Strategic Turnaround Complete; Transition to Lean, Direct-to-Consumer Model Underway

SYDNEY, AUSTRALIA / ACCESSWIRE / May 8, 2020 / Naked Brand Group Limited (NASDAQ:NAKD) ("Naked" or the "Company"), a global leader in intimate apparel and swimwear, has reported its financial results for the full year of fiscal 2020 (the year ended January 31, 2020).

Key Full Year Fiscal 2020 Financial Highlights:

- Net sales for the full year of fiscal 2020 totaled NZD$90.1 million, or USD$58.5 million, compared to NZD$111.9 million, or USD$72.7 million, for the full year of fiscal 2019.

- Gross profit margin as a percentage of revenue increased to 37.5% in the full year of fiscal 2020, as compared to approximately 33.5% in the full year of fiscal 2019.

- Operating expenses decreased to NZD $60.28 million, or USD$39.18 million, in the full year of fiscal 2020, compared to NZD$70.82 million, or USD$46.03 million, in the full year of fiscal 2019, which is a 15% saving.

- Net loss totaled NZD$52.2million, or USD$33.9 million, in the full year of fiscal 2020, or NZD$34.74, or USD$22.58, per basic and diluted share, compared to a net loss of NZD$49.2 million, or USD$32.0 million, in the full year of fiscal 2019, or NZD$200.77, or USD$130.50, per basic and diluted share.

- EBITDA loss totaled NZD$16.2 million, or USD$10.5 million, in the full year of fiscal 2020, a 37% improvement when compared to the full year of fiscal 2019 adjusted EBITDA loss of NZD$25.6 million or USD$16.6 million.

Key Full Year Fiscal 2020 and Subsequent Operational Highlights:

- Completed the appointment of key executive team members to lead the business through the completion of the strategic turnaround and back to profitability, including:

- Cheryl Durose as Chief Financial Officer

- Angela Mana-Tupara as General Manager - Retail

- Chin Edirisuriya as General Manager - Technology & Transformation

- Lyle Cardy as General Manager - Logistics and Health & Safety

- Kirsty McKeown as General Manager - Merchandise

- Announced strategic brand divestiture initiative, through which the company is exploring the option to divest one or more of the brands in its portfolio as part of its new strategic direction to become an asset light direct to consumer business model with select strategic wholesale partners.

- Divested the Naked brand as part of this initiative in January 2020, providing non-dilutive financing through trademark monetization and increasing corporate operational efficiencies.

- Completed a global strategic review and effectuated plan that realized an estimated NZD $10.54 million in additional administrative, corporate and finance cost savings in the full fiscal year of 2020.

- Fully exited unprofitable channels in the E.U., U.K. and select Australian and New Zealand independent channels, inclusive of all related distribution and support infrastructure.

- Naked will continue to service select E.U. and U.K. accounts from the New Zealand head office due to strong brand strength in the region.

- Exited costly global offices in Sydney, Hong Kong and the U.S.

- Reduced trade payables to creditors by NZD$13.1 million in the fiscal year ended January 31, 2020.

- Fortified balance sheet through financing and debt restructuring transactions including a new, amended two-year USD$10.85 million credit facility agreement with the Bank of New Zealand as well as several share issuance transactions along with raising USD$18.5 million through convertible promissory notes.

Management Commentary

"Our fiscal 2020 was highlighted by the continuing success of our new strategic direction, finalizing the completion of our transition to a lean, direct-to-consumer business model - having exited unprofitable wholesale channels worldwide and further leaning into our e-commerce and physical store infrastructure," said Anna Johnson, Chief Executive Officer of Naked.

"The savings from the closure of satellite offices and the concentration of staff in our Bendon offices in New Zealand have been immense. Our current corporate and administrative infrastructure is more than sufficient to allow us to operate a strong e-commerce business globally while maintaining our robust footprint of physical stores. This, when paired with our renegotiation of all unfavorable contracts across the enterprise, has resulted in a new Naked that is more efficient than ever before.

"We continue to fortify our balance sheet through innovative financial transactions on all fronts, reducing trade payables by NZD$13.1 million while realizing non-dilutive financing through the monetization of our Naked brand trademark. In addition, we entered into a new, amended two-year USD$10.85 million credit facility with the Bank of New Zealand which provides us with a friendly source of working capital, allowing us to ensure we can fully stock our channel with increasingly high-margin merchandise.

"We are better positioned to seize immediate-term growth opportunities than at any time in our recent history. We maintain a robust brand portfolio, including Bendon - an iconic New Zealand brand staple - presenting us with an incredible opportunity that we will continue to capitalize upon. We now have a new experienced executive team on board relentlessly focused on trading profitably. I look forward to continued operational execution over the next year and the creation of sustainable, long-term value for our shareholders," concluded Johnson.

We continue to work through the unprecedented times of COVID-19. With the government funding available to us and an immediate renegotiation of several contracts, including reduction and/or abatement of leases and employee hours, we look forward to reopening our stores and returning to our customers and continuing the journey of profitability.

Full Year Fiscal 2020 Financial Results

Net sales in the full year of fiscal 2020 totaled NZD$90.1 million, or USD$58.5 million, compared to NZD$111.9 million, or USD$72.7 million, in the full year of fiscal 2019. The decrease was a result of a stock supply issue resulting from low liquidity as well as a strategic decision to exit the U.S. wholesale market and substantially exit the E.U./U.K. wholesale market.

Gross profit totaled approximately NZD$33.8 million, or USD$22.0 million, in the full year of fiscal 2020 as compared to NZD$37.4 million, or USD$24.3 million, in the full year of fiscal 2019. Gross profit margin as a percentage of revenue increased to 37.5% in the full year of fiscal 2020, as compared to approximately 33.5% in the full year of fiscal 2019. The increase in gross margin was driven by a higher margin product mix, retaining room for further improvement as supply issues subside over time.

Operating expenses decreased to NZD$60.28 million, or USD$39.18 million, in the full year of fiscal 2020, compared to NZD$70.82 million, or USD$46.03 million, in the full year of fiscal 2019 which is 15% savings achieved mainly from the restructure of the team and wages, plus renegotiation of contracts.

Total expenses of NZD$87.3 million, or USD$56.8 million, in the full year of fiscal 2020, compared to NZD$87.9 million, or USD$57.2 million, in the full year of fiscal 2019. The decrease in operating expenses was attributable to cost savings in store overheads, reduced marketing spend and a reduced corporate headcount as a result of the Company's strategic turnaround efforts.

Net loss totaled NZD$52.2 million, or USD$33.9 million, in the full year of fiscal 2020, or NZD$34.74, or USD$22.58, per basic and diluted share, compared to a net loss of NZD$49.2 million, or USD$32.0 million, in the full year of fiscal 2019, or NZD$200.77, or USD$130.50, per basic and diluted share.

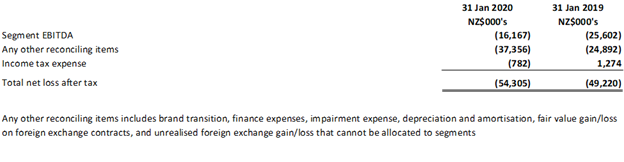

EBITDA loss improved to NZD$16.2 million, or USD$10.5 million, in the full year of fiscal 2020 from NZD$25.6 million, or USD$16.6 million, in the full year of fiscal 2020. See below under the heading "Use of Non-IFRS Financial Information" for a discussion of EBITDA and a reconciliation of such measure to the most comparable measure calculated under IFRS. The recovery of EBITDA was across all segments but in particular across New Zealand retail and Australia and E.U. wholesale, which all posted positive EBITDA.

Cash and cash equivalents at January 31, 2020 totaled NZD$3.8 million, or USD$2.5 million, as compared to $2.0 million, or USD$1.3 million, at January 31, 2019.

The New Zealand Dollar figures in this press release were converted to United States Dollar figures at an exchange rate of USD$0.65 to NZD$1.00.

Further details about the Company's results in the full year of fiscal 2020 are available in the Company's annual report on Form 20-F, which is accessible in the investor relations section of the Company's website at www.nakedbrands.com and through the U.S. Securities and Exchange Commission's website here.

About Naked Brand Group Limited:

Naked Brand Group Limited (NASDAQ:NAKD) is a leading intimate apparel and swimwear company with a diverse portfolio of brands. The company designs, manufactures and markets a portfolio of 8 company-owned and licensed brands, catering to a broad cross-section of consumers and market segments. Brands include Bendon, Bendon Man, Davenport, Fayreform, Hickory, Lovable, Pleasure State and Fredericks of Hollywood. For more information please visit www.nakedbrands.com.

Use of Non-IFRS Financial Information

This document includes "non-IFRS financial measures", that is, financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS. Specifically, we make use of the non-IFRS measures "EBITDA".

EBITDA is defined as earnings before interest, taxes, depreciation and depletion, amortization, brand transition, restructure and transaction expenses, impairment losses, change in fair value losses and gains, and certain other non-cash charges, as set forth in the table below. Our management uses EBITDA as a measure of our operating results and considers it to be a meaningful supplement to loss before income taxes as a performance measurement, primarily because we incur significant depreciation and depletion, impairment losses and other non-cash expenses and charges, as well as significant non-operating expenses, and EBITDA substantially eliminates their impact. The intent of EBITDA is to provide additional useful information to investors. However, the measure does not have any standardized meaning under IFRS. Accordingly, this measure should not be considered in isolation or used in substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate EBITDA differently.

A reconciliation of EBITDA to profit (loss) before income tax, the most directly comparable IFRS financial measure, is as follows:

Forward-Looking Statements:

This communication contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts. Such statements may be, but need not be, identified by words such as ''may,'' ''believe,'' ''anticipate,'' ''could,'' ''should,'' ''intend,'' ''plan,'' ''will,'' ''aim(s),'' '' can,'' ''would,'' ''expect(s),'' ''estimate(s),'' ''project(s),'' ''forecast(s)'', '' positioned,'' ''approximately,'' ''potential,'' ''goal,'' ''pro forma,'' ''strategy,'' ''outlook'' and similar expressions. Examples of forward-looking statements include, among other things, statements regarding continued trading in our securities on Nasdaq, future financial performance, future cost savings, future growth in our business, trends in our industry, product innovation, operational expansion and restructuring initiatives. All such forward-looking statements are based on management's current beliefs, expectations and assumptions, and are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed or implied in this communication. Among the key factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements are the following: the risk that our restructuring initiative and our focus on direct-to-consumer channels does not achieve the expected benefits; the impact of COVID-19; our ability to maintain sufficient inventory; the risk that we do not regain, or do not thereafter maintain, compliance with Nasdaq's continued listing standards; difficulties in maintaining customer, supplier, employee, operational and strategic relationships; the possibility that a robust market for our shares is not maintained; our ability to raise additional financing; our ability to anticipate consumer preferences; and the other risks and uncertainties set forth under ''Risk Factors'' in our Annual Report on Form 20-F for the fiscal year ended January 31, 2020. Further, investors should keep in mind that our revenue and profits can fluctuate materially depending on many factors. Accordingly, our revenue and profits in any particular fiscal period may not be indicative of future results. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise, except as required by law.

Investor Contact:

Chris Tyson

MZ North America

[email protected]

949-491-8235

Consolidated Balance Sheet

As at 31 January 2020 and 31 January 2019

|

|

Note | 31 January 2020 NZ$000's |

31 January 2019

NZ$000's

|

|||||||||

|

Assets

|

||||||||||||

|

Current assets

|

||||||||||||

|

Cash and cash equivalents

|

12 | 3,791 | 1,962 | |||||||||

|

Trade and other receivables

|

13 | 6,057 | 9,650 | |||||||||

|

Inventories

|

14 | 23,539 | 21,120 | |||||||||

|

Current tax receivable

|

4 | 355 | ||||||||||

|

Related party receivables

|

35 | - | 282 | |||||||||

|

Total current assets

|

33,391 | 33,369 | ||||||||||

|

Non-current assets

|

||||||||||||

|

Property, plant and equipment

|

15 | 3,037 | 3,763 | |||||||||

|

Right-of-use assets

|

16 | 23,809 | - | |||||||||

|

Deferred tax assets

|

29 | - | 692 | |||||||||

|

Intangible assets

|

17 | 28,293 | 37,864 | |||||||||

|

Total non-current assets

|

55,139 | 42,319 | ||||||||||

|

Total assets

|

88,530 | 75,687 | ||||||||||

|

Liabilities

|

||||||||||||

|

Current liabilities

|

||||||||||||

|

Trade and other payables

|

19 | 22,430 | 35,545 | |||||||||

|

Lease liabilities

|

22 | 8,112 | - | |||||||||

|

Borrowings

|

20 | 19,215 | 20,967 | |||||||||

|

Derivative financial instruments

|

18 | - | 1,484 | |||||||||

|

Current tax liabilities

|

- | 140 | ||||||||||

|

Related party payables

|

35 | - | 3,738 | |||||||||

|

Provisions

|

21 | 5,844 | 921 | |||||||||

|

Total current liabilities

|

55,601 | 62,795 | ||||||||||

|

|

||||||||||||

|

Non-current liabilities

|

||||||||||||

|

Lease liabilities

|

22 | 17,719 | - | |||||||||

|

Borrowings

|

20 | 19,698 | - | |||||||||

|

Provisions

|

21 | 1,796 | 2,372 | |||||||||

|

Total non-current liabilities

|

39,213 | 2,372 | ||||||||||

|

Total liabilities

|

94,814 | 65,167 | ||||||||||

|

Net (liabilities)/assets

|

(6,284) | 10,519 | ||||||||||

|

|

||||||||||||

|

Equity

|

||||||||||||

|

Share capital

|

23 | 170,193 | 134,183 | |||||||||

|

Other reserves

|

24 | 118 | (2,013 | ) | ||||||||

|

Accumulated losses

|

26 | (176,595) | (121,651 | ) | ||||||||

|

Total Equity

|

(6,284) | 10,519 | ||||||||||

The above consolidated balance sheet should be read in conjunction with the accompanying notes.

Consolidated Statements of Profit or Loss and Other Comprehensive Income

For the Year Ended 31 January 2020, 31 January 2019 and 31 January 2018

|

|

Note |

For the Year

Ended 31 January 2020

NZ$000's |

For the Year

Ended 31 January 2019

NZ$000's

|

For the Year

Ended 31 January 2018

NZ$000's

|

||||||||||||

|

Revenue

|

5 | 90,065 | 111,920 | 131,388 | ||||||||||||

|

Cost of goods sold

|

(56,247) | (74,480 | ) | (87,459 | ) | |||||||||||

|

Gross profit

|

33,818 | 37,440 | 43,929 | |||||||||||||

|

Brand management

|

(35,555) | (49,256 | ) | (53,653 | ) | |||||||||||

|

Administrative expenses

|

(11,837) | (3,432 | ) | (4,131 | ) | |||||||||||

|

Corporate expenses

|

(12,772) | (14,145 | ) | (12,851 | ) | |||||||||||

|

Finance expense

|

7 | (5,213) | (4,041 | ) | (8,791 | ) | ||||||||||

|

Brand transition, restructure and transaction expenses

|

(14,593) | (10,075 | ) | (3,272 | ) | |||||||||||

|

Impairment expense

|

6 | (8,904) | (8,173 | ) | (1,914 | ) | ||||||||||

|

Other foreign currency gains

|

8 | 615 | 1,963 | 757 | ||||||||||||

|

Interest income

|

12 | - | - | |||||||||||||

|

Gain on sale of intangible assets

|

906 | - | - | |||||||||||||

|

Fair value gain/(loss) on Convertible Notes derivative

|

- | (775 | ) | 2,393 | ||||||||||||

|

Loss before income tax

|

6 | (53,523) | (50,494 | ) | (37,533 | ) | ||||||||||

|

Income tax (expense)/benefit

|

10 | (782) | 1,274 | (60 | ) | |||||||||||

|

Loss for the period

|

(54,305) | (49,220 | ) | (37,593 | ) | |||||||||||

|

Other comprehensive income

|

||||||||||||||||

|

Items that may be reclassified to profit or loss

|

||||||||||||||||

|

Exchange differences on translation of foreign operations

|

24 | 2,131 | (7 | ) | 148 | |||||||||||

|

Other comprehensive income/(loss) for the period, net of tax

|

2,131 | (7 | ) | 148 | ||||||||||||

|

Total comprehensive income/(loss) for the period

|

(52,174) | (49,227 | ) | (37,445 | ) | |||||||||||

|

Total comprehensive income/(loss) attributable to:

|

||||||||||||||||

|

Owners of Naked Brand Group Limited

|

(52,174) | (49,227 | ) | (37,445 | ) | |||||||||||

|

Loss per share for profit from continuing operations attributable to the ordinary equity holders of the Group:

|

||||||||||||||||

|

Basic loss per share (NZ$)

|

25 | (34.74 | ) | (200.77 | ) | (179.03 | ) | |||||||||

|

Diluted loss per share (NZ$)

|

25 | (34.74 | ) | (200.77 | ) | (179.03 | ) | |||||||||

On 20 December 2019 the company executed a 1-100 reverse share split reducing the number of shares. The reverse split has also been reflected in the calculation of loss per share for the comparative periods. More details are contained in note 25.

The above consolidated statements of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes.

SOURCE: Naked Brand Group Limited