Recent bank crises in the U.S. and Europe have many Canadians worried about the fate of their deposits here at home, and the resiliency of our banking system.

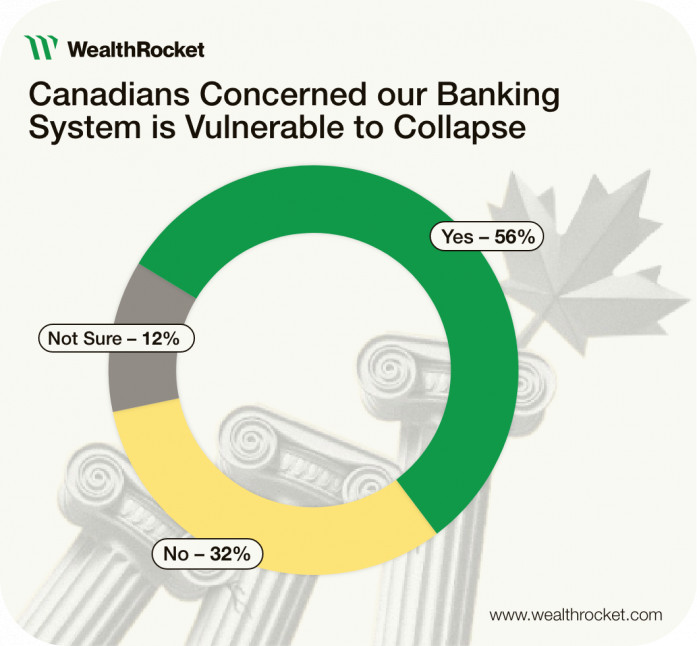

- 56% of Canadians are concerned Canada's banking system is vulnerable to collapse.

- 28% of Canadians are somewhat worried about the security of their deposits.

- To protect from a potential financial crisis, 22% of Canadians have withdrawn money from their bank in the last 30 days, and 15% have transferred money to a different institution.

TORONTO, ON / ACCESSWIRE / May 25, 2023 / A new survey conducted by WealthRocket reveals more than half (56%) of Canadians are concerned our domestic banking system is vulnerable to collapse, similar to what's happened with some banks in the U.S. and Europe.

Percentage of Canadians concerned our banking system is vulnerable to collapse compared to those who say no, or are unsure.

The recent collapse of Silicon Valley Bank and Signature Bank, followed by the near-collapse of Credit Suisse, has many Canadians worried about the fate of their deposits at home, and the resiliency of our banking system.

Concerns about banking system vulnerability and safety of deposits

Fifty-six percent of Canadians are concerned our banking system is vulnerable to collapse, with younger Canadians - particularly millennials - most concerned.

Those ages 35-44 expressed the most concern (64%), followed by those 25-34 (63%), 18-24 (51%), 45-54 (51%) and 54+ (45%).

More than a quarter (28%) of Canadians are somewhat worried about the safety of their money in a Canadian bank, with 20% very worried, 9% extremely worried, and 19% not worried.

While many banks are insured by CDIC, only 37% of Canadians know what CDIC is and know their financial institution is a member. Slightly less (32%) don't know what CDIC is, and have no idea if their financial institution is a member.

Canadians taking preventative action to protect from potential banking crisis

In an effort to shield their money from a potential financial crisis, in the last 30 days:

- 22% of Canadians have withdrawn money from their account

- 16% have transferred money to an investment account

- 15% have transferred money to a different institution

- 14% have purchased alternative assets, like cryptocurrency

- 13% have verified whether their bank is a CDIC member

Survey Methodology

Data collected via an online Pollfish survey of 1,500 Canadians (18+) conducted between April 13 and 14, 2023. Estimated margin of error: +/- 3%.

About WealthRocket

WealthRocket a Canadian personal finance website focused on credit cards, banking, investing, budgeting, and more. Our mission is to empower Canadians to make informed financial decisions and get the most out of their money.

For further information, contact Rebecca David, [email protected].

Contact Information

Rebecca David

Media Relations Coordinator

[email protected]

902-293-9342

SOURCE: WealthRocket