TACOMA, WA / ACCESSWIRE / December 22, 2020, / IONIC BRANDS CORP. (CSE:IONC)(OTC PINK:IONKF)(FRA:1B3) ("IONIC BRANDS" or the "Company"), a regional manufacturer of innovative cannabis edibles and concentrate extract products, is pleased to announce that it was reinstated for trading by the Canadian Securities Exchange (CSE) on December 14, 2020. The Company is also pleased to provide a summary of financial results for the year ended December 31, 2019 and the nine months ended September 30, 2020.

IONIC BRANDS ANNOUNCES FIRST EBITDA POSITIVE MONTH IN JUNE 2020

IONIC BRANDS ANNOUNCES FIRST EBITDA POSITIVE QUARTER IN Q3 2020

IONIC BRANDS IMPLEMENTS STATE-OF-THE-ART CANNABIS ERP/MRP TIGUNIA HERB COMMERCE

YEAR ENDED DECEMBER 31, 2019 OVERALL PERFORMANCE

During the year ended December 31, 2019, the Company's focus was to increase its sales and reduce its operating expenses. For the year ended December 31, 2019, total revenues were $10,287,447, representing an increase of 464% compared to total revenues of $1,822,682 in the prior year. The increase in revenues was primarily due to the Company's effort in introducing new products and expansion initiatives in the states of Nevada, Oregon, and California.

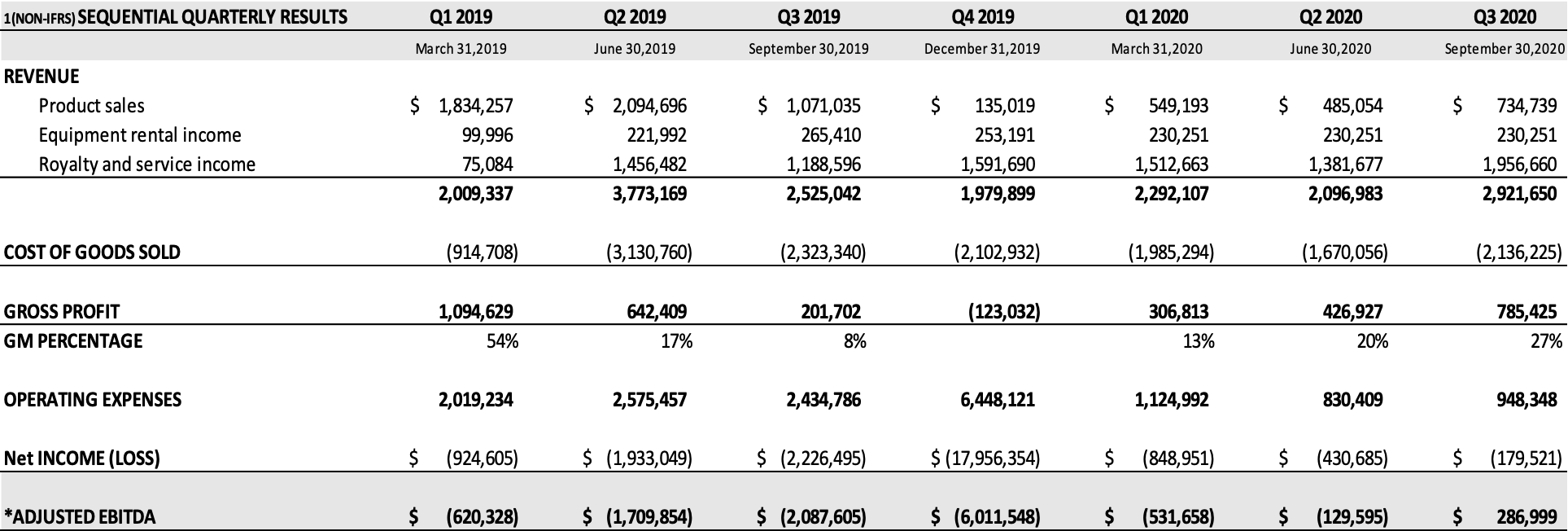

Summary of 2019 & 2020 Quarterly Results

The following table sets forth selected financial information for the Company for the following quarters. Such information is derived from unaudited financial statements and audited annual financial statements prepared by management in accordance with IFRS. All figures are presented in US dollars, except per share amounts.

|

|

Q1-2019

March 31,

2019

|

Q2-2019

June 30,

2019

|

Q3-2019

September 30,

2019

|

Q4-2019

December 31,

2019

|

Q1-2020

March 31,

2020

|

Q2-2020

June 30,

2020

|

Q3-2020

September 30, 2020

|

|||||||||||||||||||||

|

|

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

|

Total Revenue

|

2,009,988 | 3,864,041 | 2,821,616 | 1,591,802 | 2,292,107 | 2,096,983 | 2,921,650 | |||||||||||||||||||||

|

Cost of Goods Sold

|

915,126 | 2,899,265 | 2,458,478 | 2,406,273 | 1,985,294 | 1,670,056 | 2,136,225 | |||||||||||||||||||||

|

Gross

Profit (Loss)

|

1,094,862 | 964,776 | 363,138 | (814,471 | ) | 306,813 | 426,927 | 785,425 | ||||||||||||||||||||

|

Operating Expenses

|

8,833,060 | 5,759,600 | 4,642,266 | 6,467,335 | 1,582,259 | 690,317 | 1,312,727 | |||||||||||||||||||||

|

Net

Loss

|

8,654,013 | 4,800,231 | 4,690,747 | 24,129,924 | 712,958 | 857,372 | 536,659 | |||||||||||||||||||||

|

Loss per Share

|

0.15 | 0.04 | 0.03 | 0.19 | 0.00 | 0.00 | 0.00 | |||||||||||||||||||||

|

Total Assets

|

7,592,844 | 33,985,851 | 31,423,381 | 7,847,327 | 7,181,636 | 7,289,079 | 7,918,412 | |||||||||||||||||||||

|

Working

Capital / Deficiency

|

1,325,241 | 3,475,414 | 4,930,993 | 149,880 | (443,638 | ) | (1,904,873 | ) | (1,788,507 | ) | ||||||||||||||||||

During the third quarter of 2019, IONIC BRANDS updated its corporate strategy to focus on organic growth in its home markets of Washington and Oregon where the Company enjoyed strong consumer recognition of its product lines. The Company subsequently exited the California and Nevada markets, expanded distribution across Washington and Oregon, and reduced operating expenses in the pursuit of positive EBITDA1.

Results of Operations for the Year ended December 31, 2019

Revenue

Revenue for the year ended December 31, 2019, increased by $8,464,765 (464%) from 2018 mainly due to increases in revenues from product sales, licensing revenues, and equipment rentals. This was a result of growth in the underlying customers sales and the result of two significant acquisitions - Zoots Edibles and Dabulous Brands.

Gross Profit

For the year ended December 31, 2019, gross profit increased by $2,073,449 (446%) compared to the same period in 2018 because of the improved overall sales volume. Gross margins decreased to 16% compared to the same period in 2018 (26%) and were primarily attributable to the greater cost associated with co-manufacturing and distribution expenses in California and Oregon during 2019.

Total Expenses

Total operating expenses for the year ended December 31, 2019, were $25,702,261, an increase of $20,224,211 from $5,478,050 incurred during the same period in the prior year. The significant differences in expenses were as follows:

- As a result of the RTO /go-public transaction, listing expenses of $4,626,778 were incurred in 2019, representing the difference between the cost of the assets and fair value of the net assets acquired.

- Salaries and Wages increased to $3,713,813 in 2019 from $1,296,993 in 2018, as the Company hired additional people to assist in its expansion in Nevada, California, Oregon, and Washington prior to the change in corporate strategy.

- Bad debt expense of $4,079,014 was recorded for 2019, compared to $1,216,079 in 2018 as the Company recognized an impairment of trade receivables for amounts outstanding for more than 120 days. These bad debt expenses were largely attributed to the loss/destruction of inventory in the California and Nevada markets that the company had served during the 2019 operating year. Product was either destroyed or liquidated and could not be transferred out of these markets due to federal and state regulations.

- Share-based payments: $2,194,468 for the year ended December 31, 2019, compared to nil during the same period in 2018, as the Company issued stock options and performance warrants to directors, management, employees, and consultants.

- Professional fees: $1,996,431 for the year ended December 31, 2019, compared to $1,512,664 during the same period in the prior year, as the Company engaged advisors and consultants to assist in the RTO, acquisitions, and corporate growth.

- Interest and finance charges: $1,505,936 for the year ended December 31, 2019, compared to $128,238 during the same period in the prior year, as the Company borrowed money to finance its expansion and growth.

The management's discussion and analysis for the period and the accompanying financial statements and notes are available under the Company's profile on SEDAR at www.sedar.com.

QUARTERLY ACCUMULATED PERFORMANCE FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2020

|

|

Q1-2020

March 31,

2020

|

Q2-2020

June 30,

2020

|

Q3-2020

September 30,

2020

|

|||||||||

|

|

$ | $ | $ | |||||||||

|

REVENUE

|

||||||||||||

|

Product sales

|

549,193 | 1,034,248 | 1,768,987 | |||||||||

|

Equipment rental income

|

230,251 | 460,502 | 690,753 | |||||||||

|

Royalty and service income

|

1,512,663 | 2,894,340 | 4,851,000 | |||||||||

|

|

2,292,107 | 4,389,090 | 7,310,740 | |||||||||

|

COST OF GOODS SOLD3

|

(1,985,294 | ) | (3,655,350 | ) | (5,791,575 | ) | ||||||

|

GROSS PROFIT

|

306,813 | 733,740 | 1,519,165 | |||||||||

|

GROSS MARGIN

|

13 | % | 17 | % | 21 | % | ||||||

|

|

||||||||||||

|

TOTAL OPERATING EXPENSES

|

1,582,259 | 2,753,287 | 4,066,014 | |||||||||

|

NET

LOSS

|

(712,958 | ) | (1,570,330 | ) | (2,106,989 | ) | ||||||

|

ADJUSTED

EBITDA1, 2

|

(117,602 | ) | (396,065 | ) | (172,090 | ) | ||||||

2 Denotes Earnings Before Interest, Income Taxes, Depreciation and Amortization

3 Depreciation and amortization expenses in Q1-2020, Q2-2020, and Q3-2020 include amounts charged to the cost of goods sold on the statement of profits and losses.

KEY OPERATING HIGHLIGHTS

First Nine Months of 2020 Key Operating Highlights (Non-IFRS Financial and Performance Measures) include:

- The Company continued to improve its gross margin throughout the year with quarter over quarter increases from 13% in Q1-2020 to 21% in Q2-2020 and 28% in Q3-2020. The increased gross margin profile was driven by establishing inventory credit lines to improve our ability to purchase raw materials in bulk. Additionally, the company has invested in a robust MRP and ERP platform that provides systematic improvements to gross margin and cost controls.

- The Company experience a slight decrease in revenue in Q2-2020 due to temporary staffing constraints during the first wave of the COVID pandemic. Additionally, wholesale purchases by our retailers were temporarily impacted as state health service regulators in the Pacific Northwest developed safer methods for consumers including the curtailing of in-store foot traffic.

- The Company achieved a reduction in net loss of $445,964 or 37% in Q2-2020 compared to Q1-2020.

- The Company realized adjusted EBITDA1 losses in Q2-2020 over Q1-2020 decrease by $409,099.00 or 26

- The Company also saw its first EBITDA1 profitable month in June of Q2-2020 and first EBITDA1 positive quarter in Q3-2020

- The Company realized a 7% increase in gross margin in Q3-2020 (28%) compared to Q2-2020(21%).

- Total revenues increased from Q2-2020 of $2,06,983 to $2,921,650 in Q3-2020, representing a 72% increase.

1Non-IFRS Financial and Performance Measures

In this press release Ionic Brands refers to certain non-IFRS financial measures such as "Pro Forma Revenue", "Managed Revenue", "Gross Profit on Cannabis Sales" and "Adjusted EBITDA". These measures do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. Ionic Brands defines "Managed Revenue" as total revenue plus revenue from entities for which the Company has a management contract but does not consolidate the financial results based on IFRS 10 - Consolidated Financial Statements. The Company defines "Gross Profit on product Sales" as retail and wholesale revenues less the cost of goods sold. "Adjusted EBITDA" is defined by Ionic Brands as earnings before interest, taxes, depreciation and amortization less share-based compensation expense and one-time charges related to business development, acquisition, financing, and reorganization costs. Ionic Brands considers these measures to be an important indicator of the financial strength and performance of our business. We believe the adjusted results presented provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies and allow investors to review performance in the same way as our management. Since these measures are not calculated in accordance with IFRS, they should not be considered in isolation of, or as a substitute for, our reported results as indicators of our performance, and they may not be comparable to similarly named measures from other companies.

Stores Served in the Pacific Northwest Markets:

- The Company had its products stocked in 303 stores in Washington during the first 9 months of 2020, an 8.6% increase from 2019 (263 stores).

- The Company had its products stocked in 72 stores in Oregon during the first 9 months of 2020, a 9% increase from 2019 (67 stores). The company plans on introducing its full line of brands including Dabulous and the Zoots edible lines into the Oregon market in Q1-2021.

Notable Product Segments:

- In 2019 the Company was co-packing and selling Dabulous brand concentrate products for another Washington-based company. Dabulous products generated wholesale co-packing revenue of $566,510 for the full year 2019. Subsequently, on June 3rd of 2020 the company acquired the Dabulous brand which was announced on June 10th of 2020. The company has since repositioned Dabulous as an economy product with more attractive price points appealing to a more cost-conscious consumer in the Washington market. This newly implemented strategy has resulted in Dabulous products generating wholesale/co-packing revenue of $3,410,932 for a 602% increase in Dabulous sales for the first nine months of 2020.

- Washington vape unit sales for the first nine months of 2020 were 483,282 units, a 50% increase versus the same period in 2019.

- The Company launched oil-infused premium pre-rolls in Q4-2019, which marked our expansion into the flower category. Infused Pre-rolls became our third bestselling product out of all product lines in 2020 due in part to consumers being less concerned about discretion while under stay-at-home orders.

OUTLOOK

The Company has successfully recalibrated its operations and growth strategy to focus on the large and growing Pacific Northwest markets of Washington and Oregon. Operating expenses have been significantly reduced to where operating expenses and are now aligned with revenues. The Company plans to continue to reinvest into its premium and luxury branded products and also further expand its range of value-priced products to appeal to a wider customer base and increase shelf space in our partner retail stores.

Once the Company has reached a more significant and sustainable profitability level, we intend to undertake a measured and focused expansion of our cannabis operations into other states. This may include direct operations and/or licensing agreements.

The Company has completed the formulation of a range of hemp CBD-infused Zoots consumables, which we intend to sell to distributors and retailers nationwide starting in H1-2021.

IONIC BRANDS anticipates optimization of its Enterprise Resource Planning (ERP) platform, Tigunia Herb Commerce (TigHC), in late Q4-2020 to target improving production efficiencies. TigHC is an intuitive cannabis management solution that streamlines product tracking, processing, costing, and finances for growers and manufacturers in a single, easy-to-use platform.

Management will continue to focus on prudent fiscal and capital management.

PENDING ASSET ACQUISITION OF COWLITZ COUNTY CANNABIS CULTIVATION INC.

As previously announced on December 1, 2020, IONIC BRANDS intends to complete the asset acquisition if Cowlitz County Cannabis Cultivation Inc. ("Cowlitz" or "Cowlitz Assets") from Lobe Sciences Ltd. (CSE: LOBE) ("Lobe"). Cowlitz is one of the top five licensed cannabis producers/processors located in Washington State. The assets being sold to Ionic include, but are not limited to, the assignment of all property leases relating exclusively to Cowlitz's business, the assignment of Lobe's option agreement to acquire all of the outstanding shares of Cowlitz, and the assignment of other contracts and rights related exclusively to Cowlitz including service contracts and equipment leases. Cowlitz reported over $14.6-million (U.S.) in gross sales revenues for the nine-month period ended Sept. 30, 2020, according to data provided on reports to the Washington State Department of Revenues. Lobe generates revenues through licensing and leasing agreements in place with Cowlitz. The acquisition of the Cowlitz assets will represent a complementary synergistic acquisition that achieves the Company's goal of operational expansion and growth of the Company's product portfolio. The Company expects to close the acquisition of Cowlitz during the first quarter of 2021.

About IONIC BRANDS Corp.

The Company is dedicated to building a regionally based multi-state consumer-focused cannabis concentrate brand portfolio with strong roots in the premium and luxury segments of vape concentrates and edibles. The cornerstone brand of the portfolio, IONIC, is a top 10 vaporizer brand in Washington State and has aggressively expanded throughout the Pacific Northwest of the United States. The brand is currently operating in Washington and Oregon. IONIC BRANDS' strategy is to be the leader of the highest-value segments of the cannabis market.

On behalf of IONIC BRANDS CORP.

John Gorst

Chairman & Chief Executive Officer

For more information visit www.ionicbrands.com or contact:

John Gorst

[email protected]

+1.253.248.7927

To stay better informed with the current events of the company you can join our investor community at https://www.ionicbrands.com/investor-community

The CSE does not accept responsibility for the adequacy or accuracy of this release.

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities laws and United States securities laws ("forward-looking statements"). Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on management's current beliefs, expectations or assumptions regarding the future of the business, plans and strategies, operational results and other future conditions of the Company. In addition, the Company may make or approve certain statements in future filings with Canadian securities regulatory authorities, in press releases, or in oral or written presentations by representatives of the Company that are not statements of historical fact and may also constitute forward-looking statements. All statements, other than statements of historical fact, made by the Company that address activities, events or developments that the Company expects or anticipates will or may occur in the future are forward-looking statements, including, but not limited to, statements preceded by, followed by or that include words such as "assumptions", "assumes", "guidance", "outlook", "may", "will", "would", "could", "should", "believes", "estimates", "projects", "potential", "expects", "plans", "intends", "anticipates", "targeted", "continues", "forecasts", "designed", "goal", or the negative of those words or other similar or comparable words and includes, among others, information regarding: its outlook for and expected operating margins, capital allocation, free flow cash and other financial results; growth of its operations via expansion, for the effects of any transactions; expectations for the potential benefits of any transactions; statements relating to the business and future activities of, and developments related to, the Company after the date of this press release, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company's business, operations and plans; expectations that planned acquisitions will be completed; expectations regarding cultivation and manufacturing capacity; expectations regarding receipt of regulatory approvals; expectations that licenses applied for will be obtained; potential future legalization of adult-use and/or medical cannabis under U.S. federal law; expectations of market size and growth in the U.S. and the states in which the Company operates; expectations for other economic, business, regulatory and/or competitive factors related to the Company or the cannabis industry generally; and other events or conditions that may occur in the future. Forward-looking statements may relate to future financial conditions, results of operations, plans, objectives, performance or business developments. These statements speak only as at the date they are made and are based on information currently available and on the then current expectations. Holders of securities of the Company are cautioned that forward-looking statements are not based on historical facts but instead are based on reasonable assumptions and estimates of management of the Company at the time they were provided or made and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, but not limited to, risks and uncertainties related to: the available funds of the Company and the anticipated use of such funds; the availability of financing opportunities; legal and regulatory risks inherent in the cannabis industry; risks associated with economic conditions, dependence on management and currency risk; risks relating to U.S. regulatory landscape and enforcement related to cannabis, including political risks; risks relating to anti-money laundering laws and regulation; other governmental and environmental regulation; public opinion and perception of the cannabis industry; risks related to contracts with third-party service providers; risks related to the enforceability of contracts; reliance on the expertise and judgment of senior management of the Company, and ability to retain such senior management; risks related to proprietary intellectual property and potential infringement by third-parties; the concentrated voting control of the Company's Chairman and the unpredictability caused by the capital structure; risks relating to the management of growth; increasing competition in the industry; risks inherent in an agricultural business; risks relating to energy costs; risks associated to cannabis products manufactured for human consumption including potential product recalls; reliance on key inputs, suppliers and skilled labor; cybersecurity risks; ability and constraints on marketing products; fraudulent activity by employees, contractors and consultants; tax and insurance related risks; risks related to the economy generally; risk of litigation; conflicts of interest; risks relating to certain remedies being limited and the difficulty of enforcement of judgments and effect service outside of Canada; risks related to future acquisitions or dispositions; sales by existing shareholders; limited research and data relating to cannabis; as well as those risk factors discussed under "Risk Factors" in the Company's Annual Management, Discussion and Analysis dated March 26, 2020, and in the Company's Annual Information Form dated September 23, 2019, and as described from time to time in documents filed by the Company with Canadian securities regulatory authorities. The purpose of forward-looking statements is to provide the reader with a description of management's expectations, and such forward-looking statements may not be appropriate for any other purpose. In particular, but without limiting the foregoing, disclosure in this press release as well as statements regarding the Company's objectives, plans and goals, including future operating results and economic performance may make reference to or involve forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. You should not place undue reliance on forward-looking statements contained in this press release. Such forward-looking statements are made as of the date of this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. The Company's forward-looking statements are expressly qualified in their entirety by this cautionary statement.

This news release contains future-oriented financial information and financial outlook information (collectively, "FOFI") about the Company's prospective results of operations, production and production efficiency, commercialization, revenue and cash on hand, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set second in the above paragraph. FOFI contained in this document was approved by management as of the date of this document and was provided for the purpose of providing further information about the Company's future business operations. The Company disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein.

The financial information reported in this news release is based on unaudited management prepared financial statements for the quarter ended September 30, 2020. Accordingly, such financial information may be subject to change. All financial information contained in this news release is qualified in its entirety with reference to such unaudited financial statements. While the Company does not expect there to be any material changes, to the extent that the financial information contained in this news release is inconsistent with the information contained in the Company's unaudited financial statements, the financial information contained in this news release shall be deemed to be modified or superseded by the Company's unaudited financial statements. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation for purposes of applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Service Provider has reviewed and does not accept responsibility for the adequacy or accuracy of the content of this news release.

SOURCE: IONIC Brands Corp.