As a result of a review by the British Columbia Securities Commission, we are issuing the following news release to clarify our disclosure.

Golden Reign Resources Ltd. (TSX-V: GRR) (the "Company" or "Golden Reign") would like to clarify its technical disclosure on its San Albino-Murra Gold Property, Nicaragua (the "Property").

Technical disclosure issues reviewed include: potentially misleading disclosure; non-compliant disclosure of mineral resources; non-compliant disclosure of metal equivalent grades; non-compliant exploration targets; and, qualified person.

Potentially misleading disclosure

In its August 2013 corporate presentation titled "San Albino-Murra Gold Concession - High-Grade Gold in Nicaragua, Moving To Production" (the "Presentation") the Company discloses open-pit resource tonnages and grades at various gold price sensitivities for combined oxide/sulphide and oxide only conceptual open-pit shells. The purpose of these sensitivities is to demonstrate the upside resource potential with an increase for the oxide/sulphide case and to demonstrate the starter pit potential of an oxide only pit. The gold prices referenced were $955, $1,274 and $1,751. The reason for examining the potential higher open-pit resource tonnage sensitivity was the view by the Company that a higher strip ratio than that stated in the January 2013 NI 43-101 compliant resource estimate report was quite achievable due to the very high open-pit resource grades in excess of 8 g/t Au.

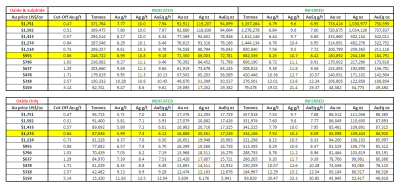

The tonnages and grades were extracts from the following detailed sensitivity tables which come from the work done for the NI 43-101 Technical Report and Resource Estimate on the San Albino Deposit prepared by P&E Mining Consultants Inc. and filed January 4, 2013 (the "NI 43-101 Report"). The referenced tonnages and grades are highlighted accordingly in the following tables:

The mineral resources estimate for the San Albino Gold Deposit, per the Company's NI 43-101 Report, is:

--------------------------------------------------------------------------------------------- |Table 3 – San Albino Gold Deposit Mineral Resources Estimate | |-------------------------------------------------------------------------------------------| | |Cut-off| | | Au | Au | Ag | Ag | | AuEq | | |grade |Classification|Tonnes |(g/t) |ounces | |ounces |AuEq |ounces | | | (g/t | | | | | (g/t)| |(g/t) | | | |AuEq) | | | | | | | | | |-------------------------------------------------------------------------------------------| |Open-pittable|0.5 |Indicated |247,000 |9.00 |71,000 |10.8 | 86,000|9.18 |73,000 | |-------------------------------------------------------------------------------------------| | |0.5 |Inferred |682,000 |8.25 |181,000|10.7 |234,000|8.42 |185,000| |-------------------------------------------------------------------------------------------| |Underground |1.5 |Indicated |101,000 | 6.59 |21,000 | 9.7 |31,000 |6.76 |22,000 | |-------------------------------------------------------------------------------------------| | |1.5 |Inferred |2,689,000|7.00 |605,000|10.6 |912,000|7.17 |620,000| ---------------------------------------------------------------------------------------------

In the Presentation, the Company discloses that a 250 ton-per-day pilot plant planned for potentially processing near-surface oxidized material may produce an estimated 20,000 ounces annually, with a low strip ratio and low capital and operating costs. The Company has not completed a preliminary economic assessment, pre-feasibility or feasibility study. As such, the Company retracts these statements and they should not be relied upon. Further, pursuant to section 4.2(6) of the NI 43-101 Companion Policy any future reference regarding putting the mineral project into production will include adequate disclosure of the increased uncertainty and associated economic and technical risks of failure, unless mineral reserves supported by a technical report are established and a feasibility study completed.

In its most recent Management Discussion & Analysis ("MD&A") for the first quarter of fiscal 2013 ended July 31, 2013, the Company discloses that it is sourcing a small modular plant with the intent of conducting near-term small scale operations at the San Albino Gold Deposit, with a production target date of December 2014. As the Company does not intend to complete a feasibility study prior to potentially commencing small scale production at San Albino there may be increased risk of failure.

Non-compliant disclosure of mineral resources

The Company's disclosure of mineral resources included in its Presentation, Performance Scorecard sheet, How Do We Measure Up sheet and on its website does not comply with NI 43-101 S.2.2 and S.3.4.

On slide 8 of the Presentation, the Company discloses its mineral resources but failed to note the effective date of the mineral resource estimate as required by S.3.4(a). On its Performance Scorecard sheet the Company disclosed the quantity of indicated and inferred resources and gold equivalent values for each category. The Company is non-compliant for not providing further details including: the quantity and grade of each category of mineral resources; the key assumptions, parameters, and methods used to estimate the mineral resources, and; the identification of any known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources. Both the Presentation and Performance Scorecard sheet have been removed from the Company's website.

In the Presentation and on its How Do We Measure Up sheet, the Company added inferred mineral resources to other categories. For example, in the Presentation the Company refers to open-pit resource tonnages and grades at varying gold price sensitivities. However, the slides demonstrating the resource potential of the oxide/sulphide and starter pit potential of an oxide only pit presented ounces from both the indicated and inferred resources category, which is contrary to NI 43-101 S.2.2(c) which requires disclosure of the quantity and grade of each category of mineral resources. To see the breakdown of resources by category refer to the sensitivity tables above.

On its How Do We Measure Up sheet, the Company stated that it has "Nearly 1M ounces at San Albino Gold Deposit", improperly disclosing resources solely in the form of metal content. This disclosure is contrary to NI 43-101 which requires disclosure of the quantity and grade of each category of mineral resources.

Non-compliant disclosure of metal equivalent grades

In a written disclosure entitled Performance Scorecard posted on its website, the Company had outlined key objectives for 2011/2012 and the results, plus 2013 key objectives. A key objective for 2011/2012 was to deliver a NI 43-101 compliant resource estimate for the San Albino Gold Deposit. Under 2011/2012 results, Golden Reign noted that this objective was met on November 20, 2012 with the announcement of its initial mineral resource estimate. The Company disclosed the quantity of indicated and inferred resources and gold equivalent values for each category. However, this disclosure is non-compliant as the metal equivalent grade does not include the individual grade of each metal used to establish the metal equivalent grade. See Table 3 above for the breakdown of grades comprising metal equivalents. The Performance Scorecard has been removed from the Company's website. In future, Golden Reign will provide additional information as to the grade of each metal used to establish a metal equivalent grade.

Non-compliant exploration targets

In the Company's recent Presentation, slide 10 disclosed an Exploration Target for the San Albino Project beyond the resource estimate (along strike and down dip) with an estimated 3 to 5 million tonnes at a grade between 6 to 10 grams gold equivalent per tonne. This Exploration Target was identified by P&E Mining Consultants Inc., the author of the Company's NI 43-101 Report. However, the Company did not include the required cautionary language in the Presentation to advise readers that the potential quantity and grade of the Exploration Target is conceptual in nature, that there has been insufficient exploration to define a mineral resource, and that it is uncertain if further exploration will result in discovery of a mineral resource.

The Company will ensure that all reference to exploration targets will henceforth include the information and cautionary language required by NI 43-101 S.2.3(2).

Qualified person

On its website, Presentation, Performance Scorecard sheet, How Do We Measure Up sheet and MD&A, the Company did not properly identify and disclose the relationship to the Company of the Qualified Person who prepared or supervised preparation of the technical information being disclosed, pursuant to section 3.1 of NI 43-101. The Company currently employs two individuals who are Qualified Persons under NI 43-101 standards - Mr. John Kowalchuk, P.Geo. and Project Manager, and Mr. David Reid, P.Geo. Both individuals are highly experienced, senior geologists who spend considerable time in Nicaragua consulting to the Company and directly overseeing its exploration activities. Either or both Qualified Persons prepare or supervise the preparation of information that forms the basis of the Company's written disclosure and approve the written disclosure.

Qualified Person

David Reid, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this news release. Mr. Reid is a senior geologist consulting to the Company.

Eugene Puritch, P.Eng. of P&E Mining Consultants Inc. who is an Independent Qualified Person (as defined under NI 43-101) has read and approved the technical information pertaining to open-pit resource tonnages and grades at various gold price sensitivities contained in this news release on behalf of the Company.

On behalf of the Board,

"Kim Evans"

Kim Evans, CGA

President & CEO

For additional information please visit our website at www.goldenreign.com and SEDAR www.sedar.com.

Forward-Looking Statements: Some of the statements contained herein may be forward-looking statements which involve known and unknown risks and uncertainties. Such forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements, including, without limitation, risks and uncertainties relating to political risks involving the Company's exploration and development of mineral properties interests, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.