VANCOUVER, BC / ACCESSWIRE / May 3, 2023 / Faraday Copper Corp. ("Faraday" or the "Company") (TSX:FDY)(OTCQX:CPPKF) is pleased to announce the results from a Preliminary Economic Assessment ("PEA") and an updated Mineral Resource Estimate ("MRE") for its Copper Creek Project, located in Arizona, U.S. ("Copper Creek"). The PEA provides an economically viable base case for the development of Copper Creek.

All financial results are in U.S. dollars unless otherwise stated. The Company will hold a conference call and webcast on May 4, 2023 at 4:30pm ET to discuss the results of the PEA and MRE. Details are provided below.

Paul Harbidge, President and CEO, commented, "In the twenty months since restarting technical activities at Copper Creek, we have delivered an MRE with 4.2 billion pounds of copper in the Measured and Indicated category, an economically robust PEA and a pipeline of exploration targets. The PEA provides an excellent basis for the future development of Copper Creek and is the beginning of the Faraday story. The projected low initial capital and upfront open pit mine unlocks a large underground operation, for a combined mine life of more than 30 years. The project is expected to grow over time as the property is endowed with numerous untested exploration targets. Importantly, the results from our ongoing 10,000-metre drill program, which are not incorporated in the current studies, are anticipated to contribute to this growth in the future. We are planning a further 20,000-metre drill program to commence in the fourth quarter of this year as we continue to advance the project and unlock value for our stakeholders."

Highlights of the Copper Creek PEA*

- Attractive economics: Post-tax Net Present Value ("NPV") (7%) of $713 million and Internal Rate of Return ("IRR") of 16% (Table 1) and significant upside to higher metal prices (Table 4).

- Strong standalone open pit economics: Standalone open pit operation supports a pre-tax NPV (7%) of $337 million (Table 2).

- Robust project: Open pit mining provides a rapid payback on initial capital of four years and fully funds development of a bulk underground mine for a combined total mine life of 32 years (Table 1).

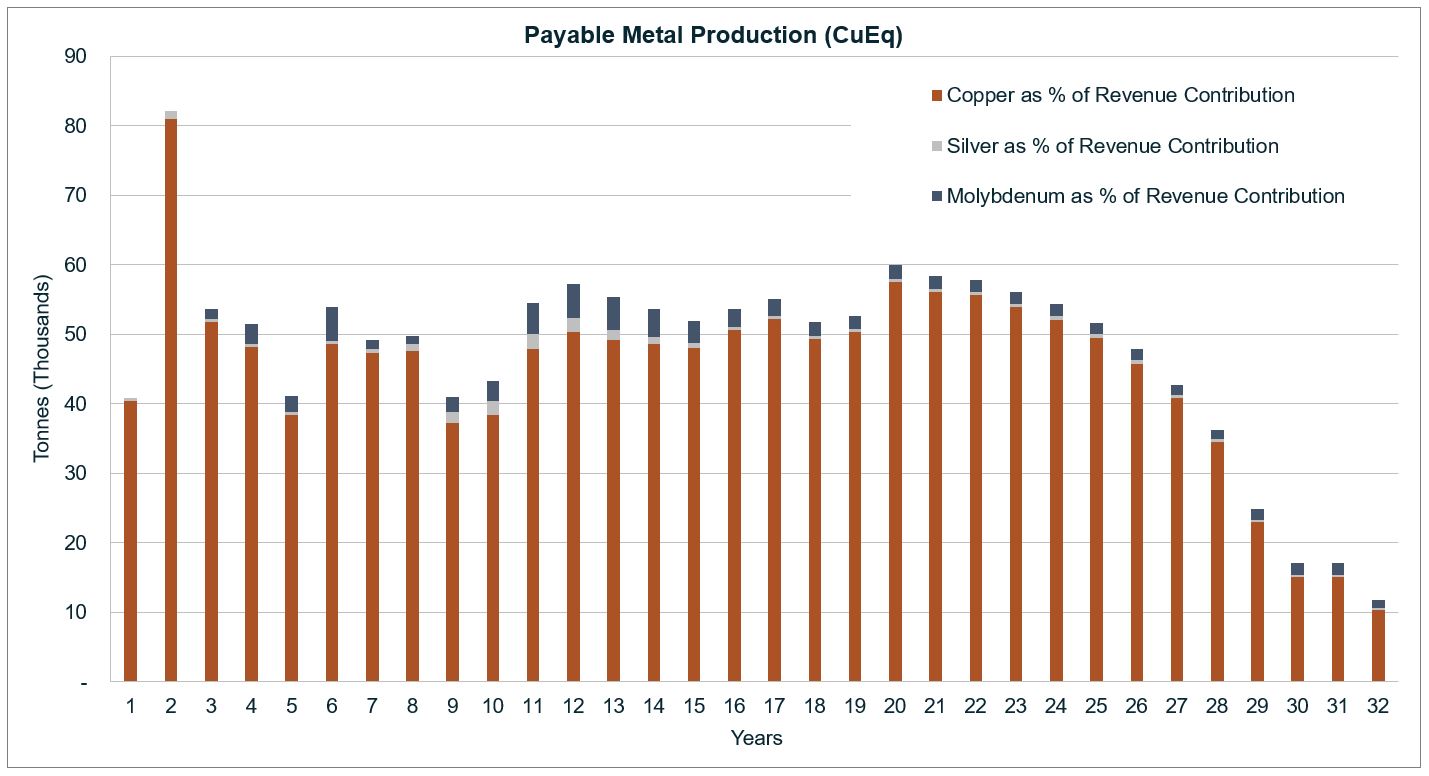

- Long life production profile: Average anticipated payable production during active miningi of 51,100 copper equivalent ("CuEq")ii tonnes per year ("tpa"), with peak production of 82,100 tonnes CuEqii in Year 2. Generating 3.4 billion pounds ("lbs") payable CuEqii metal over the anticipated life of mine (3.2 billion lbs copper, 45.1 million lbs molybdenum, and 9.7 million troy ounces ("oz") silver) (Table 3, Figure 2).

- Low initial capital investment: $798 million, with a construction period of two years (Table 1).

- Competitive operating cost profile: Average life-of-mine ("LOM") production cash costsiii of $1.67/lb copper and all-in sustaining costsiii ("AISC") of $1.85/lb copper (Table 3).

- Favourable strip ratio: Average open pit strip ratio of 1:1.2 due to the nature of the near-surface breccia mineralization that allows sequencing of high-grade production.

- High metallurgical recoveries: Over 94% average copper recovery from sulphide material, producing high-quality clean concentrates.

- Enhanced environmental, social, and governance ("ESG") practices: Dry stack tailings to reduce water requirements and environmental footprint as well as utilization of renewable solar power to reduce emissions.

- Updated Mineral Resource Estimate: An updated MRE is the basis for the PEA. Measured and Indicated resources are 421.9 million tonnes ("Mt") at an average grade of 0.45% copper for a contained 4.2 billion pounds of copper.

- Exploration upside: The mineral resource remains open at depth and laterally, as highlighted by the intersection of massive sulphides beneath the Copper Prince breccia (see news release dated January 17, 2023). In addition, there are over 400 breccia occurrences mapped at surface, 35 drill-tested and 17 included in this MRE, as well as additional porphyry potential.

Zach Allwright, VP Projects and Evaluations, stated, "The outcome of the PEA demonstrates the potential for Copper Creek to become a significant source of U.S. domestic copper production. The study is underpinned by empirical data, acquired through extensive geological and geotechnical assessments, comprehensive metallurgical test work, first principles costing and diligent schedule optimization. This base case forms a foundation on which the Company can continue to add value through resource expansion, new discoveries on the property, the potential to add a gold by-product and various opportunities to increase the production capacity."

* The metrics presented in this news release are based on a PEA that includes an economic analysis of the potential viability of Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. This PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty the PEA will be realized. See "Qualified Person and NI 43-101" below. For reference i, ii, and iii, please refer to endnotes at the end of the document.

Conference Call and Webcast

Investors, media and the public are invited to join the conference call and webcast, during which management will discuss the result of the Copper Creek PEA.

- Thursday, May 4, 2023, at 1:30pm PT (4:30pm ET)

- Toll-free in U.S. and Canada: +1 (800) 319-4610

- All other callers: +1 (604) 638-5340

- Webcast: https://services.choruscall.ca/links/faradaycopper202305.html

- Webcast replay: Available on the Company's website for one year and by phone at +1 (855) 669-9658 or (604) 674-8052 for three months. Please enter passcode 3013#

PEA Overview

The 2023 PEA outlines a low initial capital project that processes approximately 345 Mt of mill feed material from a combined open pit and underground operation. The PEA contemplates a 30,000 tonnes per day ("tpd") conventional flotation process plant producing high-quality copper and molybdenum concentrates, with silver by-product credits. The PEA also captures value from an additional 20 Mt of oxide material sourced from pre-strip mining and processed via a heap leach facility ("HLF") utilizing solvent extraction and electrowinning ("SXEW"), further supporting a rapid payback on initial capital. The PEA does not incorporate any results from the Phase II drill program, which is currently ongoing and expected to conclude near the end of the second quarter of 2023.

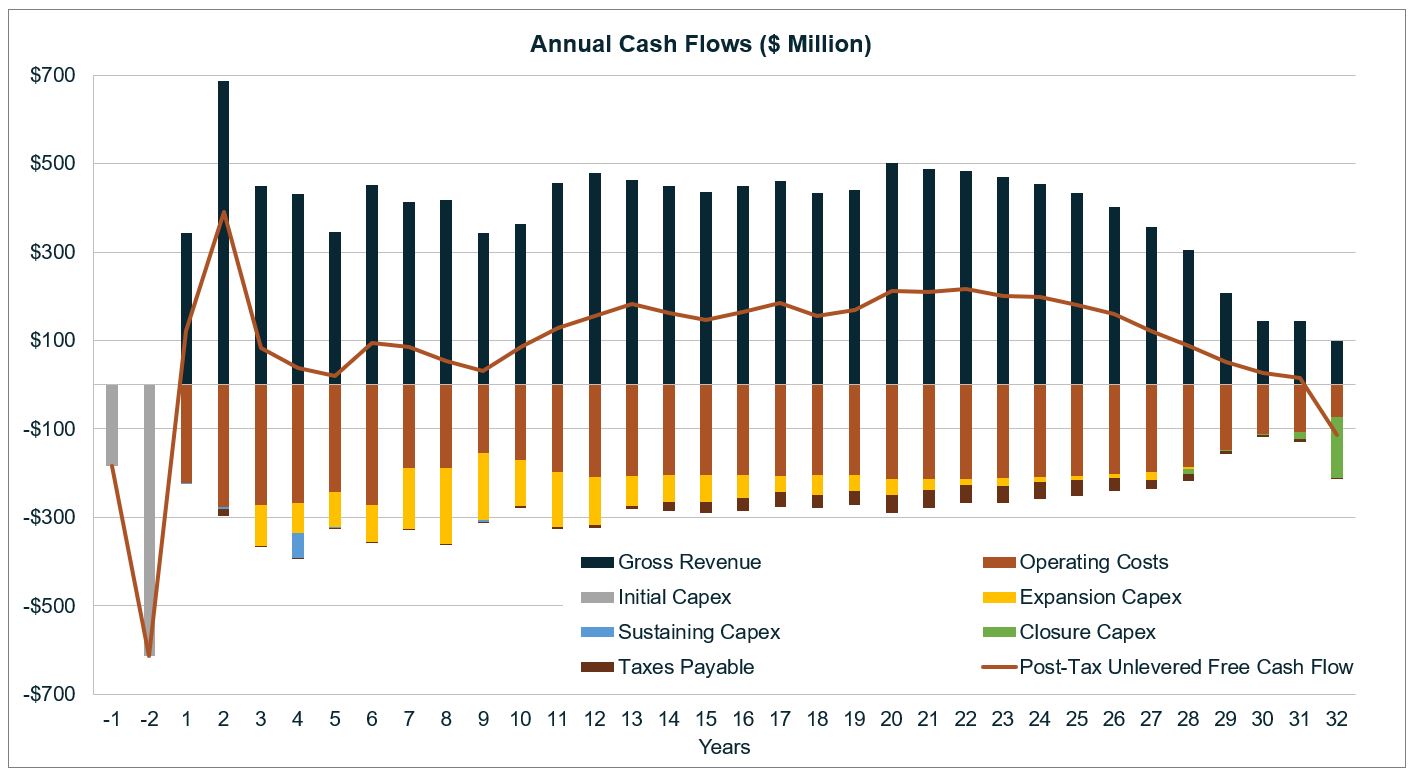

Payback of initial capital is expected to occur in Year 4, with the post-tax cash flows funding the expansionary capital, which includes the addition of a molybdenum circuit and development of the underground footprint, both of which commence in Year 3 (Figure 1, Table 1 & Table 13).

Table 1: PEA Economic Highlights

| Base Case Economics | Unit | LOM |

| Post-tax NPV(7%) | $ millions | $713 |

| Post-tax IRR | % | 15.6% |

| Post-tax Payback Period | Years | 4.1 |

| NPV / Initial Capital | Ratio | 0.9 |

| Initial Capital | $ millions | $798 |

| Sustaining and Expansion Capital | $ millions | $1,689 |

| Closure and Reclamation | $ millions | $170 |

| Economic Assumptions | ||

| Copper | $/lb | $3.80 |

| Molybdenum | $lb | $13.00 |

| Silver | $/oz | $20.00 |

| Financial Metrics a | ||

| Annual Revenue | $ millions | $428 |

| Annual Operating Costs | $ millions | $210 |

| Annual EBITDA b | $ millions | $218 |

| Annual Cash Flow (post-tax) | $ millions | $141 |

Notes to Table 1:

a Averages based on active mining during Years 1 - 29.

b EBITDA is a financial performance measure with no standardized definition under IFRS, defined as "earnings before interest, taxes, depreciation and amortization".

Table 2: Pre-Tax NPV Contributions

| Pre-Tax NPV Contributions | $ million |

| Mill Initial Capital | ($640) |

| Open Pit | $977 |

| Underground | $509 |

| Total | $846 |

| Standalone Open Pit a | $337 |

Notes to Table 2:

a Standalone open pit includes mill initial capital.

Table 3: PEA Operating Highlights

| Operating Statistics | Unit | Average LOM |

| Mine Life a | Years | 32 |

| Tonnes Milled b | Mtpa | 10.8 |

| Open Pit Strip Ratio | Ratio | 1.2 |

| Payable Production (per year) c, d | ||

| Copper | Million lbs | 106 |

| Molybdenum | Million lbs | 1.4 |

| Silver | Thousand oz | 324.6 |

| CuEq ii | Kt | 51.1 |

| Costs (by-product) iii | ||

| LOM Production Cash Costs | $/Cu lb | $1.67 |

| LOM All-in Sustaining Costs | $/Cu lb | $1.85 |

Notes to Table 3:

a Mine life includes active mining (Year 1 - 29) and final processing of stockpiles (Year 30 - 32)

b Tonnes milled are exclusive of oxide and represent the average over the 32-year life of mine.

c Average annual production considers the period of active mining during Years 1 - 29, Year 30 - 32 includes processing of stockpiles only.

d Based on payability in concentrate of 96.5%, 95% and 98.5% for copper, silver, and molybdenum, respectively. Copper cathode payability of 98% is applied.

Table 4: Economic Sensitivity

| Parameter | Unit | PEA | Alternative Copper Prices a | |

| Copper Price | $/lb | $3.80 | $4.25 | $5.00 |

| Molybdenum Price | $/lb | $13.00 | $13.00 | $13.00 |

| Silver Price | $/oz | $20.00 | $20.00 | $20.00 |

| Post-Tax NPV(7%) | $ millions | $713 | $1,144 | $1,843 |

| Post-Tax NPV(8%) | $ millions | $566 | $951 | $1,576 |

| Post-Tax IRR | % | 15.6% | 21.0% | 29.6% |

| Post-Tax Payback Period | Years | 4.1 | 2.9 | 2.1 |

Notes to Table 4:

a An increase of $10/lb or $5/oz in molybdenum or silver price assumptions increases the post-tax NPV(7%)by approximately $129 million or $15 million, respectively.

Note to Figure 1: Table 13 provides the amounts used to generate Figure 1. Total operating costs above are inclusive of royalties and offsite charges.

Figure 2: Copper Equivalent Payable Metal Production

Design and Production Profile Overview

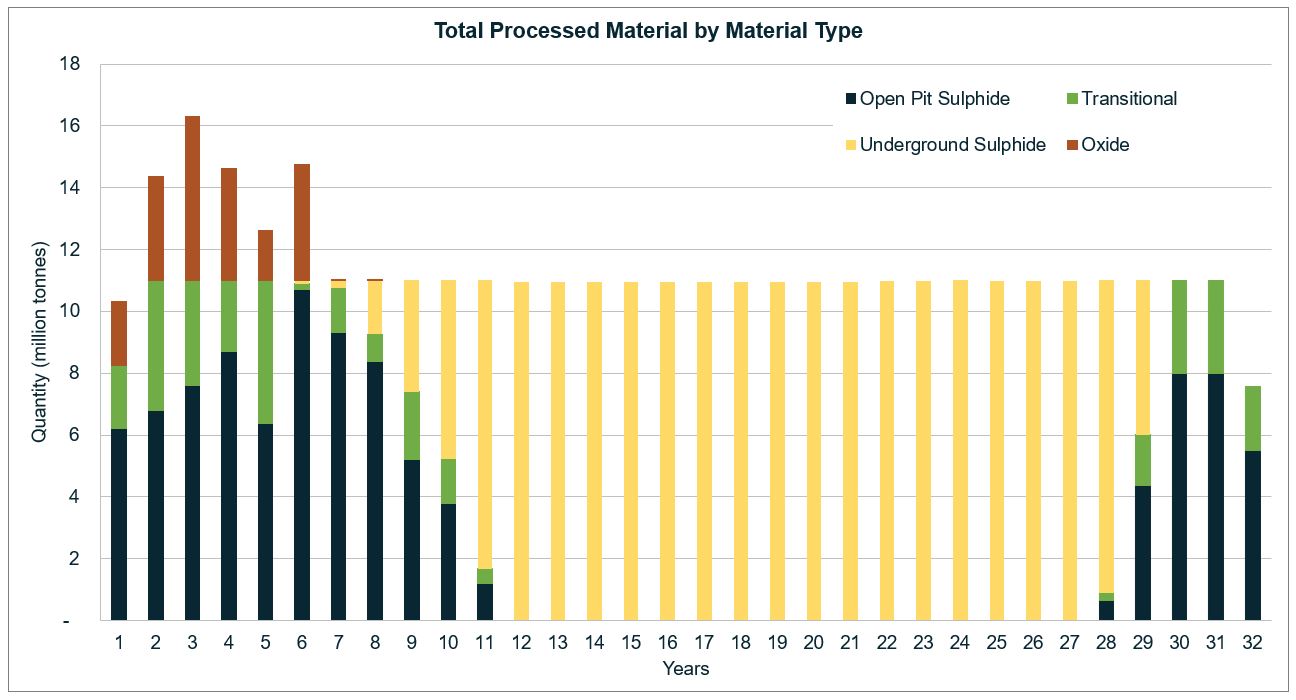

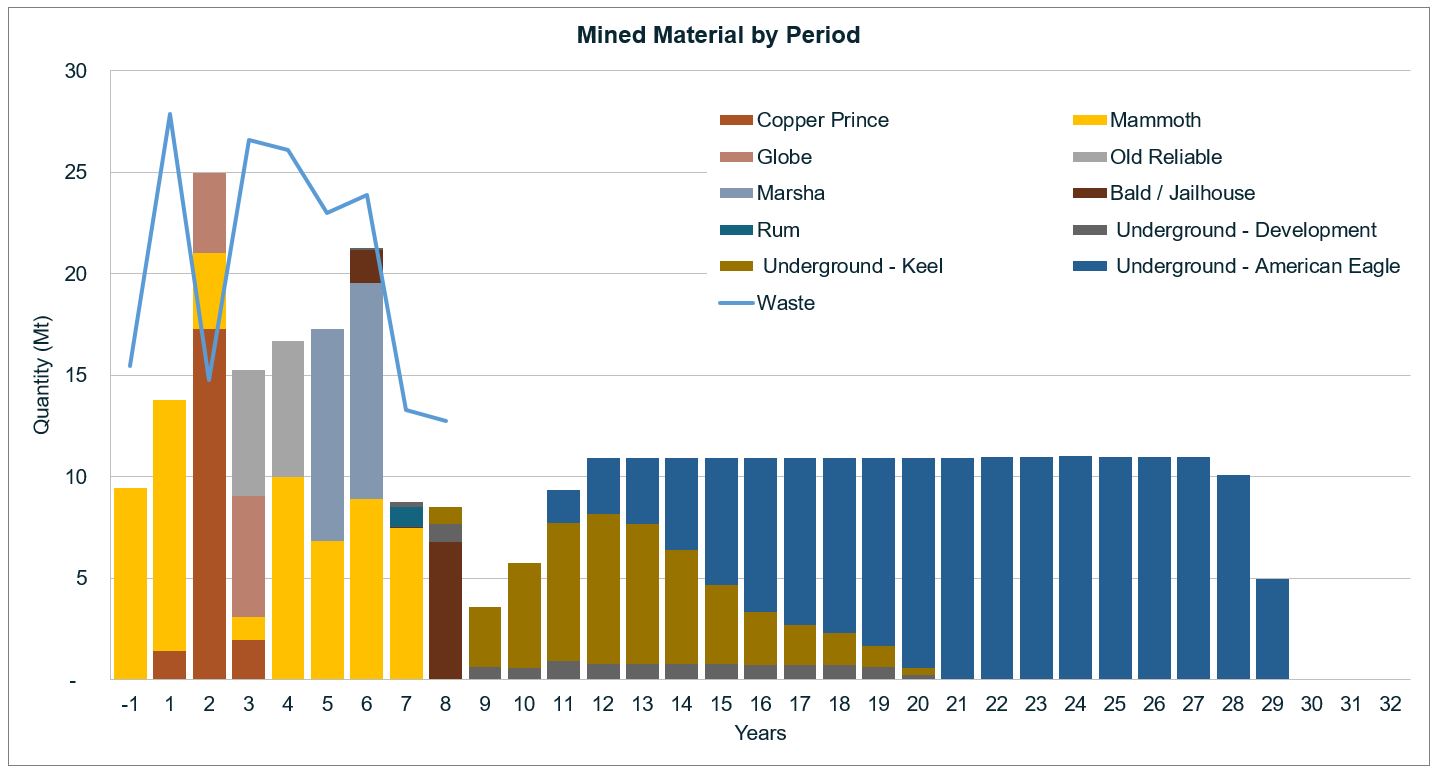

The open pit and underground mine plans were developed by SRK Consulting Inc. ("SRK"). Future mining is expected to be by contractor-operated conventional truck and shovel method at surface and during underground development (pre-production), transitioning to owner-operated block caving underground method to achieve a base annual mill feed rate of 11.0 Mt (30,000 tpd). Surface mining provides mill feed until Year 11. A four-year open pit ramp down coincides with the underground production ramp-up, achieving steady state production by Year 12 and continuing until Year 29. Current mine plan optimization has applied an open pit stockpiling strategy whereby low-grade material mined from the pits would be stockpiled and processed as supplementary mill feed or fed to the mill at the end of the mine life. The low-grade stockpile peaks at 56.5 Mt, 20.0 Mt of which would be processed as supplementary feed between Years 7 and 11, and the remaining 36.5 Mt would be processed between Years 28 and 32.

The base annual throughput would be primarily of sulphide material, with some transitional material mined from the open pits. Oxide material recovered near surface in the early years of the anticipated mine life would be segregated and processed separately in a heap leach facility, in addition to the 11.0 Mt base annual throughput (Figure 3).

Figure 3: Total Processed Material by Material Type

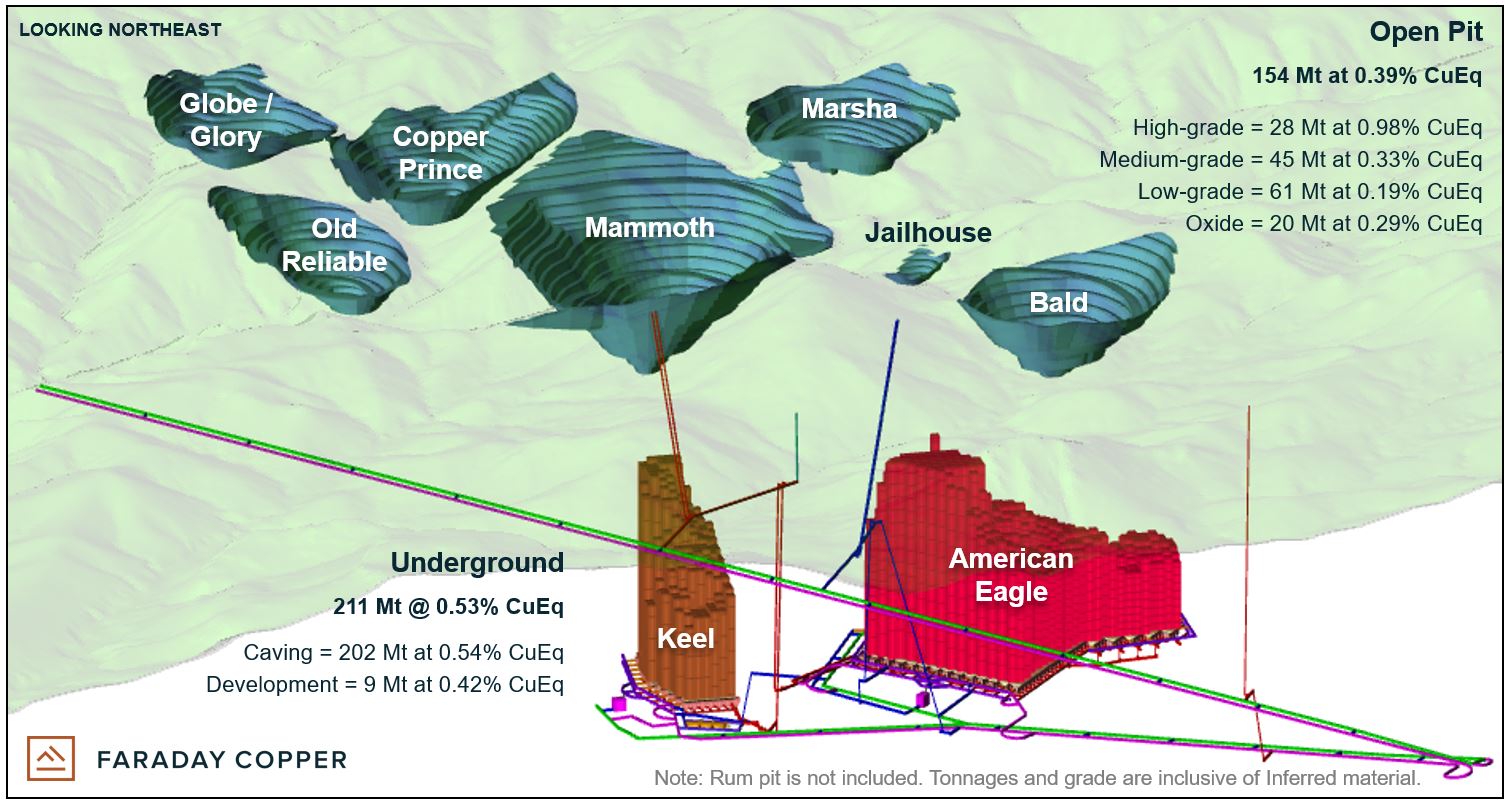

Figure 4: Mine Design Overview (isometric view looking northeast)

Note to Figure 4: Mammoth pit includes the Mammoth and Childs-Aldwinkle breccias, and the Copper Prince pit includes numerous breccias such as the Copper Prince, Copper Giant, Copper Duchess, and Copper Knight.

Figure 5: Mined Material by Period

Note to Figure 5: All material reflected in this chart is mineralized mill feed unless denoted as 'Waste'.

Open Pit Mine Design and Schedule

Open pit mine designs utilized the updated MRE. The resource model was imported into Minesight mine planning software where a Lerch Grossman algorithm was applied to the model to determine possible open pit limits. Each open pit area was assessed across a series of revenue factors to target the optimal balance of NPV contribution, footprint requirements and strip ratio. The results of the assessment culminated in pit shell selections that are reflective of an average revenue factor of 0.81 ($3.06/lb copper). Upon selection of discrete pit shells for each pit area, a full pit design was completed in alignment with geotechnical parameters developed as part of the PEA. All pit designs incorporated ramp placement, haulage networks, pit phasing and backfill opportunities.

Open pits include Mammoth, the largest open pit, and several smaller satellite pits. Mammoth would be mined in three phases, generally from the northwest to the southeast, while each of the satellite pits would be a single phase. Table 5 summarizes the pit inventories.

Table 5: Inventory by Pit

Processed Tonnage (Mt) | Processed Grade (% Copper) | Waste Tonnage | Strip Ratio | |||

| Open Pit a | Sulphide/Transitional | Oxides | Sulphide/Transitional | Oxides | ||

| Copper Prince | 20.7 | 5.9 | 0.45 | 0.36 | 11.5 | 0.43 |

| Globe | 9.9 | 2.7 | 0.40 | 0.37 | 5.0 | 0.40 |

| Old Reliable | 12.9 | 4.0 | 0.36 | 0.20 | 10.9 | 0.65 |

| Mammoth | 59.9 | 2.9 | 0.37 | 0.25 | 109.6 | 1.75 |

| Marsha | 21.1 | 4.3 | 0.24 | 0.25 | 3.2 | 0.12 |

| Bald/Jailhouse | 8.5 | 0.0 | 0.48 | 0.16 | 41.7 | 4.92 |

| Rum | 1.0 | 0.0 | 0.73 | 0.44 | 1.0 | 1.04 |

| Total | 133.9 | 19.8 | 0.37 | 0.29 | 182.9 | 1.19 |

Notes to Table 5:

a Numbers may not sum due to rounding.

Mineralization is hosted in three material types: sulphide, transitional and oxide. Sulphide and transitional material would be processed at the flotation plant, while oxide material would be heap leached.

Table 6: Open Pit Summary - Material Processed by Year

Units | Total | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 28-32 | |

| Total Processed Pit Material | Mt | 153.7 | 10.3 | 14.3 | 16.3 | 14.6 | 12.6 | 14.7 | 10.8 | 9.3 | 7.4 | 5.2 | 1.7 | 36.5 |

| Sulphides and Transitional | Mt | 133.9 | 8.3 | 11.0 | 11.0 | 11.0 | 11.0 | 10.9 | 10.8 | 9.3 | 7.4 | 5.2 | 1.7 | 36.5 |

%Cu | 0.37 | 0.50 | 0.78 | 0.38 | 0.44 | 0.39 | 0.42 | 0.48 | 0.49 | 0.29 | 0.17 | 0.17 | 0.17 | |

| Oxides | Mt | 19.8 | 2.1 | 3.3 | 5.3 | 3.6 | 1.6 | 3.8 | 0.0 | 0.0 | - | - | - | - |

%Cu | 0.29 | 0.29 | 0.27 | 0.41 | 0.20 | 0.21 | 0.25 | - | - | - | - | - |

Cut-off grades ("COG") are dictated by metal price, and consider material type, processing costs, recovery, and selling costs. The direct feed CuEqii COG for sulphide and oxide material is 0.13% CuEqii, while for transitional material it is 0.14% CuEqii. Material reporting to a stockpile has a slightly higher COG than direct mill feed material to account for rehandling costs.

Grade bins were established to aid in mine planning, including low-grade, medium-grade and high-grade bins. Low-grade material reports to stockpiles unless available throughput allows direct feed to the mill in that period. The grade bins are defined by percent copper for sulphide and transitional material (Table 7).

Table 7: Open Pit Grade Bin Application for Mine Schedule Optimization

| Grade Bin | Sulphide (% Copper) | Transitional (% Copper) |

| Low-grade | 0.13% - 0.25% | 0.14% - 0.27% |

| Medium-grade | 0.25% - 0.45% | 0.27% - 0.48% |

| High-grade | >=0.45% | >=0.48% |

Where possible, waste is proposed to be backfilled into depleted pits which allows for shorter haulage and reduced surface disturbance. Otherwise, waste would be sent to the external waste facility. The waste facilities would be designed to simplify closure and allow for progressive reclamation.

It is expected that mining at the Mammoth pit would commence during the pre-production period and continue through the entirety of surface mining, while satellite pits would be mined in a sequence driven by value and haulage efficiencies. Mineralized material above COG would be sent to either the run-of-mine pad directly south of the Old Reliable pit or to one of two low-grade stockpiles further to the west. Oxide material would be crushed immediately and conveyed to the heap leach facility adjacent to the processing plant.

Copper Prince would be the first satellite pit to be mined. Waste in the early periods would be sent east to the external storage facility. Once the Copper Prince and Globe pits are mined out in Year 3, the pits would be expected to serve as a backfill facility for waste rock from the Mammoth, Globe, and Rum pits. After Old Reliable is depleted in Year 4, it would serve as a backfill facility for Mammoth waste. By Year 5 and 6, Phases 2 and 3 of the Mammoth pit would be advancing along with the eastern satellite pits Marsha, Bald and Jailhouse (the latter two would be mined together). Waste from these phases would be sent to the adjacent external waste facility due to haulage efficiencies. Mineralized material from Marsha and Bald/Jailhouse would be hauled along in-pit haul roads in the Mammoth pit. The Rum pit (not shown in Figure 4) is a small pit located in the northwest of the project area and would be mined in Year 7. Open pit mining is expected to conclude in Year 8 when Bald is exhausted.

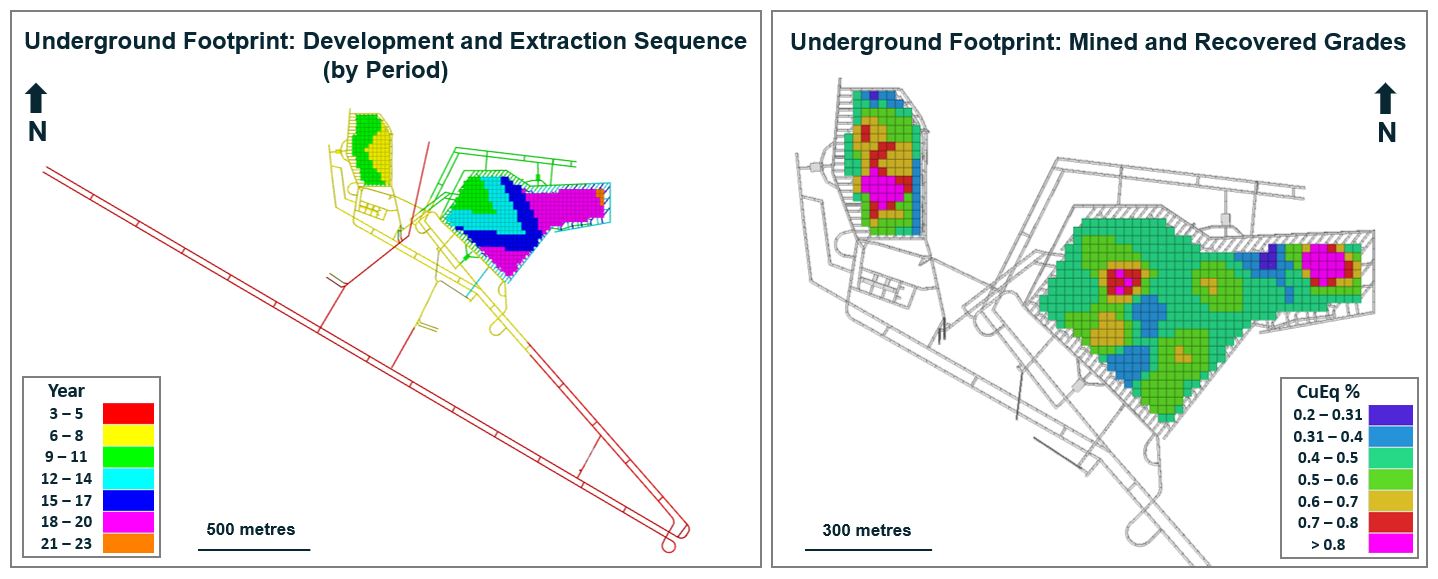

Underground Mine Design and Schedule

The Keel and American Eagle block cave footprints and production schedule were generated using Geovia's Footprint Finder software, an industry standard for cave optimization and scheduling, using the resource model. The economic parameters applied in the footprint finder optimization were maintained as per the resource constraints as part of the Reasonable Prospects for Eventual Economic Extraction ("RPEEE") process, except for the maximum height of cave draw being set to 500 metres ("m"). The footprint finder outcome was then manually optimized to prioritize the higher-grade cave blocks whilst targeting the most practical footprint geometry for sequencing and productive capacity. This exercise culminated in a PEA underground mill feed inventory of 211 Mt.

Preliminary mine development design and scheduling were completed in Deswik Suite, encompassing detailed lateral and vertical development designs for all primary and secondary infrastructure. Excavation profiles were applied to each development type enabling discrete advance rates and costs to be applied, culminating in a practical integrated mine schedule.

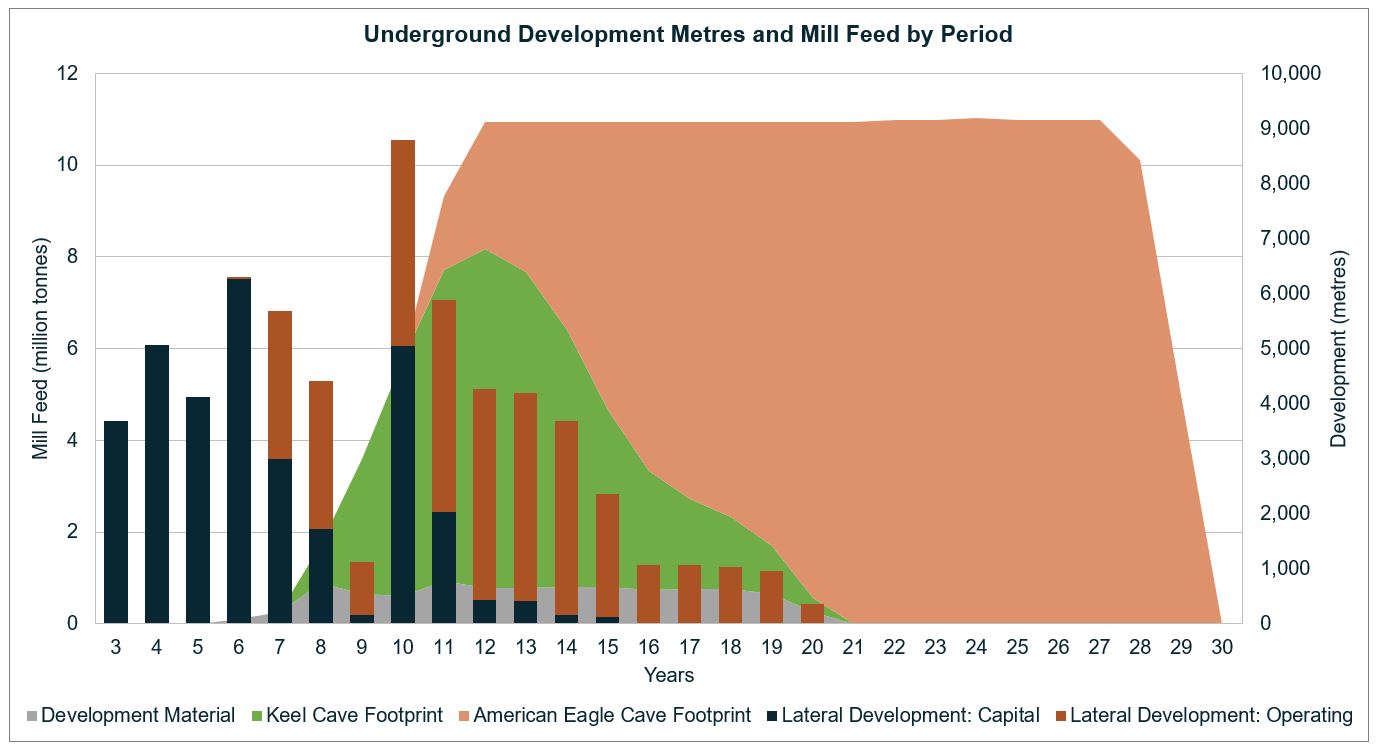

The cave footprint(s) would be accessed via a twin decline system providing access and material conveying to surface. The mine plan for the underground block cave contemplates development of the twin declines commencing in Year 3 with initial cave production beginning six years after. Underground cave production would ramp up over approximately a 3-year period and would achieve a steady-state production rate of 30,000 tpd in Year 12. The Keel and American Eagle extraction horizons are located at approximately 900 m and 760 m below the portal elevation, respectively. The cave footprints are 300 m laterally offset. The average height of draw of the Keel and American Eagle domains is 375 m and 337 m, respectively. The maximum vertical height of draw was constrained to 500 m for the purpose of the PEA design.

Table 8: Underground Footprint Metrics (exclusive of development)

Unit | Keel | American Eagle | Total | |

| Mineralized Material | Mt | 47.0 | 154.6 | 201.6 |

| Copper Grade | % | 0.55% | 0.49% | 0.51% |

| Molybdenum Grade | % | 0.014% | 0.007% | 0.008% |

| Silver Grade | g/t | 3.28 | 0.86 | 1.42 |

| CuEqii Grade | % | 0.60% | 0.52% | 0.54% |

| Footprint Area | m2 | 51,900 | 194,600 | 246,600 |

| Hydraulic Radius | m | 56 | 95 | N/A |

| Drawbells | # | 88 | 321 | 409 |

| Height of Draw (Average) | m | 375 | 337 | 346 |

Electric-drive loaders would deliver mill feed material to passes at the mid-point of each extraction level drive which connects to truck loading stations on the underlying haulage level. Trucks would haul mill feed material to one of three primary crushers, one servicing Keel and two servicing American Eagle. Following crushing, mill feed material would be conveyed 4.8 kilometres ("km") to surface via the dedicated conveyor decline. At surface, the mill feed material would be transferred to the surface overland conveyor and transported directly to the process plant.

Table 9: Underground Production Schedule by source

| Source | Unit | Total | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16-20 | 21-25 | 26-29 |

| Keel | Mt | 47.0 | - | - | 0.85 | 2.94 | 5.17 | 6.80 | 7.39 | 6.90 | 5.60 | 3.84 | 7.48 | - | - |

Cu % | 0.55 | - | - | 0.48 | 0.59 | 0.62 | 0.60 | 0.56 | 0.54 | 0.51 | 0.50 | 0.50 | - | - | |

CuEq ii % | 0.60 | - | - | 0.54 | 0.65 | 0.68 | 0.65 | 0.62 | 0.60 | 0.57 | 0.55 | 0.53 | - | - | |

| American Eagle | Mt | 154.6 | - | - | - | - | - | 1.61 | 2.78 | 3.27 | 4.55 | 6.30 | 44.11 | 54.95 | 37.08 |

Cu % | 0.49 | - | - | - | - | - | 0.39 | 0.40 | 0.45 | 0.49 | 0.49 | 0.53 | 0.53 | 0.40 | |

CuEq ii % | 0.51 | - | - | - | - | - | 0.45 | 0.45 | 0.48 | 0.52 | 0.51 | 0.56 | 0.56 | 0.42 | |

| Development | Mt | 9.7 | 0.11 | 0.25 | 0.88 | 0.65 | 0.61 | 0.92 | 0.78 | 0.77 | 0.79 | 0.81 | 3.16 | - | - |

Cu % | 0.39 | 0.30 | 0.37 | 0.39 | 0.56 | 0.36 | 0.35 | 0.34 | 0.31 | 0.32 | 0.35 | 0.43 | - | - | |

CuEq ii % | 0.42 | 0.31 | 0.42 | 0.45 | 0.61 | 0.40 | 0.40 | 0.38 | 0.35 | 0.34 | 0.38 | 0.46 | - | - | |

| Total | Mt | 211.4 | 0.11 | 0.25 | 1.73 | 3.60 | 5.77 | 9.33 | 10.95 | 10.95 | 10.95 | 10.95 | 54.75 | 54.95 | 37.08 |

Cu % | 0.50 | 0.30 | 0.37 | 0.44 | 0.59 | 0.59 | 0.54 | 0.50 | 0.49 | 0.49 | 0.48 | 0.52 | 0.53 | 0.40 | |

CuEq ii % | 0.53 | 0.31 | 0.42 | 0.49 | 0.64 | 0.65 | 0.59 | 0.56 | 0.55 | 0.53 | 0.52 | 0.55 | 0.56 | 0.42 |

Figure 6 shows the underground footprint extraction sequence by period and the average recovered drawpoint grades.

Mine levels within and directly adjacent to the cave footprints comprise undercut, extraction, haulage and crushing and ventilation levels. Total pre-production lateral development requirements are estimated to be 24,900 m, plus associated drawbell establishment. Underground development activity generates 9.7 Mt of material above COG and contributes to economic mill feed. Total lateral development requirements have been generated based on the mine design and are estimated to be approximately 32,200 m and 31,850 m of capital and operating development, respectively. A raise system from surface supplies fresh air to the mine levels and is exhausted via the twin declines to the exhaust ventilation system. Total vertical development is estimated to be 6,400 m, comprised predominantly of fresh air raises, return air raises and material passes.

Figure 7: Underground Development Metres and Mill Feed by Period

Geotechnical

Geotechnical assessments of pit slope stability and underground caveability, including fragmentation analysis, subsidence and ground support requirements, were carried out by Call & Nicholas, Tucson ("CNI"). These assessments were based on geotechnical characterizations developed from geological assessments, core logging, downhole televiewing data and laboratory rock strength analysis from the Phase I exploration drilling program (holes drilled between February and June 2022). The geotechnical program was further supported by historical core logging data and prior geomechanical studies of the pit and underground deposits.

A geotechnical assessment of multiple methods was appraised for geotechnical parameters and suitability, shortlisted to open pit mining, block caving, sub-level caving and longhole open stoping. The outcomes of the geotechnical assessment supported the selection of open pit extraction for near surface deposits (predominantly breccia) and extraction of the underground resource (predominantly porphyry) via block caving methods. Underground mining interaction with the open pits was also assessed to ensure mine sequencing accounts for adequate phasing and realistic operability. Upon method selection for the PEA, a comprehensive geotechnical design parameter report was developed to guide an optimal and practical mine plan.

Key geotechnical assessment highlights from the PEA include:

Open Pit

- Rock strength and joint orientations allows for favourable interramp slope angle between 50-53 degrees and overall slope angle of 50 degrees supporting low strip ratios

- Assessment supports 24 m double bench height (12 m single bench height)

- Geotechnical domains defined by wall dip direction informed optimal ramp placement and haulage networks between pits and material destinations

Underground Block Caving

- Confirmed caveability of the rock mass with caving rate of 55 m/year (15 cm/day) with no requirement for preconditioning currently deemed necessary

- Productive capacity of the current underground resource footprint suggests 30 to 45 kilotonnes per day (11 to 16 Mtpa)

- Rock mass quality within the footprint domain offers favourable conditions for drawpoint spacing that optimizes capital development requirements. The extraction level layout is to employ a herringbone configuration with extraction drive spacing of 32 m by 20 m

- Thermistors located in vibrating-wire piezometers indicate in-situ rock temperatures between 25 - 44 degrees Celsius, confirming the underground operation will benefit from favourable ventilation requirements

Mineral Processing

The Company recently completed a metallurgical test work program utilizing samples from the Phase I drilling to complement the historical test work conducted by Mountain States R&D International ("MSRDI") and METCON Research ("METCON"). Metallurgical testing was conducted by ALS Metallurgy, Kamloops, and tailings filtration testing completed by BaseMet, Kamloops, with oversight by Ausenco Engineering USA South Inc. ("Ausenco"), based in Tucson. This test work program was designed to accomplish the following key objectives on samples taken throughout the open pit:

- Develop process design criteria with test work results from spatially representative samples of the current mineral resource and grades

- Comminution test work to optimize grind size

- Confirm flotation recoveries for both open pit sulphide and transitional materials

- Mineralogical analyses to inform future performance by domain

- Solid-liquid separation test work to confirm dry stack tailings performance

The outcomes of the 2023 test work were assimilated with the historical test work from METCON (2008-2012) and MSRDI (1997) to form the basis of the process design criteria for the PEA. The PEA process design applies a primary grind passing 80 mesh size of 190µm for the sulphide material feed, however whilst processing transitional material during earlier open pit phases, a finer grind of 160 µm will be applied to achieve the recoveries reported in Table 10 for transitional material. A coarser grind (> 200 µm) may be optimized for sulphide materials in future with further test work. Copper concentrate grade is estimated at 30% and molybdenum concentrate grade is estimated at 50%.

Table 10: Process Design Criteria - Average Metallurgical Recoveries by Material Type

| Sulphide | Transitional | Oxide | |

| Copper Recovery | 94.4% | 74.7% | 75.0% |

| Molybdenum Recovery | 74.9% | 70.9% | - |

| Silver Recovery | 78.1% | 66.9% | - |

The 2023 test work program, paired with a detailed metallurgical review of previous data, confirmed the following:

- Sulphide zone materials responded well to froth flotation, with recoveries of greater than 94% achieved at primary grind sizes of approximately 200 µm passing 80 mesh size

- Metallurgical testing on open pit representative samples complements historical test work

- Sulphide zone materials are predominantly chalcopyrite and bornite with low levels of pyrite

- Transitional zone materials returned recoveries averaging 75% after sulphidization

- Historical test work supports 75% copper recovery from oxides via heap leaching with sulphuric acid

- Assay data and metallurgical test work from variability sample concentrates confirmed no deleterious elements above penalty levels

- Solid-liquid separation test work confirmed processed material is amenable to dry stack tailing storage

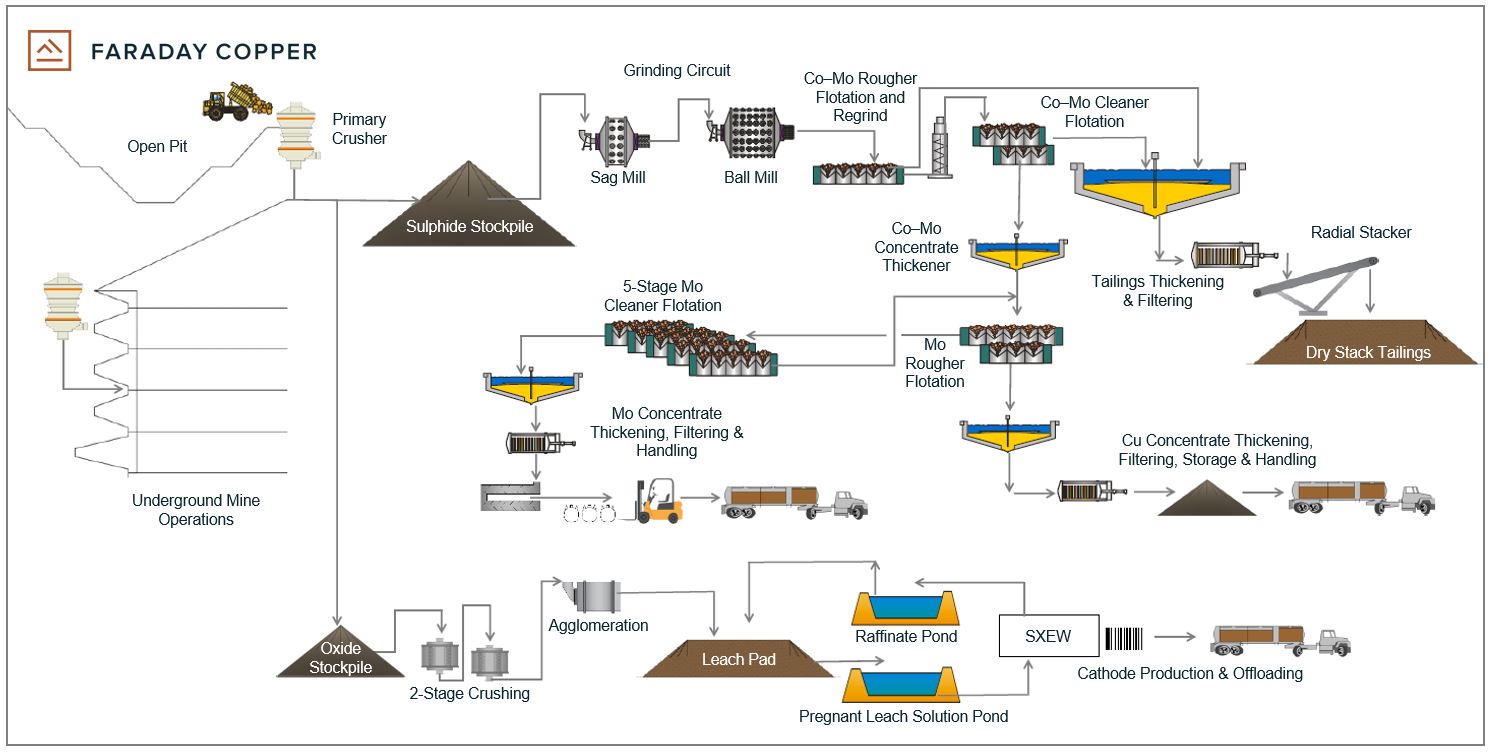

The simplified process flowsheet shown in Figure 8 was developed based on recovery methods required for processing mineralized materials and is supported by preliminary current and historical test work as well as financial evaluations. It includes a copper-molybdenum concentrator for sulphide and transitional minerals and a heap leach with SXEW operation for oxide minerals. The concentrator is designed to process, on average, 30,000 tpd (11 Mtpa) of mineralized material.

Sulphide and transitional materials would be crushed, conveyed, ground and processed by bulk rougher flotation. Bulk rougher flotation concentrate would be reground and upgraded by bulk cleaner flotation. Both bulk rougher and cleaner tails would be gravity-fed to the tails thickener and bulk cleaner concentrate would be further processed by a copper-molybdenum separation circuit. Limited copper-molybdenum separation testing is available, and therefore a typical molybdenum separation circuit recovery of 90% is estimated. Molybdenum rougher flotation tails or copper concentrate would be thickened, filtered and loaded onto weighed trucks for transport by rail to the port. Five stages of cleaning would be required to upgrade the molybdenum rougher concentrate prior to thickening, filtering, drying and packaging for shipment.

The oxide heap leach operation would consist of three stages of crushing, agglomeration, heap stacking, leaching with sulphuric acid and cathode production by an SXEW facility. Oxide materials would be fed through the same primary crusher as the sulphide materials with a belt element analyzer diverting oxide materials to a separate temporary stockpile where it would be crushed to 3/8 inch to improve leach performance on the heap.

Figure 8: Schematic Process Flow-sheet

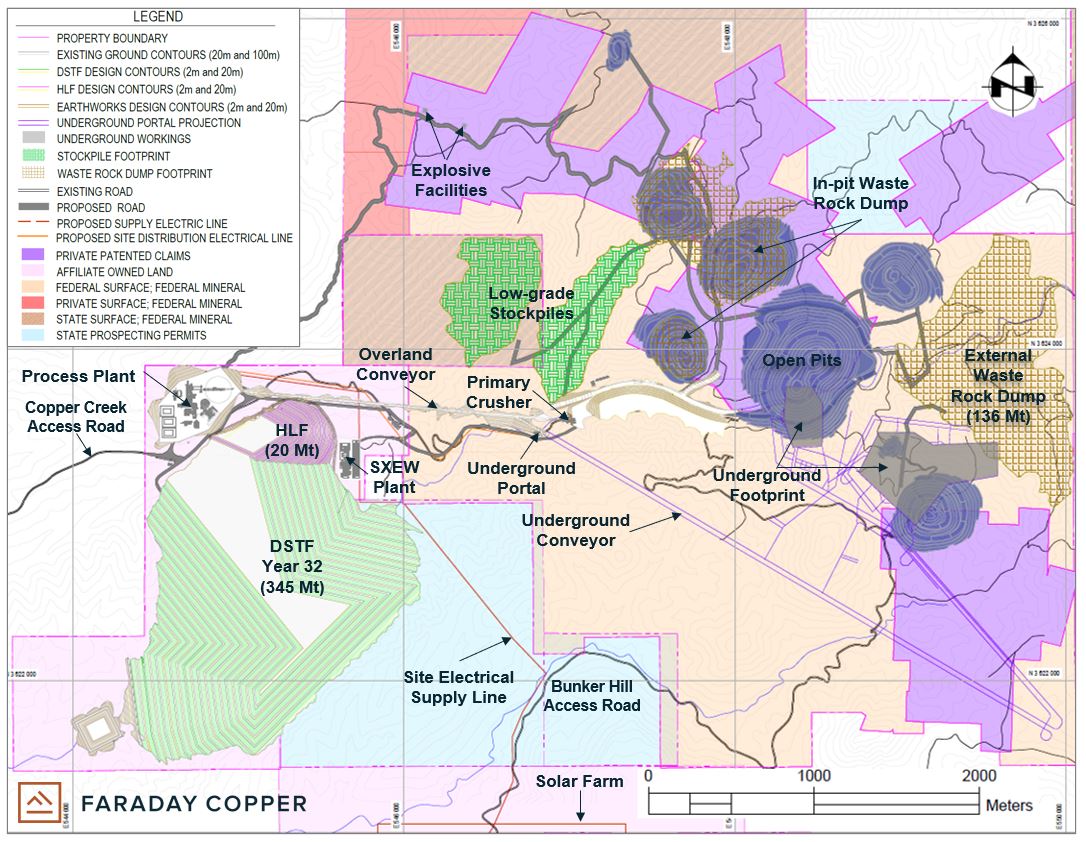

Site Infrastructure

The site layout (Figure 9) is configured to optimize materials handling synergies between the open pit and underground production, to minimize environmental footprint and to prioritize the utilization of private and patented land to ensure operational scalability upon resource expansion. The project is expected to utilize existing infrastructure such as high voltage power provision near the property, dual site access roads (Copper Creek and Bunker Hill roads), major highway(s) for concentrate haulage and rail access with loadout facilities near the property.

The primary design objectives of the dry-stack tailings facility ("DSTF") are the secure confinement of tailings and the protection of the regional groundwater and surface water during mine operations and closure. The design of the DSTF considers a staged development over the LOM and a stacking geometry that allows progressive reclamation in the form of slope cover.

The presently contemplated site arrangement considers primary surface infrastructure including (but not limited to):

- Processing plant and supporting infrastructure:

- Primary crusher and overland conveyor

- Crushed sulphide stockpile

- Process plant, which includes: Semi-autogenous and ball mill crusher grinding circuit, copper-molybdenum bulk flotation and regrind, copper-molybdenum separation flotation, separate copper and molybdenum concentrate thickening, filtration and drying (molybdenum only), copper and molybdenum concentrate load out and storage, tailings thickening, filtration and dry stacking, reagents storage and distribution (including lime slaking, flotation reagents, and flocculant)

- Heap leach operation:

- Two-stage mobile cone crushing, agglomeration, conveying and stacking, lined pad, heap leaching irrigation system and solution collection, process ponds, solvent extraction, electrowinning and tank farm

- The heap leach pad is designed to 20 Mt of crushed material capacity

- Dry-stack tailings facility:

- A preliminary siting and deposition technology study was performed to minimize water consumption and footprint. The design, in accordance with the Global Industry Standard on Tailing Management, considers a rockfill stability embankment, unlined impoundment, and a seepage collection system and pond

- Open pits, waste dumps, underground portals, and other major infrastructure to support the operations including: Main substation and power distribution lines, a guard house, security gate and truck weigh scale, administrative buildings, a fresh water supply line and storage tank, site drainage and contact water management systems including DSTF under drainage and seepage water ponds, a truck shop and mine dry facility, explosive storage, fuel depot, maintenance shop and warehousing

Capital Costs

The capital cost estimate for the project processing and associated infrastructure was developed by Ausenco using an engineering, procurement and construction management ("EPCM") project development approach. Initial, expansion, sustaining, and closure capital cost estimates were developed for the project to reflect the phased approach of the project.

The figures presented in Table 11 are based on the cost estimated to install the major process equipment, associated infrastructure, facilities and other equipment requirements to support the project. The cost estimates are based on detailed, mechanical and electrical equipment lists developed for the project's process design criteria. Pricing of the process equipment is based either on budgetary quotes obtained specifically for this project or on other recent Ausenco executed projects and studies of similar size and scope, regional labour rates and manhours associated with the physical installation of the equipment. Typical freight, growth and associated minor equipment costs required to operate the processing equipment were applied. Pricing for bulk commodities such as steel, concrete, in-plant piping, instrumentation, bulk electrical supply and platework were estimated by applying benchmarked percentages to the mechanical equipment supply. Ancillary facilities were sized for the anticipated staffing and priced according to historical estimates for similar sized modular/prefabricated buildings. Material take-offs for civil earthworks, the DSTF, and overhead powerline were generated and priced using regional construction labour rates and unit rates for bulk materials. These were obtained from Ausenco's database of current and historical assessments and executed projects. The heap leach facility was benchmarked against studies of similar size and scope. The installed process plant cost estimates also include $120 million for indirect project costs. These costs are anticipated to be incurred during implementation of the project by the owner, engineer or consultants in the design, procurement, construction, commissioning, and construction contractor's indirect costs. These estimates have a base date of the first quarter of 2023.

All mining-related capital costs (in-pit and underground) were estimated by SRK using first principles approach and leveraging the preliminary mine design outputs for appropriate mine development requirements. The preliminary mine plan and associated mine initial, growth and sustaining capital were prepared using current North American contractor development rates and current equipment prices. In-mine infrastructure was estimated using first principle buildups for purchase and installation costs, which were based on recent quotations where applicable and/or leveraged SRK's database of open pit and block caving projects and operations.

Initial capital costs are estimated to be $798 million and sustaining/expansion capital costs are estimated at $1,859 million for a total LOM capital cost of $2,657 million. Expansion capital is associated with the process plant addition of a molybdenum circuit in Year 3 and bringing the underground block cave into production.

Table 11: Summary of Capital Costs

| Item | Initial Capital | Sustaining & Expansion Capital | Total Capital |

| Installed Process Plant a | $280 | $48 | $328 |

| Crushing and Materials Handling b | $108 | $7 | $115 |

| Tailings | $117 | $9 | $126 |

| Site Infrastructure | $67 | $50 | $117 |

| Mining | $80 | $1,376 | $1,457 |

| Owners Cost | $23 | $2 | $25 |

| Contingency | $122 | $197 | $319 |

| Closure and Reclamation | $- | $170 | $170 |

| Total c | $798 | $1,859 | $2,657 |

Notes to Table 11:

a Includes indirect costs.

b Includes costs for the oxide heap leach operation.

c Totals may not sum due to rounding.

The initial capital costs associated with heap leaching total $84 million (including 20% contingency), which are comprised of an additional 2-stage crushing infrastructure, a heap leach facility and an SXEW facility. The cost associated with the molybdenum circuit installation in Year 3 totals $58 million (including 20% contingency). The initial capital costs associated with open pit mining total $80 million, as the surface operation is to be executed by a contractor. Most of the mining-related initial capital is for the pre-strip activity, which requires approximately 17.5 Mt of waste movement and 9.5 Mt of low-grade material (sulphide and transitional) to be stockpiled for processing later in the mine life.

A progressive closure and reclamation approach is expected to be adopted for the project, totalling $170 million (including 20% contingency), spread over the last 5 years of the mine life. These costs are driven by surface disturbance calculations related to all mining, processing infrastructure and stockpiling. The estimation considers re-contouring, revegetation activities, decommissioning costs, ongoing monitoring and maintenance activities. A capital allowance of $50 million (including EPCM and contingency) in Year 3 has been incorporated to cover any costs associated with waterway management.

Variable contingencies were developed for processing and mining capital costs due to the detailed method of estimation for both. The initial capital cost estimation for the processing infrastructure has a 20% contingency application. On aggregate, the total initial capital cost estimation has a 15% contingency consideration. The following contingencies were applied to project capital costing:

- 25%: Contractor mobilization

- 20%: Open pit mining related capital costs, crushing and materials handling, process plant direct costs, DSTF, on-site and off-site infrastructure, process plant indirect costs, owners cost and underground large excavations

- 15%: Lateral and vertical underground mine development, crushers and conveyors, ventilation hardware and installation, mine buildings, mine services (pumping, power, air, safety) and mobile equipment

Operating Costs

Operating costs were developed from first principles costing based on the quantities generated from the preliminary mine design, mine production schedule and processing applications by material type.

The unit operating costs used in the PEA are summarized in Table 12.

Table 12: Summary of Operating Costs

| Operating Costs | Units | Open Pit | Underground |

| Mining a | $/t mined | $2.43 | $7.30 |

| Processing b | $/t processed | $6.26 | $6.30 |

| Offsite charges c | $2.51 | $2.51 | |

| General and administrative (non-mill) d | $1.45 | $1.45 | |

| Total unit costs e | $/t processed | $13.01 | $17.56 |

Notes to Table 12:

a Open pit mining unit costs apply to both mineralized material and waste, but exclude stockpile rehandle costs of $1.47/t rehandled. Underground mining unit costs exclude capitalized development and mill feed generated from mine development.

b Includes processing-related general & administrative costs.

c Offsite charges are based on land transportation costs of $46.35 per wet metric tonne, treatment charges of $75.00 per dry metric tonne, refining charges of $0.080/lb, $0.50/oz, and $1.30/lb for copper, silver, and molybdenum, respectively.

d Includes $0.45/tonne average cost over the life of mine related to Arizona property tax.

e Amounts will not sum as mining costs are presented on a per tonne mined basis.

Future mining is expected to be a contractor-operated conventional truck and shovel method at surface and during underground development (pre-production), transitioning to owner-operated block caving underground method. Open pit mining operating costs were developed from first principles costing and considered differential costs for materials handling based on a haulage assessment, which included discrete costing for material that would be stockpiled and reclaimed for future processing.

The open pit mining activity is expected to be conducted by a contractor and therefore costing is inclusive of contractor capital repayment (equipment) and all associated markups. The open pit operating cost has been estimated at $2.43/t mined and $1.47/t for stockpile rehandling costs, resulting in a LOM average total open pit material movement cost of $2.79/t mined, which excludes costs attributed to waste material. Underground mining operating costs associated with block cave production have been estimated from first principles costing with discrete cost buildups for key activities such as drawpoint mucking, secondary breaking, crushing, conveying, mine services and maintenance, definition drilling, rehabilitation and mine operating staff. The underground operating costs have been estimated at $7.30/t mined.

Processing operating costs have been developed for all three material types with consideration of primary crushing (for open pit processed material), conveyance reagent requirements, consumables, plant maintenance, power consumption, labour and plant specific general and administrative ("G&A"). Processing costs have been estimated as $5.91 and $5.74 per tonne for sulphide and transitional materials, respectively. The operating cost of the molybdenum plant contributes an additional $0.39 per tonne processed through the concentrator and will be applied starting in Year 3 when the molybdenum plant is commissioned and operational. Operating costs of the oxide heap leach have been estimates as $6.71 per tonne leached. An average site power unit cost of $0.065 per kilowatt hour was assumed, based on a portion of expected power requirements coming from a proposed solar and battery facility.

G&A cost of $1.45/t processed (exclusive of process plant related G&A) is comprised of $1.00/t processed based on regional benchmarks of comparative operational scale, plus $0.45/t processed average over the life of mine related to Arizona property tax. The project would not require a camp facility as the location is easily accessible from the townsites of Mammoth, San Manuel and Oracle, as well as being approximately 80 road km northeast from the city of Tucson.

Tax

The LOM expected effective income tax rate of 14.4% includes U.S. federal income taxes, state income taxes and state severance taxes. These were based on the Internal Revenue Code of 1986, as amended and the regulations thereunder, and the Arizona Revised Statutes in effect as of March 31, 2023. Amounts were calculated based on modelling expected future cash flows with the following assumptions:

- The open pit and underground mines would be treated as separate depletable properties under Section 614

- The project would deduct mine development costs as incurred under Section 616(a) subject to Section 291(b)(2) adjustment for corporate taxpayers

- The project would elect to depreciate long-lived assets under the unit of production basis under Section 168(f)(1) and all other assets would be depreciated under Modified Accelerated Cost Recovery System in accordance with Rev. Proc. 87-56

- All metal sales would be delivered outside of the U.S. and are therefore expected to be eligible for the Foreign Derived Intangible Income deduction under Section 250. The project would use a third party outside of the U.S. for concentrate treatment and refining

- No section 382 ownership change would occur during the construction or operation of the mine

Arizona property taxes, which are included as an operating cost within G&A, were determined based on the current Arizona Department of Revenue Appraisal Manual for Centrally Valued Resource Properties and observable market precedents. The valuation of the project uses the cost approach for Years 1 through 5, a 60% / 40% blend of the income and cost approaches during the middle of the mine life and the cost approach again for the final 5 years of the mine life.

Cash Flow Details

Table 13 provides a detailed breakdown of annual cash flows over the life of mine.

Table 13: Annual Cash Flows ($ millions)

| Year a | -1 | -2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| Gross Revenue | - | - | 342 | 687 | 449 | 431 | 345 | 452 | 412 | 417 | 343 | 362 | 456 | 480 | 464 | 449 | 435 |

| Offsite Charges | - | - | -22 | -46 | -24 | -29 | -24 | -30 | -30 | -30 | -25 | -26 | -33 | -35 | -34 | -33 | -32 |

| Royalties | - | - | -9 | -12 | -9 | -13 | -10 | -13 | -11 | -12 | -9 | -10 | -13 | -13 | -13 | -12 | -12 |

| Operating Expenses | - | - | -190 | -219 | -239 | -225 | -209 | -228 | -148 | -147 | -119 | -133 | -151 | -161 | -160 | -160 | -159 |

| Operating Costs | - | - | -221 | -277 | -272 | -267 | -243 | -271 | -189 | -189 | -154 | -169 | -197 | -209 | -207 | -205 | -203 |

| Initial Capex | -185 | -613 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Expansion Capex | - | - | - | - | -92 | -69 | -78 | -84 | -136 | -172 | -152 | -105 | -124 | -108 | -67 | -60 | -62 |

| Sustaining Capex | - | - | 0 | -5 | 0 | -57 | -2 | - | 0 | - | -5 | - | - | - | - | - | - |

| Closure Capex | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Taxes Payable | - | - | - | -15 | -2 | -1 | 0 | -2 | -2 | -3 | -2 | -4 | -6 | -7 | -7 | -21 | -24 |

| Post-Tax Unlevered Cash Flow | -185 | -613 | 121 | 390 | 84 | 38 | 20 | 95 | 84 | 54 | 30 | 85 | 129 | 156 | 183 | 162 | 146 |

| Year a | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 |

| Gross Revenue | 450 | 461 | 434 | 440 | 502 | 489 | 484 | 470 | 455 | 433 | 401 | 357 | 304 | 208 | 144 | 144 | 99 |

| Offsite Charges | -33 | -34 | -32 | -32 | -37 | -36 | -35 | -34 | -33 | -32 | -29 | -26 | -22 | -15 | -11 | -11 | -7 |

| Royalties | -12 | -13 | -12 | -12 | -14 | -13 | -13 | -13 | -13 | -12 | -11 | -10 | -8 | -6 | -4 | 0 | 0 |

| Operating Expenses | -160 | -159 | -159 | -160 | -163 | -164 | -164 | -164 | -164 | -163 | -162 | -161 | -156 | -125 | -96 | -96 | -66 |

| Operating Costs | -205 | -206 | -203 | -204 | -213 | -213 | -213 | -211 | -210 | -206 | -202 | -197 | -186 | -147 | -111 | -107 | -73 |

| Initial Capex | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Expansion Capex | -51 | -37 | -47 | -37 | -35 | -25 | -13 | -18 | -10 | -10 | -8 | -18 | -4 | - | - | - | - |

| Sustaining Capex | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Closure Capex | - | - | - | - | - | - | - | - | - | - | - | - | -11 | -3 | -3 | -17 | -137 |

| Taxes Payable | -29 | -34 | -28 | -31 | -42 | -41 | -42 | -39 | -38 | -35 | -30 | -21 | -16 | -8 | -4 | -5 | -3 |

| Post-Tax Unlevered Cash Flow | 164 | 184 | 156 | 168 | 212 | 210 | 216 | 201 | 197 | 181 | 160 | 120 | 87 | 51 | 26 | 15 | -114 |

Notes to Table 13:

a Amounts may not sum due to rounding.

Mineral Resource Estimate

The effective date of the MRE is February 9, 2023, prepared by SRK. This resource represents an update to the MRE released in July 2022 and incorporates Phase I drill results and assay data from historical drill holes not previously sampled, together with the evaluation of 17 near-surface breccia units and the deeper porphyry zone.

Mineral Resources have been updated based on the following:

- Drill hole database inclusive of Phase I drilling results (as of October 27, 2022)

- Updated geological model and breccia wireframe domain models based on logging of Phase I and selected historical drill core

- Increase of rock density used for MRE based on updated measurement method

- Detailed topographic data

- Updated open pit and underground resource constraints for RPEEE, which include variable COG based on material type

The MRE is based on the drill hole database, revised lithology from re-logging, discrete breccia wireframe domain models and current detailed topographic data. The resource estimation is supported by logging, drilling and sampling with a data cut-off of October 27, 2022. As of the data cut-off, the current drill hole database contained validated assay data from the majority of the Phase I drilling, except for drill hole FCD-22-001, which had pending results. Geological logging data was available from all nine Phase I drill holes and most historical drill holes.

SRK has defined the MRE (Table 14) based on variable COG derived from assumed economics for both open pit and underground mining potential. The estimation was constrained within discrete breccia domains based on geological logging and assay grades. SRK reviewed the breccia interpretations and updated the wireframe boundaries to reflect the results of the 2022 Phase I drill program. Estimation within the breccias considered only the composites and blocks within each unique domain and assumed hard boundary conditions at the breccia unit outer contacts to constrain smearing of high grades in the breccias. Estimation outside of the defined breccia units, within the deeper porphyry-style mineralization and halo zones around the near-surface breccias, considered a 5-metre soft boundary with the breccia units.

Table 14: Combined Open Pit and Underground Mineral Resource Estimate, Copper Creek Project

| Category | Tonnage (Mt) | Grade | Contained Metal | ||||||

Cu (%) | Mo (%) | Ag (g/t) | CuEq (%) | Cu (Mlb) | Mo (Mlb) | Ag (Moz) | CuEq (Mlb) | ||

| Open Pit | |||||||||

| Measured | 67.2 | 0.48 | 0.008 | 1.2 | 0.51 | 710.5 | 12.5 | 2.6 | 751.1 |

| Indicated | 59.9 | 0.31 | 0.008 | 0.6 | 0.33 | 412.9 | 10.1 | 1.1 | 440.5 |

| Measured and Indicated (M&I) | 127.1 | 0.40 | 0.008 | 0.9 | 0.43 | 1,123.4 | 22.6 | 3.8 | 1,191.6 |

| Inferred | 48.1 | 0.28 | 0.006 | 0.5 | 0.30 | 298.4 | 6.4 | 0.7 | 316.0 |

| Underground | |||||||||

| Measured | 34.5 | 0.47 | 0.011 | 1.6 | 0.51 | 359.8 | 8.0 | 1.7 | 388.0 |

| Indicated | 260.3 | 0.47 | 0.008 | 1.2 | 0.50 | 2,720.6 | 43.9 | 10.0 | 2,876.8 |

| M&I | 294.8 | 0.47 | 0.008 | 1.2 | 0.50 | 3,080.4 | 52.0 | 11.8 | 3,264.8 |

| Inferred | 35.5 | 0.42 | 0.009 | 0.8 | 0.45 | 329.7 | 7.1 | 0.9 | 353.0 |

| Total (open pit + underground) | |||||||||

| Measured | 101.6 | 0.48 | 0.009 | 1.3 | 0.51 | 1,070.3 | 20.5 | 4.4 | 1,139.1 |

| Indicated | 320.2 | 0.44 | 0.008 | 1.1 | 0.47 | 3,133.5 | 54.0 | 11.2 | 3,317.3 |

| M&I | 421.9 | 0.45 | 0.008 | 1.1 | 0.48 | 4,203.8 | 74.6 | 15.5 | 4,456.4 |

| Inferred | 83.6 | 0.34 | 0.007 | 0.6 | 0.36 | 628.2 | 13.4 | 1.7 | 669.0 |

Notes to Table 14 and 15:

- The mineral resources in this estimate were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Standards on Mineral Resources and Reserves, Definitions and Guidelines (CIM, 2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

- Mineral Resource (MRE) copper equivalent ("CuEq") values are calculated using commodity type and price, considering the relevant preliminary recovery rate based on domain. For example, sulphide CuEq = [(Cu grade/100 * 0.92 Cu recovery * 2,204.62 * $3.80) + (Mo grade/100 * 0.78 Mo recovery * 2,204.62 * $13.00) + (Ag grade * 0.50 Ag recovery * $20.00/31.10348)]/(0.92 Cu recovery * 2,204.62 * $3.80) * 100.

- Pit shell constrained resources with Reasonable Prospect for Eventual Economic Extraction ("RPEEE") are stated as contained within estimation domains defined by the following cut-off grade ("COG"): 0.13% CuEq for oxide material, 0.14% CuEq for transitional material, and 0.13% CuEq for sulphide material. Pit shells are based on an assumed copper price of $3.80/lb, assumed molybdenum price of $13.00/lb, assumed silver price of $20.00/oz, and overall slope angle of 47 degrees based on preliminary geotechnical data. Operating cost assumptions include open pit mining cost of $2.25/t, processing cost of $7.60/t for milling transitional and sulphide material, $4.56/t for oxide processing, general and administrative ("G&A") costs of $1.00/t, and treatment charges and refining charges ("TCRC") and freight costs dependent on product and material type.

- Underground constrained resources with RPEEE are stated as contained within estimation domains above 0.31% CuEq COG. Underground bulk mining footprints are based on an assumed copper price of $3.80/lb, assumed molybdenum price of $13.00/lb, assumed silver price of $20.00/oz, underground mining cost of $7.30/t, processing cost of $7.60/t, G&A costs of $1.00/t, and TCRC and freight costs of $6.50/t. Cave footprint optimization was completed in Geovia's Footprint Finder software and applied a 700 m maximum height of draw.

- Average bulk density assigned by domain is as follows: 2.47 grams per cubic centimetre (g/cm3) for all near-surface breccias, 2.60 g/cm3 for the deeper Mammoth and Keel breccias, porphyry mineralization, and all other areas outside of breccias.

- Preliminary variable metallurgical recovery by metal and domain are considered for CuEq as follows: copper recovery of 92%, 85%, and 60% within sulphide, transitional, and oxide material, respectively; molybdenum recovery of 78% and 68% for sulphide and transitional material, respectively; and silver recovery of 50% and 40% for sulphide and transitional material, respectively.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- All quantities are rounded to the appropriate number of significant figures; consequently, sums may not add up due to rounding.

Three domains are recognized within the open pit resource, referred to as Oxide, Transitional, and Sulphide. The underground resources stated in Table 14 are comprised only of sulphide mineralization. The open pit MRE is reported by domain in Table 15.

Table 15: Open Pit Mineral Resource Estimate by Domain, Copper Creek Project

| Category | Domain | Tonnage (Mt) | Grade | Contained Metal | ||||||

Cu (%) | Mo (%) | Ag (g/t) | CuEq (%) | Cu (Mlb) | Mo (Mlb) | Ag (Moz) | CuEq (Mlb) | |||

| Measured | Oxide | 5.9 | 0.36 | 0.006 | 0.9 | 0.36 | 47.0 | 0.8 | 0.2 | 47.0 |

| Transitional | 11.0 | 0.42 | 0.006 | 0.8 | 0.44 | 101.6 | 1.5 | 0.3 | 106.4 | |

| Sulphide | 50.3 | 0.51 | 0.009 | 1.3 | 0.54 | 561.9 | 10.2 | 2.2 | 597.7 | |

| Total | 67.2 | 0.48 | 0.008 | 1.2 | 0.51 | 710.5 | 12.5 | 2.6 | 751.1 | |

| Indicated | Oxide | 7.1 | 0.29 | 0.009 | 0.6 | 0.29 | 45.7 | 1.4 | 0.1 | 45.7 |

| Transitional | 10.8 | 0.31 | 0.008 | 0.6 | 0.34 | 74.4 | 1.8 | 0.2 | 80.0 | |

| Sulphide | 42.1 | 0.32 | 0.007 | 0.6 | 0.34 | 292.8 | 6.8 | 0.8 | 314.8 | |

| Total | 59.9 | 0.31 | 0.008 | 0.6 | 0.33 | 412.9 | 10.1 | 1.1 | 440.5 | |

| M&I | Oxide | 13.0 | 0.32 | 0.008 | 0.8 | 0.32 | 92.7 | 2.2 | 0.3 | 92.7 |

| Transitional | 21.7 | 0.37 | 0.007 | 0.7 | 0.39 | 176.0 | 3.3 | 0.5 | 186.4 | |

| Sulphide | 92.3 | 0.42 | 0.008 | 1.0 | 0.45 | 854.7 | 17.0 | 2.9 | 912.6 | |

| Total | 127.1 | 0.40 | 0.008 | 0.9 | 0.43 | 1,123.4 | 22.6 | 3.8 | 1,191.6 | |

| Inferred | Oxide | 8.1 | 0.25 | 0.005 | 0.4 | 0.25 | 44.3 | 0.8 | 0.1 | 44.3 |

| Transitional | 12.6 | 0.30 | 0.005 | 0.4 | 0.32 | 84.0 | 1.3 | 0.2 | 88.1 | |

| Sulphide | 27.5 | 0.28 | 0.007 | 0.5 | 0.30 | 170.2 | 4.2 | 0.5 | 183.7 | |

| Total | 48.1 | 0.28 | 0.006 | 0.5 | 0.30 | 298.4 | 6.4 | 0.7 | 316.0 | |

Notes: See notes to Table 14.

ESG & Permitting Considerations

The Company is committed to developing the Copper Creek Project in an environmentally responsible and socially sustainable way through the incorporation of environmental best practices; transparent and respectful engagement with our local communities, Native Americans, and other stakeholders; and to contributing to the electrification of a greener economy through the development of U.S.-sourced copper.

The project is in a historical mining jurisdiction which has experienced mining activities dating from the 1860s to as recently as the early 1980s. The project lies on the western flank of the Galiuro Mountains and is currently accessed via two gravel roads.

Copper Creek is an intermittent waterway through portions of its length and is dry at its lower reach, which is a gravel confluence with the San Pedro River. The Arizona Department of Environmental Quality deems both Copper Creek and the portion of the San Pedro River that Copper Creek connects to as ‘impaired waterways'.

Additionally, the project is located outside of an Active Management Area administered by the Arizona Department of Water Resources, and therefore it is not subject to certain state statutory and administrative regulations for groundwater use.

Since resuming activities at the project, the Company has conducted routine environmental baseline monitoring, which includes data gathering via the following activities:

- Installation of stream gauges (flow meters) in major drainages

- Piezometer installation in selected drill holes to collect sub-surface water data

- Surface water sampling of major drainages

- Analytical water sampling and water elevation measurements from monitoring wells

- Installation of a meteorological station, planned for 2023, for collecting site-specific climate data

All baseline data collected will be incorporated into future hydrogeological and site-specific water balance studies. The Company is updating existing biological and cultural surveys, as well as proactively assessing and classifying waterways, all of which will serve as the foundation for the regulatory permitting processes.

The project is in proximity to existing mining districts and associated infrastructure, while being outside of residential and urban centres. Since portions of the project are located on public lands managed by the Bureau of Land Management ("BLM"), it is assumed that development of the project would require approval of a Mine Plan of Operations ("MPO") permit. Critical path items related to environmental permitting for the project are expected to be:

- BLM approvals including National Environmental Policy Act ("NEPA"), Endangered Species Act ("ESA"), and National Historic Preservation Act ("NHPA") compliance

- Clean Air Act permitting

- Clean Waters Act Section 404 Permit (including NEPA, ESA, and NHPA) compliance

- Aquifer protection permit

Historical small-scale production at the property resulted in various legacy tailings, waste rock piles, adits, and a settling pond system, which are primarily located on BLM lands.

The Company is dedicated to working collaboratively with all stakeholders throughout the lifecycle of the project.

The Company has signed a Letter of Intent with Proteus Power for the evaluation of a new solar photovoltaic power generation facility and battery energy storage system on recently acquired private ground (see news release dated March 9, 2023), which could facilitate reducing carbon emissions during production and increase renewable, clean energy generation in the State of Arizona.

Post-PEA Opportunities

Following the PEA, the Company will focus on growth of the MRE, new discoveries and scalability of the asset. The main catalysts include:

- Phase II drill program: Results were not included in the MRE that formed the basis of the PEA. Results of Phase II released to date demonstrate the potential for expansion of the MRE, refer to news releases dated January 17, February 23, and March 14, 2023.

- Gold program: Certain copper mineralized domains have been shown to contain elevated levels of gold. Approximately 12% of the drill core analyzed for copper was assayed for gold. A program to analyze additional historical samples for gold to obtain adequate data coverage for inclusion in future MRE updates has been initiated.

- Asset scalability: Increased processing rates will be evaluated through continued metallurgical test work programs targeting coarser grind opportunities, assessments on alternative tailings deposition strategies and increasing mine production capacity.

- Phase III drill program: A 20,000-metre drill program is planned to commence in the fourth quarter of 2023. This will focus on testing new targets on the property outside of the resource area, expansion of the MRE with additional step out and follow-up drilling from Phase II.

- District Exploration: District exploration will utilize new information from ongoing geological mapping, recently reprocessed and newly acquired geophysical data, and a planned airborne spectral mineralogy survey to provide a pipeline of future exploration targets.

Copper Creek Project Overview

Copper Creek is a 100% owned project located ~80 road km northeast of Tucson, Arizona, and ~24 km northeast of the town of San Manuel, Arizona. The current resource area is ~3 km in length and open in all directions. The property consists of ~65 square km of patented and unpatented mining claims, private land and state prospecting permits. Additionally, the Company controls several grazing leases adjacent to the project. The area is in a mining friendly and politically stable jurisdiction with extensive infrastructure including power, rail, roads, and access to skilled personnel.

The property is in the prolific southwest porphyry copper region at the projected intersection of a major northwest belt of copper deposits (Ray, Miami/Globe, Superior/Resolution, Johnson Camp) and a major east-northeast belt of copper deposits (San Manuel/Kalamazoo, Silver Bell, Lakeshore, Safford, Morenci). The project hosts a porphyry copper deposit in addition to high-grade, near-surface, breccia mineralization. With over 200,000 m of historical drilling and modest past production, the Company believes significant exploration upside remains. There are over 400 known breccia occurrences mapped at surface, of which 35 have been drill-tested and 17 are included in the MRE.

Technical Report

A PEA, with an effective date of May 3, 2023, in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), will be filed on SEDAR within 45 days of this news release and will be available at that time on the Faraday website.

For readers to fully understand the information in this news release, they should read the technical report in its entirety when it is available, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not be read or relied upon out of context.

Qualified Persons

The PEA was compiled by Ausenco with contributions from a team of Qualified Persons as defined by NI 43-101. The scientific and technical information contained in this news release pertaining to Copper Creek has been reviewed and verified by the following independent qualified persons under NI 43-101:

- Erin Patterson, P.Eng. of Ausenco; Processing, Infrastructure, Cost Estimating and Economic Analysis

- Peter Mehrfert, P.Eng. of Ausenco; Metallurgy

- Scott Elfen, P.Eng. of Ausenco; Tailings and Heap Leach Facility

- Scott Weston, P.Geo. of Ausenco; Environmental

- Berkley Tracy, P.Geo. of SRK; Mineral Resource Estimate

- Bob McCarthy, P.Eng. of SRK; Open Pit Mine Planning and Costing

- Jarek Jakubek, P.Eng. of SRK; Underground Mine Planning and Costing

- Rob Pratt, P.Eng. of CNI; Geotechnical

The qualified persons have verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and are not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein. The disclosure of scientific and technical information in this news release regarding resource and exploration has been reviewed and approved by Thomas Bissig, P.Geo., Faraday's Vice President, Exploration. Disclosure regarding mine development and infrastructure has been reviewed and approved by Zach Allwright, P.Eng., Faraday's Vice President, Projects and Evaluations.

About Ausenco

Ausenco is a global company ‘redefining what's possible'. Its team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining their deep technical expertise with a 30-year track record, Ausenco provides innovative, value-add consulting and engineering studies and project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors.

About SRK

SRK is an independent international mining consultancy firm that provides focused advice and solutions to clients in the earth and water resource industries. The company has contributed to its clients' success for over 45 years on over 20,000 projects globally. It is based across 44 offices worldwide with leading mining specialists in fields such as due diligence, technical studies, mine waste and water management, permitting and mine rehabilitation.

About CNI

CNI is an international mining consulting firm that specializes in geological engineering, geotechnical engineering, and hydrogeology. The company has been providing a wide range of engineering services to the mining industry for 42 years.

About Faraday Copper

Faraday Copper is a Canadian exploration company focused on advancing its flagship copper project in Arizona, U.S. The Copper Creek Project is one of the largest undeveloped copper projects in North America with open pit and bulk underground mining potential. The Company is well-funded to deliver on its key milestones and benefits from a management team and board of directors with senior mining company experience and expertise. Faraday trades on the TSX under the symbol "FDY".

For additional information please contact:

Stacey Pavlova, CFA

Vice President, Investor Relations & Communications

Faraday Copper Corp.

E-mail: [email protected]

Website: www.faradaycopper.com

To receive news releases by e-mail, please register using the Faraday website at www.faradaycopper.com.

Cautionary Note on Forward Looking Statements

Some of the statements in this news release, other than statements of historical fact, are "forward-looking statements" and are based on the opinions and estimates of management as of the date such statements are made and are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements of Faraday to be materially different from those expressed or implied by such forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements concerning the exploration potential of Copper Creek, the expected contributions of the Phase II drill programs, the expected mine life for Copper Creek, the expected upside of Copper Creek relative to the copper price, the anticipated economics of the standalone pit operation, the ability of the Company to fund development of a bulk underground mine through the open pit mine, the expected production during active mining, the expected construction timing, the low operating cost profile, the expected high-performance metallurgical recoveries, the anticipated exploration upside and the ability of the Company to reduce carbon emissions during production through its proposed partnership with Proteus Power.

Although Faraday believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements should not be in any way construed as guarantees of future performance and actual results or developments may differ materially. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Factors that could cause actual results to differ materially from those in forward-looking statements include without limitation: market prices for metals; the conclusions of detailed feasibility and technical analyses; lower than expected grades and quantities of resources; receipt of regulatory approval; receipt of shareholder approval; mining rates and recovery rates; significant capital requirements; price volatility in the spot and forward markets for commodities; fluctuations in rates of exchange; taxation; controls, regulations and political or economic developments in the countries in which Faraday does or may carry on business; the speculative nature of mineral exploration and development, competition; loss of key employees; rising costs of labour, supplies, fuel and equipment; actual results of current exploration or reclamation activities; accidents; labour disputes; defective title to mineral claims or property or contests over claims to mineral properties; unexpected delays and costs inherent to consulting and accommodating rights of Indigenous peoples and other groups; risks, uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements, including those associated with the Copper Creek property; and uncertainties with respect to any future acquisitions by Faraday. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks as well as "Risk Factors" included in Faraday's disclosure documents filed on and available at www.sedar.com.

All of the forward-looking statements contained in this press release are qualified by these cautionary statements. Faraday does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. For more information on Faraday, readers should refer to www.sedar.com for the Faraday's filings with the Canadian securities regulatory authorities.

Risks Relating to Mineral Resource Estimates

The figures for mineral resources contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that the mineral resources could be mined or processed profitably. Actual reserves, if any, may not conform to geological, metallurgical or other expectations, and the volume and grade of mineralized material recovered may be below the estimated levels. There are numerous uncertainties inherent in estimating mineral resources, including many factors beyond the Company's control. Such estimation is a subjective process, and the accuracy of any resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the mineral resources, such as the need for orderly development of the mineralized bodies or the processing of new or different mineralized material grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Lower market prices, increased production costs, the presence of deleterious elements, reduced recovery rates and other factors may result in revision of its resource estimates from time to time or may render the Company's resources uneconomic to exploit. Resource data is not indicative of future results of operations. If the Company fails to develop its resource base through the realization of identified mineralized potential, its results of operations or financial condition may be materially and adversely affected.

Non-IFRS Financial Measures

This press release makes reference to certain non-IFRS measures. These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of Faraday's results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of Faraday's financial information reported under IFRS. This press release makes reference to the following non-IFRS measures: "EBITDA", production cash costs, and All-In Sustaining Costs.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. This news release is not, and under no circumstances is to be construed as, a prospectus, an offering memorandum, an advertisement or a public offering of securities in Faraday in Canada, the United States or any other jurisdiction. No securities commission or similar authority in Canada or in the United States has reviewed or in any way passed upon this news release, and any representation to the contrary is an offence.

i Active mining refers to years 1 - 29 and excludes years 30 - 32 when only stockpile processing occurs.

ii Preliminary Economic Assessment (PEA) copper equivalent (CuEq) values are calculated using commodity type and price, considering the relevant recovery rate based on domain, applied using a regression formula as a function of grade. Recovery regression formulas are based on the outcomes of the 2023 metallurgical test work and associated recovery guidance. Metal prices used in the calculation include $3.80/lb copper, $13.00/lb molybdenum, $20.00/oz silver.

iii Production cash costs and all-in sustaining cash costs, net of by-product credits, per pound of copper or CuEq are non-IFRS financial performance measures with no standardized definition under IFRS. The Company believes these metrics are useful performance indicators based on industry standards and disclosures. Production cash costs are based on the direct operating costs, including mining, processing, and G&A, offsite charges, net of by-product credits. By-product credits are calculated using commodity prices: $13.00 per pound of molybdenum, and $20.00 per ounce of silver. Sustaining cash costs include sustaining capital expenditures and royalties.

SOURCE: Faraday Copper Corp.