NEW YORK, NY / ACCESSWIRE / December 20, 2019 / MXC Exchange is brewing a quiet change.

In recent days it seems that MXC Exchange is in line with the bearish momentum and keeps a low profile, but, in real, its pace has not slowed down at all.

The Margin Trading feature that had been tested for many times was launched on November 7. About a month ago, MXC Exchange announced on the official website that it will officially launch the public beta of margin trading at 14:00 (UTC+8), November 7th to provide users with leverage services.

Only five days after the launching of margin trading feature, MXC Exchange, together with Cobo and other 6 institutions jointly launched the Loop Alliance. It solved the problems of transaction congestion, delays and excessive fees in the inter-agency clearing and settlement blockchain network. Transfer between agencies in Loop Alliance is free of delay and service fee. In addition , On December 1, MXC Exchange announced that in November it repurchased and burnt a total of 7,309,567.36 MX. And on December 3, the ETH adding in "PoS Stakings" was announced.

The business of MXC Exchange seems to be rolling out faster than before.

From the launching of the margin trading to joining the Loop Alliance to solve the problem of slow and expensive transfers; from the low-profile repurchase of local token to adding major cryptocurrency in "PoS Stakings" ... MXC Exchange is incorporating the previously unexplored businesses into its strategic layout, trying hard to enrich its ecosystem . Some people have commented that today's MXC Exchange seems to be more robust than several month ago when dauntless effort was made to strive forward. This shall be attributed to the down-to-earth efforts of MXC Exchange around the business and product line.

However, data comparison and scientific method are required to decide whether MXC Exchange is really devoted for the margin product. This article will scientifically evaluate the margin trading of MXC Exchange and analyze its comprehensive strength in detail.

Margin Trading Comparison in a Chart

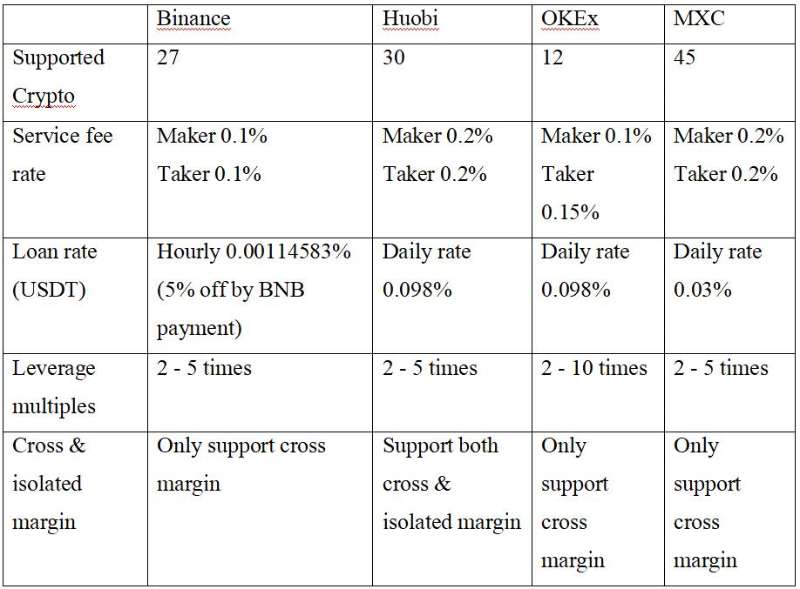

At present, there are many exchanges that support margin trading, so we has selected four major exchanges for comparison. As a digital-currency derivative derived from traditional finance, margin trading can be analyzed in the following five aspects: number of supported currency, funding rate, loan rate, leverage times, and margin mode.

All data of the four exchanges on margin trading is shown below

Please note the following four points:

1. The supported currencies refers to tradable currencies, not the number of trading pairs.

2. The initial funding rate is adopted among the four exchanges, because, though some may provide tiered funding rate system, it is not suitable for ordinary retail investors as it often requires large transaction volume to get the discount rate.

3. In terms of loan rate, the loan rate for USDT is taken for reference because even in a same exchange, different crypto has different loan rate. For example, the loan rate for USDT on MXC Exchange is 0.03%, while for BTC, it is 0.1%.

4. The data in this article is real data. The evaluation analysis is subjective opinion. If you have different views, discussion is welcomed.

Therefore, we will evaluate the margin trading of MXC Exchange from the five perspectives.

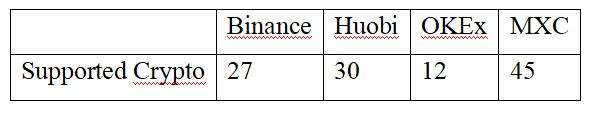

I. Number of Supported Cryptourrencies

According to the official website of MXC Exchange, it added the RVN / USDT trading pair on margin trading on December 9th and the loan for RVN is available with an interest rate of 0.1%. It is the 45th token that MXC Exchange supported in margin trading. As a platform where the margin trading has just been launched for a month, MXC Exchange do make an accomplishment.

Therefore, in terms of quantity, the score shall be:

Binance: ★★★★ ☆

Huobi: ★★★★ ☆

OKEx: ★★★ ☆

MXC Exchange: ★★★★★

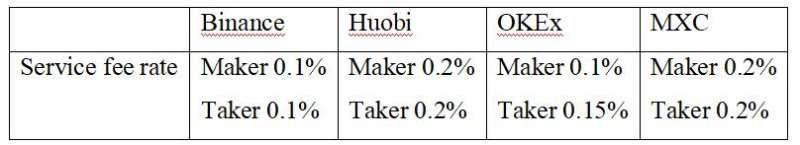

II. Service Fee Rate:

As one of the key points of comparison, funding rate is often easily overlooked by traders, but it is an important part for comparison.

The service fee rate for margin trading on MXC Exchange is the same as that of the spot trading. That is 0.2%. In other word, $2 will be charged for every $1000 transaction, and of course, the loan is included. This fee rate is generally adopted by many exchanges.

After comparing with other exchanges, the service fee rate of MXC Exchange is not favorable.

In terms of fee rate, Binance is the lowest, with both Maker and Taker reaching 0.1%. In addition, with BNB payment, the fee can also be deducted 25% off. OKEx is followed by Maker0.1% and Taker0.15%. However, in term of tiered fee rate, it is necessary to hold a certain amount of OKB to enjoy discount, so there is no advantage compared to Binance. Although the fee rate on MXC Exchange is 0.2%, it supports MX token payment with a discount of 20%. It is 0.16% after discount. Finally, the fee rate of Huobi is also 0.2%. Users who have to hold a certain amount of HT to enjoy its tired fee rate preference.

In the perspective of ordinary retail users, the score for the exchanges shall be:

Binance: ★★★★★

Huobi: ★★★☆

OKEx: ★★★★☆

MXC Exchange: ★★★★

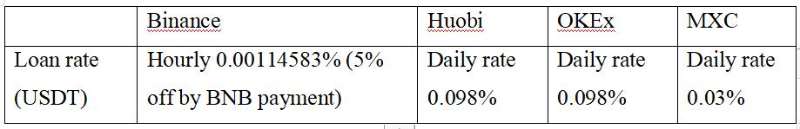

III. Loan Rate

As to the margin trading, the loan rate is definitely a field that every exchange will compete against. However, because different currencies have different loan rates on the same exchange, the loan rate of USDT among the exchanges are taken for comparison.

As shown in the table above, except for Binance's hourly rate, the mainstream loan rates in the market are daily rates.

Binance's daily interest rate is about 0.0275%, the lowest in the market, and 0.03% of MXC Exchange is close behind. OKEx and Huobi's 0.098% are higher than the previous two. However, holders of HT can enjoy tired loan rate , where high as 65% discount can be offered for holders of more than 5000 HT.

In terms of loan rate, the scores are:

Binance: ★★★★★

Huobi: ★★★★

OKEx: ★★★★

MXC Exchange: ★★★★☆

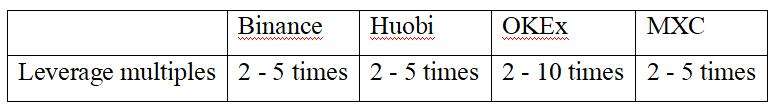

IV. Leverage Multiples

Margin trading is not the same as a futures contract. Futures contracts are a type of agreement, with multiples ranging from 10 to 100; margin trading is more like spot trading, with multiples ranging from 2 to 5 times.

The leverage multiples of margin trading on MXC Exchange is the same as the prevailing leverage multiples on the market, which are basically 2-5 times. OKEx, which has a long operating time for margins and futures, is more aggressive than other trading platforms, and the leverage multiple is higher.

Although it increases some of the risks, it also provides users with greater choice.

The scores on this perspective shall be:

Binance: ★★★★

Huobi: ★★★★

OKEx: ★★★★☆

MXC Exchange: ★★★★

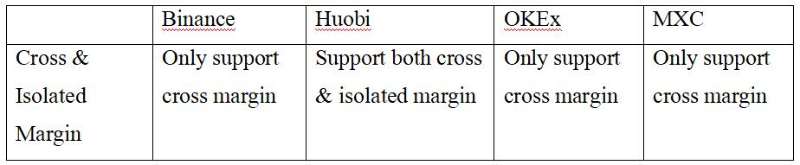

V. Margin Mode

In contract trading, cross margin and isolated margin are often mentioned. In terms of cross margin, the margin is shared between open positions. When needed, a position will draw more margin from the total account balance to avoid liquidation. In terms of isolated margin, the margin assigned to a position is restricted to a certain amount. If the margin falls below the Maintenance Margin level, the position is liquidated. However, you can add and remove margin at will under this method.

The margin mode for margin trading is similar. According to the official announcement and data, MXC Exchange margin trading now only supports cross margin. Compared to Huobi where both cross and isolated margin are available, there is still room for improvement.

In this part, the score shall be:

Binance: ★★★★

Huobi: ★★★★★

OKEx: ★★★★

MXC Exchange: ★★★★

Comprehensive Analysis

As the main character of the article, the margin trading on MXC Exchange is not inferior to that of the long-established trading platform in data analysis. And do remember that its margin trading module is only launched for one month. High-efficiency and strong execution are the advantages of MXC Exchange. In addition, it pays more attention on qualities instead of quantity and speed.

MXC Exchange is steadily walking on a path of excellence where it delivers determination to get out of the bearish market trend.

Organization: MXC PRO FOUNDATION LTD

Email: [email protected]

Media Relation

800-2365-8932

Website: www.mxc.com

SOURCE: MXC PRO FOUNDATION LTD