TALLINN, ESTONIA / ACCESSWIRE / April 28, 2020 / Recently, Eunion has released some key data of platform trading in the past 2 years. As the first platform of the blockchain industry liquidation concept, Eunion's data information has received a lot of market attention.

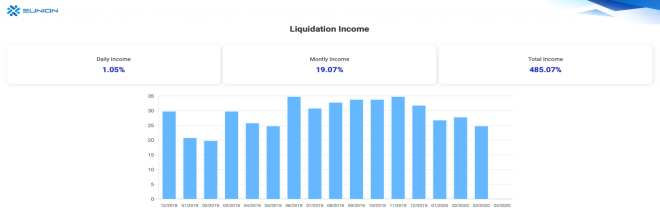

The data shows that from December 2018 to March 2020, Eunion made a profit of 4.66 million RMB through liquidation within 16 months. Among them, the average monthly liquidation income is about 30%, and the total income in 16 months is 466%.

Since the launch of the platform at the end of 2018, Eunion's liquidation margin has remained stable overall. By comparing the transaction scale in the same period of the market, the profit margin is greatly affected by the market transaction scale. This can be explained as when there are many opportunities for liquidation and arbitrage, Eunion's profit margin rises. In contrast, when the market transaction scale shrinks, there are fewer arbitrage opportunities, and the profit margin declines. Despite this, Eunion 's profit margins still able to remain at a relatively high level, reaching 25% per month at its lowest.

1. Interpretation of the project background

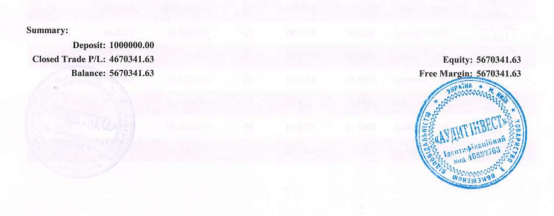

Eunion is a professional-level transaction clearing platform combined with artificial intelligence. It holds MTR licenses and MSB licenses, which are authoritative regulatory licenses in the global financial sector. This means that Eunion's business is subject to the supervision of financial authorities in Europe and the United States. Eunion needs to regularly submit transaction records to the regulatory agency and regularly receive audits from third-party independent licensed audit offices.

Hence, the transaction data published by Eunion is certified by regulatory agencies and third-party audits, which is completely different from most blockchain industry institutions that rely on self-regulation. The following figure is the pipeline record after Eunion has been audited:

In the digital currency business, Eunion uses sub-accounts between different exchanges to take advantage of different prices and rates between exchanges for arbitrage, and finally returns these profits to users. Eunion acts as a clearing agent for exchanges, giving part of the profits to the users that originally belonged to the exchange through liquidation, and at the same time arbitrage between different exchanges provides the market with more liquidity.

Eunion launched the digital currency-related business in 2018, with the core of clearing business. Prior to this, Eunion has been serving clearing services such as securities, stocks, and commodity futures to traditional financial customers.

2. Interpretation of operational data

Among the transaction data being released, the most interesting matter is the revenue and profitability of the platform. Since being launched online, the total revenue has reached 4.66 million RMB. According to the data in the first quarter of 2020, the average profit margin for the quarter was 26.6%, compared with 23.6% in the same period in 2019, an increase of 3% from the previous quarter can be observed.

In the meantime, the digital currency market experienced large volatility. On March 21, most digital currencies fell more than 50% during the day, and the largest decline in March was around 70%. A large number of market makers or exchanges have suffered heavy losses in such dramatic market fluctuations.

Judging from Eunion's operating data, its revenue in March was not affected by the extreme market conditions. It was able to maintain stability and overall grew steadily compared to the same period of last year. Judging from the continuous revenue data, except for fixed personnel and transaction system expenses, Eunion's operating cash flow continues to increase, the profitability is undoubted, and its stability can fully withstand the market crisis.

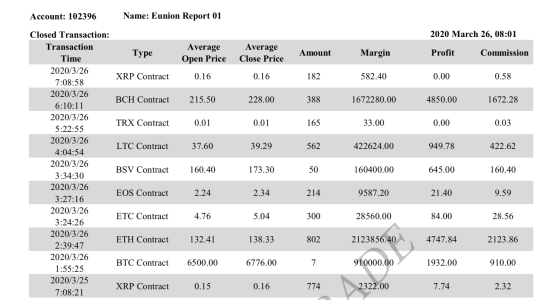

As can be seen from the detailed Eunion core account revenue data released, every clearing transaction of Eunion is almost zero loss, although the profit generated may not be large, the accumulation is very impressive. Its liquidation profit averages between tens to hundreds of dollars, with occasional profits of several thousand dollars. In total, the gains reached 467% in the past 16 months.

According to the operation data in 2020, with the increase of the clearing account principal, Eunion's profitability is accelerating, and the average single income directly increases by an order of magnitude, jumping from an average of several hundred dollars to several thousand dollars. This shows that the larger the scale of the principal held by Eunion, the greater the profit from its liquidation. And it shows a very obvious phenomenon of rolling amplification of earnings. Therefore, it can be determined that with the extension of time, even if Eunion's liquidation scale does not continue to expand, with the existing funds, Eunion's profitability will continue to grow, and the platform's cash flow will increase significantly.

Resulting from the impact of the epidemic in the world recently, most of the performances have been poor. But Eunion's performance in the first quarter was still impressive. For the upcoming business situation, we have reasons to believe that Eunion will not be affected too much by the epidemic, and its profits will continue to expand.

As the first platform for digital currency settlement, Eunion will obviously continue to sing along the existing roads to achieve its own industrial goals, and how far it can go will require the entire industry to wait and see.

Company Name: Eunion

Person:PR Team

Telephone: +37251234567

Company Email: [email protected]

Website: https://www.eunion.trade

SOURCE: Eunion