The choices and sacrifice of DrazCanna, Inc.'s Cannabis Bio-Pharmaceutical Research and Development project team members resulting from Michigan's legacy of police brutality.

DEARBORN HEIGHTS, MI / ACCESSWIRE / December 20, 2022 / DrazCanna, Inc. (OTC PINK:DZCA) release is a continuation of the disclosure of the challenges presented to the organization's evolution and its impact upon the organization and shareholders. The disclosure of the evolution of DrazCanna's history since its as cannabis bio-pharmaceutical research and development project in 2015 is reflective of DrazCanna's commitment to excellence in corporate governance.

"By December of 2020, the troubling challenges forced upon us by Michigan's legacy of police brutality led to a difficult decision for Gina and I. What do we do with the thousand upon thousand of hours devoted to research and development?" asked Ty Putrich, "The decision was to proceed ahead with the entrepreneurial endeavor as a team with Ali and Hussein, in hopes that resolution from the damaging false accusations made to cover up the reality of police brutality would be achieved."

The Decision

"It was hard to think about just letting go of the effort we put in. The shattering of our entrepreneurial dreams was our reality, the fate we didn't want to accept." stated Gina Szpak, "The choice was simple, since the start it was about the realization of the dream. We committed to the success of DrazCanna as we wanted something good to come out of the years of work and sacrifice even if we could not participate so as to not have the false allegations from the police brutality call into question the integrity of the DrazCanna leadership team. Our hope was that success of DrazCanna would open doors of opportunity in the future."

The decision was made by the couple to commit to the success of DrazCanna. The work began on the formation of the plan and financial projections of a Detroit based cultivation operation as its start. The plan was to employ a Detroit owned building and the couple's proprietary cultivation process as basis for environmental excellence in the cannabis bio-pharmaceutical supply chain. The financial projections and plan were quickly created and refined. The plan included expansion subsequent expansion with a state-of-the-art hybrid greenhouse to be built with the proprietary cultivation system and Michigan's geographic location and weather aiding the operation to grow. The challenge to the team was how to best finance the expansion given the financing constraints unique to the cannabis touching companies.

The Entrepreneurial Equity Capitalization Journey Begins

The DEA's Schedule 1 classification of cannabis is based upon the "belief" that "no currently accepted medical use" is known for cannabis. The result has discouraged banks and other financial institutions from maintaining relationships with cannabis touching businesses. According to the U.S. Treasury Department, only about 11 percent of all U.S. banks and 4 percent of all U.S. credit unions are currently providing banking services to marijuana-related businesses as of October of 2022. During October 2022, president Joe Biden ordered the review of the classification schedule of cannabis, during a "Statement on Marijuana Reform" to consider administrative descheduling of marijuana.

"The challenges we face as a cannabis bio-pharmaceutical supply chain company that is excluded from the financial services and products offered to all other US industries forced us to look for non-traditional sources knowing that we desired to ultimately be a public company striving to be one of the top OTC cannabis stocks." stated Hussein Anani, President of DrazCanna, Inc. "As a pre-revenue company the sources of debt and equity are limited. We looked at alternatives from private loans, cannabis construction financing, cannabis real estate loans, sale/leaseback structures, non-dilutive debt capital, lines of credit, convertible debt, senior secured financing, and even crowdfunding."

Raising investment for emerging cannabis companies has always been one of the most challenging aspects of doing business and DrazCanna is no exception. In 2021, the cannabis industry saw more banks and institutional investors opening up to the cannabis industry, offering loans at lower rates than ever before.

The maturation and growth of the cannabis industry saw total debt and capital raises in 2021 in excess of $12 billion reported. Equity capital raises for the year exceeded $7 billion, up significantly over prior year. Debt raises with lower interest rates on their loans in the United States, spurned an increase of debt raises to over $5 billion for the year.

A Path of Raising Equity Capital for DrazCanna

The popularity of raising investment capital through special purpose acquisition companies, or "SPACs" caught the attention of the team. The SPAC had the biggest venture capitalists involved with celebrity endorsements and participation adding to their allure.

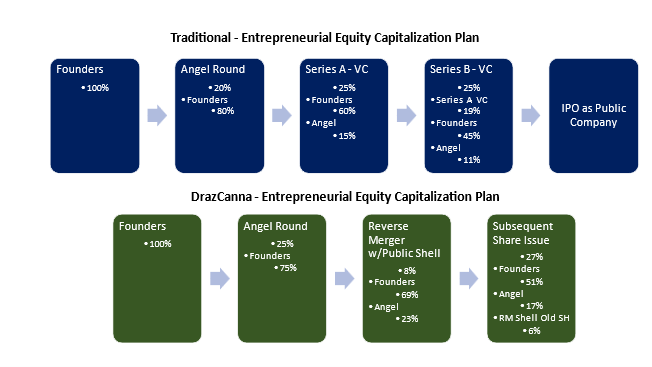

The SPAC "blank-check" vehicle and subsequent reverse merger provided a path for the entrepreneurial team to the equity capital. It also provided for a decrease to the number of dilutionary rounds that adversely impact most founding entrepreneurs. SPACs were quite the rage in 2021 with leading multi-state operators merging into the SPAC shell.

The Question: What is "special" about a Special Purpose Acquisition Company?

"With an understanding of initial public offerings (IPOs), the novel SPAC looked like the next best financing approach alternative for funding our expansion with equity capital to build a fortress balance sheet to maximize revenue growth without the constraints that debt sometimes present." stated Ty, "But when the question was asked as to what is ‘special' about an SPAC, my answer was it's a reverse merger with a public shell. That didn't sound so special so I asked for some time to do a little research on the benefits of SPACs for DrazCanna."

The research led to the facts. Most SPAC originators take 20% or more for the creation of the SPAC shell itself. Celebrity endorsements earn a cut as well. The shares are generally sold to institutional investors who hopefully profit from a gain when sold to the retail investor at a premium.

"His answer was clear, the special thing about an SPAC is that 20% of the value goes to the SPAC creators and the same thing could be done through a reverse merger with a public shell and a subsequent share issuance, it is the equivalent of an IPO for a reverse merger with a public shell." added Ali Anani, "The SPAC approach was eliminated from further consideration as we saw disproportionate benefit going to a relatively few individuals who were arranging the creation of the SPAC shell itself. So now what do we do? A reverse merger with a public shell streamlines the entrepreneurial equity capitalization process creating a closer connection between the founders and the retail investors eliminating several dilution rounds that impact all shareholders in the end."

The Streamlining of Entrepreneurial Equity Capitalization Process

"As we looked at the potential of a pre-planned reverse merger with a public shell the benefits in reducing the dilutionary rounds and sought to close the connection between entrepreneurial founders and retail investors came into view." added Hussein Anani, "We also explored Crowdfunding as an opportunity to connect the retail investor into the equation as well as to open up a structure for family and friends who desire to invest."

Finding a public shell was the next task. But not just any shell, the considerations were many including existing common and preferred share structure, outstanding liabilities, lawsuits, ‘bad actors' within management and/or shareholders, fraudulent activities, and even common share par value were criteria for determining which shell amongst the estimated three thousand dormant OTC public shells existing during 2021.

The Search for an OTC Public Shell

"We looked at over a hundred different OTC shells and spoke with industry leaders that resurrect the dormant shells. We found a number of shells that through our research we quickly eliminated from further consideration as we found bad actors within the history of the shell." stated Ty Putrich, "With the pending SEC deadline of September 2021 looming to relegate all non-reporting shells to the lowest OTC classification increasing the difficulty in buying and selling of the OTC shell's shares. We found an opportunity to work with a leading industry company that resurrected OTC dormant shells."

The process involved filings in state court for the appointment of a receiver (or custodian depending upon state) to bring the company current in its reporting for the benefit of existing shareholders in preparation to find a private company who is seeking a reverse merger public shell. The DrazCanna team partnered with the receiver and his organization to do the work of bringing the public shell current.

Sibling Group Holdings - DrazCanna's History

"We were adamant that we wanted a clean shell. Our plan was to maintain the highest integrity in the selection of a public shell if we were to achieve our goal to be one of the top OTC cannabis stocks. Given the plan was a preplanned reverse merger with a cannabis company we didn't want any complications to slow us down." stated Hussein Anani, "Our process began on July 30 with myself being appointed by the receiver as sole officer and director with our team beginning work that day. Our experienced accountants and attorneys immediately began working on financial reporting."

After searching for so long to find the shell that met the criteria, the team hard work met the September 28 deadline with the filing of 2021 and 2020 annual financial statements. The team searched through hundreds of SEC filings to insure the financial statements were presented in accordance to GAAP. DrazCanna (fka Sibling Group Holdings) had become OTC Pink Current before the deadline. Acquisition of the corporate shell occurred on September 22, 2021 by Michigan based The High Company, LLC which is owned and controlled by Hussein Anani, President of DrazCanna, Inc. (OTCBB: DZCA).

DrazCanna will continue the disclosure of the evolution of our unique entrepreneurial journey as the preparation of the corporate shell for a reverse merger continues. "Come Grow with US"

DrazCanna Contact:

DrazCanna, Inc.

Hussein Anani, President

P.O. Box 600

Dearborn Heights, MI 48127

www.drazcanna.com

[email protected]

Disclaimer: The opinions expressed are those of Gina Szpak and Ty Putrich and may not necessarily reflect the opinions of DrazCanna, Inc.

For more information about DrazCanna's Cannabis ESG project "Cannabis Helping Cops" and cannabis industry social equity initiatives contact [email protected]

About DrazCanna, Inc.

DrazCanna, Inc. (OTC:DZCA) was operating in the educational sector until 2016 and was dormant until 2021 when the corporation filed its reports to achieve current status. For more information, visit www.drazcanna.com.

Safe Harbor

This press release contains forward-looking statements that involve risks and uncertainties concerning the plans and expectations of DrazCanna, Inc. These statements are only predictions and actual events, or results may differ materially from those described in this press release due to a number of risks and uncertainties, some of which are out of the company's control. The potential risks and uncertainties include, among others, that the company's expectations of future growth may not be realized. These forward-looking statements are made only as of the date hereof. The company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are expressly qualified in their entirety by the "Risk Factors" and other cautionary statements included in the company's annual, quarterly and current reports and other filings, including but not limited for the quarter ended September 30, 2022, and filings with the OTC Markets.

SOURCE: DrazCanna, Inc.