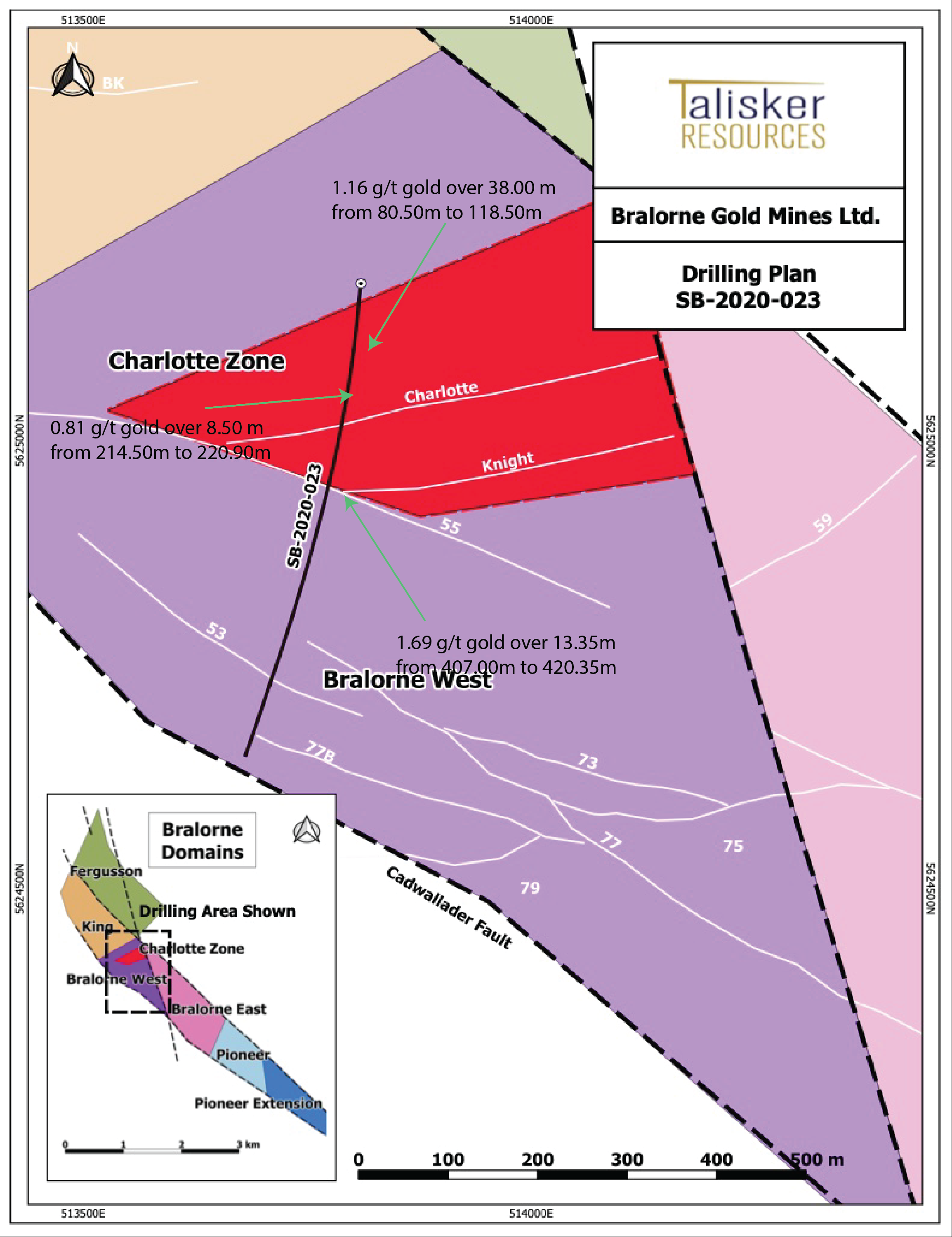

TORONTO, ON / ACCESSWIRE / February 2, 2021 / Talisker Resources Ltd. ("Talisker" or the "Company") (TSX:TSK)(OTCQX:TSKFF) is pleased to announce further drilling results from its Bralorne Gold Project in British Columbia. Hole SB-02020-023 (partial results only) are part of Talisker's resource drill out program which is currently underway with four drill rigs on site. This press release focuses on results from the Charlotte Zone, where broad zones of near-surface gold mineralization sit adjacent to the high-grade gold-bearing veins that remain the primary focus of drilling in 2021. Additional information on the Charlotte Zone is included in a separate press release also issued today.

Key Points:

- Drilling has intersected additional zones of broad, near-surface gold mineralization at the Charlotte Zone that could provide optionality to the high-grade gold-bearing veins at depth.

- Drilling continues to demonstrate structural continuity of high-grade gold-bearing veins at depth.

- Talisker commenced its 50,000m infill drilling program with four drill rigs on site last month and has completed 4,354m to date.

- A total of 4,125 samples are awaiting assay at the lab.

The Charlotte Zone represents near-surface gold mineralization occurring as broad intervals of stacked, parallel structures occurring adjacent and immediately above the high-grade veins at Bralorne West (see Figure 1). The Charlotte Zone outcrops on surface and several holes drilled by Talisker have intersected the zone starting at 90m below surface. To date, drilling has defined the Charlotte Zone over a strike length of 600m and a width of 270m.

Highlights from the Charlotte Zone include:

- SB-2020-023

- 1.16 g/t gold over 38.00m, from 80.50m to 118.50m

- 0.81 g/t gold over 8.50m from 212.4m to 220.90m

- 1.69 g/t gold over 13.35m from 407.00m to 420.35m

"Today's results further highlight the potential at the Bralorne Gold Project for broad zones of near-surface, bulk tonnage gold mineralization at Charlotte alongside the high-grade veins below that remain the primary focus of our 50,000m drill program in 2021. The discovery of the Charlotte Zone is a credit to our technical team who originally identified these shallower zones from historical drilling undertaken by the prior owner of the Bralorne Gold Project," stated Terry Harbort, President and CEO of Talisker, who added, "The Charlotte Zone not only has the potential to provide a bulk tonnage option when we begin economic evaluation of the project but could accelerate the delivery of a resource estimate given the shallower drilling and wider drill spacing required for a National Instrument 43-101 technical report. Despite this success, we stress that the primary focus for the Company is the continued delineation of high-grade veins at depth."

|

Bralorne Gold Project Drill Holes SB-2020-023 |

||||||

|

Diamond Drill Hole Name |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Interpreted Structure |

Method Reported |

|

SB-2020-023 |

16.40 |

16.90 |

0.50 |

1.42 |

Charlotte HW Zone |

Au-AA24 |

|

SB-2020-023 |

16.90 |

17.50 |

0.60 |

0.86 |

Au-AA24 |

|

|

SB-2020-023 |

17.50 |

18.50 |

1.00 |

0.09 |

Au-AA24 |

|

|

SB-2020-023 |

18.50 |

19.50 |

1.00 |

0.04 |

Au-AA24 |

|

|

SB-2020-023 |

19.50 |

20.20 |

0.70 |

0.07 |

Au-AA24 |

|

|

SB-2020-023 |

20.20 |

20.95 |

0.75 |

2.21 |

Au-AA24 |

|

|

SB-2020-023 |

20.95 |

21.50 |

0.55 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

21.50 |

22.20 |

0.70 |

0.03 |

Au-AA24 |

|

|

SB-2020-023 |

22.20 |

23.00 |

0.80 |

0.07 |

Au-AA24 |

|

|

SB-2020-023 |

23.00 |

24.00 |

1.00 |

0.07 |

Au-AA24 |

|

|

SB-2020-023 |

24.00 |

25.05 |

1.05 |

0.03 |

Au-AA24 |

|

|

SB-2020-023 |

25.05 |

26.20 |

1.15 |

0.46 |

Au-AA24 |

|

|

SB-2020-023 |

26.20 |

27.00 |

0.80 |

0.01 |

Au-AA24 |

|

|

SB-2020-023 |

27.00 |

28.10 |

1.10 |

2.35 |

Au-AA24 |

|

|

SB-2020-023 |

28.10 |

29.45 |

1.35 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

29.45 |

30.50 |

1.05 |

0.01 |

Au-AA24 |

|

|

SB-2020-023 |

30.50 |

32.00 |

1.50 |

0.01 |

Au-AA24 |

|

|

SB-2020-023 |

32.00 |

33.25 |

1.25 |

0.54 |

Au-AA24 |

|

|

SB-2020-023 |

33.25 |

33.90 |

0.65 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

33.90 |

34.60 |

0.70 |

0.35 |

Au-AA24 |

|

|

SB-2020-023 |

34.60 |

35.10 |

0.50 |

0.11 |

Au-AA24 |

|

|

SB-2020-023 |

35.10 |

36.25 |

1.15 |

0.10 |

Au-AA24 |

|

|

SB-2020-023 |

36.25 |

37.30 |

1.05 |

0.12 |

Au-AA24 |

|

|

SB-2020-023 |

37.30 |

38.00 |

0.70 |

0.10 |

Au-AA24 |

|

|

SB-2020-023 |

38.00 |

38.60 |

0.60 |

0.95 |

Au-AA24 |

|

|

SB-2020-023 |

38.60 |

39.40 |

0.80 |

0.03 |

Au-AA24 |

|

|

SB-2020-023 |

39.40 |

40.20 |

0.80 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

40.20 |

41.20 |

1.00 |

0.29 |

Au-AA24 |

|

|

SB-2020-023 |

41.20 |

42.00 |

0.80 |

0.05 |

Au-AA24 |

|

|

SB-2020-023 |

42.00 |

43.00 |

1.00 |

0.05 |

Au-AA24 |

|

|

SB-2020-023 |

43.00 |

44.20 |

1.20 |

0.50 |

Au-AA24 |

|

|

SB-2020-023 |

44.20 |

45.00 |

0.80 |

0.42 |

Au-AA24 |

|

|

SB-2020-023 |

45.00 |

46.00 |

1.00 |

0.28 |

Au-AA24 |

|

|

SB-2020-023 |

46.00 |

47.00 |

1.00 |

0.51 |

Au-AA24 |

|

|

SB-2020-023 |

47.00 |

48.00 |

1.00 |

0.47 |

Au-AA24 |

|

|

SB-2020-023 |

65.00 |

66.00 |

1.00 |

0.18 |

Au-AA24 |

|

|

SB-2020-023 |

66.00 |

67.00 |

1.00 |

0.91 |

Au-AA24 |

|

|

SB-2020-023 |

67.00 |

68.50 |

1.50 |

0.31 |

Au-AA24 |

|

|

SB-2020-023 |

68.50 |

70.00 |

1.50 |

0.21 |

Charlotte HW Zone |

Au-AA24 |

|

SB-2020-023 |

70.00 |

71.00 |

1.00 |

0.82 |

Au-AA24 |

|

|

SB-2020-023 |

71.00 |

71.50 |

0.50 |

0.79 |

Au-AA24 |

|

|

SB-2020-023 |

71.50 |

72.50 |

1.00 |

1.10 |

Au-AA24 |

|

|

SB-2020-023 |

72.50 |

73.50 |

1.00 |

0.32 |

Au-AA24 |

|

|

SB-2020-023 |

80.50 |

81.20 |

0.70 |

0.15 |

Au-AA24 |

|

|

SB-2020-023 |

81.20 |

82.20 |

1.00 |

0.62 |

Au-AA24 |

|

|

SB-2020-023 |

82.20 |

83.30 |

1.10 |

0.18 |

Au-AA24 |

|

|

SB-2020-023 |

83.30 |

84.40 |

1.10 |

0.50 |

Au-AA24 |

|

|

SB-2020-023 |

84.40 |

85.40 |

1.00 |

1.84 |

Au-AA24 |

|

|

SB-2020-023 |

85.40 |

86.40 |

1.00 |

2.16 |

Au-AA24 |

|

|

SB-2020-023 |

86.40 |

87.10 |

0.70 |

2.01 |

Au-AA24 |

|

|

SB-2020-023 |

87.10 |

88.00 |

0.90 |

2.82 |

Au-AA24 |

|

|

SB-2020-023 |

88.00 |

89.00 |

1.00 |

1.84 |

Au-AA24 |

|

|

SB-2020-023 |

89.00 |

89.90 |

0.90 |

1.33 |

Au-AA24 |

|

|

SB-2020-023 |

89.90 |

90.80 |

0.90 |

1.87 |

Au-AA24 |

|

|

SB-2020-023 |

90.80 |

91.50 |

0.70 |

2.17 |

Au-AA24 |

|

|

SB-2020-023 |

91.50 |

92.20 |

0.70 |

2.68 |

Au-AA24 |

|

|

SB-2020-023 |

92.20 |

92.80 |

0.60 |

3.08 |

Au-AA24 |

|

|

SB-2020-023 |

92.80 |

93.80 |

1.00 |

0.78 |

Au-AA24 |

|

|

SB-2020-023 |

93.80 |

94.80 |

1.00 |

1.33 |

Au-AA24 |

|

|

SB-2020-023 |

94.80 |

95.80 |

1.00 |

1.77 |

Au-AA24 |

|

|

SB-2020-023 |

95.80 |

96.80 |

1.00 |

1.78 |

Au-AA24 |

|

|

SB-2020-023 |

96.80 |

97.80 |

1.00 |

0.74 |

Au-AA24 |

|

|

SB-2020-023 |

97.80 |

98.80 |

1.00 |

0.23 |

Au-AA24 |

|

|

SB-2020-023 |

98.80 |

99.80 |

1.00 |

0.34 |

Au-AA24 |

|

|

SB-2020-023 |

99.80 |

100.40 |

0.60 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

100.40 |

101.20 |

0.80 |

0.05 |

Au-AA24 |

|

|

SB-2020-023 |

101.20 |

102.00 |

0.80 |

0.28 |

Au-AA24 |

|

|

SB-2020-023 |

102.00 |

103.00 |

1.00 |

0.22 |

Au-AA24 |

|

|

SB-2020-023 |

103.00 |

103.70 |

0.70 |

0.05 |

Au-AA24 |

|

|

SB-2020-023 |

103.70 |

104.40 |

0.70 |

0.40 |

Au-AA24 |

|

|

SB-2020-023 |

104.40 |

105.10 |

0.70 |

0.07 |

Au-AA24 |

|

|

SB-2020-023 |

105.10 |

105.80 |

0.70 |

0.31 |

Au-AA24 |

|

|

SB-2020-023 |

105.80 |

106.90 |

1.10 |

1.42 |

Au-AA24 |

|

|

SB-2020-023 |

106.90 |

107.70 |

0.80 |

3.66 |

Au-AA24 |

|

|

SB-2020-023 |

107.70 |

108.50 |

0.80 |

1.92 |

Au-AA24 |

|

|

SB-2020-023 |

108.50 |

109.60 |

1.10 |

0.46 |

Au-AA24 |

|

|

SB-2020-023 |

109.60 |

110.70 |

1.10 |

0.53 |

Charlotte HW Zone |

Au-AA24 |

|

SB-2020-023 |

110.70 |

111.80 |

1.10 |

1.04 |

Au-AA24 |

|

|

SB-2020-023 |

111.80 |

112.90 |

1.10 |

0.64 |

Au-AA24 |

|

|

SB-2020-023 |

112.90 |

114.00 |

1.10 |

1.22 |

Au-AA24 |

|

|

SB-2020-023 |

114.00 |

115.10 |

1.10 |

1.54 |

Au-AA24 |

|

|

SB-2020-023 |

115.10 |

116.10 |

1.00 |

2.60 |

Au-AA24 |

|

|

SB-2020-023 |

116.10 |

116.95 |

0.85 |

0.89 |

Au-AA24 |

|

|

SB-2020-023 |

116.95 |

117.90 |

0.95 |

1.25 |

Au-AA24 |

|

|

SB-2020-023 |

117.90 |

118.50 |

0.60 |

0.17 |

Au-AA24 |

|

|

SB-2020-023 |

197.70 |

198.80 |

1.10 |

0.40 |

Au-AA24 |

|

|

SB-2020-023 |

198.80 |

200.00 |

1.20 |

0.02 |

Au-AA24 |

|

|

SB-2020-023 |

200.00 |

201.20 |

1.20 |

0.32 |

Au-AA24 |

|

|

SB-2020-023 |

201.20 |

202.40 |

1.20 |

0.93 |

Au-AA24 |

|

|

SB-2020-023 |

202.40 |

203.60 |

1.20 |

0.73 |

Au-AA24 |

|

|

SB-2020-023 |

203.60 |

205.00 |

1.40 |

0.41 |

Au-AA24 |

|

|

SB-2020-023 |

214.40 |

215.30 |

0.90 |

0.14 |

Charlotte Zone |

Au-AA24 |

|

SB-2020-023 |

215.30 |

216.10 |

0.80 |

0.76 |

Au-AA24 |

|

|

SB-2020-023 |

216.10 |

217.40 |

1.30 |

1.02 |

Au-AA24 |

|

|

SB-2020-023 |

217.40 |

218.50 |

1.10 |

0.38 |

Au-AA24 |

|

|

SB-2020-023 |

218.50 |

219.20 |

0.70 |

0.84 |

Au-AA24 |

|

|

SB-2020-023 |

219.20 |

220.20 |

1.00 |

0.19 |

Au-AA24 |

|

|

SB-2020-023 |

220.20 |

221.00 |

0.80 |

0.21 |

Au-AA24 |

|

|

SB-2020-023 |

221.00 |

221.60 |

0.60 |

2.55 |

Au-AA24 |

|

|

SB-2020-023 |

221.60 |

222.40 |

0.80 |

2.19 |

Au-AA24 |

|

|

SB-2020-023 |

222.40 |

222.90 |

0.50 |

0.45 |

Au-AA24 |

|

|

SB-2020-023 |

407.00 |

408.00 |

1.00 |

0.17 |

Knight Zone |

Au-AA24 |

|

SB-2020-023 |

408.00 |

408.50 |

0.50 |

1.60 |

Au-AA24 |

|

|

SB-2020-023 |

408.50 |

409.00 |

0.50 |

1.16 |

Au-AA24 |

|

|

SB-2020-023 |

409.00 |

409.55 |

0.55 |

1.72 |

Au-AA24 |

|

|

SB-2020-023 |

409.55 |

410.20 |

0.65 |

0.43 |

Au-AA24 |

|

|

SB-2020-023 |

410.20 |

410.70 |

0.50 |

8.96 |

Au-AA24 |

|

|

SB-2020-023 |

410.70 |

412.30 |

1.60 |

4.89 |

Au-AA24 |

|

|

SB-2020-023 |

412.30 |

412.80 |

0.50 |

1.77 |

Au-AA24 |

|

|

SB-2020-023 |

412.80 |

413.40 |

0.60 |

1.29 |

Au-AA24 |

|

|

SB-2020-023 |

413.40 |

414.00 |

0.60 |

1.49 |

Au-AA24 |

|

|

SB-2020-023 |

414.00 |

414.55 |

0.55 |

1.46 |

Au-AA24 |

|

|

SB-2020-023 |

414.55 |

415.05 |

0.50 |

0.72 |

Au-AA24 |

|

|

SB-2020-023 |

415.05 |

415.55 |

0.50 |

1.54 |

Au-AA24 |

|

|

SB-2020-023 |

415.55 |

416.10 |

0.55 |

1.71 |

Knight Zone |

Au-AA24 |

|

SB-2020-023 |

416.10 |

416.60 |

0.50 |

0.57 |

Au-AA24 |

|

|

SB-2020-023 |

416.60 |

417.20 |

0.60 |

0.18 |

Au-AA24 |

|

|

SB-2020-023 |

417.20 |

417.80 |

0.60 |

0.01 |

Au-AA24 |

|

|

SB-2020-023 |

417.80 |

418.40 |

0.60 |

0.11 |

Au-AA24 |

|

|

SB-2020-023 |

418.40 |

419.20 |

0.80 |

0.25 |

Au-AA24 |

|

|

SB-2020-023 |

419.20 |

419.80 |

0.60 |

1.52 |

Au-AA24 |

|

|

SB-2020-023 |

419.80 |

420.35 |

0.55 |

0.92 |

Au-AA24 |

|

|

Notes: Diamond drill hole SB-2020-021 has collar orientation of Azimuth 187; Dip -50. Diamond drill hole SB-2020-022 has collar orientation of Azimuth 175; Dip -65. Diamond drill hole SB-2020-023 has collar orientation of Azimuth 186; Dip -54. True widths are estimated 40 - 90% of intercept lengths and are based on oriented core measurements where available. Method reported includes the most up to date information as of this press release. |

||||||

Talisker is providing an opportunity for shareholders and other interested parties to participate in a Webinar to be held at 4 pm ET on Thursday, February 4th. To register, please click on the following link - https://us02web.zoom.us/webinar/register/WN_86qwSGqUTLCyEBO2w2SM3w. After registering, you will receive a confirmation email containing information about joining the webinar.

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior resource company involved in the exploration of gold projects in British Columbia, Canada. Talisker's projects include the Bralorne Gold Complex, an advanced stage project with significant exploration potential from a historical high-grade producing gold mine as well as its Spences Bridge Project where the Company holds ~85% of the emerging Spences Bridge Gold Belt and several other early-stage Greenfields projects. With its properties comprising 278,364 hectares over 256 claims, three leases and 198 crown grant claims, Talisker is a dominant exploration player in the south-central British Columbia. The Company is well funded to advance its aggressive systematic exploration program at its projects.

For further information, please contact:

|

Terry Harbort |

Mick Carew |

Qualified Person

The technical information contained in this news release relating to the drill results at the Bralorne Gold Project has been approved by Leonardo de Souza (BSc, AusIMM (CP) Membership 224827), Talisker's Vice President, Exploration and Resource Development, who is a "qualified person" within the meaning of National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Sample Preparation and QAQC

Drill core at the Bralorne Gold Project is drilled in HQ to NQ size ranges (63.5mm and 47.6mm respectively). Drill core samples are minimum 50 cm and maximum 160 cm long along the core axis. Samples are focused on an interval of interest such as a vein or zone of mineralization. Shoulder samples bracket the interval of interest such that a total sampled core length of not less than 3 m both above and below the interval of interest must be assigned. Sample QAQC measures of unmarked certified reference materials (CRMs), blanks, and duplicates are inserted into the sample sequence and make up 9% of the samples submitted to the lab for holes reported in this release.

Sample preparation and analyses is carried out by ALS Global, at their laboratory in North Vancouver, British Columbia, Canada. Drill core sample preparation includes drying in an oven at a maximum temperature of 60°C, fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250 g split to at least 85% passing 75 microns (code PREP-31).

Gold and in diamond drill core is analysed by fire assay and atomic absorption spectroscopy (AAS) of a 50g sample (code Au-AA24), while multi-element chemistry is analysed by 4-Acid digestion of a 0.25 g sample split with detection by inductively coupled plasma mass spectrometer (ICP-MS) for 48 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd, Ce, Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W, Y, Zn, Zr).

Gold assay technique Au-AA24 has an upper detection limit of 10ppm. Any sample that produces an over-limit gold value via the Au-AA24 technique is sent for gravimetric finish via method Au-GRA22 which has an upper detection limit of 1,000 ppm Au. Samples where visible gold was observed are sent directly to screen metallics analysis and all samples that fire assay above 3 ppm Au are re-analysed with method Au-SCR24 which employs a 1kg pulp screened to 100 microns with assay of the entire oversize fraction and duplicate 50g assays on the undersize fraction. Where possible all samples initially sent to screen metallics processing will also be re-run through the fire assay with gravimetric finish provided there is enough material left for further processing.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Talisker's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, the operations of the Company and the timing which could be affected by the current global COVID-19 pandemic. Those assumptions and factors are based on information currently available to Talisker. Although such statements are based on reasonable assumptions of Talisker's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While Talisker considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and Talisker is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Figure 1: Map of the Bralorne Gold Project showing drill traces from today's release, major high-grade vein structures projected to surface (white) and surface infrastructure.

SOURCE: Talisker Resources Ltd.