VANCOUVER, BC / ACCESSWIRE / July 28, 2019 / Doubleview Capital Corp. (“Doubleview”) (“the Company”) (TSX-V: DBV, OTC: DBLVF, FRANKFURT: 1D4) is pleased to announce a proposed $1,000,000 unit financing at $0.10 per unit for a proposed drilling exploration program on its 100% owned Hat Gold-Copper Porphyry project in Northern British Columbia. Furthermore, the Company announces that the Hat project option to joint venture agreement with Hudbay Minerals Inc. (“Hudbay”) is now terminated.

“Doubleview’s management is excited to resume its own exploration on the Hat Gold-Copper Porphyry property. Over the past year, Hudbay has provided tremendous geological and exploration insight to the Hat project with approximately $1.2 million expenditures without any dilution to the share capital or Doubleview’s property interest. Hudbay’s technical expertise has provided important new interpretations of the Hat Property, geophysics and geology and the development of exciting new exploration targets.” stated Doubleview’s President and CEO, Farshad Shirvani.

Further, he added that “the Company and its shareholders still retain a 100% interest in the Hat Property and have the opportunity to explore a number of recently developed drill targets, to further develop the Lisle Zone and several areas of high potential.

For Doubleview this change of events comes at an opportune time when: (1) a renewed interest in above average grade copper - gold porphyries is evolving due to the resumption of drilling on GT Golds Saddle Property, and (2) there appears to be renewed interest on the part of the investing public in junior resource sector.

Thus, with its current cash position, a new financing and resumption of management of the Hat Project, Doubleview is in a better position to expeditiously develop the Hat project with its >1000m IP target.”

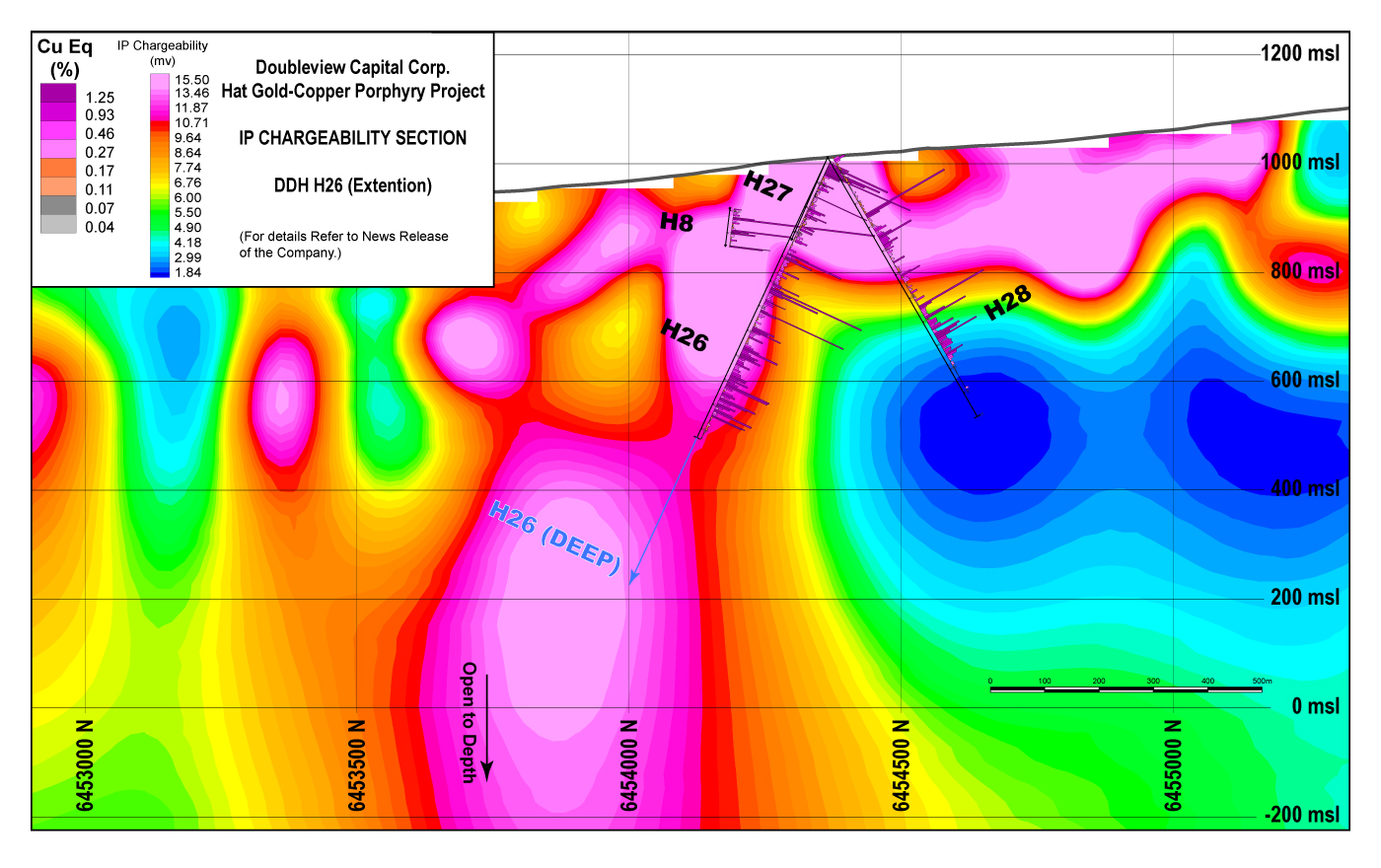

As previously announced, the following table and diagrams illustrate the proposed drill program:

|

Drill Hole

proposed

|

Easting (m) | Northing (m) | Elevation (m) |

Azimuth

(d)

|

Dip

(d)

|

Depth

(m)

|

Comment

|

||||||||||||||||||

|

Hole H26 - Deep

|

348024 | 6454385 | 1005.0 | 180 | -60 | 868 |

Re-enter hole 26, originally drilled to 568.5m, and add 300m to test deeper continuity of central Lisle mineralization as indicated by 3D IP

|

||||||||||||||||||

|

PP-DDH-A

|

348055 | 6454681 | 1031.5 | 45 | -60 | 350 |

Drill 350 m into SW part of Anomaly-A as an initial test of a strong chargeability and magnetic feature

|

||||||||||||||||||

|

PP-DDH-B

|

347500 | 6454800 | 1018.8 | 45 | -60 | 400 |

Drill 400 m into NE part of Anomaly-A where strong Cu and Au soil geochemistry is combined with a chargeability feature.

|

||||||||||||||||||

|

PP-DDH-C

|

348348 | 6454186 | 1000.0 | 225 | -70 | 500 |

Drill 500 m to test a deep-rooted easterly extension of the Lisle Zone as indicated by chargeability data and geologic modelling

|

||||||||||||||||||

|

PP-DDH-D

|

347875 | 6453950 | 957.7 | 225 | -70 | 500 |

Drill 500 m SW into chargeability feature that extends the Lisle Zone

|

||||||||||||||||||

|

PP-DDH-E

|

347475 | 6454025 | 960.7 | 45 | -70 | 400 |

Drill 400 m into westerly continuation of the Lisle SW chargeability feature (see above), towards modelled potassic alteration and monzonite intrusion

|

||||||||||||||||||

|

PP-DDH-F

|

346568 | 6453758 | 987.6 | 290 | -60 | 600 |

Drill 600 m into SW diorite/hornfels contact zone with deep chargeability root

|

||||||||||||||||||

Table 1. Proposed Drill Holes

The proposed drill holes will be guided by 3D IP and geochemical sampling that revealed the potential extension to depth of the deposit.

Doubleview is planning the resumption of a drill program to test the new geological model of the Hat deposit develop by Hudbay Minerals.

The following illustrations show the proposed drill plan and section plotted the proposed H26 Extension.

Figure 1. Induced Polarization - Chargeability Plan at 300m (mean sea level)

Figure 2. Vertical Section - Lisle Zone

Private Placement Financing

As set out above, Doubleview also announces that it proposes to complete a non-brokered private placement of up to 10,000,000 units at $0.10 per unit for gross proceeds of $1,000,000. Each unit consist of one share and one share purchase warrant, with each warrant entitles the holder to purchase an additional share at $0.15 per share for a period of two years from the date of issue.

Doubleview may pay a finder’s fee on the financing. Closing of the financing is subject to approval of the TSX Venture Exchange.

Qualified Person

Mr. Erik A. Ostensoe, P. Geo., a consulting geologist and Doubleview’s Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder.

About Doubleview Capital Corp.

Doubleview Capital Corp., a mineral resource exploration and development company, is based in Vancouver, British Columbia, Canada, and is publicly traded on the TSX-Venture Exchange [TSX-V: DBV], [OTCBB: DBLVF], [GER: A1W038], [Frankfurt: 1D4]. Doubleview identifies, acquires and finances precious and base metal exploration projects in North America, particularly in

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Capital Corp.

409 Granville St., Suite #880

Vancouver, BC V6C 1T2

Farshad Shirvani, President & CEO

T: (604) 689-9523

E: [email protected]

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: Doubleview Capital Corp.