- Closed the final tranche of its $23.8M private placement with strategic investors for gross proceeds of $5.1M

- Provided update to Strategic Plan, Directing all Growth Capital to Drivrz Financial

TORONTO, ON / ACCESSWIRE / November 30, 2022 / PowerBand Solutions (TSXV:PBX)(OTCQB:PWWBF)(Frankfurt:1ZVA) ("PowerBand", "PBX" or the "Company"), a comprehensive e-commerce solution transforming the online experience to sell, trade, lease, and finance vehicles, announced that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three and nine-month period ended September 30, 2022. These documents may be viewed under the Company's SEDAR profile at www.sedar.com. All numbers in this press release are in Canadian dollars, except otherwise noted.

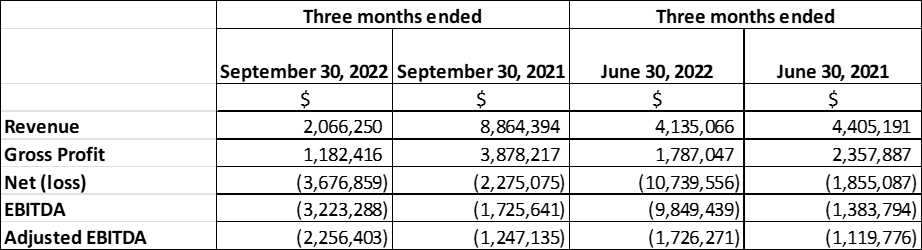

The following table sets out selected financial information for the third quarter ended September 30, 2022, and highlights described below:

- Cash on hand at September 30, 2022 was $18,219,435 compared to $6,367,533 as at December 31, 2021. The working capital position at September 30, 2022 was $12,423,282 and has improved with the proceeds raised from private placement financings.

- Revenue for the three months ended September 30, 2022, was 76% lower than the same comparable three months period last year and 50% lower than Q2/2022. The lease origination counts have been lower in the third quarter. The CDK integration with key enterprise customers is now complete and the Company is positioned to commence systematic origination programs with these customers.

- Gross margins for the three months ended September 30, 2022, were 57% compared to gross margins of 44% for the comparable three months last year. The increase in gross margin is a consequence of a streamlined control process, with a focus on customers with higher credit scores.

- Net loss, EBITDA and adjusted EBITDA for the three months ended September 30, 2022, were higher compared to the three months ended last year due to a decrease in revenue for the current quarter. The Company believes it has made significant improvements to its cost structure and expects that will be reflected in future EBITDA figures as revenues increase.

Darrin Swenson, CEO and Director of PowerBand Solutions states, "Following the comprehensive strategic review of the Company's business units, several corporate changes have been implemented. The Company has suspended operations of DrivrzLane and has moved to a maintenance mode for DrivrzXchange. The Company is allocating all growth capital and resources to its used and new vehicle leasing platform, DrivrzFinancial. We are expanding our business development initiatives to capture market share in additional highly profitable segments of the industry, namely commercial, fleet, professional corporations, EV's and exotic vehicles. In addition, we are looking to expand our lending relationships to fund transactions in these new segments. As we have previously disclosed, the Company will not be providing lease origination forecasts due to systemic supply chain challenges in the industry. The management team believes that the Company is on a path to profitability, given the cost saving measures that have been implemented, and the focus on expanding lease originations in DrivrzFinancial."

About PowerBand Solutions, Inc.

PowerBand Solutions Inc., listed on the TSX Venture Exchange and the OTCQB markets, is a fintech provider disrupting the automotive industry. PowerBand's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, funders, and manufacturers (OEMs). It enables them to buy, sell, trade, finance, and lease new and used, electric and non-electric vehicles, on any phone, tablet or PC connected to the internet. PowerBand's transaction platform - being trademarked under DRIVRZ™ - is being made available across North American and global markets.

For further information, please contact:

Darrin Swenson

Chief Executive Officer and Director

E: [email protected]

P: 1-866-768-7653

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures, such as EBITDA and Adjusted EBITDA. The Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance withIFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

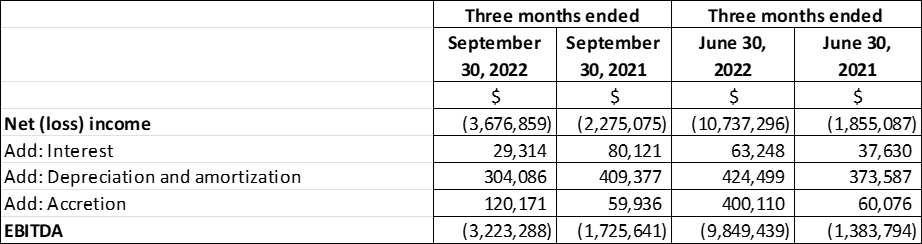

Earnings before Interest, Taxation, Depreciation and Amortization ("EBITDA")

EBITDA is a measure used by management to evaluate operational performance. It is also a common measure that is reported on and used by investors in determining a company's ability to incur and service debt as well as a valuation methodology. Management believes EBITDA enhances the information provided in the Financial Statements. EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance. EBITDA should not be used as an exclusive measure of cash flows because it does not consider the impact of working capital growth, capital expenditures, debt principal reductions and other sources and uses of cash which are disclosed in the consolidated statements of cash flows.

The following chart reflects the calculation of EBITDA:

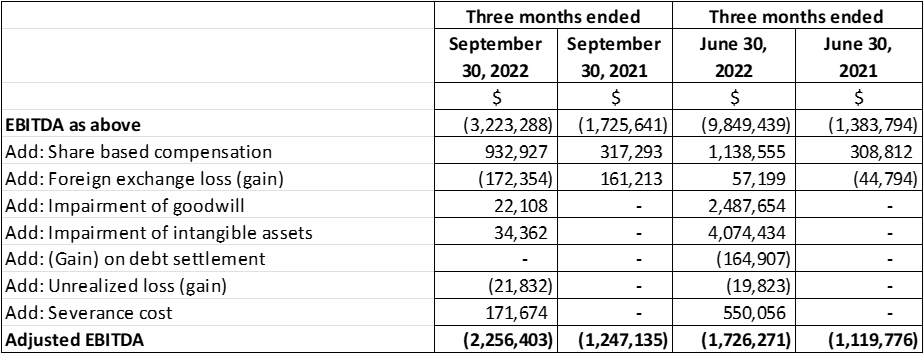

Adjusted EBITDA

Adjusted EBITDA, defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss, foreign exchange loss, and loss from debt settlement and shares issued and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance.

The following chart reflects the Company's calculation of Adjusted EBITDA:

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, expected benefits and results from operations and the potential benefits of cost saving measures implemented by the Company, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

SOURCE: PowerBand Solutions Inc.