Record Revenues and Quarterly Growth of 43% Alongside Reduced Operating Expenses Leads to 70% Improvement in Operating Loss to $0.2 Million and Continued Margin Expansion

PHOENIX, AZ / ACCESSWIRE / August 17, 2020 / Item 9 Labs Corp. (OTCQB:INLB) ("Item 9 Labs" or the "Company"), a vertically integrated cannabis operator that produces premium products, announced today the Company's operating and financial results for the fiscal third quarter ended June 30, 2020.

Key Financial Highlights for Q3 FY 2020

- Revenue increased 43% to $2.2 million over Q3 FY 2019

- Operating loss decreased 70% to $0.2 million

- Operating expenses as a percentage of revenue declined from 108% to 57%

- Adjusted EBITDA loss declined 91% to $0.04 million

Management Commentary

"It has been an eventful past several months, as our production and demand for our products grew in Arizona," commented, Andrew Bowden, Item 9 Labs's Chief Executive Officer. "While most companies have been negatively impacted by the global COVID-19 pandemic, we have been more fortunate than most due to the fact that our cannabis products remain in high demand in Arizona."

Bowden, continued, "We expect revenues to continue to grow as the trends are positive month over month. At the same time, we have been able to lower costs since March 2020 and expect to see margins increase over the next several months. As we focus on increasing revenue, reducing expenses and performing more efficiently, our operating expenses as a percentage of revenue decreased from 108% to 57% for the three months ended June 30, 2020. We believe this ratio will continue to decrease going forward as our expectation is that revenues will continue to grow at a higher rate than operating expenses as we have our sights on turning EBITDA profitable."

Bowden concluded, "In addition to continued growth in Arizona, we are extremely excited about our expansion to Nevada and our pending acquisition of ONE Cannabis Group and its global dispensary franchise strategy. Our team is poised to execute on this expansion and believes it will add significant value to our shareholders. I couldn't be more personally excited about our future and believe we are well-positioned for future success."

Growth Initiatives

Arizona

Item 9 Labs currently offers more than 300 products that are grouped in the following categories: flower, concentrates, distillates, and hardware. The Company's product offerings will continue to grow as it develops new products to meet the needs of the end-users. Its products are available to consumers through more than 60 licensed dispensaries in Arizona.

The Company has expanded its Arizona facility and increased its production in the nine months ended June 30, 2020 to meet increased demand for its products.

Nevada

Item 9 Labs acquired cultivation, processing and production licenses in Nevada in early 2020, to go along with its Pahrump, Nevada land acquisition in 2018 to establish its expansion into Nevada. As of June 30, 2020, the licenses have not been transferred to the Company as the transfer is awaiting Nevada regulatory approval.

ONE Cannabis Group

Items 9 Labs expects to close its acquisition of OCG, Inc. ("ONE Cannabis Group") near the Company's fiscal year end of September 30, 2020. ONE Cannabis Group is the parent company to the cannabis dispensary franchise Unity Rd. The merger was previously disclosed on a Form 8-K filed with the U.S. Securities and Exchange on March 2, 2020. The parties are currently in negotiations to finalize certain necessary amendments to the merger agreement and completing the condition precedents and compliance-related matters. The merger with ONE Cannabis Group greatly enhances the Company's business capabilities with its retail distribution. Its cannabis dispensary franchise Unity Rd. is a first in industry and nationally recognized true cannabis franchise.

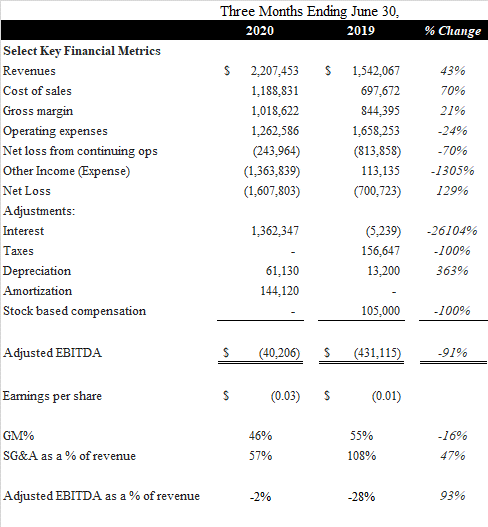

Financial Results for the Three Months Ended June 30, 2020:

Revenue for the three months ended June 30, 2020 was $2.2 million, an increase of $0.7 million or 43%, compared to $1.5 million for the three months ended June 30, 2019. The revenue increase was primarily due to an overall increase in monthly sales as production and demand for our products grew. Management anticipates revenues to continue to grow as the revenue trends are positive month over month.

Gross profit for the three months ended June 30, 2020 was $1.0 million, an increase of $0.2 million or 21%, compared to $0.8 million for the three months ended June 30, 2019. The resulting gross margin was 46% for the three months ended June 30, 2020, compared to 55% for the three months ended June 30, 2019. The decrease in gross margin was due to an increase in costs necessary to ramp up production to meet demand, as well as a pivot of its sales strategy for certain product lines, reducing margins in the short term. The Company has been able to lower costs since March 2020 and expects to see gross margins increase over the next several months.

Operating expenses for the three months ended June 30, 2020 were $1.3 million, a decrease of $0.4 million or 24%, compared to $1.7 million for the three months ended June 30, 2019. Operating expenses as a percentage of revenue decreased from 108% to 57% for the three months ended June 30, 2020, from the three months ended June 30, 2019. The decrease in operating expenses as a percentage of revenues for the three months ended June 30, 2020 was due to the Company's focus on increasing revenue, reducing expenses and performing more efficiently. Management believes this ratio will continue to decrease going forward as the expectation is that revenues will continue to grow at a higher rate than operating expenses.

Operating loss for the three months ended June 30, 2020 was $0.2 million, a decrease of $0.6 million, or 70%, compared to $0.8 million for the three months ended June 30, 2019.

Net loss for the three months ended June 30, 2020 was $1.6 million, an increase of $0.8 million, or 88%, compared to $0.9 million for the three months ended June 30, 2019. The net loss for the three months ended June 30, 2020 included $1.4 million of interest expense, as compared to minimal for the three months ended June 30, 2019. The resulting loss per share for the three months ended June 30, 2020 was ($0.03) per share, compared to ($0.01) per share for the three months ended June 30, 2019.

Adjusted EBITDA loss, after adding back non-cash operating expenses, depreciation and amortization, interest and stock-based compensation, for the three months ended June 30, 2020 was $0.04 million, a decrease of $0.4 million, or 91%, compared to $0.4 million for the three months ended June 30, 2019.

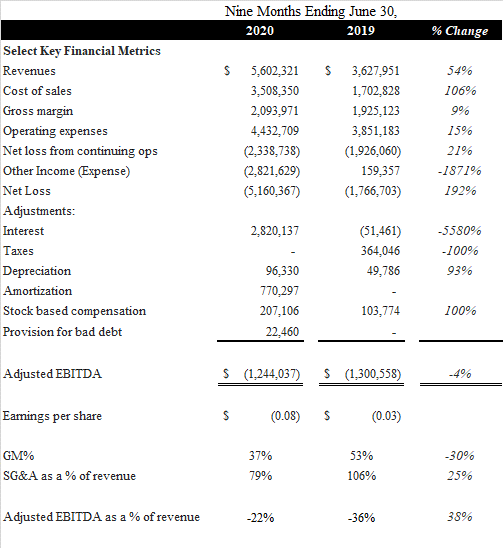

Financial Results for the Nine Months Ended June 30, 2020:

Revenue for the nine months ended June 30, 2020 was $5.6 million, an increase of $2.0 million or 54%, compared to $3.6 million for the nine months ended June 30, 2019.

Gross profit for the nine months ended June 30, 2020 was $2.1 million, an increase of $0.2 or 9%, compared to $1.9 million for the nine months ended June 30, 2019. The resulting gross margin was 37% for the nine months ended June 30, 2020, compared to 53% for the nine months ended June 30, 2019.

Operating expenses for the nine months ended June 30, 2020 was $4.4 million, an increase of $0.6 million or 15%, compared to $3.9 million for the nine months ended June 30, 2019. Operating expenses as a percentage of revenue decreased from 106% to 79% for the nine months ended June 30, 2020, from the nine months ended June 30, 2019.

Operating loss for the nine months ended June 30, 2020 was $2.3 million, an increase of $0.4 million, or 21%, compared to $1.9 million for the nine months ended June 30, 2019.

Net loss for the nine months ended June 30, 2020 was $5.2 million, an increase of $3.1 million, or 192%, compared to $2.1 million for the nine months ended June 30, 2019. The net loss for the nine months ended June 30, 2020 included $2.8 million of interest expense, as compared to minimal for the nine months ended June 30, 2019. The resulting loss per share for the nine months ended June 30, 2020 was ($0.08) per share, compared to ($0.03) per share for the nine months ended June 30, 2019.

Adjusted EBITDA loss, after adding back non-cash operating expenses, depreciation and amortization, interest and stock-based compensation, for the nine months ended June 30, 2020 was $1.2 million, a decrease of $0.1 million, or 4%, compared to $1.3 million for the nine months ended June 30, 2019.

Use of Non-GAAP Financial Measures

To supplement Item 9 Labs's financial statements presented on a GAAP basis, Item 9 Labs provides Adjusted EBITDA as a supplemental measure of its performance.

To provide investors with additional insight and allow for a more comprehensive understanding of the information used by management in its financial and decision-making surrounding pro forma operations, we supplement our consolidated financial statements presented on a basis consistent with U.S. generally accepted accounting principles, or GAAP, Adjusted EBITDA as a non-GAAP financial measures of earnings. Adjusted EBITDA represents EBITDA plus stock-based compensation and change in fair value of derivative liabilities. Our management uses Adjusted EBITDA, as financial measures to evaluate the profitability and efficiency of our business model. We use these non-GAAP financial measures to access the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial measures that are derived from them, provide supplemental information to analyze our operations between periods and over time. We find this especially useful when reviewing pro forma results of operations, which include large non-cash amortizations of intangible assets from acquisitions and stock-based compensation. Investors should consider our non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP.

About Item 9 Labs Corp.

Item 9 Labs Corp. (OTCQB:INLB) is a vertically integrated multi-state cannabis operator headquartered in Arizona. The Company creates best-in-class products and canna-business solutions designed to help people become the best versions of themselves. With an award-winning CPG brand and nationally recognized application team, Item 9 Labs improves the cannabis experience while providing transparency, consistency, and well-being for those relying on them. For additional information, please visit: item9labscorp.com.

Media Contact:

Item 9 Labs

Jayne Levy, Director of Communications

Email: [email protected]

Investor Contact:

Hayden IR

Brett Mass, Managing Partner

Phone: (646) 536-7331

Email: [email protected]

SOURCE: Item 9 Labs Corp.