Not for Distribution to United States Newswire Services or for Dissemination in the United States

OTTAWA, ON / ACCESSWIRE / June 4, 2019 / InterRent Real Estate Investment Trust (TSX-IIP.UN) ("InterRent") announced today that it has entered into a joint venture agreement with Brookfield Property Group ("Brookfield") and CLV Group ("CLV") to develop an 8.5-acre, mixed-use development in Burlington, Ontario (the "Burlington GO Lands").

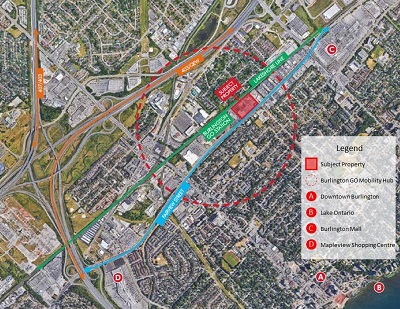

The Burlington GO Lands consists of three land parcels located on Fairview Street between Brant Street and Guelph Line that has been acquired for approximately $65 million. The site is within the area of the Burlington GO Mobility Hub Secondary Plan, which is recognized by both the provincial and regional governments as a high-priority growth area and allows for high density mixed-use development. The development is currently in the planning phase and construction is expected to commence once approvals are in place.

This multi-phase development will be designed with a focus on urban lifestyle and will include a full array of residential, retail and amenity space to create a thriving community. The site features access to commuter rail and highways as well as existing retail amenities in Burlington. See the illustration below.

Over a period of several years, CLV sourced and tied up the parcels making up the land assembly. The first parcel was acquired by CLV's development arm whom immediately began working through the planning and entitlement process. As InterRent developed sufficient size and scale to bring a measured amount of development onto its balance sheet, CLV assigned its position on the second parcel, at cost, to InterRent. The finalization of the joint venture agreement between all three parties coincided with the closing of the third parcel of land.

"The formation of this joint venture between InterRent, Brookfield, and CLV provides an amazing opportunity to combine the experience and resources of three best-in-class real estate entities in developing this unique, ideally located site. It is very rare to find a prime development site of this size, on transit, and with such complementary zoning permissions. Our investment into this land assembly further demonstrates our commitment to developing newly built residential apartments as part of our growth strategy to position the REIT for the future with a best in class portfolio for our Unitholders. It will provide a pipeline of new supply for years to come." said Mike McGahan, Chief Executive Officer. "We are incredibly pleased with finding a development site with this profile, and with the newly formed joint venture partnership."

"Brookfield is extremely pleased to be partnering with InterRent and CLV on its first multi-family anchored mixed use development in Canada. Each partner brings a wealth of experience in different but complementary areas of expertise that we believe will come together to create a vibrant mixed-use site that will mesh into the fabric of Burlington," said Ashley Lawrence, Head of Canadian Real Estate for Brookfield.

InterRent will own a 25% interest in the joint venture and will receive fees for the provision of property management and residential leasing services, including lease-up, to the project. The balance of the joint venture will be owned by Brookfield (50%) and CLV (25%), who will provide planning, entitlement and development management services. Brookfield is one of the world's largest investors in real estate, with a wealth of real estate development and related investment experience. CLV has a proven track record of creating significant long-term value and has been involved in over $5 billion of real estate activities.

About InterRent

InterRent REIT is a growth-oriented real estate investment trust engaged in increasing Unitholder value and creating a growing and sustainable distribution through the acquisition and ownership of multi-residential properties.

InterRent's strategy is to expand its portfolio primarily within markets that have exhibited stable market vacancies, sufficient suites available to attain the critical mass necessary to implement an efficient portfolio management structure and, offer opportunities for accretive acquisitions.

InterRent's primary objectives are to use the proven industry experience of the Trustees, Management and Operational Team to: (i) to grow both funds from operations per Unit and net asset value per Unit through investments in a diversified portfolio of multi-residential properties; (ii) to provide Unitholders with sustainable and growing cash distributions, payable monthly; and (iii) to maintain a conservative payout ratio and balance sheet.

For further information about InterRent please contact:

|

Mike McGahan |

Brad Cutsey, CFA |

Curt Millar, CPA, CA |

|

Chief Executive Officer |

President |

Chief Financial Officer |

|

Tel: (613) 569-5699 Ext 244 |

Tel: (613) 569-5699 Ext 226 |

Tel: (613) 569-5699 Ext 233 |

|

Fax: (613) 569-5698 |

Fax: (613) 569-5698 |

Fax: (613) 569-5698 |

|

e-mail: [email protected] |

e-mail: [email protected] |

e-mail: [email protected] |

The TSX has not reviewed and does not accept responsibility

for the adequacy or accuracy of this release.

SOURCE: InterRent Real Estate Investment Trust