The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. There is no guarantee that the Fund or the index will achieve its investment objective. To view the most recent month-end performance go to: www.wearetf.com;the fund has a gross expense ratio of 0.85%.

The Wearable Technology ETF (NASDAQ: WEAR) is the first wearable technology exchange traded product to market, providing investors with a liquid, cost-effective and diversified way to gain access to rapidly evolving wearable technology. To many consumers, the wearable technology market is identified by the Fit Bit sports bracelet, the Apple Watch, and Google Glasses, but it is so much more. Wearables technology is a global trend and in addition, it spans ten sub-sectors including healthcare, electronic equipment, textiles, and aerospace.

Wearables are expected to be a $19-billion industry by 2018, according to Juniper Research. Products including Fitbit fitness trackers, Android Wear watches, and the Apple Watch have helped fuel a rise in mainstream awareness of wearable's for the past several years, even leading Fitbit to go public in 2015. "With attractive growth rates after a new product launch because of the relative lower price points, decreasing costs, and improving technology; we believe wearables is an investment that has never looked better," says Bryce Tillery, Managing Partner at Eve Capital, the sponsor to the fund.

Wearable is a broad category of technology, found across almost every industry in a variety of applications. The 31-stock portfolio of WEAR includes global companies across 10 sub-sectors as identified by ETF.com.

Just as the market spiked with smart watches like the Apple watch and the Fitbit, wearable cameras that cost between $350 - $700 a piece to deploy across a police force will soon be rolled out across the US and the world. Just this week, Google and Levi's have announced the smart jean jacket coming out this fall for $350.00 according to CNBC. In China, wristbands have been sold to track millions of children too young to own a smartphone.

For Financial Advisors, the Wearable Technology ETF represents a global growth trend that they can invest in through companies focused on the future, and a way to potentially add alpha to a global allocation or breathe life into an old technology allocation that now lacks innovation. The excess returns of a fund, relative to the return of a benchmark index is the fund's alpha.

Plus as a smart beta product, it uses an equal weighted approach divided into a core and non-core tiered system. Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Contact: Mike Cronan (516) 695-9447 for more information.

Disclaimers: Carefully consider the Fund's investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund's prospectus, which may be obtained by visiting www.wearETF.com.

Read the prospectus carefully before investing.

| Name | % of Net Assets |

|---|---|

| IRHYTHM TEHCNOLOGIES INC (IRTC) | 3.64% |

| BIOTELEMETRY INC (BEAT) | 3.37% |

| DEXCOM INC (DXCM) | 3.21% |

| ADIDAS AG (ADS GR) | 3.08% |

| APPLE INC (AAPL) | 3.05% |

| GN STORE NORD A/S (GN DC) | 2.89% |

| TOMTOM (TOM2 NA) | 2.87% |

| BOSTON SCIENTIFIC CORP (BSX) | 2.86% |

| ABBOTT LABORATORIES (ABT) | 2.81% |

| INSULET CORP (PODD) | 2.80% |

Investing involves risk, including the possible loss of principal. International investments may also involve risk from unfavorable fluctuations in currency values, differences in generally accepted accounting principles, and from economic or political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

Narrowly focused investments and investments in smaller companies typically exhibit higher volatility.

Investing involves risk, including possible loss of principal. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets. The Fund may invest a relatively large percentage of its assets in securities denominated in non-U.S. currencies, the values of which may be affected by changes in the currency rates or exchange control regulations. Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, especially those which are Internet related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance. The Fund is non-diversified which means it may be invested in a limited number of issuers and susceptible to any economic, political and regulatory events than a more diversified fund.

Diversification may not protect against market risk. Holdings are subject to change.

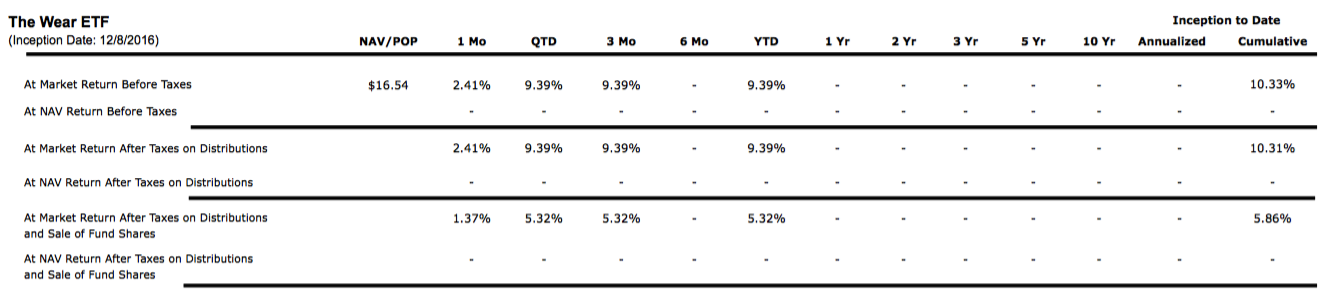

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00pm Eastern time. NAV return is determined using the daily-calculated Net Asset Value (NAV). Brokerage commissions will reduce returns.

Exchange Traded Concepts, LLC serves as the investment advisor, and EVE Capital, LLC serves as the sponsor to the fund. The Funds are distributed by Foreside Fund Services, LLC, which is not affiliated with Exchange Traded Concepts, LLC or any of its affiliates.

SOURCE: The Wearable Technology ETF