VANCOUVER, BC / ACCESSWIRE / September 4, 2019 / Dimension Five Technologies Inc. (CSE:DFT) (the “Company”), is pleased to announce that it has entered into a non-binding letter of intent dated September 03, 2019 (the “LOI”) with Emergent Waste Solutions Inc. (“EWS”) regarding a proposed transaction to acquire all of the issued and outstanding securities of EWS (the “Transaction”). The Company will have until October 31, 2019 (or such other date as agreed to by the parties) to conduct due diligence on EWS, with a view to negotiating the terms of a definitive agreement (the “Definitive Agreement”) in order to complete the Transaction.

About Emergent Waste Solutions Inc.

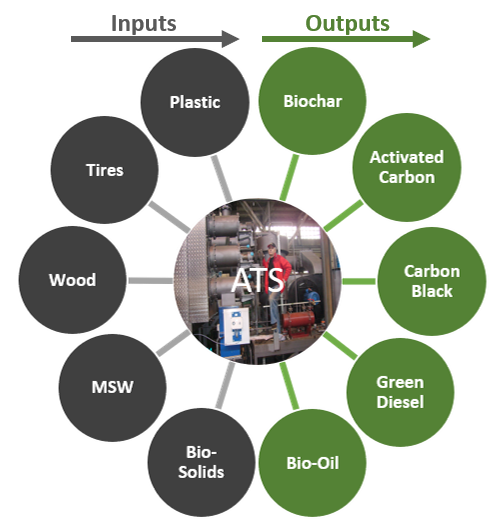

EWS is a British Columbia company with the exclusive Canadian rights to market and deploy the world leading Advanced Thermolysis System (“ATS”) technology. The ATS is an innovative, secure, efficient and proven method incorporating a combination of medium and slow thermolysis systems for the converting of waste materials into marketable products, such as activated carbon, carbon black, biochar, syngas and fuel oil.

The ATS technology is designed to answer the global challenge of waste disposal by utilizing an efficient, cost effective and waste conversion process that is safe, non-polluting, non-toxic and compatible with all environmental standards. The ATS plant is able to convert a variety of carbon-based waste materials such as: municipal solid waste, petrochemical compounds, plastic waste, biomass, animal waste, electronic waste, coal and used tires into marketable products while eliminating residual waste.

Market Data for Manufactured Products:

- Retail prices for biochar, especially when in a mix with other elements, such as compost, average $7,000/tonne, not only in Canada, but the USA and UK as well.

- To secure more market for our biochar EWS has created three Grow Medium Blends for home and commercial use that incorporate 10% biochar; the Company is maintaining a price point of $2,600 per tonne for the biochar.

- EWS has secured a Canadian wholesaler in the in-door growing market and has done market testing in the Garden Centres and Landscape Supply marketplace. EWS is currently in talks with a second wholesaler

- Other markets and products have been identified and will be considered for development in the future

Market Data for Biochar:

- The global biochar market grew from USD 572.76 million in 2015 to USD 1.48 billion in 2018 and is expected to reach USD 3.82 billion by 2025, at a compound annual growth rate (CAGR) of 14.5% between 2019 and 2025.

- North American countries (the U.S., Canada, and Mexico) are increasingly investing in biochar in industries (pharmaceuticals, agriculture, etc.), which is anticipated to further this regional market’s growth in the years ahead.

- Agriculture emerged as the largest application segment in 2015 and is estimated to generate revenue over USD 2.44 billion by 2025.

The Asia Pacific biochar market is anticipated to be the fastest growing in the future, owing to the increasing biochar demand from food, pharmaceutical, agricultural, and clinical sectors. Strict environmental regulations, increasing use of biochar as livestock feedstock, growing demand for organic farming and its use as waste management material are expected to propel the Asia Pacific biochar marker over the forecast time period. It is expected to grow at a CAGR of 15.6% from 2016 to 2025.

EWS has commissioned and commercially tested an ATS500 plant in Canada. After thorough testing, this plant has been relocated to the Hope BC area in a partnership with Yale First Nation; it is slated for recommissioning and commercial operation within a few weeks.

EWS is already in talks with two municipalities and a First Nation here in Canada to manage their waste challenges with our ATS solution.

The Transaction

Subject to the execution of a Definitive Agreement, the Company proposes to acquire all of the issued and outstanding common shares of EWS in exchange for common shares of the Company (the “Payment Shares”). The Payment Shares would be issued to the shareholders of EWS on a basis to be negotiated, based on the relative values of the companies. In addition, all the outstanding convertible securities of EWS, if any, would, subject to the rules of the Canadian Securities Exchange (the “CSE”), be exchanged for convertible securities of EWS on economic terms and conditions to be consistent with the share exchange ratio.

On or before the closing of the Transaction, it is proposed that the Company or EWS will complete an equity financing of common shares or units (common shares and common share purchase warrants) (the “Concurrent Financing”) by way of a non-brokered private placement to raise a minimum of gross proceeds of CAD$500,000 and a maximum of CAD$800,000 at an intended price per security to be mutually determined by the parties.

The Transaction is conditional upon, among other things:

i. the parties will have received all necessary regulatory and third-party consents, approvals and authorizations as may be required in respect of the Transaction, including, but without limitation, acceptance of the CSE;

ii. completion of due diligence to the satisfaction of the parties;

iii. negotiation of business terms and approval by the boards of directors of each of D5 and EWS to final terms and conditions of the Transaction as set forth in the Definitive Agreement and all other necessary matters related thereto prior to the signing of the Definitive Agreement;

iv. the signing of the Definitive Agreement;

v. completion of all matters, and the satisfaction of all conditions (unless waived in writing), under the Definitive Agreement required to be completed or satisfied on or before closing of the Transaction including but not limited to: receipt by EWS of a loan of $20,000 from D5 used for the audit and legal fees of EWS; completion of the Concurrent Financing; and D5 consolidating its common shares on the basis of one (1) post-consolidation common share for every two and one-half (2.5) pre-consolidation common shares; and

vi. the shareholders of EWS, and if required, the shareholders of D5, will have approved the Transaction and any and all matters in connection therewith pursuant to applicable laws and the rules and policies of the CSE.

In connection with the Transaction, it is intended that the Company will be re-named as the parties may reasonably agree upon and as is acceptable to the CSE (the “Resulting Entity”). Upon completion of the Transaction the Resulting Entity will carry on the business currently conducted by EWS and will cease to carry on the business currently being conducted by D5. It is also intended that concurrent with the closing of the Transaction, the board of directors of D5 will be reconstituted as determined by the parties through negotiation.

Additional Information

Further details regarding the proposed Transaction and the Resulting Entity will be provided in a comprehensive news release if and when the parties enter into a Definitive Agreement. If completed, the Transaction will constitute a “Fundamental Change” pursuant to CSE policies.

The Definitive Agreement will incorporate the principal terms of the Transaction described herein, and in addition, such other terms and provisions of a more detailed structure and nature as the parties may agree upon after receiving further tax, legal and financial advice from their respective advisers. However, there is no assurance that the Definitive Agreement will be successfully negotiated or entered into.

About us

Dimension Five Technologies Inc., based in Vancouver, British Columbia, Canada, is currently developing a new investing platform that helps connect early stage companies with investors. Over time, the Company also intends to focus on developing, marketing and acquiring other software in the investment and financial technology sector. Additional information on Dimension Five is available on the company’s website at http://www.dimensionfive.ca.

For further information, please contact:

Chris Parr, CEO

[email protected]

The Canadian Securities Exchange has not reviewed, nor approved the contents of this news release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities law and may not be offered or sold in the “United States”, as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration requirements is available.

Forward-Looking Statements

Completion of the Transaction is subject to a number of conditions, including but not limited to, successful due diligence, successful negotiation of major business terms and specific agreement terms, CSE acceptance and, if applicable, pursuant to the requirements of the CSE, shareholder approval by a majority of the minority of shareholders. There can be no assurance that the Transaction will be completed as proposed or at all.

Trading in the securities of the Company should be considered highly speculative.

All information in this news release concerning EWS has been provided for inclusion herein by EWS. Although the Company has no knowledge that would indicate that any information contained herein concerning EWS is untrue or incomplete, the Company assumes no responsibility for the accuracy or completeness of any such information as the Company has not completed due diligence on EWS.

Investors are cautioned that, except as disclosed in the listing statement or information circular to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon.

Statements about the execution of a Definitive Agreement, closing of the Transaction, expected terms of the Transaction, the number of securities of the Company that may be issued in connection with the Transaction, the ownership of the Company, the requirement to obtain shareholder approval, if applicable, the terms of and the completion of the Concurrent Financing, the Company’s share consolidation and the parties’ ability to satisfy any and all other closing conditions, and receive necessary regulatory and CSE approvals in connection therewith and anticipate costs and the ability to achieve goals are all forward-looking information. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include, failure to negotiate the substantive business terms, items of due diligence presenting challenges to closing that cannot be overcome, failure to get financing as required, failure to get required shareholder approval and if required by the Exchange, failure to get a majority of the minority shareholder approval, failure to obtain regulatory approval, the continued availability of capital and financing, and general economic, market or business conditions, changes in legislation and regulations, failure of counterparties to perform their contractual obligations, litigation, the loss of key directors, employees, advisors or consultants and fees charged by service providers. The Company assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company’s forward-looking statements.

(Not for dissemination in the United States of America)

SOURCE: Dimension Five Technologies Inc.