Is Cyber Monday Dying Because of Retail Apocalypse?

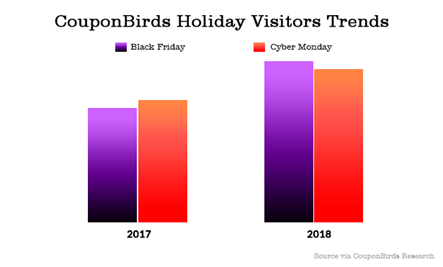

When retailers were celebrating turning from being “in the red” to being “in the huge black”, CouponBirds recorded an unexpected trend after the shopping frenzy. CouponBirds found that online deals hunters on 2018 Cyber Monday turned to be less than that of Black Friday for the first time since CouponBirds was created. In 2017, the number of shoppers who visited CouponBirds, one of the leading coupon aggregating sites, searching for Cyber Monday coupons and deals was 4% more than that of 2017 Black Friday, and it was 15% more in 2016. The slowing growth rate for Cyber Monday visitors is comprehensible, but falling lower than Black Friday is unlooked-for.

Even though, CouponBirds traced that after

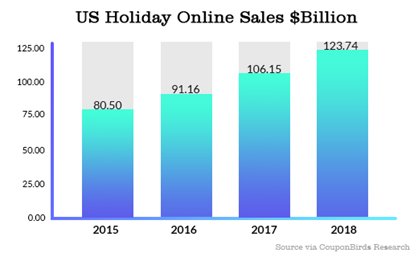

CouponBirds data analysts paid attention to the new trend and linked the depressing online shopping spree to the “retail apocalypse”. With the strong move to online spending, consumers opt to make their purchases on the web instead of waiting in line for hours and fighting the crowds in person. E-commerce giants like Amazon keep stealing market share from brick-and-mortar competitors by converting consumers through online especially on mobile ends. Amazon has captured up to 50% of total online holiday sales this year and it was 22% back in the year 2014. U.S. holiday online spending increased 16.6% from a year earlier. Online shopping squeezed in-store retailing. In 2017, a record high 8,640 retail stores in the U.S. closed or went bankrupt, which means 24 stores closure a day. Toys“R

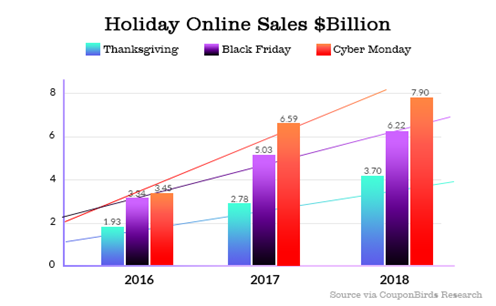

As more consumers go shopping online, Amazon and online stores push Black Friday promotion earlier and there was no difference in digital discount rates from Thanksgiving to Cyber week. Cyber Monday has now been a part of an extended Thanksgiving weekend. CouponBirds recorded that traffic was still pretty strong on Saturday and Sunday after 2018 Black Friday. According to Adobe, the Saturday and Sunday of the holiday period set a new record as the biggest online shopping weekend in U.S. history, at a combined $6.4 billion in sales, growing faster than Black Friday and Cyber Monday with gains of 25% each day. U.S. National Retail Federation research found that 47% and 20% of respondents are expected to shop on Saturday and Sunday respectively.

Consumers’ attention to Cyber Monday has been split by the early onset of Thanksgiving shopping holiday. A great many shops sold out and people emptied their wallets before Cyber Monday, resulting in the lack of inventory for Cyber Monday online sales and the lack of growth momentum for Cyber Monday net traffic. On 2018 Cyber Monday, 2.4% of online product pages exhibited on out-of-stock message. It took a long time for retailers to prepare for a shopping spree. Cyber Monday follows immediately Black Friday which make it even harder for stores to get well prepared for

Black Friday Internet sales started in a high consumption base and kept fast growing, preempting the purchasing power from Cyber Monday and it will merge with Thanksgiving weekend going forward. It is not Cyber Monday but physical retail which is diminishing and reinventing. E-commerce stores are promised with strong demands ahead and physical retailing brands are forced to pursue new solutions to adapt to the new trends.