Highlights include 52.9% ZnEq over 0.75 metres in the Footwall of the East Lens

THUNDER BAY, ON / ACCESSWIRE / January 11, 2021 / Wolfden Resources Corporation (TSXV:WLF) ("Wolfden" or the "Company") is pleased to report additional positive step-out drill results proximal to the known polymetallic mineral resource of the Company's wholly owned Pickett Mountain deposit in Northeastern Maine.

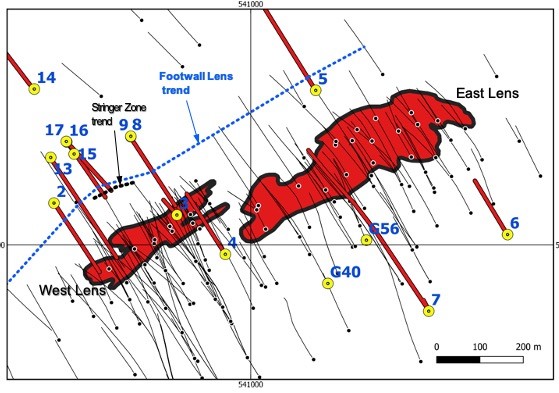

Hole PM20-07 intersected 52.9% ZnEq over 0.75 metres that is comprised of 24.2% Zn, 11.2% Pb, 3.1% Cu, 514 g/t Ag and 2.1 g/t Au from 678.7 to 679.45 metres down the hole. The intersection occurs in a footwall lens that roughly parallels the East and West Lenses, 150 metres to the north. The intercept has an estimated true width of 0.52 metres and is situated approximately 100 metres to the east of holes PM18-31 and 31A (a wedge hole off 31) that previously intersected the same footwall lens returning 24.7% ZnEq over 7.1 meters and 9.0% ZnEq over 9.1 metres (5.7 and 7.8 metres true width). Assays are pending for additional narrow intervals of footwall massive sulphide mineralization, that appear to correlate with this intercept, including in recent drill holes PM-20-G56-ext (138 metres above and to the west), PM20-13 (785 metres above and to the west), PM20-15 (775 metres above and to the west) and PM20-16 (708 metres above and west). Further drill testing of this narrow and higher-grade massive sulphide lens, is expected to occur this winter, once all assays have been received and evaluated.

"As stated previously, the footwall of the Pickett Mt deposit remains largely untested by most of the previous drilling and provides a significant opportunity to potentially increase the total Project resource," stated Ron Little, CEO for Wolfden. "Massive sulphide mineralization has been intersected in at least six footwall holes including five from this program. In addition, strong stringer mineralization was intersected in two of the last three holes of the 2020 drill program. Many of these results are pending and drilling is expected to resume in this area once all results have been received."

Geology of the Footwall Lens

The footwall massive sulphide lens appears to be hosted or associated with a debris flow/carbonate-enriched interval that occurred between two pulses of felsic volcanism some 150 to 200 metres below the West and East massive sulphide lenses. Alteration varies from weak to intense chlorite and sericite and also includes variable amounts of sulphide stringer mineralization. The footwall lens remains largely untested as most of the drilling to date was not deep enough. To date 22 of 24 holes have intersected stringer to massive sulphide mineralization within a 1,000 by 700 metre initial target area.

Also associated and paralleling the footwall lens is stringer mineralization that is hosted in a moderate to intensely altered, quartz (+- feldspar) porphyry (See Figure 1 and 2.). Assays are pending for this mineralization type in holes PM20-16 and 17 as announced on December 8, 2020. Both the footwall lens and quartz porphyry stringer mineralization are believed to have economic potential and will both be the focus of the next round of drilling.

Laboratory turn-around time for assays has been approximately eight weeks and additional results are expected in the coming weeks. Drilling can be carried out on the project year-round.

Wolfden adheres to strict Quality Assurance and Quality Control protocols including routine insertion of blanks and certified reference standards in each sample batch of drill core that is sent to the lab for analyses. Drill core samples are split in half using a diamond saw with one half saved for reference and the other half shipped via secure transport to Activation Laboratories sample preparation facility in Fredericton, New Brunswick. Core samples are analyzed for zinc, lead, copper and silver utilizing 4-acid dissolution followed by ICP-OES (Code 8). Gold is analyzed by fire assay (30 g) utilizing AA finish (Code 1A2) and samples with over 5 g/t are analyzed by fire assay with gravimetric finish (Code 1A3). Silver over 100 g is analyzed by fire assay with gravimetric finish (Code 8-Ag).

About Wolfden and the Pickett Mountain Project

With the support of major investors Kinross Gold Corporation and Altius Minerals, Wolfden plans to explore and develop high-margin deposits in good jurisdictions. Its wholly owned Pickett Mountain Project is one of the highest-grade polymetallic projects in North America (Zn, Pb, Cu, Ag, Au). This relatively advanced project is well-located near excellent infrastructure which will support straight forward development as detailed in a Preliminary Economic Assessment date September 14, 2020.

Upcoming Milestones

- Additional Pickett Mt. drill results designed to further expand resources are pending

- Approval of the ongoing rezoning petition in 2021 would be a significant milestone

- Generating drill targets on the new Big Silver Project

- Commencing drill programs in Manitoba and New Brunswick focused on Nickel and Silver

Pickett Mt. Mineral Resources dated Sept 14, 2020 using a 7% ZnEq* cut-off

- 2.2 Mt at 18.2% ZnEq of Indicated (9.3% Zn, 3.7% Pb, 1.3% Cu, 96 g/t Ag & 0.9 g/t Au)

- 2.3 Mt at 18.6% ZnEq of Inferred (9.8 % Zn, 3.9% lead, 1.2% Cu, 101 g/t Ag & 0.9 g/t Au)

Pickett Mt. Preliminary Economic Assessment dated Sept 14, 2020

- $198 million After-tax NPV8% to Wolfden for an underground mine plan scenario

- 37% After-tax IRR with a 2.4-year payback

- $147 million Initial capital expenditure including closure costs and 20% contingency

Note: The PEA Mineral Resources estimate used metal price assumptions of US$1.20/pound for zinc, US$1.00/pound for lead, US$2.50/pound for copper, US$16.00/troy ounce for silver, and US$1200/troy ounce for gold. The PEA financial model used consensus metal prices assumptions of $1.15/lb Zinc, $1.00/lb Lead, $3.00/lb Copper, $18.00/oz Silver and $1,500/oz Gold. All financial figures are in US dollars.

For further information please contact Ron Little, President & CEO, at (807) 624-1136 or Rahim Lakha, Corporate Development at (416) 414-9954.

The information in this news release has been reviewed and approved by Don Dudek, P. Geo., VP Exploration, Jeremy Ouellette, P.Eng, VP Project Developments, and Ron Little P.Eng., President and CEO, who are Qualified Persons' under National Instrument 43-101. The metal prices used to determine Zinc Equivalent (ZnEq)* grades are US$1.20/pound for zinc, US$1.00/pound for lead, US$2.50/pound for copper, US$16.00/troy ounce for silver, and US$1200/troy ounce for gold. For further information on the project, see technical report entitled "National Instrument 43-101 Technical Report, Preliminary Economic Assessment Pickett Mountain Project, Penobscot County, Maine, USA" dated September 14, 2020 on Sedar.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, statements relating to metal price assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates, and other assumptions used in Preliminary Economic Assessment dated September 14, 2020, information about future activities at the Pickett Mountain Project that include plans to complete additional drilling and pre-permitting (rezoning petition), the results of the Preliminary Economic Assessment dated September 14, 2020, the potential upside of the Pickett Mt. Project, and the timing and commencement of future drill programs in Maine, Manitoba and New Brunswick. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1. Map of Completed 2020 Drill Holes in red and trace of Footwall and Stringer Lens in blue and black

Figure 2. Photo of Stringer Type Mineralization in Hole PM20-16

SOURCE: Wolfden Resources Corporation