- Resource definition drilling and scout channel sampling program has extended known mineralization by 200 metres vertically and 130 metres horizontally

- Assay results indicate significant gold values in the Tangana 1 vein, up to 70.88 g/t Au over 0.95 metres

- High-grade silver-polymetallic channel sampling results include:

- 1,675 g/t Ag over 0.95 metres

- 7.37% Pb over 0.60 metres

- 6.75% Zn over 0.80 metres

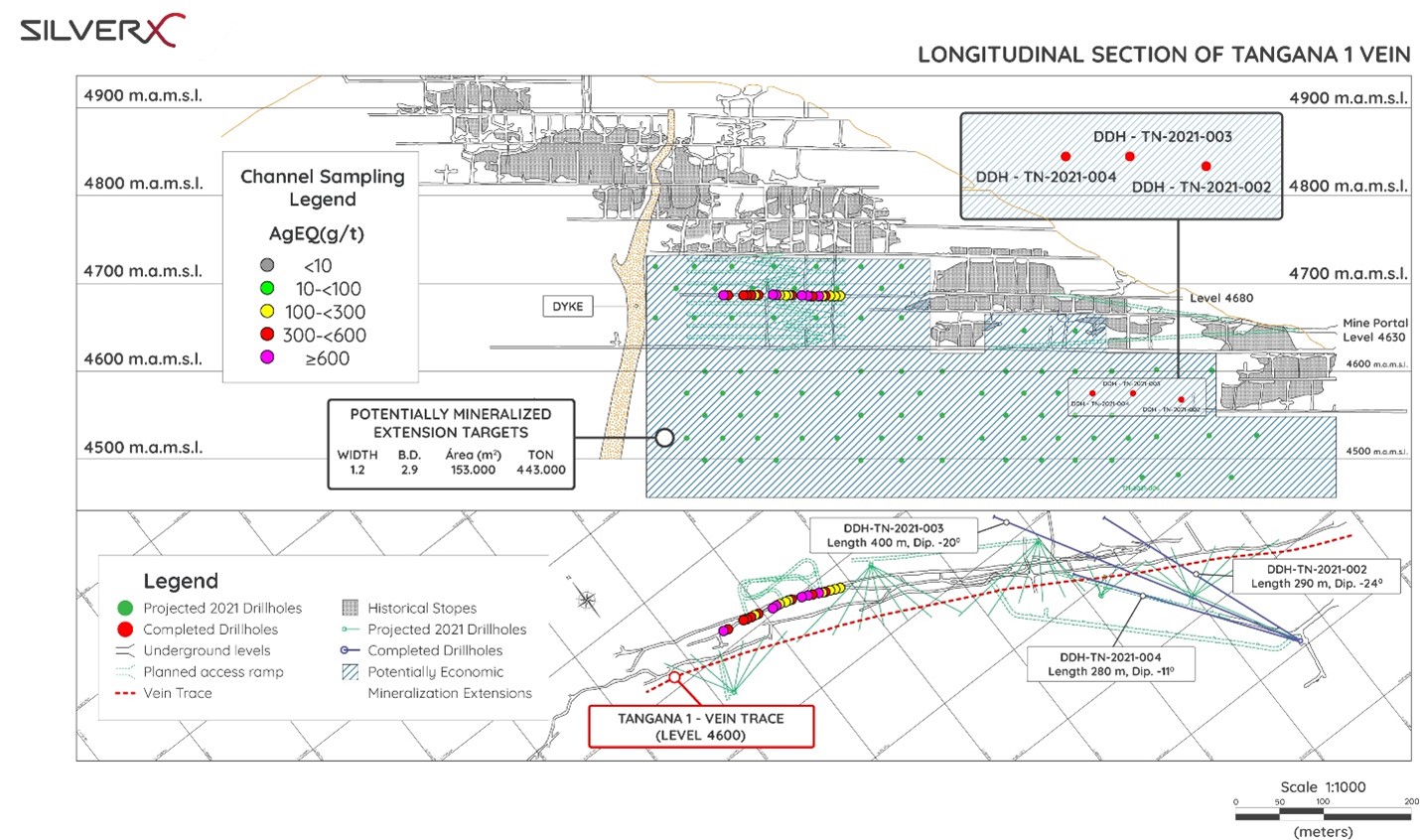

VANCOUVER, BC / ACCESSWIRE / September 3, 2021 / SILVER X MINING CORP. (TSXV:AGX)(OTC Pink:WRPSF) ("Silver X" or the "Company") is pleased to announce it has intersected high-grade silver-gold-polymetallic mineralization, up to 7,232.83 g/t AgEq over 0.95 metres true width. Channel sampling of the Tangana 1 Vein (see Table 1 below) has now increased the horizontal strike of known mineralization by over 130 metres at the Company's Tangana Mining Unit in Huancavelica, Peru. These results, together with previously reported drill intersections (see Company's press release dated August 23, 2021) from zones below existing Level 4630 stopes, have also extended the potentially economic mineralization downwards vertically by over 200 metres. Furthermore, Silver X has undertaken a program of re-analyzing samples produced by Mines and Metals Trading (Peru) PLC ("MMTP") in early 2021. This analysis indicates that the true horizontal mineralized strike length of Tangana 1 could extend more than 220 metres.

The channel sampling results also indicate the gold tenor in the Tangana 1 silver-gold-polymetallic mineralized vein may be higher than initially understood. Individual channel sampling high-grade mineralization results along the 4680 level include gold values up to 70.88 g/t Au, silver up to 2,034 g/t Ag, 7.37% Pb and 6.75% Zn, see full results in Table 1.

Production reporting on work historically done by Compañia de Minas Buenaventura SAA (NYSE: BVN) around 1970 at average grades of 293.62 g/t Ag, 9.77 % Pb and 4.62 % Zn1 from underground stopes situated nearby recent channel sampling, supports the potential of extensive mineralization.

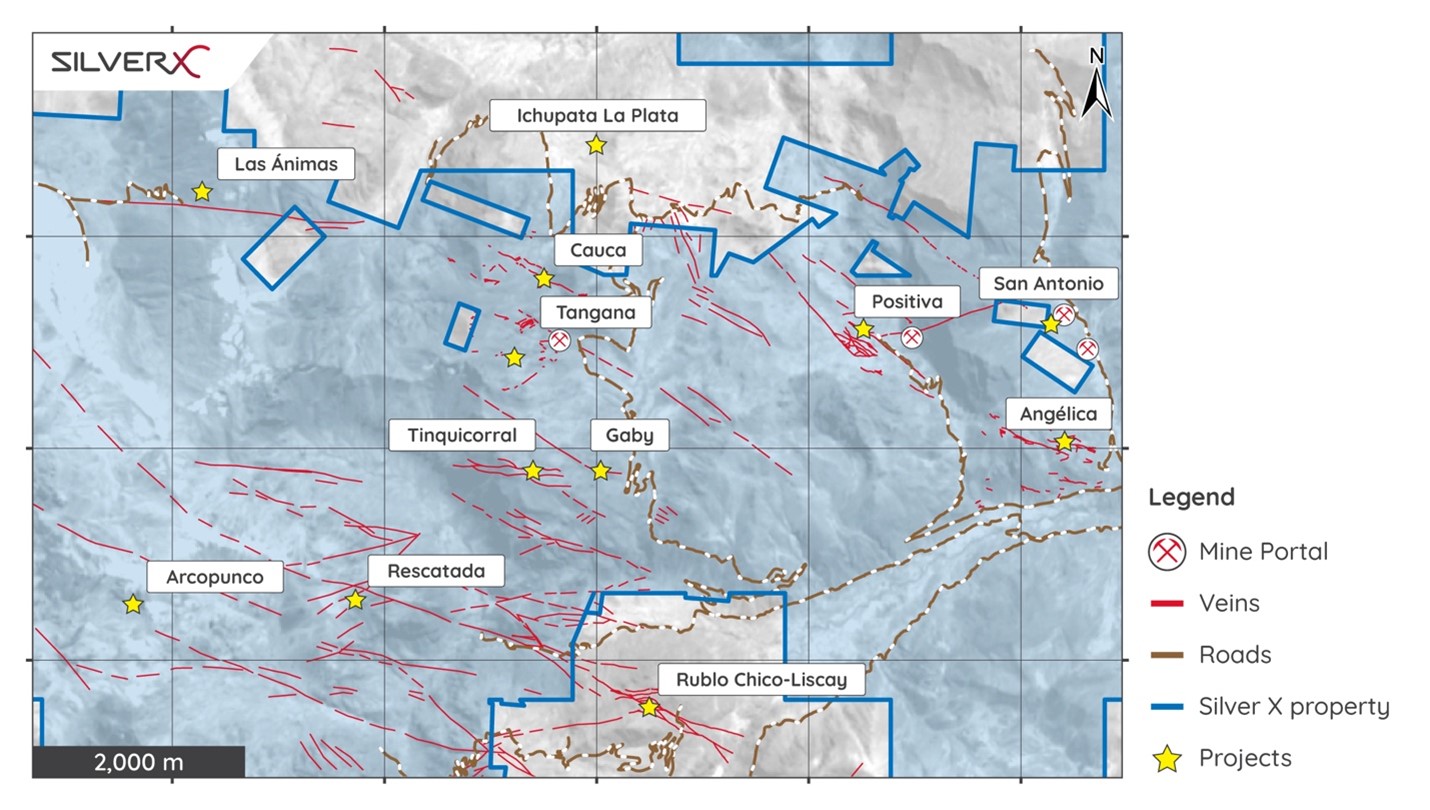

Figure 1: Location map of the Tangana Mining Unit, showing the location of key veins (Tangana Vein located centrally), infrastructure, concession limits, etc.

Figure 2: Long-section and plan view of the Tangana 1 silver-polymetallic vein project showing current underground development, mineralization extension potential, past-producing mined-out stopes, location of recently reported drill hole intercepts and Level 4680 "scout" channel sampling locations (note "colour highlighted" results).

Table 1: Tabulated summary of principal silver-gold-polymetallic grades intersected during channel sampling in underground workings accessing in situ potentially economic mineralization

Channel Sample ID | True | Gold - Silver - Polymetallic Grades | AgEq* Grade | ||||

Au ppm | Ag ppm | Cu % | Pb % | Zn % | |||

01 | 0.6 | 0.55 | 155.0 | 0.27 | 7.32 | 3.66 | 604.0 |

02 | 0.6 | 0.31 | 111.0 | 0.14 | 7.37 | 5.01 | 581.6 |

17 | 1.2 | 1.17 | 71.4 | 0.18 | 4.49 | 4.87 | 515.0 |

18 | 0.45 | 0.87 | 76.2 | 0.19 | 2.00 | 5.56 | 448.3 |

19 | 0.6 | 0.40 | 56.9 | 0.15 | 2.95 | 4.47 | 375.0 |

21 | 0.6 | 0.28 | 45.7 | 0.11 | 1.27 | 1.79 | 190.9 |

22 | 0.6 | 0.53 | 183.0 | 0.27 | 0.96 | 2.79 | 396.9 |

47 | 0.8 | 1.50 | 161.0 | 0.30 | 3.68 | 6.75 | 693.6 |

48 | 0.9 | 0.71 | 59.5 | 0.12 | 1.71 | 2.88 | 294.9 |

49 | 0.95 | 70.88 | 1675.0 | 0.14 | 3.36 | 2.95 | 7232.8 |

51 | 0.35 | 0.24 | 88.1 | 0.07 | 3.48 | 0.35 | 238.5 |

52 | 0.4 | 0.25 | 59.3 | 0.10 | 0.37 | 0.32 | 114.9 |

53 | 0.45 | 0.88 | 86.3 | 0.14 | 3.12 | 1.75 | 336.6 |

54 | 0.5 | 70.33 | 1530.0 | 0.48 | 3.29 | 0.85 | 7003.3 |

55 | 0.2 | 3.22 | 2034.0 | 1.62 | 4.99 | 4.64 | 2818.1 |

56 | 0.5 | 1.20 | 181.0 | 0.35 | 2.98 | 3.64 | 551.4 |

73 | 1.1 | 9.31 | 223.0 | 0.32 | 1.15 | 1.09 | 1041.2 |

74 | 1.1 | 0.46 | 52.2 | 0.11 | 0.46 | 0.61 | 139.3 |

75 | 0.8 | 6.68 | 12.4 | 0.02 | 0.27 | 0.33 | 537.8 |

76 | 0.8 | 0.51 | 109.0 | 0.13 | 2.49 | 0.55 | 263.9 |

77 | 0.6 | 0.75 | 12.1 | 0.06 | 0.40 | 0.42 | 104.6 |

78 | 0.6 | 0.34 | 34.8 | 0.04 | 1.42 | 0.68 | 137.0 |

Note: all numbers are rounded; assays are uncut, undiluted; *AgEq based on USD $1,778/oz Au, $23.7/oz Ag, $9,508/t Cu, $2,390/t Pb, $3016/t Zn and does not consider metallurgical recovery.

Based on these positive preliminary results, Silver X will proceed to systematically channel sample relevant Tangana 1 underground workings.

Tangana encompasses 11 silver-polymetallic vein targets across 4,500 ha of prospective silver-polymetallic concessions. The Tangana 1 and 2 veins extend over 1.7 kilometers along strike with an average width of 1.0 metres, at an average grade of 286.71 g/t AgEq. The Tangana 1 vein has historically been selectively mined in places between levels 4550 and 4950, predominantly staying close to the topographic profile and leaving unmined potentially economic silver-polymetallic mineralization in situ below the historical workings (see Figure 2). A resource and mine development drilling program is presently in progress to define mineralization below level 4680 and to delineate additional ore for future feed to the Recuperada processing plant.

"These high-grade channel sampling results are a strong indication that we are just scratching the surface of the silver-polymetallic potential at the Tangana Mining Unit", said José Garcia, Chief Executive Officer of Silver X. "The ongoing mine development programme that includes diamond drilling, channel sampling, and structural mapping, has encountered multiple prospective mineralized zones that will be utilized to increase production at the Recuperada processing plant. Furthermore, the Tangana 1 vein is just one of 11 veins with near-term exploitation potential in this area."

In total, the silver-polymetallic veins identified within the Tangana vein field extend on surface more than 11 kilometers in combined strike-length. Additional veins associated with the Tangana mineralized structure include the Tangana 2, Morlupito and Cauca veins. As mine infrastructure advances, historic workings and in situ silver-gold-polymetallic mineralization associated with these veins will be evaluated by underground channel sampling and diamond drilling. The Company's concurrent 25,000 metre resource expansion drill campaign continues to broaden the extent of known open-ended mineralization.

Sampling, Analytical Analysis, Quality Assurance and Quality Control (QAQC)

Rock-chips from all underground channel sampling are taken as near as perpendicularly as possible across silver-gold-polymetallic structures and stored on-site in clearly labelled plastic sample-bags in a secure storage facility attached to the Company core-shed. Channel sample length and locality coordinates are registered. The geological description of the sample is recorded. Where mineralized veins and structures are fully exposed by the underground workings, sampling is done from one side of the mineralized structure to the other. Minimum sample length is 30 cm. No sample collected through the potentially economic mineralized vein exposures is longer than 1.2 m. Each channel sample has a minimum channel thickness of 60 mm and minimum channel depth of 30 mm. All steps are taken to prevent contamination of the sample; the underground channel sample is collected with the use of a hammer and chisel and carefully stored in a plastic bag. Samples have unique number identifiers for "chain of custody" tracking of samples and for subsequent incorporation into the database once QAQC sign-off on analytical results has been received. Depending on the width, length, depth, and bulk density of the channel sample, approximately 4-8 kg of sample are collected for analysis per one metre length of sample.

The entire volume of all samples are shipped by Company 4x4 vehicle from the field to the certified and independent Certimin analytical laboratory facility in Lima. Certimin complies with ISO 9001, OHSAS 18001 and is a fully recognized and certified facility. After the underground channel samples have been prepared for analysis (code G0640), the sample pulps are then analyzed for gold, silver, and multi-elements using relevant Certimin analytical methodologies. All samples are analyzed using 30 g nominal weight fire assay with an ICP finish (code G0108) and multi-element four acid digest ICP-AES/ICP-MS methodology (code G0176). Where Au analytical results from G0108 are >10 g/t, the analysis is repeated with 30 g nominal weight fire assay and a gravimetric finish (code G0014). Where multi-element results from G0176 are greater than 100 ppm for Ag, the analysis is repeated with ore-grade four acid digest method (Code G0002). Where multi-element results from G0176 are greater than 10,000 ppm for Cu, Pb or Zn, the analysis is repeated with ore-grade four acid digest methods, respectively codes G0039, G0077 and G0388. Periodically, duplicate sample pulps are sent to independent umpire laboratories for review and checking of Certimin analytical analyses results.

Silver X Mining has introduced a fully NI 43-101 compliant quality assurance/quality control (QAQC) protocol on all its advanced and exploration projects. Our trained QAQC staff insert both fine and coarse blank samples, field duplicates and twin samples into each batch of field samples prior to delivery to the independent certified analytical laboratory. The QAQC control samples, including the random insertion of certified reference material, are designed to test the integrity of the samples by providing an independent check on precision, accuracy, and possibilities of contamination during sample preparation and analytical procedure within the elected commercial laboratory. With the objective of assuring best practice compliance, resource and exploration related assay results are not reported until the results of internal QAQC procedures have been reviewed and approved.

About Silver X Mining

Silver X Mining is a Canadian silver mining company with assets in Peru and Ecuador. The Company's flagship asset is the Nueva Recuperada silver lead zinc project located in Huancavelica, Peru. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverx-mining.com.

Qualified Person

Mr. A. David Heyl who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. Heyl, B.Sc., C.P.G., QP is a Certified Professional Geologist and Qualified Person under NI 43-101. With over 25 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas. Mr. A. David Heyl is a consultant for Silver X Mining Corp.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

ON BEHALF OF THE BOARD

José M García

CEO and Director

For further information, please contact:

Silver X Mining Corp.

+ 1 604 358 1382 | [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

Some of the statements contained in this news release are forward-looking statements and information within the meaning of applicable securities laws. Forward-looking statements and information can be identified by the use of words such as "expects", "intends", "is expected", "potential", "suggests" or variations of such words or phrases, or statements that certain actions, events or results "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this news release include statements in respect of the Company's exploration plans and development potential for the Company's properties. Forward-looking statements and information are not historical facts and are subject to a number of risks and uncertainties beyond the Company's control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this news release. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except as may be required by law.

1Latitude Silver, "Plan Comparativo del Proyecto Tangana para Segundo Pulmón de Mineral, Setiembre de 2020" (Issue Date: September 2020)

SOURCE: Silver X Mining Corp.