LOS ANGELES, CA / ACCESSWIRE / May 15, 2023 / The Employee Retention Credit (ERC) tax refund for manufacturing companies, distributors, suppliers, plants, manufacturers, and other small and large factory-type businesses, provides a valuable tax refund from the Internal Revenue Service (IRS). Many manufacturers in every state qualify a portion of the eligibility period due to mandated state government, county, city, or municipality restrictions placed on plant locations during the COVID pandemic. Manufacturers were forced to partially or fully close factories, limit assembly line capacity, reduce workforce operation capacity, reduce hours of operation, and had on-going supply chain delay issues of getting raw materials from overseas, to shipping their products to their dealers and suppliers. Even if a manufacturing company revenue didn't decline, or even if it increased, under the full and partial shutdown rules and/or supply chain issues, most manufacturing companies may still qualify for up to a $26,000 to $33,000 employee retention tax credit refund per employee on the company's payroll during the 2020 and 2021 tax years.

Manufacturing companies, suppliers, warehouse distributors, plants, factories, and other manufacturers may be missing out on a potentially large Manufacturing Employee Retention Credit Business Tax Refund by not fully understanding how and why their company qualifies. Image Credit: Pressmaster / 123rf.

"With more that 591,000 manufacturing businesses in the United States employing almost 13,000,000 manufacturer employees on payroll, the manufacturing industry was definitely one of the most disrupted industries during the pandemic. Many manufacturing companies will qualify for the Employee Retention Tax Credit in some way, depending on their particular business circumstances," said Marty Stewart, Chief Strategy Officer (CSO) with Disaster Loan Advisors (DLA).

How Most Manufacturers Qualify for the Employee Retention Credit (ERC) Tax Refund

All manufacturers may be eligible to claim the IRS employee retention credit in 2023, 2024, and even 2025, "if" they qualify any portion of time between March 13, 2020 to September 30, 2021 for manufacturing companies that were around prior to the COVID pandemic. For manufacturers, suppliers, or distribution companies that were started or purchased after February 15, 2020, those manufacture types are eligible from the time their company opened until December 31, 2021. These types of manufacturing businesses are also referred to as a recovery startup business, and qualify for the 4th quarter of 2021.

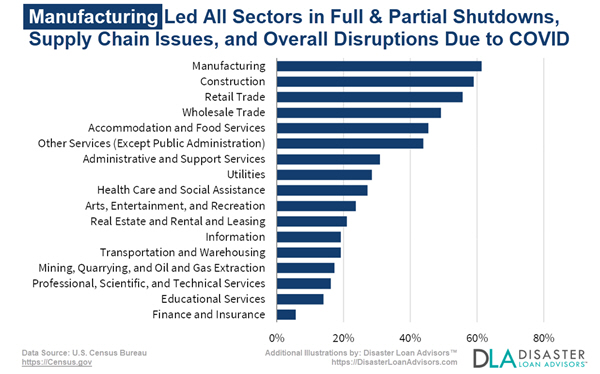

The Manufacturing Industry (NAICS 31-33) Led All Sectors in Full and Partial Shutdowns, Supply Chain Issues, and Overall Disruptions Due to the COVID Pandemic. Data Source: U.S. Census Bureau, Illustrations by: Disaster Loan Advisors™

Three Key Ways Manufacturers and Manufacturing Businesses Can Qualify for the Employee Retention Tax Credit (ERTC)

Manufacturers only need to qualify a quarter or portion of time for the $26,000 employee retention tax credit in one of three potential ways.

1. The first way a manufacturing company that produces goods and products can qualify is if it experienced a full or partial shutdown due to COVID-19 government regulations. Or, any other government-mandated shutdown orders that caused disruptions to production or distribution operations during specific periods in 2020 or 2021 due to the pandemic, says the IRS.

From the government mandated shutdown or start date of manufacturing operation capacity restrictions, or lack of raw materials to produce and ship goods sold due to supply chain disruptions, to the end date when those same restrictions were fully lifted, your manufacturing business qualifies for the manufacturing ERC credit and tax refund.

The pandemic led to the closure of manufacturing plants, factories, and production facilities worldwide, resulting in a lack of goods and products to make and sell. This, in turn, caused significant delays and shortages in shipments to retailers, distributors, suppliers, dealers and other businesses across the nation, leading to a surge in pandemic prices of various manufactured goods. Manufacturers have continued to face shortages and supply chain problems throughout 2020, 2021, 2022, and 2023.

2. The second way is that a manufacturer did not have to be fully shut down to qualify. It could have been considered only partially shut down due to lack of goods and products to produce and sell, often caused by their suppliers of raw materials (whether domestic or imported) having shortages or shutting down themselves. State mandates caused manufacturers to suspend operations, assembly lines to halt production, and limited factory hours of operation and assembly capacities. All of these issues clearly impacted most, if not all manufacturers, distributors, suppliers and warehouse operations nationwide, depending on the type of goods and products they produced and distributed.

3. Or, the third way a manufacturing business can qualify for the ERTC tax credit is if it has experienced a significant decline in gross receipts compared to one of two prior years (2019 versus 2020 or 2021). A decline in gross receipts is significant when the decline is more than -50% in 2020 as compared to the same quarter in 2019, or -20% in 2021 compared to the same quarter in 2019. In clear terms, you have to compare 2020 versus 2021 of the same quarters with 2019.

If you are a manufacturing owner or executive and paid wages to less than 100 employees in any quarter in 2020 (500 employees or less in 2021), those payroll gross wage numbers and salaries will be counted towards the ERC tax credit, regardless of whether they were full-time or part-time.

The rules get tricky if you paid more than 100 manufacturing employees in any quarter in 2020, or paid more than 500 employees in any qualifying quarter in 2021.

ERC Warning for Manufacturers: Many CFOs, Controllers, Accounting Professionals, CPA's, Financial Planners, Bookkeepers, and Tax Preparers Are Wrongly Advising Their Manufacturing Company Clients They Do Not Qualify for the Employee Retention Credit

The unfortunate mistake for some manufacturer owners, partners, and principals, many may have been given bad advice by their corporate CFO, controller, accountant, CPA, tax preparer, bookkeeper, financial planner, or other well-meaning accounting and tax professional.

The main reason this is occurring is their accounting, tax, or financial professionals did not take the time to fully educate themselves on the complex and confusing employee retention credit program for themselves or their manufacturing clientele.

"Your manufacturing business did not have to be fully shut down to qualify. It could have been only partially shut down. And this is easy for many manufacturers to prove this, due to all the government capacity issues imposed, supply chain distribution issues, and raw material shortages that severely limited manufacturers from producing new inventory to sell and distribute to businesses and consumers. If your accounting, tax, legal, or financial professional told you that your manufacturing company does not qualify, without first having done a thorough deep-dive analysis, they are completely wrong and do not fully understand the comprehensive current guidelines for the Employee Retention Tax Credit (ERC / ERTC) program," said Stewart with DLA.

Manufacturing Industry owners and executives can read the Employee Retention Tax Credit Guide that shows how valuable this business tax refund is for Manufacturers. Image Credit: FeverPitched / 123rf.

Are Manufacturers Able to Claim the Employee Retention Credit if They Received a Paycheck Protection Program (PPP) Loan from the SBA?

In prior IRS rulings, companies were disqualified from claiming the ERC credit. Great news is that it has changed. With current ERC rules, manufacturers that did receive PPP loans still may qualify, as long as the PPP loans are deducted properly from the ERC credit calculations.

Will Manufacturing Companies Qualify for the Employee Retention Credit if They Didn't Suffer a Large Financial Decline, or Even Increased Revenue?

Yes they can, as the Gross Receipts Test (GRT) is only one of three ways to qualify a quarter. Most manufacturers experienced disruptions to their operations solely through manufacturing supply chain issues and raw material shortages that made their production of new inventory almost non-existent at times, massively disrupting their production, distribution. and sales operations. This greatly affected their normal way of doing business, if it wasn't for the pandemic.

Is There a Difference Between the Employee Retention Credit (ERC) and the Employee Retention Tax Credit (ERTC)?

Both the employee retention credit (ERC) and the employee retention tax credit (ERTC) are actually one in the same. The ERC or ERTC are actually the same program from the Internal Revenue Service (IRS) and the terms are used interchangeably.

If a Manufacturing Facility Was Closed, is it Still Eligible for the Employee Retention Credit?

Depending on circumstances, closed or shuttered manufacturers and manufacturing businesses may be eligible for partners and owners to retroactively claim during the qualification period in 2020 and 2021. The employee retention credit is claimed by filing IRS Form 941-X which is amending quarterly payroll from the past. Manufacturing facility owners and partners are able to go back and claim the ERC in certain circumstances, even though they closed or sold their production location.

Would Manufacturing Company Owners and Partners Who Sold Their Manufacturing Business Qualify for the Employee Retention Credit?

Manufacturing companies that were sold during the eligibility period in 2020 and 2021, might also qualify, up until the date they were sold. Manufacturing company owners and partners are able to retroactively claim the ERC for their past businesses under certain circumstances.

Manufacturing Industry Beware: Employee Retention Credit Companies Charging a Contingency Fee on Your ERC Tax Refund

Manufacturing Industry companies, distributors, suppliers, plants, factories, manufacturers, and other similar businesses are reporting receiving many calls and emails from companies claiming to be employee retention credit experts. An overnight industry has been created around the Employee Retention Credit. Some ERC companies will have manufacturing owners and partners sign lengthy page agreements, will charge them no money upfront, and then wait to get paid once the business receives their ERC tax refund check. Sounds good in theory until manufacturers realize how much in excessive fees they really end up paying.

What many manufacturing owners do not realize is that they are overpaying on an excessive scale. Some of these ERC contingency fee levels may rival corporate level fee structures, or big company pricing. Yet, for many small to medium-sized manufacturers, they could be paying 5x to 25x more than they really need to.

Manufacturing partners feel these percentage-based contingency fees are very expensive. There have been numerous instances of manufacturers being quoted a percentage of their estimated ERC Employee Retention Credit tax refund. Or, where the fee levels are so excessive, they fall in the range of 20% to 30% of the manufacturer's ERC tax refund.

For example, if a manufacturing company was qualified to receive a $2,000,000 Employee Retention Credit tax refund, and they engaged with a company charging them 25% (or fee equivalent) of their refund, this would be $500,000 the manufacturer would be paying right off the top. This is a very excessive fee for the small amount of tax work required to process the refund.

Manufacturing companies receive their ERC Tax Credit Refund checks from the United States Treasury Department in Washington, DC. Image Credit: Elec / 123rf.

IRS Rules Say Charging a Contingent Fee or Percentage % of a Tax Refund is Not Permissible

Even though many companies out there performing ERC services are charging a percentage of a client's Employee Retention Credit refund, they are knowingly, or unknowingly, running afoul of IRS rules and regulations.

The IRS is very clear on this point. It can be found on page 21 of the Regulations Governing Practice before the Internal Revenue Service, Treasury Department Circular No. 230 (Rev. 6-2014), Catalog Number 16586R, under Section 10.27 Fees.

The IRS clearly states, "A practitioner may not charge a contingent fee for services rendered in connection with any matter before the Internal Revenue Service. A contingent fee includes a fee that is based on a percentage of the refund reported on a return, that is based on a percentage of the taxes saved, or that otherwise depends on the specific result attained.

Types of Manufacturing Industry Sectors That Were Disrupted During the Pandemic

What were some of the manufacturing industry sub-sectors that were shutdown or partially shutdown during the pandemic? Here is a comprehensive list of the types of manufacturing companies that were either shutdown for periods of time, and / or significantly altered their manufacturing operations that greatly affected the majority of manufacturers from running their assembly line and production operations efficiently, if it wasn't for the disruptions caused by the COVID-19 pandemic.

- Plastics Manufacturing

- Publishing & Printing Manufacturing

- Tobacco Manufacturing

- Petroleum & Coal Products Manufacturing

- Furniture & Fixtures Manufacturing

- Motor Vehicles Manufacturing

- Aerospace & Defense Manufacturing

- Computers & Other Electronic Products Manufacturing

- Medical Instruments & Equipment Manufacturing

- Communications Equipment Manufacturing

- Transportation Equipment Manufacturing

- Paper Manufacturing

- Chemicals Manufacturing

- Miscellaneous Manufacturing

- Wood Products Manufacturing

- Textiles Manufacturing

- Rubber Products Manufacturing

- Fabricated Metal Products Manufacturing

- Fabricated Metal Product Manufacturing

- Electrical Equipment & Appliances Manufacturing

- Beverages Manufacturing

- Motor Vehicle Parts Manufacturing

- Food Manufacturing

- Railcars, Ships, & Other Transportation Equipment Manufacturing

- Nonmetallic Mineral Product Manufacturing

- Primary Metals Manufacturing

- Pharmaceuticals Manufacturing

- Stone, Clay, Glass & Concrete Products Manufacturing

- Instruments Manufacturing

- Apparel Manufacturing

- Machinery Manufacturing

Top States for Manufacturing in the United States

What are the top ten states for manufacturing companies?

- California is first with 24,304 manufacturers employing 1,541,050 workers.

- Texas is second with 20,141 manufacturers employing 1,276,706 workers.

- Ohio is third with 15,449 manufacturers employing 892,810 workers.

- Illinois is fourth with 15,768 manufacturers employing 772,082 workers.

- Pennsylvania is fifth with 14,484 manufacturers employing 756,747 workers.

- Michigan is sixth with 12,328 manufacturers employing 711,807 workers.

- New York is seventh with 13,981 manufacturers employing 671,826 workers.

- Indiana is eighth with 8,472 manufacturers employing 589,816 workers.

- Wisconsin is ninth with 9,754 manufacturers employing 586,044 workers.

- North Carolina is tenth with 9,084 manufacturers employing 578,890 workers.

State Manufacturing Association Members Affected by COVID Government Shutdowns and Disruptions

What manufacturing association members were affected during COVID? Most manufacturers are members of The National Association of Manufacturers (NAM), and also members of their state manufacturing associations in their geographic area. Here is a complete list of Manufacturer Associations and members that were affected during the pandemic.

- Alabama - Business Council of Alabama

- Alaska - Alaska Chamber

- Arizona - Arizona Chamber of Commerce & Industry

- Arkansas - Arkansas State Chamber of Commerce/AIA

- California - California Manufacturers & Technology Association

- Colorado - Colorado Chamber of Commerce

- Connecticut - Connecticut Business & Industry Assn, Inc.

- Delaware - Delaware State Chamber of Commerce

- Florida - Associated Industries of Florida

- Georgia - Georgia Association of Manufacturers

- Hawaii - Chamber of Commerce of Hawaii

- Idaho - Idaho Association of Commerce & Industry

- Illinois - Illinois Manufacturers' Association

- Indiana - Indiana Manufacturers Association, Inc.

- Iowa - Iowa Association of Business & Industry

- Kansas - Kansas Chamber of Commerce & Industry

- Kentucky - Kentucky Association of Manufacturers

- Louisiana - Louisiana Association of Business & Industry

- Maine - Maine State Chamber of Commerce

- Maryland - Maryland Chamber of Commerce

- Massachusetts - Associated Industries of Massachusetts

- Michigan - Michigan Manufacturers Association

- Minnesota - Minnesota Chamber of Commerce

- Mississippi - Mississippi Manufacturers Association

- Missouri - Missouri Chamber of Commerce & Industry

- Montana - Montana Chamber of Commerce

- Nebraska - Nebraska Chamber of Commerce & Industry

- Nevada - Nevada Manufacturers Association

- New Hampshire - Business & Industry Association of NH

- New Jersey - New Jersey Business & Industry Assn

- New Mexico - New Mexico Business Coalition

- New York - Business Council of NY State, Inc.

- North Carolina - North Carolina Chamber

- North Dakota - Greater North Dakota Chamber

- Ohio - The Ohio Manufacturers' Association

- Oklahoma - State Chamber of Oklahoma

- Oregon - Oregon Manufacturers and Commerce

- Pennsylvania - Pennsylvania Manufacturers' Association

- Puerto Rico - Puerto Rico Manufacturers Association

- Rhode Island - Rhode Island Manufacturers Association

- South Carolina - South Carolina Chamber of Commerce

- South Dakota - South Dakota Chamber of Commerce & Industry

- Tennessee - Tennessee Chamber of Commerce and Industry

- Texas - Texas Association of Business

- Utah - Utah Manufacturers Association

- Vermont - Associated Industries of Vermont

- Virginia - Virginia Manufacturers Association

- Washington - Association of Washington Business

- West Virginia - West Virginia Manufacturers Association

- Wisconsin - Wisconsin Manufacturers & Commerce

- Wyoming - Alliance of Wyoming Manufacturers

Top Cities for Manufacturing in the United States

What are the leading manufacturing cities in the U.S.?

- Houston, TX had 254,186 manufacturing jobs, with 3,504 companies.

- New York, NY had 135,830 manufacturing jobs, with 1,997 companies.

- Chicago, IL had 109,969 manufacturing jobs, with 2,131 companies.

- St. Louis, MO had 73,681 manufacturing jobs, with 1,139 companies.

- Fort Worth, TX had 72,205 manufacturing jobs, with 764 companies.

- San Diego, CA had 71,263 manufacturing jobs, with 776 companies.

- Phoenix, AZ had 71,005 manufacturing jobs, with 1,446 companies.

- Cincinnati, OH had 70,275 manufacturing jobs, with 1,113 companies.

- Louisville, KY had 67,847 manufacturing jobs, with 851 companies.

- Indianapolis, IN had 67,765 manufacturing jobs, with 1,022 companies.

About Disaster Loan Advisors™ Employee Retention Credit (ERC) Services for the Manufacturing Industry Companies and Manufacturers

Disaster Loan Advisors™ (DLA) is a trusted team of financial tax professionals and Employee Retention Credit (ERC) consulting specialists dedicated to saving businesses from lost sales, lost customers and clients, lost revenue due to financial and economic harm caused by the COVID-19 / Coronavirus disaster, Delta and Omicron variants, and other recession and inflation downturns in the economy.

Having worked with over 1500+ business clients navigate the SBA Economic Injury Disaster Loan (EIDL), Paycheck Protection Program (PPP), and Restaurant Revitalization Fund (RRF) programs, DLA further refined its expertise in the ERC Tax Credit IRS program having assisted more than 700+ companies with their ERC Claims. Assisting ownership groups with multiple business entities, multiple location business owners, and other complex situations that require an expert tax and accounting strategist to be brought in to assess the situation and create the most strategic path forward.

DLA further specializes in another key pandemic-era SBA / IRS program where business owners are leaving a lot of relief fund money on the table. It is the often misunderstood and confusing Employee Retention Tax Credit (ERC) / Employee Retention Tax Credit (ERTC) program whereby company owners and partners can retroactively receive up to $26,000 to $33,000 back for each W-2 employee they had on payroll for the 2020 and 2021 tax filing years. Done correctly, these tax credits or cash refunds can be claimed retroactively for up to 3 years.

It's encouraged that business owners obtain professional assistance in going through the complex 941-X amended filing process to help your company maximize the full value of the ERC Credit Program, while staying safe and compliant within the complex IRS rules and regulations for claiming the ERC Credits.

DLA doesn't charge a percentage (%) of your ERC refund like many companies are charging. Instead, DLA works on a reasonable professional flat-fee basis. If you are looking for an ERC company that believes in providing professional ERC services and value for small business owners, in exchange for a fair, reasonable, and ethical fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Need Strategic Employee Retention Tax Credit Guidance for Your Manufacturing Company?

CONTACT:

Disaster Loan Advisors

Elena Goldstein

Director of Media Relations

877-463-9777 ext. 3

[email protected]

Connect with Disaster Loan Advisors via Social Media:

Linkedin, Facebook, Instagram, Twitter, Youtube, and CrunchBase.

For an Employee Retention Credit Deep-Dive Analysis for Your Manufacturing Business, Visit:

https://www.disasterloanadvisors.com/erc

SOURCE: Disaster Loan Advisors™ (DLA)