NEW YORK, NY / ACCESSWIRE / September 24, 2019 / Greenland Acquisition Corp. ("GLAC"), a Nasdaq Capital Market quoted SPAC or special purpose acquisition company incorporated on Dec. 28, 2017, signed a share exchange agreement on July 12, 2019 to acquire 100% of the issued and outstanding capital stock of Zhongchai Holdings ("Zhongchai").

Under the terms of the agreement, GLAC will acquire all of the outstanding equity interests of Zhongchai from its existing shareholders, in exchange for 7.5 million newly issued ordinary shares of GLAC, where Zhongchai's initial shareholders will roll 100% of their equity holdings into the transaction, in order to receive a total of 7.5 million equity shares. Of which, 10% of the 7.5 million shares (or 750,000 shares) will be put under escrow account for 18 months from the closing as security for the indemnification claims. Upon closing, Zhongchai will become a wholly-owned subsidiary of GLAC, and Zhongchai's majority owned subsidiaries will become the operating entities of the Company., Subsequently, Zhongchai's initial shareholders would own an aggregate stake of 67% of the newly created company at closing, and an ownership of 69% when the escrowed shares are released in 18 months, subject to the satisfaction of customary closing conditions.

Zhongchai Holding Company Highlight

Incorporated under Hong Kong laws on April 23, 2009, Zhongchai Holding is a leading provider of transmission system for the material handling equipment market in China. The company conducts its business through four subsidiaries in China, whose transmission products are used as the key components for forklift trucks used in manufacturing, industrial and logistic applications. Zhongchai is a high-tech company garnering many patents and intellectual properties, and has completed a prototype of Robotic Cargo Carrier in August 2018. The conceptual prototype targets the same market segments as the company's transmission systems, and soon can be commercialized with the first production-ready sample expected to complete in late 2019.

Founded and managed by proficient industry veterans of proven track record

Zhongchai was founded by Peter Wang, an industry veteran who co-founded Unitech Telecom ("UT"), which was then merged into UTStarcom, a Chinese tech/telecom company traded under ticker UTSI on Nasdaq. Mr. Wang has an unique background that combines more than 20 years of experience in technology, R&D, operation, finance, and management. Mr. Wang received his BS and MS from University of Illinois, as well as an MBA degree from Nova Southeastern University. Mr. Wang also worked at AT&T Bell Labs as researcher in his early career.

Following the GLAC acquisition, Zhongchai's key executives are expected to remain as key executives of the combined company to continue driving business growth, by tapping into the resources from the public capital markets to speed up the innovations to traditional transmission products as well as robotic cargo carriers. With a widely-recognized brand in China, a growing customer base, a strong R&D team and a new commercial ready robotic product.

Strong technological innovation and product development capabilities

As of June 2019, Zhongchai held 85 registered patents, including 75 utility patents under the China National Intellectual Property Administration and 10 invention patents. Zhongchai's intellectual property consists of a portfolio of patents, trade markets and proprietary design specifications. These IPs, together with its strong product development and manufacturing capabilities have made Zhongchai highly valuable in the industrial and logistic markets.

Customer, Product Portfolio, Production Capacity, Service & Support

Broad customer base of leading manufactures - Zhongchai has an established customer base of over 100 major original equipment manufacturers ("OEM") and system integrators in China. The company enjoys existing brand's leadership through developed long-term relationship with the leading manufacturers, such as Linde, HELI, Modern Hailin, Maximal, Shantui, JAC, XGMA, GoodSense, etc., which could further support its expansion into new product categories.

High quality product portfolio serving forklifts industry needs - Zhongchai provides a comprehensive, high-quality product portfolio consisting of 14 mechanical-gearbox models, 18 hydraulic-gearbox models, and 3 transaxle models over a range of different rated speeds, transmission ratios and torque co-efficiencies that are geared to serve the industry needs of forklifts.

Efficient production capabilities catered for growing market opportunities - Zhongchai has ~44,751 square meters of modern, efficient manufacturing facilities valued at around $35 million, and is projected to provide an annual production capacity of up to 200,000 transmission systems, as well as 10,000 robots.

Strategically positioned service network with national coverage - With the extensive areas covered by its service centers, Zhongchai is able to offer its customers with prompt on-site service & training and after-market support within 24-48 hours, allowing fast response to the customer needs, which in turn has helped building close customer relationship and loyalty.

New Robotic Products Creating Strategic Growth Opportunity

On the back of ever-rising labor cost and subpar manual performance, the needs for factory/warehouse automation to effectively implement material handling have never been greater, prompting insatiable demand for the robotic material handling equipment.

In order to capitalize on such mounting demand by the industrial and logistic applications, Zhongchai has been engaging in the design and manufacture of robotic material handling equipment, enabled by its technological advancement and manufacturing efficiency. Subsequently, the company rolled out a new product prototype of Robotic Cargo Carrier ("RCC") in late 2018, presenting a substantial business growth opportunity for Zhongchai when the commercial-grade RCC products expected to hit the China market towards the end of 2019.

RCC products are geared to target the similar customer base of Zhongchai's existing industrial users, with customer service, support and training continuous to be met by the company's existing, strategically located service network. Additionally, as the company has already earned brand loyalty from its existing clients, the incremental sales & marketing costs could be significantly reduced. And with its well-established supply chain, Zhongchai is able to provide highly cost-effective products outperforming other technology-based competitors.

The first commercial product to hit the market, RC 1000, is expected to come with an advanced wheels setup, making it highly adoptable and readily for use by a wide range of warehousing conditions. Management is confident that the company could effectively deliver high-quality products that differentiate from other competitors, with its unique chassis designs to address the under-served yet rapidly growing market of high precision manufacturing and heavy payload market, ranging from 100kg to 5 tons.

RC 1000 Model Specs - Expected Releasing Date: By End of 2019

Forklift & LogisticsGrowth Drivers & Market Potential

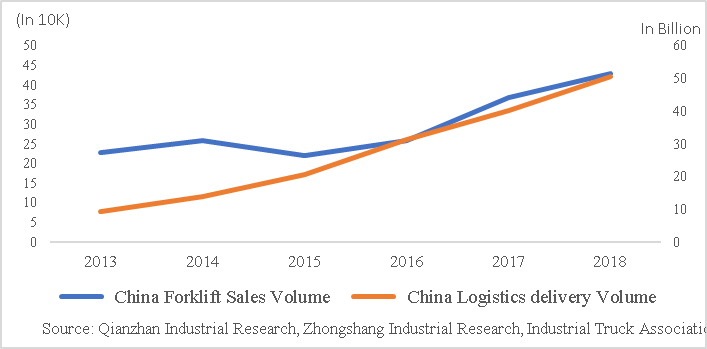

In terms of total global forklift-truck sales, China has been the number 1 since 2017, and accounted for around 33% of the global market in 2018. The overall demand on forklift trucks has been fairly consistent in China, with sales increase mainly attributable to the electric-driven portions.

According to CCMA study, China forklift-truck unit sales are expected to reach 2.7 millions in 2020, implying an annual growth of around 10%.

Zhongchai to benefit from positive correlation between forklift trucks & logistic industry growth

There also exists strong positive correlation between growing demand on forklift trucks and growth in China's logistic industry. Growth in China's logistic industry would put China's forklift trucks sales on the positive trajectory, which in turn would benefit the company's transmission systems product sales.

Correlation between China Forklift Trucks Sales & Logistics Delivery Volume

Global Robots (Service Robots, Industrial Robots, Cobots)

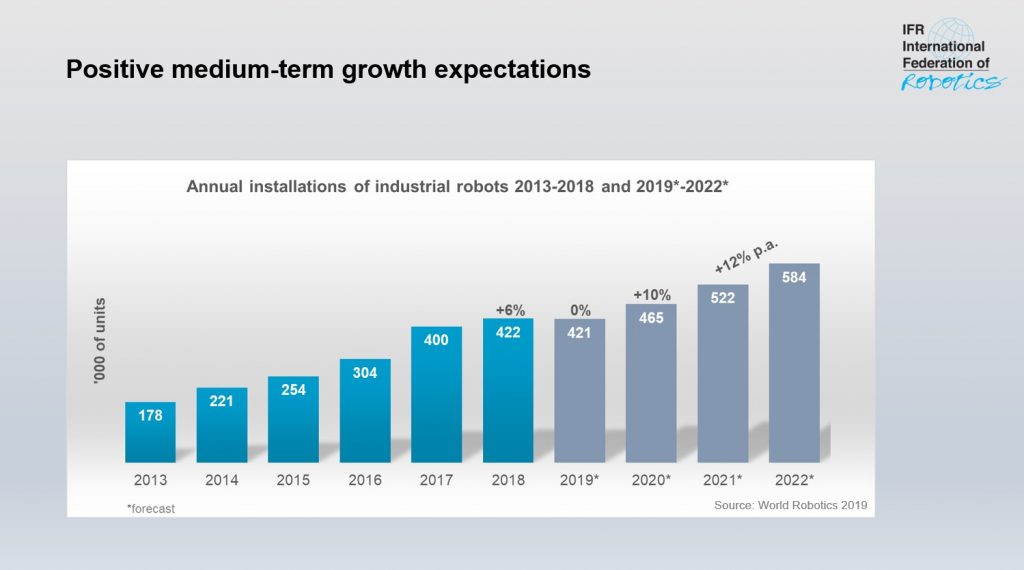

IFR's (International Federation of Robotics) World Robotics report showed that the global sales of robots, including service robots, industrial robots and cobots hit $16.5 billion in 2018, with shipment increased to 422,000 units, an increase of 6% from 2017. The report expects the global sales to grow at an average annual rate of 12% from 2020 to 2022, despite of a temporary pause anticipated in 2019, flat from the record levels reached in 2018.

Five major markets represent 73% of the total global robots sales volume in 2017, namely China, Japan, South Korea, the United States and Germany. China has been the biggest robot market in the world since 2013, and remains the world's largest industrial robot market as of today. Yet, the nation's robot density remains relative low at 97 units per 10,000 workers, compared to market leaders like South Korea, Singapore and Germany. The low robot density has positioned China to lead the demand for robots use in the next few years, creating substantial growth opportunity for the industrial robots market.

Industrial Robots - Fast Growing Logistics Robotic AGV Market

According to IFR, the worldwide industrial robot sales reached a record 380,555 units in 2017, an impressive YoY increase of 29%, however followed by a merely 1% YoY increase in 2018, mainly dragged by the decline in China auto sales whereas the auto industry remained as the top robots adopter globally, accounting for ~30% of the total supply in 2018, followed by the Electronics industry.

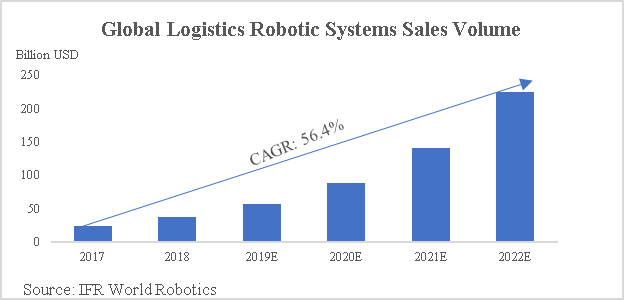

IFR report also showed that logistics systems, such as autonomous guided vehicles (AGVs), represented 41% of all units sold in 2018, followed by inspection and maintenance robots (39%). Logistics systems sales volume and unit grew to $3.7 billion and 111,000 in 2018, representing a 53% and 60% growth from 2017, respectively, mainly driven by warehouse solutions for major e-commerce companies, according to IFR. Overall, logistic systems are the main value growth drivers for the professional service robots, and are expected to grow at a CAGR of ~56% 2017-2022e.

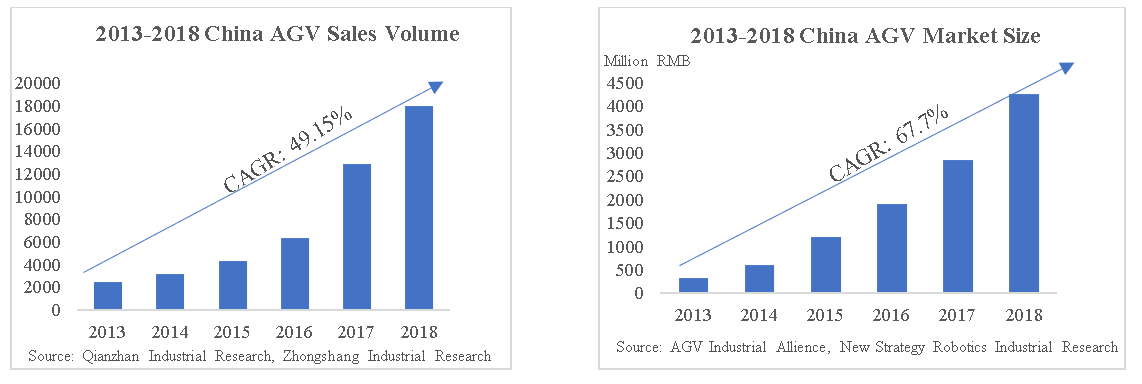

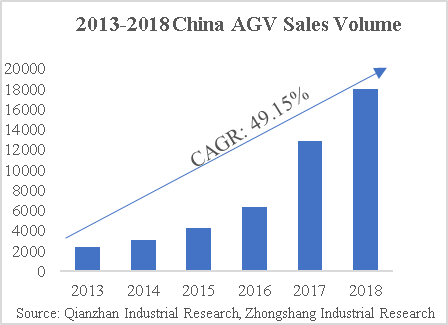

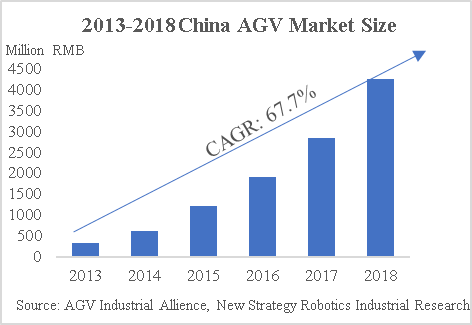

Near 68% of the global logistics systems sales were from AGV market alone in 2018, valued at USD 2.49 billion. The global AGV market size is projected to expand at a CAGR of 15.8% from 2019 to 2025 to reach USD 7.28 billion by 2025, and among which, Chinese AGVs sales volume and revenue are expected to expand at a CAGR of 30.3% and 25.0% respectively from 2013 to 2020, as majority of the factories in China have been seeking to maximize productivity and efficiency by limiting human intervention and potential errors caused by labor-intensive efforts.

Zhongchai to benefit from strong AGV logistic systems sales growth

The company's Robotic Cargo Carrier ("RCC") products would help companies with operating cost reduction, workforce safety improvement, productivity enhancement, and are strategically set to benefit from the rapid growth of e-commerce companies leading to the robots market growth, as well as the increasing need for automation in maritime applications.

Financial Highlights

Proven historical growth - The company's revenues increased 23% YoY to ~$60.2 million in 2018 from ~$49.1 million in 2017. Zhongchai also turned profitable in 2018, with net income increased to ~$6.6 million and EBITDA reaching ~$10.3 million.

Substantiated growth momentum - On pro-forma basis, the company expects its revenue to grow to ~$67 million and ~$74 million in 2019e and 2020e, respectively, representing a 2-year CAGR of ~11%. Net income and EBITDA are expected to grow to ~$6.8/$11 million in 2019e and ~$8.8/$14.2 million in 2020e, representing a 2-year CAGR of 15.4% and 17.6%, respectively. Growth margin is expected to further improve to ~25% in 2020 from ~22% in 2019.

CONTACT:

[email protected]

SOURCE: Stone Street Group LLC