Retirement Tax Advisor Says Pre-Retirees Should Plan for Rising Taxes to Protect Their Savings

MCKINNEY, TX / ACCESSWIRE / November 1, 2022 / Many Americans dream of the day when they can retire, but U.S. workers are retiring at later ages than those in the past thirty years according to a recent Gallup poll. The average reported retirement age is 61, as compared to age 57 in 1991 based on Gallup's annual Economy and Personal Finance survey. This delay in retirement could be linked to baby boomers' concerns about their finances.

According to an Anytime Estimate Retirement Finances survey of 1,000 non-retired Americans, the median amount Baby Boomers have saved for retirement is just $112,000. This is only 39% of the $286,000 that investment experts say they should have in the bank by age 60. The survey also found that 62% of Americans with retirement savings spent some of it during the pandemic. About 1 in 6 - or 16% - spent $15,000 or more from their retirement fund.

The most concerning outcomes of the survey were that around 80% of people expect to see their living standards fall during retirement, while 10% feared they wouldn't be able to retire at all.

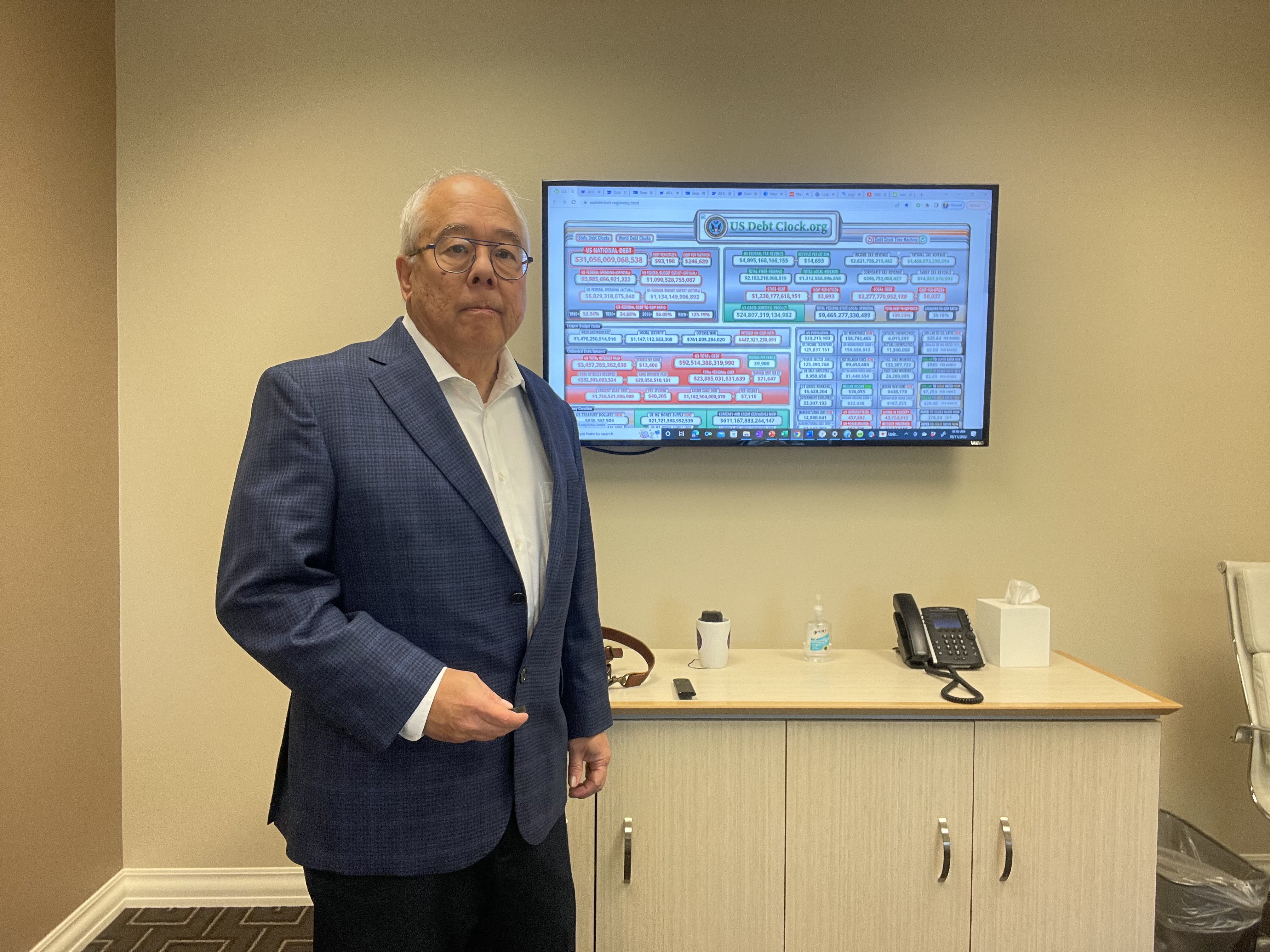

David Hyden, President and Founder of Retirement Tax Advisers and Safe Secure Planning, says that as the Federal Reserve continues to raise interest rates to combat inflation, the pressure to borrow increases, including the cost of servicing the nation's $31 trillion in national debt. Eventually, this will affect retirees' ability to save and build their investment portfolios.

"Most people are completely unaware of what is going on behind the scenes in our country's economy," says Hyden. "Marginal tax rates are predicted to rise significantly in the next ten years; as Baby Boomers continue to retire, and then Gen X'ers after them, we will see both groups at the most risk of having their retirement lifestyles affected. As a result, a lot of people in retirement could get blindsided and hurt financially."

Hyden says as tax rates rise, U.S. workers can focus on key strategies that will decrease their future tax liabilities. He says when mapping out financial and retirement goals, pre-retirees that factor in stock market volatility, tax increases, and inflation can strategically minimize wealth erosion.

For those who are young, Retired Tax Advisors recommend saving more and saving earlier - along with investing in long-term assets while budgeting costs in the right now. Recent research from Market Watch shows that millennials started saving earlier than boomers and have about $70,000 in retirement savings, putting them on track to reach the $107,000 investment experts say they need by age 40.

"Most investment advisers and accountants focus almost exclusively on minimizing taxes in the current year," Hyden contends. "But you have to analyze the long-term consequences in retirement when you talk about portfolio accumulation. Having a strategy to minimize your future tax liability could be the difference in the quality of your retirement, your legacy, and ultimately whether you will run out of money."

ABOUT RETIRED TAX ADVISORS, LLC

Retirement Tax Advisers and Safe Secure Planning is helmed by a seasoned Retirement Consultant, Certified Financial Fiduciary (CFF®), and National Social Security Adviser (NSSA®) who also holds a College Funding Adviser certification from The College Authority and is co-author of the best-selling book Crash Proof Wealth. Unlike investment advisors or CPAs, Retired Tax Advisors offer tax strategies to minimize taxes in retirement and your overall future tax liability - which can be the difference in the quality of your legacy, your livelihood, and your retirement at large. For more information visit https://retirementtaxadvisers.com/.

CONTACT INFO

David Hyden

[email protected]

469-342-8889

SOURCE: Retirement Tax Advisers, LLC