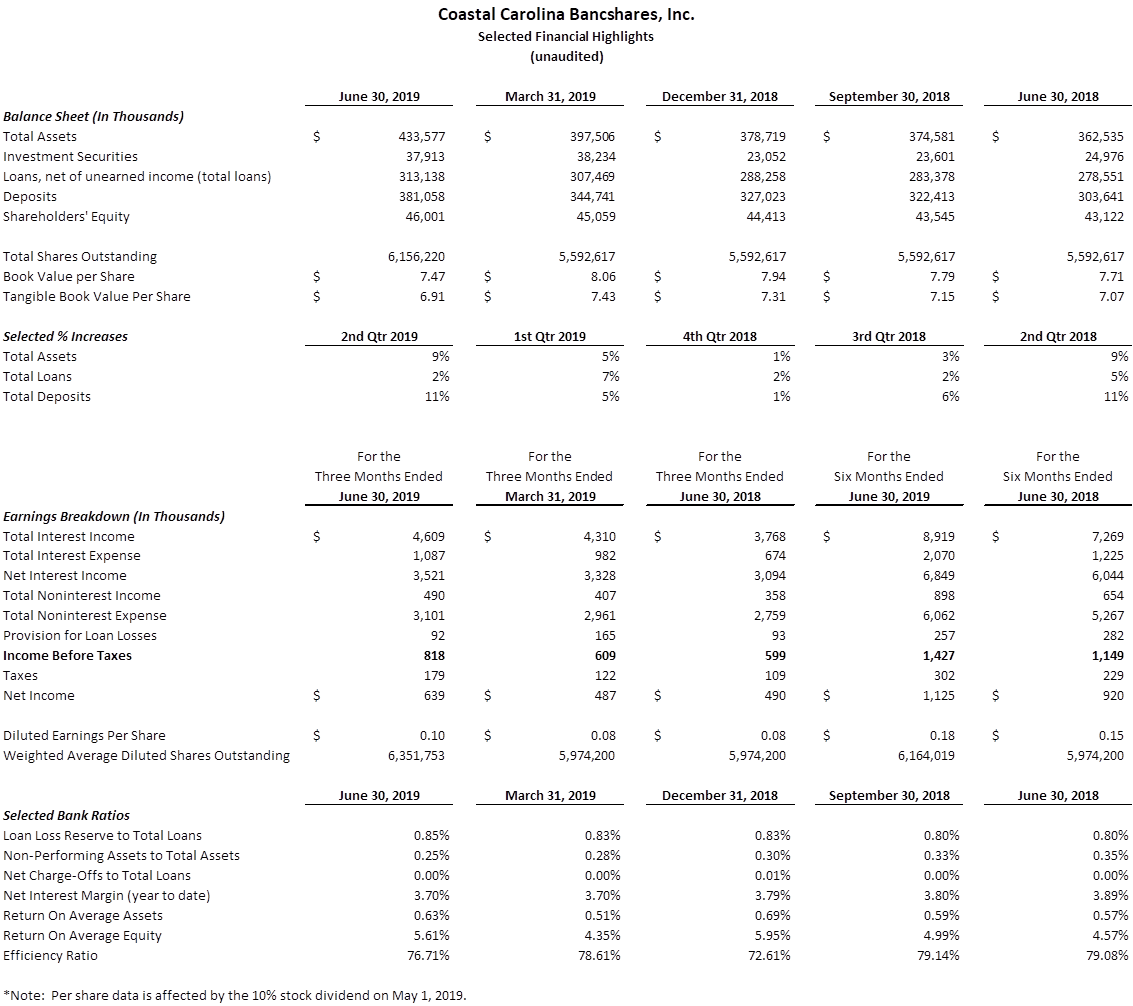

MYRTLE BEACH, SC / ACCESSWIRE / July 26, 2019 / Coastal Carolina Bancshares, Inc. (the “Company”) (OTCQX: CCNB), parent of Coastal Carolina National Bank (“CCNB”), announced today net income of $1,125,445 or $.18 cents per diluted share for the six months ended June 30, 2019 compared to $920,402 for the same period one year ago. Net income for the three months ended June 30, 2019, was $638,547 or $.10 cents per diluted share, compared to $489,874 for the same period one year ago. Net income for the six months ended June 30, 2019, represents a 22% increase and net income for the three months ended June 30, 2019, represents a 30% increase when compared to the same periods in 2018.

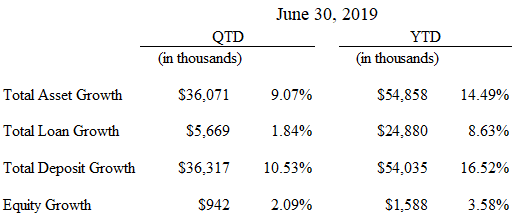

Key Balance Sheet Highlights:

“We are very pleased with our strong financial performance in the second quarter of 2019,” says Laurence S. Bolchoz, Jr., President and Chief Executive Officer of the Company and the Bank. “We experienced dramatic asset and deposit growth of $36 million by continuing our focus on establishing quality retail and commercial deposit relationships in all of our markets. Our deposit growth for the quarter was bolstered by a large temporary deposit of approximately $8 million on the last day of the quarter. Excluding this temporary deposit, we still had $28 million in deposit and asset growth figures for the quarter, which is quite significant. Our diligent focus on deposit generation continues to provide good results in a very competitive environment. We also had solid loan portfolio growth of $6 million in the second quarter and $25 million for the first six months of 2019. We continue to grow our loan portfolio while maintaining very strong asset quality as evidenced by our excellent credit quality metrics. I am very proud of our entire CCNB team for the way they continue to demonstrate daily our “We Can Do That” spirit by going the extra mile to provide exemplary customer service to our clients. As a true community bank, we are eager to assist our clients in meeting their financial needs while we enhance value for our shareholders,” says Bolchoz.

About Coastal Carolina Bancshares, Inc. Coastal Carolina Bancshares, Inc. is the bank holding company of Coastal Carolina National Bank, a Myrtle Beach-based community bank serving Horry, Georgetown, Aiken, Richland, Lexington, Greenville (SC), and Brunswick (NC) counties. Coastal Carolina National Bank is a locally operated financial institution focused on providing personalized service, and offers a full range of banking services designed to meet the specific needs of individuals and small and medium-sized businesses. Headquartered in Myrtle Beach, SC, the Bank also has branches in Garden City, North Myrtle Beach, Conway, Aiken, Columbia, and Greenville, South Carolina. Through the substantial experience of our local management and Board of Directors, Coastal Carolina Bancshares, Inc. seeks to enhance value for our shareholders, build lasting customer relationships, benefit our communities and give our employees a meaningful career opportunity. Coastal Carolina Bancshares, Inc. common stock currently trades on the OTCQX market under the symbol “CCNB”. To learn more about the Company and its subsidiary bank, please visit our website at www.myccnb.com.

Forward-Looking Statements Except for historical information, all of the statements, expectations, and assumptions contained in this press release are forward-looking statements. Actual results might differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include, without limitation: the effects of future economic conditions; governmental fiscal and monetary policies; legislative and regulatory changes; the risks of changes in interest rates; successful merger integration; management of growth; fluctuations in our financial results; reliance on key personnel; our ability to compete effectively; privacy, security and other risks associated with our business. Coastal Carolina Bancshares, Inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

CONTACT:

Russell Vedder

Title: EVP/CFO

Phone: (843) 839-5662

Fax: (843) 839-5699

SOURCE: Coastal Carolina National Bank