EDMONTON, AB / ACCESSWIRE / May 19, 2022 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSX-V:OSS, OTCQB:OSSIF), a North American developer of cloud-based business solutions, announces its financial results for the three months ended March 31, 2022 ("Q1 2022").

Please refer to the Unaudited Condensed Consolidated Interim Financial Statements and Management's Discussion and Analysis ("MD&A") for the three months ended March 31, 2022 filed on SEDAR at www.sedar.com for more information. All dollar amounts are denominated in Canadian dollars.

financial Results

| Three months ended | ||||||||||||||||

(in C$,000, per share in C$) | March 31, 2022 | March 31, 2021 | Change | |||||||||||||

| $ | $ | % | % | |||||||||||||

Revenue | 1,280 | 954 | 326 | 34.2 | ||||||||||||

Gross profit | 897 | 708 | 190 | 26.8 | ||||||||||||

Net loss | (1,064 | ) | (994 | ) | (70 | ) | 7.0 | |||||||||

Exchange gain (loss) on translation of foreign operations | 14 | (8 | ) | 23 | 268.9 | |||||||||||

Comprehensive loss | (1,050 | ) | (1,003 | ) | (47 | ) | 4.7 | |||||||||

Weighted average common shares outstanding - basic and fully diluted (000)'s | 118,476 | 113,111 | ||||||||||||||

Net loss per share | (0.01 | ) | (0.01 | ) | - | - | ||||||||||

| March 31, 2022 | December 31, 2021 | |||||||

Cash and cash equivalents | 4,302 | 5,509 | ||||||

Working capital | 3,209 | 4,154 | ||||||

HIGHLIGHTS FOR QUARTER ENDED MARCH 31, 2022

- Revenue of $1,279,764 increased $325,848 or 34.2% over Q1 2021, primarily due to the addition of new customers after Q1 2021.

- Gross profit as a percentage of sales was 70% in Q1 2022, lower than our 75% fiscal 2021 average, due to higher costs to assist new customer implementations and ongoing support, and a shift in product sales that resulted in an increase in royalty expense.

- Net loss of $1,064,201 was $69,776 higher than in Q1 2021. Management continues to invest in additional resources to enhance CIM product features and to increase revenue.

- New and renewed customer contracts increased accounts receivable to $3.1 million from $0.2 million at December 31, 2021. The customer contracts, which included some commitments to increased CIM usage in Fiscal 2022, increased deferred revenue by 321% to $3.8 million from $1.2 million at December 31, 2021. The Company anticipates that most of the accounts receivable will be collected by the end of Q2 2022.

- Liquid assets (cash of $4.3 million and accounts receivable of $3.1 million) totaled $7.4 million at March 31, 2022 versus $5.7 million at December 31, 2021. The Company has no debt. Assuming no significant changes in current business strategies and cash consumption, Management believes the Company has sufficient cash on hand to fund its business plan as envisioned for Fiscal 2022.

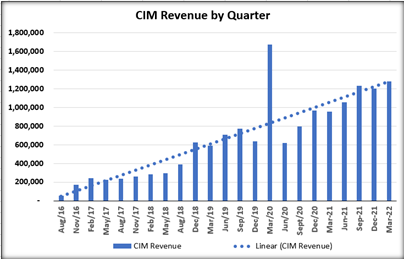

- The chart below shows CIM revenue for the past twenty-three quarters. The dotted line illustrates CIM's compounded annual revenue growth rate of 76.9%, based on linear growth over 5.75 years.

- OneSoft continued pursuit of two key growth objectives in Q1 2022: 1) signing new customers and 2) increasing revenue. A new customer entered into a multi-year agreement to use our CIM solution in the quarter, and sales efforts with other prospective customers were pursued that we believe will convert to new customers in future quarters.

- OneSoft contracted with an ILI tool vendor that intends to use components of CIM functionality to perform ILI run comparisons. We intend to utilize this new CIM component deployment model for future "Integrity as-a-Service" offerings to pipeline operators who may access CIM and OneBridge technical services on a fee for service basis to conduct their integrity management functions.

- OneSoft commenced in person attendance at trade show and customer meeting events in Q1 2002, for the first time since the start of the pandemic 2 years ago.

- New product software development for Risk, Corrosion and Crack Management modules continued in the quarter. This development is part of the Company's roadmap to deliver a "whole solution" demanded by our customers and the industry. We believe these features are necessary to achieve market dominant status in new technology markets. The Company's Innovation Lab continued to investigate GeoHazard functionality as a potential future addition to the CIM platform.

OUTLOOK

With strong validation of OneSoft's solutions from customers and industry experts, the Company is modifying its marketing and sales initiatives used to engage "innovator and early adopter" customers to focus on "majority" customer cohorts, as was explained in the Fiscal 2021 MD&A filed March 2022 on SEDAR. "Majority" customers are generally more risk-averse and pragmatic, are highly motivated by return-on-investment considerations and tend to purchase solutions that have been thoroughly tested and are referrable by peer company users. Sales efforts will target integrity management staff and senior managers responsible for allocation of resources and purchasing decisions on an overall company value approach, as opposed to departmental managers whose scope is narrower. Revised sales and marketing strategies will be deployed in Fiscal 2022, along with additional case studies and white papers that support OneSoft's unique value proposition including the high value gain and advantageous use-experience of OneSoft customers that have adopted CIM. The Company recruited and appointed a new Vice President of Sales in Q1 2022 to operationalize these objectives.

We believe that our first mover advantage, strong validation of our technology and products, and positioning of CIM to be the foundational data-hub for digital transformation jointly create the foundation to build the market leading company envisioned by Management. We anticipate that our client relationships will remain strong for years, providing we continue to deliver technologically advanced solutions that assist operators to reduce pipeline failures, realize cost savings, and unlock trapped value from unused and underutilized data.

Given the Company's strong balance sheet with $4.3 million of cash and $3.1 million of accounts receivable at the end of Q1 2022, no debt, budgeted cash burn rate, and anticipated revenue for Fiscal 2022, Management believes the Company is sufficiently funded to execute its Fiscal 2022 business plans as currently envisioned without requirement to raise additional capital.

ON BEHALF OF THE BOARD OF DIRECTORS OF ONESOFT SOLUTIONS INC.

Douglas Thomson

Chair

For more information, please contact

| Dwayne Kushniruk, CEO [email protected] 587-416-6787 | Sean Peasgood, Investor Relations [email protected] 647-494-7710 |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally; which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; interest rate ad exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.