Winnipeg, MB / Accesswire / March 13, 2014 - Cougar Minerals Corp. - TSX-V: COU ("Cougar" or "the "Company") is pleased to announce that it has entered into two separate assignment and novation agreements with the Sociedad De Asesoria Jurdica y Economica Minem S.A. ("Minem") for the acquisition of 100% interest (directly and indirectly) in two (2) properties, Tres Amantes and San Antonio, both of which are located in the Atacama Region of Chile. Both property transactions are entirely arm's length to the Company.

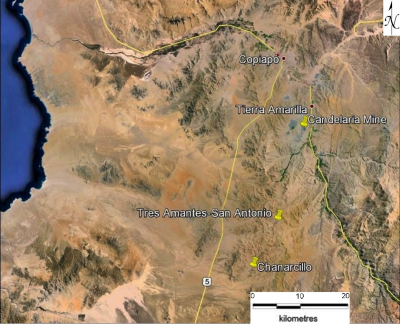

The Tres Amantes and San Antonio concessions are located in Chile's Atacama Region which is approximately 38 kilometers south of Copiapo, and are accessible by paved road. The properties lie in northern Chile's Cretaceous Metallogenic belt, 23 km south-southwest of the Candelaria copper-gold mine (Freeport McMoRan, 2012 reserves of 4.2 billion pounds of copper and 1.2 million ounces of gold - footnote 1), and 12 km north-northeast of the historic Chanarcillo Mine which historically produced more than 100 million ounces of high-grade silver in the mid-1800s (footnote 2) (Figure 1). These figures are historical and are provided for context only. There is no guarantee that either the Tres Amantes or San Antonio properties will ever produce and investors are cautioned that trading in the shares of the Company is highly speculative.

Figure 1. Location Map:

Note that the information about the Candelaria and Chanarcillo Mines has not been verified by the Company's Qualified Person, and the information about these two properties is not necessarily indicative of the mineralization on the Tres Amantes or San Antonio properties.

The Tres Amantes and San Antonio mines were both mined for gold from the early 1900s until 1940. After 1940 there has been only small-scale, intermittent artisanal production. Gold mineralization in the concessions is found within a near-surface blanket or "manto" along the contact between limestone and a porphyritic intrusion of dacitic composition, especially where this contact is intersected by northwest and northeast-trending structures, which are also mineralized locally. The mineralization occurs as replacements in both the limestone and the dacitic intrusive, as well as disseminations, especially in the intrusive rock (footnote 3).

Cougar entered into an assignment and novation agreement dated March 12th , 2014 with Minem to acquire all rights under a memorandum of understanding with the Sociedad De Inversiones Puelche Limitada (the "Tres Amantes MOU") for the option to acquire the Tres Amantes property (the "Tres Amantes Agreement"). Cougar also entered into an assignment and novation agreement dated March 12, 2014 with Minem to acquire all rights under a memorandum of understanding with the Sociedad Contractual Minera San Antonio (the "San Antonio MOU") for the option to acquire the San Antonio property (the "San Antonio Agreement").

The "Tres Amantes and San Antonio" Project includes the following mining concessions: Tres Amantes 1-6 with an area of 30 hectares; Tres Amantes 7-20 with an area of 70 hectares; San Antonio 1-10 with an area of 50 hectares and Susy Uno 1-37 with an area of 37 hectares.

Under the terms of the Tres Amantes Agreement and the San Antonio Agreement (collectively, the "Assignment Agreements"), Cougar has the option to acquire a 100% interest in gold properties located in Tres Amantes and adjacent San Antonio by paying $45,000 USD in cash and issuing 500,000 common shares of Cougar, subject to TSX Venture Exchange approval, for each of the properties for a total of 1,000,000 shares and $90,000 USD. The agreements are independent of one another and the Company may exercise the option on either property to the exclusion of the other. In addition Cougar will assume all underlying payment obligations under each of the Tres Amantes MOU and the San Antonio MOU. This includes $600,000 USD in cash to exercise the option for each property and minimum royalty payments required pursuant to underlying agreements with respect to the Tres Amantes 1-6 and Tres Amantes 7-20 concessions. Each of the $600,000 USD payments are due July 25th, 2015. The royalty payment with respect to the Tres Amantes concessions corresponds to 7% of the net sales of minerals deriving from these concessions. In addition, Inversiones Puelche is obligated to make advance royalty payments of US$5,000 per month, regardless of the previous month's sales being lower or nil. Inversiones Puelche started making these advance royalty payments in December 2013, and Cougar will assume the payments starting March 2014.

President Murray Nye stated, "These new acquisitions should allow Cougar Minerals to advance significantly in building an exploration portfolio and generating shareholder value through future exploration and development."

Director Larry Segerstrom commented, "This is an amazing opportunity and I am thrilled to be stepping back to my roots in Chile. Cougar is excited to acquire a gold deposit with a historic resource. Our immediate goal is to produce a National Instrument 43-101 compliant report. In addition, we will apply for a permit to drill between the two historical mines in order to verify, expand and connect the deposits, as there may be potential for additional mineralization. We have received excellent support from our team in Chile in expediting skilled manpower and equipment, and we believe that we can create shareholder value going forward."

Mr. Larry Segerstrom, P.Geo and a Director of the Company, is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed and approved the disclosure of technical information contained in this news release.

-

1.Freeport-McMoRan Copper & Gold, 2012 Annual Report, p. 109

-

2.Sillitoe, Richard H., 2007, "Hypogene Reinterpretation of Supergene Silver Enrichment

at Chanarcillo, Northern Chile": Economic Geology, Vol. 102, p. 777.

-

3.Minera Hochschild Chile, 2012, "Informe Final, Proyecto San Antonio" (internal company report), p. 7-1 to 7-9.

The Company also wishes to announce that it will hold a non-brokered private placement of up to 7,000,000 units (the "Financing Units"), consisting of one common share and one half of one whole common share purchase warrant, at a price of $0.20 per Financing Unit to raise gross proceeds of up to $1,400,000 (the "Financing"). Each whole warrant will have a purchase price of $0.30 per common

share for a period of eighteen months and will be subject to forced conversion if the price exceeds $0.60 for any 10 consecutive trading days subject to TSX Venture Exchange policies.

In connection with the Financing, the Company will pay a 9% cash finder's fee and issue 4.5% finder's warrants. Proceeds from the Financing will be used for general working capital.

The Financing is subject to Exchange approval and all securities issued will be subject to a four month resale restriction.

About Cougar Minerals Corp.

Cougar is a junior exploration company focused on the discovery and development of economic mineral deposits.

Additional information on Cougar Mineral can be found on the Company's website at www.cougarminerals.com and by reviewing the Company's page on SEDAR at www.sedar.com.

On behalf of the Board of Directors

COUGAR MINERALS CORP.

s/ "Murray Nye"

Murray Nye

President

For more information, please contact:

Cougar Minerals Corp.

Murray Nye, President/CEO

(204) 989-2434

OR

Senergy Communications Inc.

Anthony Zelen, President

(778) 331-2028

Neither TSX Venture Exchange, nor its Regulation Services Providers (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The information in this release may contain forward-looking information under applicable securities laws. This forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those implied in the forward-looking information.