WINNIPEG, MB / ACCESSWIRE / November 26, 2018 / Bird River Resources Inc. (CSE: BDR) (the "Bird River" or the "Compan"”) announces the results of its independent reserves evaluation (the "Chapman Report") dated November 15, 2018 and effective July 31, 2018, as prepared by Chapman Petroleum Engineering Ltd. ("Chapman").

Bird River is pleased to announce the Company's year-end 2018 net asset value ("NAV") per share is $0.36 per share.

The Company also reported that its 2018 capital expenditure program resulted in total evaluated net reserves on a total proved plus probable basis, of 1.3 million barrels of oil equivalent ("boe")- with 81 percent being oil.

With the acquisition of High Point Oil Inc. ("High Point") the Company has acquired significant high working interest properties in Alberta. These were further enhanced by High Point's early summer drilling in 2018. In this press release, no comparison's to prior period reserves or production has been provided as they are largely meaningless. Bird River's previously owned Manitoba resource properties were not included in the above reserve report as they are not significant to the Company's future activities producing only 1 bbl of oil per day.

2018 RESERVES HIGHLIGHTS

The company's focused operating strategy of targeting light oil conventional reservoirs provided excellent results, as demonstrated by the following:

|

Note - 2018 NAV and 2P reserves value are based on pricing assumptions at July 31, 2018. These assumptions are materially higher than current pricing for "AB Synthetic and Light Sweet - Edmonton".

2018 INDEPENDENT RESERVES EVALUATION

The evaluation of our reserves was done in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") and National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). Additional reserves information as required under NI 51-101 will be filed on SEDAR on or before November 30, 2018.

Independent reserve evaluators, Chapman, evaluated 100 percent of Bird River's Alberta reserves. They did not evaluate the Company's Manitoba reserves which have an insignificant value by comparison and produce approximately 1 boe/d net to the Company.

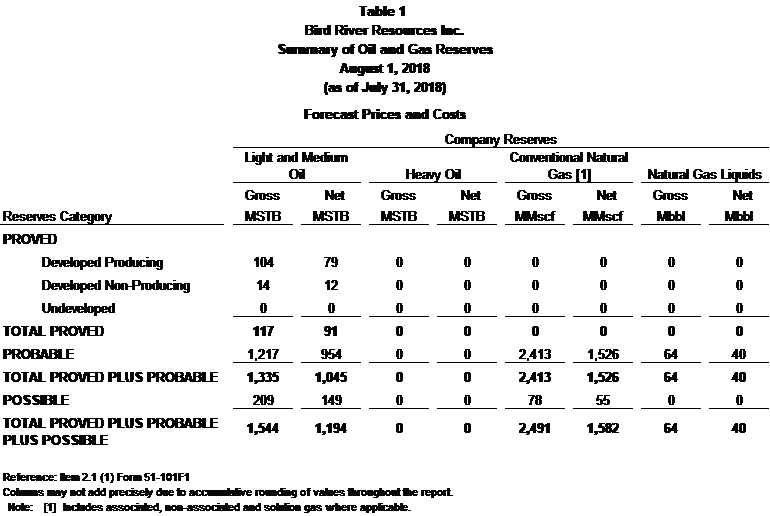

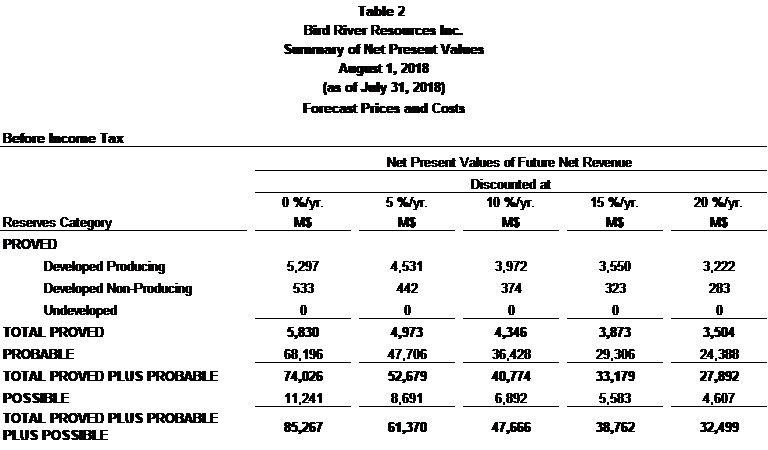

RESERVES SUMMARY

The following tables summarize Bird River's working interest oil and natural gas reserves and the net present values ("NPV") of future net revenue for these reserves (before taxes) using forecast prices and costs as set forth in the Chapman Report.

NET ASSET VALUE

The Company's NAV, as of July 31, 2018, has been evaluated to be $0.36 per basic share – utilizing Chapman's July 31, 2018 independent reserves valuation and price forecast.

Bird River's July 31, 2018 detailed NAV calculation is set forth below:

|

NAV |

||

|

Proved Plus Probable Reserve Value NPV10 BT (incl. FDC) |

$M |

40,774 |

|

Undeveloped Land and Seismic (internally estimated) |

$M |

750 |

|

Estimated Net Working Capital (unaudited) |

$M |

652 |

|

Total Net Assets |

$M |

42,176 |

|

Basic Shares Outstanding (000's) |

116,000 |

|

|

Estimated NAV per Basic Share |

$/share |

0.36 |

|

|

|

|

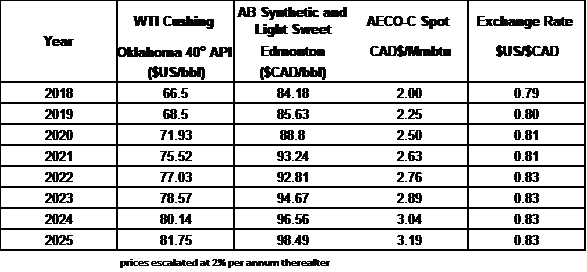

SUMMARY OF SELECTED CHAPMAN PRICE FORECASTS AS AT July 31, 2018

Note - 2018 NAV and 2P reserves value are based on pricing assumptions at July 31, 2018. These assumptions are materially higher than current pricing for "AB Synthetic and Light Sweet - Edmonton".

FUTURE DEVELOPMENT COSTS ("FDC")

Future development cost estimates reflect Chapman's best estimate of the costs required to bring the total proved and proved plus probable reserves on production. The Company has 1.2 million boe of total proved and probable undeveloped and non-producing reserves with an estimated $5.9 million of FDC. These future reserves generate $36 million of net present value discounted at 10 percent, before income tax.

The Company estimates 2019 internally funded corporate capital expenditures at $3.0 million (unaudited) with additional spending potential dependent on financing and commodities pricing.

The following table sets forth the schedule of FDC required to develop Bird River's future undeveloped reserves (using forecast prices and costs).

|

Future Development Costs |

Total Proved |

||

|

($M) |

|||

|

2018 (balance of calendar year) |

500 |

||

|

2019 |

3,417 |

||

|

2020 |

936 |

||

|

2021 |

1,035 |

||

|

Remaining |

0 |

||

|

Total (Undiscounted) |

5,888 |

||

FINDING, DEVELOPMENT AND ACQUISITION COSTS

Finding, Development and Acquisition Costs ("FD&A") costs are calculated as the sum of development capital of $3.9 million plus acquisition capital of $5.5 million (the value attributed to the shares issued on the acquisition of High Point at $0.10/share) less the value attributed by management to undeveloped land and seismic of $0.8 million plus the undiscounted FDC of $5.8 million (P+P), for a total of $14.1 million, divided by the change in total reserves, (all the evaluated reserves), 1.3 million boe. This results in FD&A costs of $10.85 per boe for the period.

OUTLOOK - CONTINUED CORE AREA DEVELOPMENT

Management's stated goal at Bird River is to continue the development of its existing core area in Central Alberta and at the same time to seek additional core areas so as to broaden future opportunities. The Company will continue to focus on light oil.

DISCLAIMERS

Unaudited Financial Information

Certain financial and operating information included in this press release for the year ended July 31, 2018, such as finding and development costs and net asset value calculations are based on unaudited financial results for the year ended July 31, 2018 and are subject to the certain limitations as discussed under forward-looking statements outlined at the end of this news release. These estimated amounts may change upon completion of the audited financial statements for the year ended July 31, 2018 and those changes may be material.

Per share information is based on the total common shares outstanding, as at July 31, 2018.

Information Regarding Disclosure on Oil and Gas Reserves

The reserve data provided in this news release presents only a portion of the disclosure required under NI 51-101. The oil and gas disclosure statements for the year ended July 31, 2018, which will include complete disclosure of Bird River's oil and gas reserves and other oil and gas information in accordance with NI 51-101, will be available on Bird River's SEDAR profile on or before November 29, 2018 at www.sedar.com.

There are numerous uncertainties inherent in estimating quantities of crude oil, natural gas and natural gas liquids ("NGL") reserves and the future cash flows attributed to such reserves. The reserve and associated cash flow information set forth above are estimates only. In general, estimates of economically recoverable crude oil, natural gas and NGL reserves and the future net cash flows therefrom are based upon a number of variable factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially. For those reasons, estimates of the economically recoverable crude oil, NGL and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary. The Company's actual production, revenues, taxes and development and operating expenditures with respect to its reserves will vary from estimates thereof and such variations could be material.

All evaluations and reviews of future net revenue are stated prior to any provisions for interest costs or general and administrative costs and after the deduction of estimated future capital expenditures for wells to which reserves have been assigned. The after-tax net present value of the Company's oil and gas properties reflects the tax burden on the properties on a stand-alone basis and utilizes the Company's tax pools. It does not consider the corporate tax situation, or tax planning. It does not provide an estimate of the after-tax value of the Company, which may be significantly different. The Company's financial statements and the management's discussion and analysis should be consulted for information at the level of the Company.

The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to effects of aggregation. The estimated values of future net revenue disclosed in this press release do not represent fair market value. There is no assurance that the forecast prices and cost assumptions used in the reserve evaluations will be attained and variances could be material. Estimates made herein assume the development of the applicable property without regard to the likely availability of the funding required for that development.

Boe means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Boe/d and boepd means barrel of oil equivalent per day.

Forward Looking Statements

This press release contains forward-looking statements. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: expectations with respect to the Company's ability to operate and succeed in the current commodity price environment; the Company's declared focus and primary goals; the Company's estimated decline rate; management's estimates and expectations regarding capital expenditures and operating costs, growth opportunities and strategies, estimated reserves and estimated resources; the availability operating cash flow and financing to provide the Company with sufficient liquidity and financial flexibility; and anticipated commodity prices; management's expectations regarding debt levels, and the timing of the filing of Bird River's NI 51-101 report and financial statements.

Statements relating to "reserves" are also deemed to be forward looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated and that the reserves can be profitably produced in the future.

Certain other measures set forth in this press release may be considered to be future-oriented financial information or a financial outlook for the purposes of applicable Canadian securities laws. Future-oriented financial information and financial outlooks contained in this press release are based on assumptions about future events based on management's assessment of the relevant information currently available. The future-oriented financial information and financial outlooks contained in this press release have been approved by management as of the date of this press release. Readers are cautioned that any such future-oriented financial information and financial outlook contained herein should not be used for purposes other than those for which it is disclosed herein.

The forward-looking statements are based on certain key expectations and assumptions made by Bird River, including expectations and assumptions concerning the performance of existing wells and success obtained in drilling new wells, anticipated expenses, cash flow and capital expenditures, ability to create shareholder value and generate returns, sustainability of reserves, operational results, the application of regulatory and royalty regimes, prevailing commodity prices and economic conditions, development and completion activities and the cost thereof, the performance of new wells, The availability of and performance of facilities and pipelines, the geological characteristics of Bird River's properties and properties acquired by Bird River, the successful application of drilling, completion and seismic technology, the determination of decommissioning liabilities, prevailing weather conditions, exchange rates, licensing requirements, the impact of completed facilities on operating costs, costs of capital, liquidity of Bird River, labour and services, and the creditworthiness of industry partners.

Although Bird River believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Bird River can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions, uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures or failure to obtain the continued support of the lenders under Bird River's bank line. Certain of these risks are set out in more detail in Bird River's CSE Listing Statement Form 2A dated October 15, 2018 and in Bird River's MD&A for the period ended April 30, 2018, both of which have been filed on SEDAR and can be accessed at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date hereof and Bird River undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Non-IFRS Measures

This press release contains the terms "NAV, and FD&A" which do not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and therefore may not be comparable with the calculation of similar measures by other companies. Additional information relating to non-IFRS measures will be found in the Company's MD&A for the year ended July 31, 2018, which may be accessed through the SEDAR website (www.sedar.com) after November 30, 2018.

Select Definitions

bbl |

barrel |

|

|

bbls |

barrels |

|

|

Mbbls |

thousand barrels |

|

|

MSTB |

|

thousand stock tank barrels |

|

MMBtu |

million British thermal units |

|

|

NGLs |

natural gas liquids |

|

|

mcf |

thousand cubic feet |

|

|

mmscf |

Millions of standard cubic feet |

|

|

mmcf/d |

million cubic feet per day |

|

|

boe |

barrel of oil equivalent on the basis of 1 boe to 6 Mcf of natural gas. |

|

|

mboe |

thousand boe |

|

|

$M |

thousands of dollars |

For further information:

Jon Bridgman, CEO and Director Bird River Resources Inc. Tel: 204-589-2848 Email: [email protected]

Ty Pfeifer, Director, (CEO High Point Oil) Tel: 403-614-9907 [email protected]

This news release is for information purposes only and no statement herein should be considered an offer or a solicitation of an offer for the purchase or sale of any securities and may contain forward looking statements that are based upon current expectations or beliefs as well as a number of assumptions about future events and words such as may, should, could, will, expect, anticipate, estimate, believe, intend, project should not be taken out of context.

NEITHER THE CSE NOR ITS MARKET REGULATOR (AS THAT TERM IS DEFINED IN THE POLICIES OF THE CSE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

SOURCE: Bird River Resources Inc