Sultan Minerals Inc. (SUL - TSX Venture) ("Sultan" or the "Company") is pleased to provide a year-end update of activities for the Company's Daylight, Kena Gold and Jersey-Emerald projects. The highlight for 2013 was Sultan's 100% owned Daylight Gold Property where the Company obtained 25.6 g/t gold, 175.2 g/t silver and 0.34% copper across a 1.9 metre wide vein.

Daylight Gold Property:

During 2013 Sultan focused its exploration activities on it Daylight Gold Property located 10 km south of the town of Nelson in southeastern, British Columbia. The Daylight property overlies several historic, high-grade, gold mines that operated in the late 1890's and early 1900's. The historic mines have been owned by several individuals for many years and little exploration has been done since the Daylight mine closed in 1949.

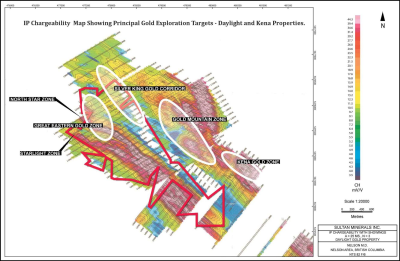

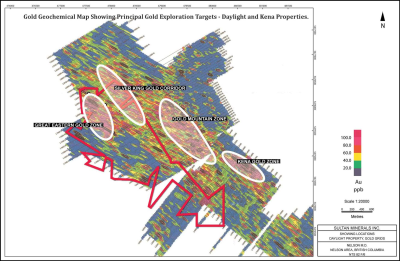

A complete review of historic information on the Daylight property was recently completed by the company's consulting geologist, Perry Grunenberg. The study included an assessment of historical exploration, mining and sampling activities and recent geochemical, geophysical and sampling programs completed by Sultan. The project review has successfully identified four gold bearing targets that require exploration. These are the Starlight Shear Zone, the North Star Shear Zone, the Great Eastern Porphyry Gold Zone, and the Silver King Gold Corridor.

The Starlight Shear Zone is host to the Starlight, Victoria and Daylight gold mines. This mineralized shear strikes 125 o and dips 65 o SW. The zone is up to 50 metres wide and has been traced by an IP geophysical survey for 3.0 km along strike. The shear zone centres on a series of gold bearing, en echelon, quartz veins often surrounded by a low grade network of smaller veins on both sides of the principal quartz vein. Associated sulfides consist of pyrite and locally chalcopyrite. In November a prospecting and rock chip sampling program was completed on the Starlight Shear Zone. The highlights of the program were: 1) the Starlight Gold Vein which assayed 10.3 g/t gold and 68.15 g/t silver over a 60.0 metre vein length with an average vein width of 1.6 metres and 2) the Victoria Gold Vein which assayed 28.1 g/t gold across a vein width of 0.85 metres. The best channel sample across the Starlight Vein assayed 25.6 g/t gold, 175.2 g/t silver and 0.34% copper across a 1.9 metre wide vein (see News Release of December 16, 2013).

The North Star Shear Zone lies 500 metres north of the Starlight shear and appears similar to the Starlight zone. The zone was explored with 7 long trenches in 1939 which exposed a 54 metres wide shear zone with a strike of 130o and a dip of 67o SW. The trenches were reported to have assayed 1.20 g/t gold across the entire 54 metre width. An IP geophysical survey completed by Sultan showed the zone to give a prominent IP chargeability anomaly that has been traced 2.0 km south where it joins with the Starlight IP anomaly.

The Great Eastern Porphyry Gold Zone is a strong untested gold soil anomaly that is 1.1 km long and up to 500 metres wide located 100 metres west of the historic Great Eastern Gold Mine. This target follows the southwest contact of the Silver King Intrusive with the Elise volcanics.

The Silver King Gold Corridor is located within the main Silver King Intrusive along the eastern margin of the Daylight property. The target is a string of strong gold anomalies that follow the trend of the intrusive. The soil anomaly is 1.0 km long and up to 300 metres wide.

In light of these extremely encouraging targets and the success of the 2013 sampling program Sultan plans to investigate the potential of the Daylight property for high grade vein type mineralization as well as bulk-tonnage gold mineralization in 2014. Permits are now in place for the planned follow-up program that will involve additional surface sampling, trenching and diamond drilling of the four target areas discussed above.

Kena Gold Property:

Sultan's 7,600 hectare Kena Gold property adjoins the Daylight property on its eastern border. The Kena property presently has a NI43-101 compliant measured and indicated resource of 490,000 ounces of gold and an additional drill inferred resource of 1.399 million ounces of gold using a cut-off grade of 0.30 g/t.

In 2012 Sultan entered into a joint Venture agreement with Altair Gold Inc. (Altair) of Vancouver, B.C. giving Altair an option to earn up to 75% interest in the Kena gold project by taking the property to production. To earn an initial 60% interest in the property Altair must incur exploration expenditures of $6.15 million over the next 4 years and make cash and share payments to Sultan totaling $2 million and 2,166,666 shares over the next four years (please see News Release July 2, 2013).

In 2012 Altair explored the property with 7,527 meters of diamond drilling on the known showings and completed an updated resource estimate. In 2013 Altair carried out regional prospecting and sampling programs in order to prepare the property for drill testing in 2014.

Jersey-Emerald Project.

The Jersey Emerald Property is located in southeastern British Columbia, 10 kilometres southeast of the community of Salmo. The 15,000 hectares Property includes British Columbia's second largest historic lead zinc mine as well as Canada's second largest historic tungsten mine which have been inactive since 1973. The property has a significant remnant resource for tungsten (please see News Release January 21, 2009) and for lead zinc (please see News Release March 1, 2010).

In November 2013: Sultan entered into an option agreement with Margaux Resources Ltd. ("Margaux") for the disposition of 100% of the Jersey-Emerald property. Under the terms of the agreement, Margaux has an exclusive option to acquire the Property by making payments to Sultan of an aggregate $4.0 million, paid in several installments on or before November 8, 2016.

Sultan will retain a 1.5% net smelter returns royalty ("NSR") on the Property. For a period of 60 days following the earlier of (a) the commencement of commercial production on the Property or (b) the completion of a feasibility study on the Property, Margaux may purchase 50% of the NSR (being a 0.75% net smelter returns royalty) from Sultan for a payment to Sultan of $5.0 million.

Sultan has obtained shareholder approval and TSX Venture Exchange approval for the sale of the property (see news release of November 11, 2013). The transaction is currently pending shareholder and TSX Venture Exchange Approval for Margaux.

Mr. Grunenberg, P.Geo., of PBG Geoscience of Kamloops, B.C., is Sultan's project supervisor and "Qualified Person" for the purpose of NI 43-101, "Standards of Disclosure for Mineral Projects".

For further information on the Company's projects, visit www.sultanminerals.com.

Arthur G. Troup, P.Eng., Geological

President and CEO

For further information please contact:

Marc Lee, Investor and Corporate Communications

Tel: (604) 628-0519 Fax: (604) 628-0446

Email: [email protected] or [email protected]