NEW YORK, NY / ACCESSWIRE / September 7, 2020 / The average home buyer can save $1,500 over the life of their mortgage simply by getting a second mortgage quote, according to a 2018 Freddie Mac study.

But almost half of borrowers don't shop around for multiple rates, the study found.

All home buyers should shop around for rates, because there is a lot of variance between lenders, says Jennifer Beeston, mortgage educator and a 13-year industry veteran who is one of the top 1% of mortgage originators in the country by dollar volume.

That means being able to interpret what you'll find on a Loan Estimate document is critical, which is your first real look at a prospective mortgage.

We asked Beeston to walk us through the Loan Estimate and highlight what borrowers should be focusing on.

What Is a Mortgage Loan Estimate?

A Loan Estimate is a three-page document detailing your prospective mortgage costs. This form outlines the fees, interest rate, and all other expenses associated with your mortgage. The lender must provide you with a Loan Estimate within three business days of receiving your application.

To get an official Loan Estimate you'll need to have a home under contract-meaning the home seller has accepted your offer-unless you're refinancing an existing mortgage. A lot of people think they'll get a Loan Estimate with a prequalification or a preapproval, but you won't get the official estimate without a property address, Beeston says.

All lenders are required to use the same Loan Estimate form. This makes it easier to compare offers, but you still need to know what you're looking at. Also keep in mind the Loan Estimate is just that - an estimate. Fees vary between lenders and some can change by the time of closing. The good news is you don't have to be an expert to understand what's on a Loan Estimate. You just need to know what to focus on.

4 Keys to Comparing Lenders With Loan Estimates

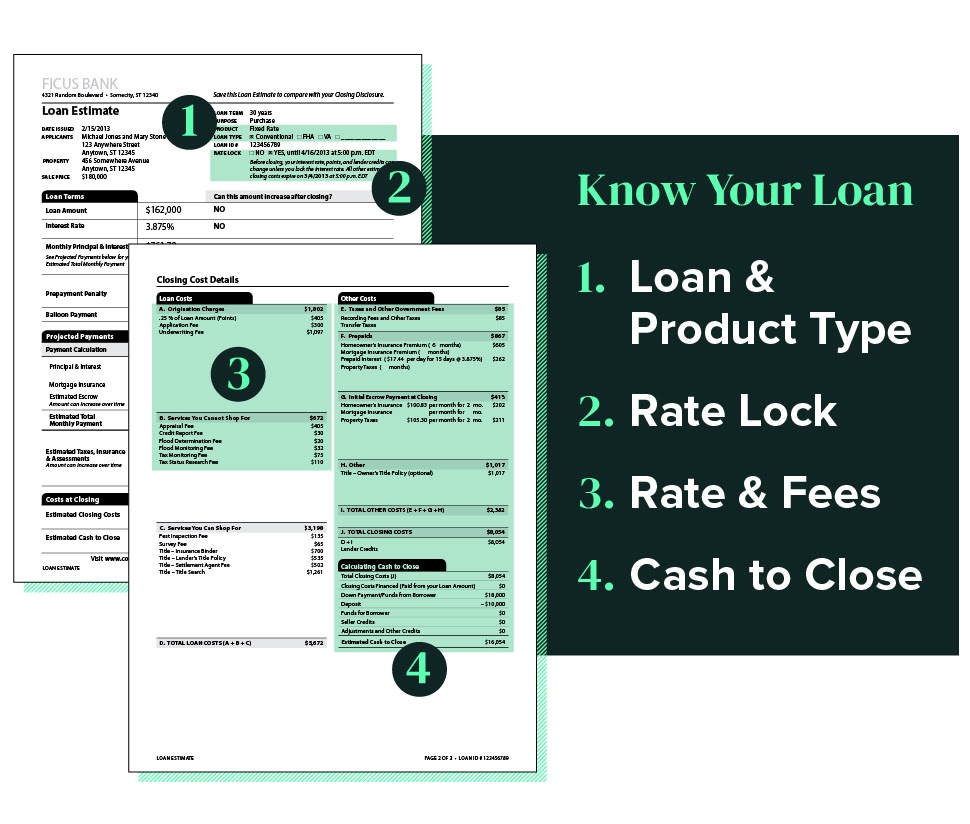

All the most important things for a borrower to look at are on the first two pages of the Loan Estimate, Beeston says: the loan type, rate lock information, rate, and fees.

For example, the APR (annual percentage rate), which includes the interest rate plus fees, is a better measure of the overall cost of a mortgage than the interest rate. But it does include some costs such as prepaid taxes that can adjust between the Loan Estimate and closing. So the APR on the Loan Estimate might change, that's why it's important to focus on comparing lenders fees and the interest rate.

1. Verify the Loan and Product Type

When you get the Loan Estimate the first thing you want to do is verify the details. Make sure what you're seeing is what you expected to be there.

Pay particular attention to "loan type," and "product." You need to compare the same types of loans when looking at different lenders. If someone is comparing a conventional loan to an FHA loan, that's not apples to apples, Beeston says.

If you think you're getting a conventional loan, make sure that box is checked. A conventional loan isn't secured by the government, but you can have private mortgage insurance requirements waived in certain circumstances. If you're not sure about what makes the most sense for you, ask your lender to explain the differences and all the possible options you might consider.

2. Rate Lock

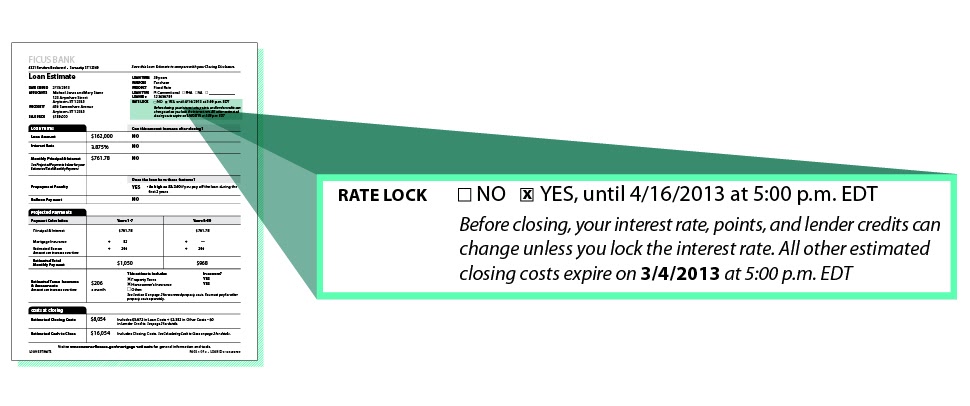

Don't let anyone rush you through the process of applying for a mortgage. But, when it comes to locking in a good interest rate - be decisive. "If you like it, lock it," Beeston says. Rates change every day, so if the rate isn't locked it could change tomorrow.

Ask whether or not the lender charges fees to lock the rate. You also want to ask how long the rate is locked for. If you're closing on the home in 30 days, be sure that the rate lock covers you until closing. If you need to extend the rate lock, there are typically fees for that.

3. Rate and Fees

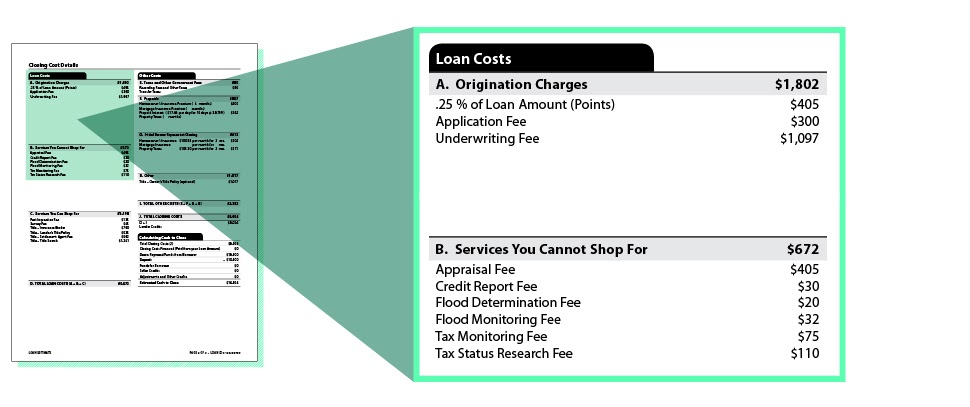

Mortgage interest rates get all the headlines, but you can't effectively compare mortgage offers without also looking at the fees. People might see a lower rate when comparing lenders and assume it's a better deal. But that's not always the case, Beeston says.

It depends on the rate and the fees from section A on page two of the Loan Estimate. "It's not like the industry has set underwriting fees or each rate has a set cost to it," Beeston emphasized. The same interest rate with six different lenders could cost six different amounts because of lender fees.

You should always ask if the interest rate you're getting includes discount points. Discount points are extra fees you can pay in exchange for a lower interest rate. Paying more upfront to save on interest over the life of the loan can make sense in some cases, but you'll want to run the math with your loan officer to be sure.

Beeston advises borrowers to always ask a potential lender these questions:

- What are your origination charges?

- Are there any discount points for this rate?

If there are discount points built into the rate you're offered and the lender doesn't disclose that, consider it a big warning sign. Beeston says she once worked with a borrower who came to her with a Loan Estimate featuring a competitive refinance interest rate, but which included 5% in hidden discount point charges. On a $108,000 loan, that added up to over $5,000.

PRO TIP

A price match guarantee is a red flag. Why would you want to work with a lender who is offering you a high rate and only lowering it if you go do the work? "Why won't they just give you a lower rate right now?" Beeston says

Looking at section B on page 2, you'll see fees for 3rd-party services required by the lender, but Beeston says not to worry about this box too much because it's largely nickel and diming. These are fees for required services you aren't allowed to shop for, so they can't change without the lender sending you a revised Loan Estimate.

"In this case they're estimating that the appraisal fee is $405. Now, if the appraisal actually ends up being $600, in order to charge the client that extra $200, we would have to redisclose," Beeston said.

4. Ignore Cash to Close (For Now)

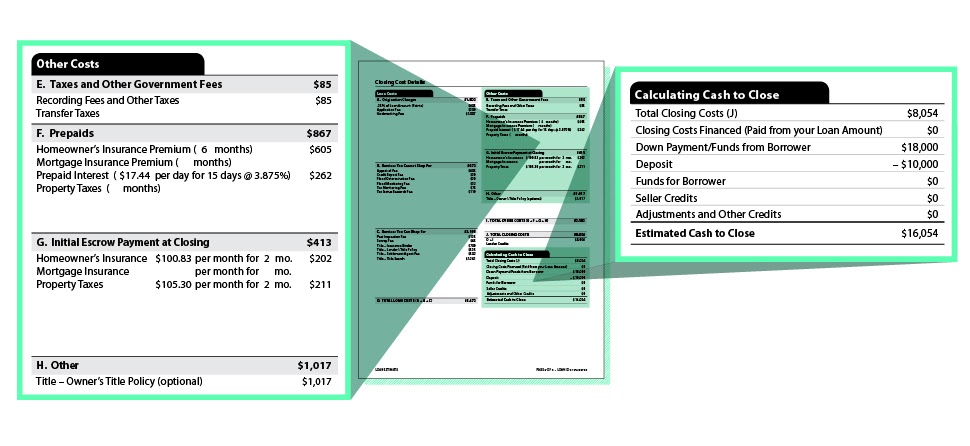

"The biggest mistake that people make is they don't look at the details. They'll take three Loan Estimates, they'll put them next to each other, and they just go off the estimated cash to close," Beeston said.

This isn't to say the amount of cash you need to close doesn't matter but rather, it's not a good way to compare offers from different lenders. This is because the cash to close total at the bottom of page two includes sections E, F, H, and G, but which lender you choose has zero impact on these costs.

The borrower shops for homeowner's insurance and taxes are set by local and state governments, so the figures you find for insurance and taxes are estimates. And estimating these fees isn't an exact science.

"It's incredibly challenging for lenders to figure out estimated property taxes," Beeston said. In some areas, homes located only a short distance apart can have significantly different property taxes. Think of the property tax calculation on the Loan Estimate as a starting point, rather than the final breakdown. The official numbers will be on the Closing Disclosure you get from your lender three days before closing.

But don't completely ignore these costs either, depending on where you're purchasing, taxes and insurance can greatly impact housing affordability. If insurance costs are high, Beeston recommends getting a basic online homeowners insurance quote in advance. That way there won't be a huge jump in your insurance costs, which could impact your ability to qualify for a mortgage.

How to Choose Which Lenders to Get Loan Estimates From

You shouldn't get Loan Estimates from every lender you talk to. You'll want to narrow down your list and get Loan Estimates from just three lenders, Beeston says.

When you're shopping for a lender look at online reviews for specific loan officers, not just the lender they work for. Otherwise, you may end up working with an inexperienced mortgage professional who just happens to work for a reputable lender. You have to feel the loan officer is competent and knows the guidelines, it's not just about rate, Beeston says.

To weed out lenders, call a bunch to get a feel for who you connect with, and be sure to touch on the following topics:

Ask About Rates

Beeston recommends calling a handful of lenders to ask about what rates you may qualify for. While you won't get a full preapproval based on the information you share over the phone, the lender should be able to give you a ballpark estimate. A lender can't lock your rate based on that first phone call, but a lender should always be able to give you an estimate. Giving you an estimate shows you the lender is willing to work with you, Beeston says.

When it comes time to submit an application, confirm the rate will be locked in and double check those rate lock details when you get the Loan Estimate.

Is the Lender Offering a Price Match Guarantee?

A price match guarantee sounds great: if you find a lower rate the lender promises to match it. But buyers should resist this marketing tactic, Beeston says. If you ask a lender for a better rate and the response is, "well, if you find someone lower I'll match it," that's a red flag, Beeston says. "Why won't they just give you a lower rate right now?"

Why would you want to work with a lender who is offering you a high rate and only lowering it if you go do a bunch of work? Whenever you are offered a price match it shows you could probably find a better deal somewhere else, Beeston says.

Are There Upfront Fees Before Getting a Loan Estimate?

Beeston is not a fan of upfront fees. "If someone's trying to get money out of you before you see a disclosure [Loan Estimate], be afraid," Beeston says. She recommends not handing over your credit card information until your rate is locked, you've reviewed all of the loan disclosures, and you're comfortable with the loan.

Company: Jennifer Beeston Mortgage Educator

Email: [email protected]

Phone number: 707-478-0637

Website: https://www.youtube.com/jenniferbeeston

SOURCE: Jennifer Beeston Mortgage Educator