WHITE ROCK, BC / ACCESSWIRE / June 29, 2021 / TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to announce that it entered into a non-binding letter of intent (the "LOI") on June 18, 2021 with ASX-listed Kingsgate Consolidated Limited ("Kingsgate"), an arm's length party to TDG, to acquire Kingsgate's "Nueva Esperanza" silver-gold advanced exploration and development project, located in the Maricunga Belt of the Atacama Region of Northern Chile (Figure 1). The proposed transaction will be transformative for TDG, creating a leading pure precious metals focused company with the ambition to accelerate both Nueva Esperanza in the Maricunga and TDG's Shasta project in BC's Toodoggone Production Corridor to production decisions by the end of 2024.

The Nueva Esperanza project is located in the northern half of the Maricunga Belt, 140 kilometres ("km") northeast of the city of Copiapo, which is a regional mining centre. It is situated at 4000-4200 metres ("m") elevation and has three mining areas Arqueros, Chimberos and Teteritawith permits for development and associated water rights.

On April 13, 2016, Kingsgate published a JORC-compliant(1) mineral resource(2) estimate (the "Historical Estimate") for the Nueva Esperanza project (see Table 1) in a technical report titled "Nueva Esperanza Mineral Resource Update", including:

- Measured and indicated mineral resource of 28.8 million tonnes ("Mt") containing 68.6 million ounces ("Moz") silver ("Ag") at an average grade of 74 grams per tonne ("g/t") and 400,000 oz gold ("Au") at an average grade 0.43 g/t; and,

- Inferred mineral resource of 6.0 Mt containing 8.3 Moz Ag at an average grade of 43 g/t and 80,000 oz Au at an average grade of 0.42 g/t.

On April 13 2016, Kingsgate also published a JORC-compliant(1) prefeasibility study, including estimation of a mineral reserve(2) titled "Nueva Esperanza Pre-feasibility Study" (see Kingsgate's announcement of the prefeasibility study on April 13, 2016).

In July 2020, the Nueva Esperanza project was granted Environmental Impact Assessment approval allowing the pre-development, construction and operation of the project (see Kingsgate's news release dated July 14,2020).

TDG, as part of its due diligence, commissioned Sue Bird, P.Eng of MMTS (Moose Mountain Technical Services) to undertake an independent mineral resource estimate for the Nueva Esperanza project in accordance with NI 43-101. The work required to verify the historical mineral resource estimate as current includes a project site visit, and QA/QC data review together with modelling the in-pit silver and gold assay data.

TDG has completed extensive legal and technical due diligence review on the Nueva Esperanza project and concluded that the project offers an opportunity for significant value creation for TDG's owners and its other stakeholders, whilst transforming TDG into a silver-focused advanced exploration and development company.

TDG thanks Kingsgate for its work between 2009 to present and looks forward to working with the Kingsgate team located in Chile, and to welcoming Kingsgate as strategic owners of TDG (see summary of key transaction terms below).

The new 2021 mineral resource estimate, in combination with the foundational work by Kingsgate, would provide the basis for TDG to prepare a new Preliminary Economic Assessment study in accordance with NI 43-101 guidelines.

TDG looks forward to providing additional updates as the transaction progresses.

Key Transaction Terms (all amounts in Canadian Dollars unless specified otherwise)

Under the terms of the LOI, in exchange for 100% ownership of the Nueva Esperanza project, TDG will pay to Kingsgate the following consideration:

- $25,000,000 cash on closing, subject to certain working capital and other deductions;

- 14.0% of TDG's outstanding common shares calculated on a post-closing basis (inclusive of any shares issued in a concurrent financing);

- Up to $25,000,000 in future milestone payments, again subject to certain deductions, and of which up to $10,000,000 may be settled in TDG common shares at TDG's discretion, with the applicable milestones including completion of a feasibility study and the occurrence of a production decision in respect of the Nueva Esperanza project.

TDG has agreed to raise a minimum of $35,000,000 in an equity financing concurrent with the closing - further announcements will follow in due course regarding the financing arrangements. Kingsgate will also receive certain rights pursuant to an investor rights agreement providing, amongst other things, a Kingsgate nominee on TDG's Board of Directors and rights to maintain its TDG share ownership percentage under certain conditions.

TDG intends to file the acquisition with the TSX Venture Exchange (the "Exchange") as a Fundamental Acquisition and, as such, the acquisition is subject to Exchange review and approval per Exchange Policy 5.3.

The LOI is non-binding, and investors are cautioned that there is no guarantee that the Company will enter into a binding agreement in respect of, or ultimately complete, the proposed acquisition. Completion of the proposed acquisition would be subject to a number of conditions precedent, including completion of satisfactory due diligence, the negotiation and settlement of a binding definitive agreement, and receipt of regulatory approval, including the approval of the Exchange. The LOI will be terminable by either party if the parties have not entered into a binding definitive agreement by July 16, 2021, or such other date as determined by the parties. TDG anticipates that the proposed acquisition should close in mid-August of 2021, however the LOI contemplates an outside date for completion of August 31, 2021, which date may be extended by the agreement of the parties.

Nueva Esperanza and the Maricunga Belt, Chile

Over 100 Moz of gold with associated silver and copper have been discovered in the Maricunga Belt in northern Chile to date, with deposits dominantly hosted in a late Oligocene to Miocene age metallogenic belt. The sedimentary and volcanic rocks are host to a number of existing and advanced exploration and development stage projects as well as producing mines (Figure 1) including: Gold Fields' Salares Norte project, currently in construction, which is located in the northern Maricunga belt, and Kinross Gold's final stage La Coipa mine development, which is located approximately 30 km southwest from Nueva Esperanza.

Figure 1 showing the location of Nueva Esperanza and other key projects in the Maricunga Belt of the Atacama Region of Chile.

About Nueva Esperanza

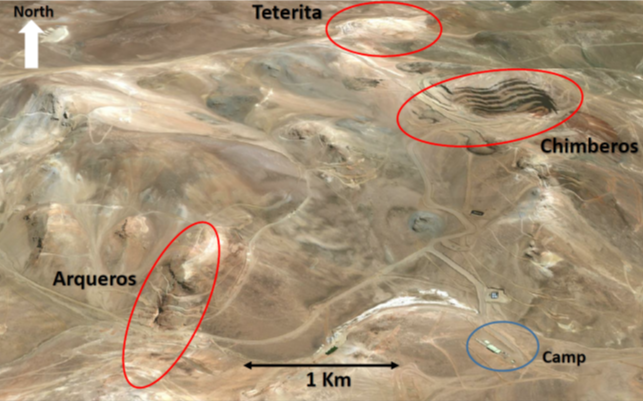

Nueva Esperanza is a silver and gold project covering approximately 14,000 hectares of exploitation and exploration concessions. It comprises three well-defined silver-gold deposits hosted in a high sulphidation epithermal system along with a number of undeveloped exploration targets, including additional epithermal targets and gold mineralization hosted in porphyritic rocks. The principal silver-gold deposits within the project are Arqueros, Chimberos and Teterita (Figure 2). Since the initial discovery by Anglo American Chile in 1981, the project has been subject to over 279,000 m of historical drilling in > 3,900 drill holes. The Chimberos deposit was open pit mined in 1998-1999, producing 32 Moz Ag. The Arqueros deposit was underground mined between 2000-2004 producing 14 Moz Ag and 0.05 Moz Au.

In July 2020, the project was granted Environmental Impact Assessment approval allowing the pre-development, construction and operation of Arqueros, Chimberos and Teterita. The project also has existing water rights with Anglo American Chile through to November 14, 2029, which can be renewed on further agreement with the owner.

Figure 2 showing the proximity of the Arqueros, Chimberos and Teterita deposits and the location of the camp.

The project has existing Net Smelter Return ("NSR") royalties payable to Anglo American Chile ("MAAC") and Maverix Metals Inc. MAAC currently receives US$2 million per annum advance NSR payments of which US$1 million can be deducted from future payable royalty related to the Teterita zone production. Please see TDG's updated website and corporate presentation for more details.

2016 HISTORICAL MINERAL RESOURCE ESTIMATE

Table 1 Summary Historical Mineral Resource Estimate3

| Deposit | Category | Tonnes | Ag | Au | Ounces (Moz) | |

(Million) | g/t | g/t | Ag | Au | ||

| Measured | - | - | - | - | - | |

| Arqueros | Indicated | 14.7 | 76 | 0.32 | 35.9 | 0.15 |

| Inferred | 3.3 | 42 | 0.30 | 4.5 | 0.03 | |

| Measured | 1.6 | 93 | 0.01 | 4.8 | 0.0005 | |

| Teterita | Indicated | 3.3 | 98 | 0 | 10.4 | 0.001 |

| Inferred | 0.4 | 65 | 0 | 0.8 | 0.0001 | |

| Measured | - | - | - | - | - | |

| Chimberos | Indicated | 9.2 | 59 | 0.84 | 17.5 | 0.25 |

| Inferred | 2.3 | 40 | 0.70 | 3.0 | 0.05 | |

| Total Measured | 1.6 | 93 | 0.01 | 4.8 | 0.0005 | |

| Total Indicated | 27.2 | 73 | 0.46 | 63.8 | 0.401 | |

| Total Measured & Indicated | 28.8 | 74 | 0.43 | 68.6 | 0.402 | |

| Total Inferred | 6.0 | 43 | 0.42 | 8.3 | 0.08 | |

The Historical Estimate was estimated using Ordinary Kriging (OK) using a 0.5g/t gold equivalent cut-off grade, with the gold equivalent being calculated on an AuEQ60 basis (Gold Equivalent: AuEq (g/t) = Au (g/t) + (Ag (g/t) ÷ 60)). The cut-off grade was calculated assuming long-term historical prices of US$1,200/oz for gold and US$19.00 for silver and combined life of mine average metallurgical recoveries of 80% Au and 84% Ag, estimated from test work by Kingsgate.

The Historical Estimate is based on reverse circulation (RC), diamond (DDH) and open hole percussion (DTH) drilling from surface and underground mine workings completed by several companies since 1980. The sampling includes 2009-2015 drilling by Laguna Resources, a wholly owned division of Kingsgate Consolidated Ltd (25% of the drill meters) and previous explorers including Anglo American Chile (18%), Can Can Mining (44%) and Kinross (14%). The combined resource database totals 3,390 holes for 183,852 m.

Waste piles estimated at 4.6 Mt are located at Chimberos and were included in the Historical Estimate published by Kingsgate, but have not been included in the estimates summarised in this news release, as TDG believes additional sampling data is required.

A full description of the sample techniques and data was provided in the report published by Kingsgate.

In order to classify the Historical Estimate as current, a qualified person under NI 43-101 would have to complete a site visit to the project and complete an analysis of the Historical Estimate, including re-modelling each deposit and validating the historical assay results using statistical methods. Because the Historical Estimate was completed relatively recently pursuant to JORC standards, TDG considers the Historical Estimate to be generally reliable and relevant, however a qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources, and TDG is not treating the historical estimate as current mineral resources.

Qualified Person

The technical content of this news release has been reviewed and approved by Andrew French, P.Geo., a qualified person as defined by NI 43-101 and a director of the Company.

About TDG Gold Corp.

TDG is a major holder of mineral claims and mining leases in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 metres of historical drilling. In 2021, TDG proposes to advance the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and drill testing of the known mineralization occurrences and their extensions. TDG currently has 64,423,459 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "would", "predict", "potential" and similar expressions are intended to identify forward looking statements. In particular, this press release contains forward looking statements concerning the completion of the proposed acquisition of the Nueva Esperanza project, the completion of equity financing, and the potential development of the Nueva Esperanza project and the Company's existing mineral properties, including the completion of feasibility studies or the making of production decisions in respect thereof. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the ability of the Company to enter into a binding agreement with respect to the proposed acquisition of the Nueva Esperanza project, the completion of other conditions precedent to such acquisition, including the receipt of regulatory approvals, the completion of the Company's due diligence review in relation to the proposed acquisition, the state of equity financing markets and the Company's ability to complete the planned funding to complete the acquisition and undertake its future work programs, and results of future exploration activities by the Company.

Management has provided the above summary of risks and assumptions related to forward looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

1 JORC (Joint Ore Reserves Committee) standards are not in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and all figures quoted in this news release from the 2016 mineral resource estimate should therefore be treated as historical.

2 A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources or mineral reserves, and TDG is not treating the historical estimate as current mineral resources and reserves. For more information, see Table 1 and the information following Table 1, and Kingsgate's Nueva Esperanza Mineral Resource Update dated on April 13, 2016.

3 A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources or mineral reserves, and TDG is not treating the historical estimate as current mineral resources and reserves. For more information, see Table 1 and the information following Table 1, and Kingsgate's Nueva Esperanza Mineral Resource Update dated on April 13, 2016.

SOURCE: TDG Gold Corp