5 meters @ 1.6% Cu, including 2 meters @ 4.9% Cu. The results from the southern wall are nearly identical with an interval of 13.6 meters @ 1.6 % Cu. The samples were taken at the far ends of the old pit that extends presently 250 meters along strike.

- Historical and recent drilling confirms these results. Highlights include 6m @ 0.8% Cu from hole MV04, 10.0m @ 0.9% Cu from hole MV05, 8.6m @ 1.1% Cu from hole MV07, 7.9m @ 2.03% Cu from hole MV08, 4.25m @ 1.5% Cu from hole MV09, 16.5m @ 1.5% Cu from hole MV10, 6.0m @ 1.0% Cu from hole MV14, 7.9 m @ 1.0 % Cu from hole MV16, 21.6m @ 1.6% Cu from hole MV19 and 10.7m @ 1.94% Cu from hole BOMV15001.

- Rio Narcea produced an in-house resource estimation (non-compliant) exercise based on a 100 x 100m drilling campaign (20 holes in total) using the basic Tysson Polygon method. Results point out to a figure of 5.54 Mt with a total contained 68,186 tonnes Cu metal. This includes a total of 1.12 Mt @t 1.23% Cu from the oxidized blanket and 4.4 Mt @ 1.24% Cu from primary sulphide ore.

This underground mine was registered in 1866 and operated intermittently until around 1900. There are records for a total of 9 mine levels down to a total depth of 200m.

The vein system occupies a 1km long section of the fault zone and includes three main veins that have been mined in the past: Vein 1 (main vein) - N50oE/80o NW, up to 1.2 m thick, mined over 800m along strike; Vein2 - NS/50o E, average 1.3m thickness and Vein 3 - NS/90o;no records on thickness.

Dump samples of silicified and sheared acid tuffs from the Bugalho mine area within the Vascas deposit assay up to 9.14 g/t Au and 0.35% Cu. The mineralization is from a wide NE-SW trending shear zone that can be mapped on at least 5 km along strike. Detailed follow-up is planned in this prospect.

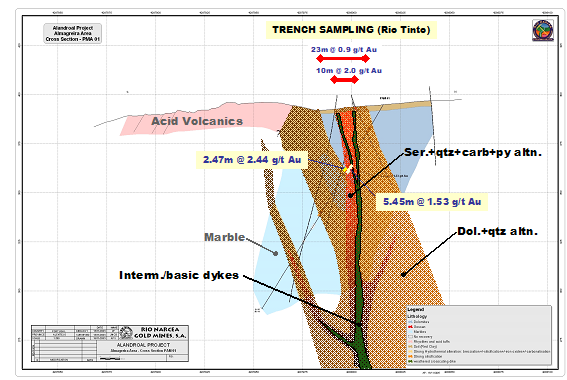

Significant drill intercepts comprise 5.45 m @ 1.53 g/t Au, including 2.47m @ 2.44 g/t Au in hole PAM-1. The highest individual value obtained came from a gossanous quartz-dolomite altered marble @ 5.77 g/t Au over an intercept of 0.75m. Banded carbonatization and low-temperature silica alteration occur thoroughly in the hole. Zones of poor recovery are interpreted to represent karst fill features.

Results obtained for Borehole PAM-2, located in the same zone include an intercept of 17 m @ 0.5 g/t Au, including an interval of 2m @ 3.7 g/t Au. The mineralized zone coincides with sections of intense silica-carbonate alteration with several massive gossan zones and localized fresh sulphide dissemination (chalcopyrite and pyrite).

- Additional new targets identified with follow-up mapping, soil and rock geochemistry along with detailed geophysics (IP/resistivity), followed by drill checking.

Exploring for critical elements, particularly copper, presents a compelling value proposition in today's market characterized by a global deficit. As industries increasingly rely on copper for essential applications in renewable energy, electric vehicles, and infrastructure development, the demand for this critical element continues to outpace supply. By securing access to new copper reserves through exploration efforts, companies can not only mitigate supply chain risks but also stand to benefit from potentially lucrative opportunities in a market hungry for this indispensable resource.

EuroPacific is opportunistically positioned as we further develop and explore the Miguel Vacas Copper project. The Company is also in the process of rebranding and will be announcing a name change to better align the Company's focus in the Iberian Peninsula.

About Europacific Metals Inc

Europacific Metals Inc. is a Canadian public company listed on TSXV and in US on OTCQB. The Company holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in Europe and Eurasian jurisdictions.

On behalf of the Board of Directors

Karim Rayani

CEO & President

For further information please contact:

Europacific Metals Inc.

Mr. Karim Rayani, Chief Executive Officer

11th Floor - 1111 Melville Street

Vancouver, BC V6E 3V6

E: [email protected]

www.europacific.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the exploration potential of the Company's properties. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. These forward-looking statements involve risks and uncertainties relating to, among other things, results of future exploration and development activities, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and unanticipated environmental impacts on operations. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The readers should not rely on any historical estimates. The Company and the QP have not done sufficient work to classify historical estimate as a current resource. The Company is not treating the historical estimate as a current resource. Additional work including drilling will be required to verify and upgrade historical estimates.

SOURCE: Europacific Metals Inc.