NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE OR FOR DISSEMINATION IN THE UNITED STATES

REGINA, SK / ACCESSWIRE / March 24, 2022 / ROK Resources Inc. ("ROK" or the "Company") (TSXV:ROK) is pleased to announce the results of its December 31, 2021 independent reserves evaluation. The evaluation for the Company as at December 31, 2021 was conducted by GLJ Ltd. ("GLJ") of Calgary and was conducted in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluators Handbook ("COGEH") and National Instrument 51-101 - Standards for Disclosure of Oil and Gas Activities ("NI 51-101"). Please note that all amounts are in Canadian dollars unless otherwise stated and BOPD refers to barrels of oil per day. Reserves volumes reported below are "Total Company Interest Reserves", a classification of reserves used in the evaluation which represents production and reserves before deduction of royalties.

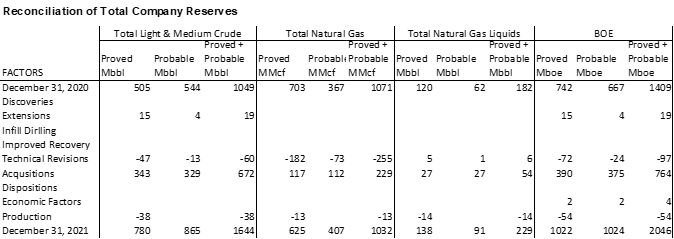

The reserve volumes do not include the Acquisition, as defined in the press release dated March 7, 2022, as the Acquisition was acquired subsequent to December 31, 2021. ROK has engaged a 3rd party evaluator to prepare a post-acquisition corporate reserves update effective March 31, 2022. This is expected to be released in late April 2022.

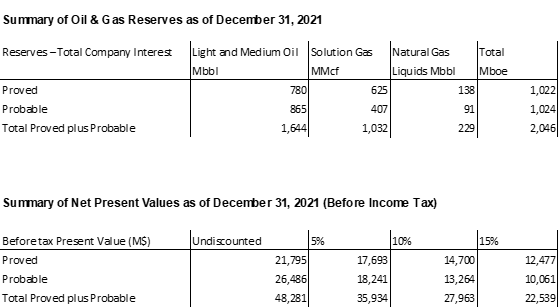

Summary of Reserves

- Crude oil & natural gas reserves and present values at December 31, 2021, as provided by GLJ:

- Proved oil and gas reserves ("1P") of 1,022,000 Boe and Net Present Value of proved oil and gas reserves ("1P") discounted at 10% ("NPV10%") of $14,700,000

- Proved plus probable oil and gas reserves ("2P") of 2,046,000 Boe and Net Present Value of proved plus probable oil and gas reserves ("2P") discounted at 10% ("NPV10%") of $27,963,000

| 1 | ) | The tables shown have assessed reserves at forecast crude oil reference prices and costs |

| 2 | ) | The inflation rate is 0% in 2022, 3% per year in 2023 and 2% per year starting in 2024 |

| 3 | ) | Estimated future undiscounted development costs, in dollars, at December 31, 2021 were CAD $8.9 million for proved reserves and CAD $18.1 million for proved plus probable reserves |

| 4 | ) | Well abandonment and reclamation costs of CAD $3.0 million for the proved plus probable case were included in this report and include abandonment and reclamation costs for all existing and future wells assigned reserves |

| 5 | ) | The net present values disclosed may not represent fair market value. |

| 6 | ) | Totals may not add exactly due to rounding. |

About ROK

ROK is primarily engaged in exploring for petroleum and natural gas development activities in Alberta and Saskatchewan. Its head office is located in Regina, Saskatchewan, Canada and ROK's common shares are traded on the Exchange under the trading symbol "ROK".

For further information, please contact:

Cameron Taylor, Chairman and CEO

Jared Lukomski, Senior Vice President, Land & Business Development

Phone: (306) 522-0011

Email: [email protected]

Boe Disclosure

The term barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6 Mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in the report are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Reserve Disclosure

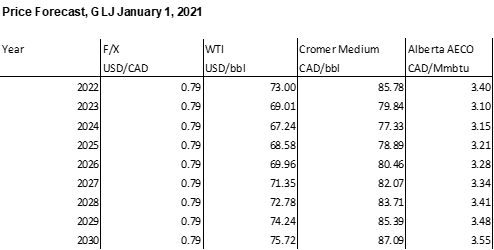

All reserves information in this press release was prepared by GLJ Ltd. ("GLJ"), effective December 31, 2021, using the reserve evaluators January 1, 2021 forecast prices and costs in accordance with National Instrument 51-101 - Standards of Disclosure of Oil and Gas Activities ("NI 51-101") and the Canadian Oil and Gas Evaluation Handbook (the "COGE Handbook"). All reserve references in this press release are "Company gross reserves". Company gross reserves are the Company's total working interest reserves before the deduction of any royalties payable by the Company and before the consideration of the Company's royalty interests. It should not be assumed that the present worth of estimated future cash flow of net revenue presented herein represents the fair market value of the reserves. There is no assurance that the forecast prices and costs assumptions will be attained, and variances could be material. The recovery and reserve estimates of ROK's crude oil, NGLs and natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Actual crude oil, natural gas and NGLs reserves may be greater than or less than the estimates provided herein. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

Abbreviations

bbls/d barrels per day

boe barrels of oil equivalent

boe/d barrels oil equivalent per day

NGLs Natural Gas Liquids

Mboe Thousands of barrels of oil equivalent

MMboe Millions of barrels of oil equivalent

PDP Proved Developed Producing

TP Total Proved Reserves

TPP Total Proved and Probable Reserves

IFRS International Financial Reporting Standards as issued by the International Accounting Standards Board

WTI West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for the crude oil standard grade

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation that are not historical facts. Forward-looking statements involve risks, uncertainties, and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to the Company's objectives, goals, or future plans with respect to pursuing the objectives and the expectations regarding the expected results thereof. Forward-looking statements are necessarily based on several estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include but are not limited to general business, economic and social uncertainties; litigation, legislative, environmental, and other judicial, regulatory, political and competitive developments; delay or failure to receive board, shareholder or regulatory approvals; those additional risks set out in ROK's public documents filed on SEDAR at www.sedar.com; and other matters discussed in this news release. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether because of new information, future events, or otherwise.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility of the adequacy or accuracy of this release.

SOURCE: ROK Resources Inc.